Hair Removal Spray Market Size

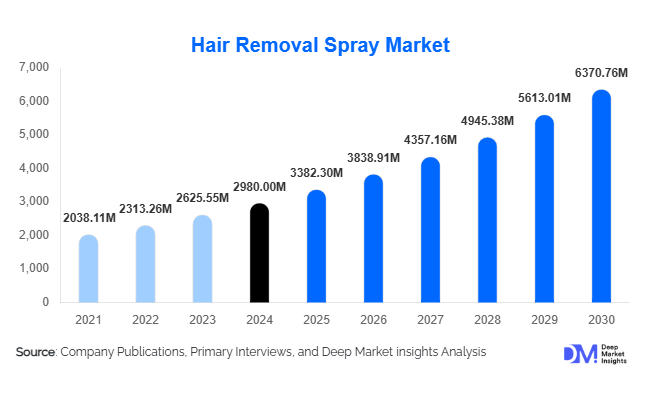

According to Deep Market Insights, the global hair removal spray market size was valued at USD 2,980 million in 2024 and is projected to grow from USD 3,382.3 million in 2025 to reach USD 6,370.76 million by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). The hair removal spray market growth is driven by increasing consumer preference for convenient at-home grooming solutions, rising disposable incomes, gender-neutral product adoption, and expanding online retail distribution channels across both developed and emerging economies.

Key Market Insights

- Growing demand for at-home, mess-free hair removal solutions is driving global adoption of aerosol and pump-based sprays.

- Product innovation in natural, hypoallergenic, and sensitive-skin formulations is enabling manufacturers to capture premium market segments.

- Asia-Pacific leads the market with 35% of global share, fueled by rapid urbanization, expanding middle-class income, and e-commerce growth.

- North America and Europe remain mature markets, with strong demand for premium and organic spray variants.

- E-commerce and direct-to-consumer channels are emerging as dominant distribution modes, accelerating global reach.

- Rising male grooming awareness is expanding the total addressable market beyond traditional female demographics.

Latest Market Trends

Natural and Sensitive-Skin Formulations Rising in Demand

Consumer preference is shifting toward safer, skin-friendly, and naturally derived depilatory sprays. Formulations featuring aloe vera, chamomile, and botanical extracts are increasingly replacing harsh chemical-based products. Brands are investing heavily in R&D to develop dermatologically tested, paraben-free, and hypoallergenic sprays suitable for sensitive skin. The clean beauty movement and transparency in ingredient labeling are reinforcing consumer trust and driving repeat purchases, particularly in Western markets and among health-conscious millennials.

Expansion of E-commerce and Subscription-Based Models

Digital transformation is reshaping the hair removal spray market. Online platforms and D2C channels allow brands to bypass traditional retail and engage customers directly. Subscription models for recurring home-use sprays, personalized product recommendations, and influencer marketing campaigns have enhanced consumer engagement. Real-time feedback loops and digital advertising are helping niche brands scale rapidly, while established players invest in omnichannel strategies to balance in-store and online sales. This digital-first approach is expected to account for over 45% of global sales by 2030.

Hair Removal Spray Market Drivers

Growing Personal Grooming Awareness

The normalization of personal grooming as part of daily hygiene routines—across both men and women—is a primary growth driver. Increasing disposable income, urbanization, and media influence have boosted demand for quick and efficient grooming products. Consumers are now prioritizing ease, affordability, and effectiveness, driving a steady shift from traditional methods such as waxing and razors toward convenient spray-based depilation solutions.

Technological and Formulation Innovation

Continuous product innovation has expanded the appeal of hair removal sprays. The introduction of fast-acting formulas, fragrance-infused sprays, and skin-nourishing ingredients has improved performance and minimized irritation. Packaging advancements such as precision nozzles and ergonomic bottles enhance user convenience, while eco-friendly aerosol technology addresses environmental concerns, aligning with the sustainability goals of major manufacturers.

Rising Male Grooming Segment

Men’s grooming is no longer a niche market. Increasing emphasis on body aesthetics and professional appearance is driving male consumers toward hair removal products. Targeted marketing, gender-neutral branding, and social media trends have encouraged men to adopt sprays for chest, back, and leg hair removal. This emerging segment represents one of the fastest-growing demographics, with expected CAGR exceeding 6% between 2025 and 2030.

Market Restraints

Skin Sensitivity and Regulatory Concerns

Despite convenience, chemical-based depilatory sprays often face consumer hesitation due to skin irritation and allergic reactions. Stringent cosmetic safety regulations in the U.S. and EU add compliance complexity and slow product approvals. Manufacturers must invest in dermatological testing and transparent labeling to mitigate these challenges.

Competition from Alternative Hair Removal Methods

The availability of long-term alternatives like laser and IPL hair removal devices poses a restraint. While sprays cater to convenience, durable results offered by advanced methods can divert potential consumers, especially in developed markets where affordability barriers are lower.

Hair Removal Spray Market Opportunities

Emerging Markets and Expanding Middle Class

Asia-Pacific, Latin America, and parts of Africa offer high-growth potential due to increasing disposable incomes, rapid urbanization, and expanding middle-class populations. Growing beauty awareness and the influence of social media are fueling demand for personal grooming products. Localized marketing, affordable pricing, and distribution partnerships can help brands capture untapped demand in these regions.

Natural and Eco-Friendly Product Development

Rising environmental consciousness presents opportunities for brands to introduce sustainable, biodegradable, and vegan-certified sprays. Consumers increasingly prefer products free from parabens, sulfates, and artificial fragrances. Investing in plant-based depilatories and recyclable packaging can differentiate premium brands while aligning with global sustainability standards.

Digital Transformation and D2C Models

Digitally native brands leveraging direct-to-consumer strategies can significantly cut marketing and distribution costs while enhancing customer intimacy. Personalized recommendations, subscription models, and data-driven marketing can increase brand loyalty and reduce churn. The ability to rapidly launch new SKUs based on online feedback enables agile product development and faster scaling.

Product Type Insights

Aerosol sprays dominate the market, accounting for approximately 45% of global revenue in 2024. They offer even coverage, faster drying, and easy usability, making them the preferred choice for body hair removal. However, pump and foam sprays are emerging as eco-friendly and cost-efficient alternatives, especially in regions with aerosol propellant regulations.

Application Insights

Body hair removal remains the leading application segment, contributing nearly 50% of total market share in 2024. Consumers primarily use sprays for legs, arms, and back due to convenience and speed. The under-arm and bikini line applications are expanding rapidly, fueled by product diversification and gender-neutral formulations.

Distribution Channel Insights

Offline retail channels, including supermarkets and pharmacies, accounted for about 55% of global revenue in 2024. However, online channels are growing at a double-digit pace as digital convenience, doorstep delivery, and targeted social media advertising reshape consumer purchasing behavior. By 2030, e-commerce is expected to become the dominant channel globally.

Target Consumer Insights

Women constitute the largest consumer segment, representing around 65% of the 2024 global market share. Nevertheless, the male grooming segment is the fastest-growing, driven by evolving cultural attitudes and the normalization of self-care among men. Gender-neutral branding is also gaining momentum, bridging product design and marketing toward inclusivity.

| By Product Type | By Application / Use Case | By Target Consumer / Demographics | By Ingredient / Formulation Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America held approximately 25% of the global market share in 2024. High disposable income, established beauty standards, and premium product penetration underpin demand. The U.S. leads regional consumption, supported by e-commerce adoption and an increasing preference for clean-label formulations.

Europe

Europe accounts for roughly 20% of the market, with strong demand in the U.K., Germany, and France. Consumers prioritize dermatologically tested and eco-certified products. Regulatory emphasis on sustainable packaging and cruelty-free cosmetics continues to shape market strategies.

Asia-Pacific

Asia-Pacific dominates the global market with a 35% share in 2024 and is projected to be the fastest-growing region (CAGR 6–7%). China, India, Japan, and South Korea drive consumption due to growing middle-class populations, expanding e-commerce penetration, and increasing beauty awareness among younger demographics.

Latin America

Latin America represents around 10% of the global market. Brazil and Mexico are key contributors, with the rising popularity of personal grooming products influenced by a beauty-conscious culture and expanding retail networks. The region’s growth is supported by increasing participation of local manufacturers in the affordable segment.

Middle East & Africa

MEA holds approximately 10% market share, led by the GCC countries, South Africa, and Nigeria. Demand is accelerating due to urbanization, a high youth population, and growing acceptance of Western grooming habits. Premium and imported sprays are particularly popular in Gulf markets, while affordable local brands dominate African subregions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Removal Spray Market

- L’Oréal S.A.

- Reckitt Benckiser Group plc

- Church & Dwight Co., Inc.

- Avon Products, Inc.

- Edgewell Personal Care Company

- Revlon, Inc.

- Sally Hansen (Coty Inc.)

- Sirona Hygiene Pvt. Ltd.

- Helios Lifestyle Pvt. Ltd.

- Beardo (HCP Wellness Pvt. Ltd.)

- GiGi (Global Beauty Brands)

- Jolen

- Nature Nation (India)

- Sanfe

- Wilson Cosmetics Co. Ltd.

Recent Developments

- In May 2025, L’Oréal launched a new vegan-certified hair removal spray line under its Garnier brand, emphasizing biodegradable ingredients and eco-friendly aerosol technology.

- In March 2025, Reckitt Benckiser introduced a men-specific depilatory spray under its Veet brand in Asia, targeting the expanding male grooming market.

- In January 2025, Sirona Hygiene announced the expansion of its manufacturing plant in India to cater to domestic and export demand for organic and sensitive-skin hair removal sprays.