Hair Oil Control Spray Market Size

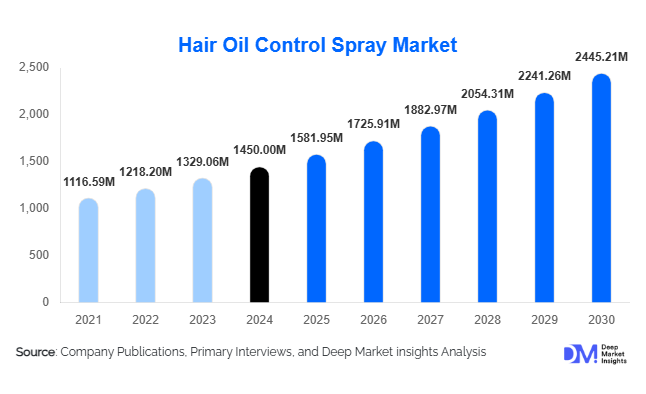

According to Deep Market Insights, the global hair oil control spray market size was valued at USD 1,450 million in 2024 and is projected to grow from USD 1581.95 million in 2025 to reach USD 2,445.21 million by 2030, expanding at a CAGR of 9.1% during the forecast period (2025–2030). The market growth is driven by increasing consumer awareness of scalp health, rising demand for non-greasy and lightweight hair care formulations, and the expanding adoption of clean beauty and multifunctional grooming products across both genders.

Key Market Insights

- Rising global awareness of scalp hygiene and oil balance is significantly influencing product innovation and consumer purchasing patterns.

- Natural and botanical-based formulations are gaining traction as consumers increasingly avoid harsh chemicals such as parabens, sulfates, and silicones.

- Men’s grooming and unisex product categories are emerging as high-growth segments in developed and developing economies alike.

- Asia-Pacific dominates the global hair oil control spray market, led by high humidity-driven demand and a booming personal care industry in India, China, and Japan.

- Europe and North America are witnessing premiumization trends, with brands emphasizing clinical efficacy, minimalism, and eco-conscious packaging.

- E-commerce and social media-driven marketing continue to reshape brand visibility and consumer engagement, particularly among younger demographics.

What are the latest trends in the hair oil control spray market?

Shift Toward Natural and Plant-Based Ingredients

Consumers are increasingly gravitating toward hair oil control sprays formulated with natural extracts such as tea tree oil, witch hazel, aloe vera, and green tea. These ingredients provide anti-sebum and soothing benefits while aligning with clean beauty trends. Brands are responding with “free-from” product labels, emphasizing transparency and sustainability. The adoption of vegan and cruelty-free certifications is also becoming a key differentiator in this space.

Hybrid and Multifunctional Hair Sprays

Manufacturers are introducing multifunctional sprays that not only control oil but also provide heat protection, volumizing, and UV defense properties. These hybrid formulations cater to the modern consumer’s demand for convenience and efficiency, reducing the need for multiple hair care products. The trend is particularly strong in urban markets, where busy lifestyles drive the preference for all-in-one grooming solutions.

What are the key drivers in the hair oil control spray market?

Growing Focus on Scalp Health and Hygiene

Rising pollution levels, increased humidity, and changing lifestyle habits have heightened the prevalence of oily scalp conditions. Consumers are becoming more aware of the link between scalp care and overall hair health, leading to increased demand for oil control sprays that help maintain freshness and balance throughout the day. Dermatologist-recommended and clinically tested formulations are especially influencing purchase decisions.

Expansion of Men’s Grooming Segment

The global rise in male grooming awareness is significantly contributing to the market’s growth. Men are actively seeking lightweight, oil-control products that offer a clean, matte finish without residue. Brands are developing gender-neutral or male-targeted variants with minimal fragrance and fast-absorbing properties, broadening market penetration beyond traditional female consumers.

What are the restraints for the global market?

High Competition and Price Sensitivity

The market is witnessing intense competition from dry shampoos, scalp serums, and oil-absorbing powders that offer similar results. Price-sensitive consumers in emerging markets often favor multifunctional or traditional solutions like herbal rinses, which can restrain product adoption. Additionally, the cost of premium natural ingredients increases retail pricing, limiting accessibility in lower-income segments.

Potential Side Effects from Overuse

Frequent use of oil control sprays may lead to scalp dryness, irritation, or buildup, especially in products containing alcohol or synthetic agents. These concerns are prompting cautious consumer behavior, necessitating stronger education efforts and innovation toward safer, pH-balanced formulations.

What are the key opportunities in the hair oil control spray industry?

Personalized and Smart Haircare Solutions

The integration of AI-driven scalp diagnostics and data-based product personalization is opening new avenues for growth. Brands leveraging mobile apps and diagnostic tools to recommend tailored oil-control sprays are likely to strengthen consumer loyalty and command premium pricing.

Expansion in Emerging Markets

Rapid urbanization, rising disposable incomes, and growing grooming awareness in Asia-Pacific, Latin America, and the Middle East offer significant untapped potential. Localized formulations addressing specific climatic conditions—such as high humidity or pollution exposure—are expected to gain substantial traction.

Product Type Insights

Natural ingredient-based sprays dominate the market due to strong consumer preference for safe and sustainable formulations. Chemical-based sprays retain demand in professional salons for immediate and long-lasting results. Hybrid products combining botanical and synthetic ingredients are gaining favor for offering a balance between efficacy and gentleness.

Application Insights

Daily-use sprays account for the largest market share, driven by increasing adoption among urban professionals and students. Professional-grade sprays are primarily used in salons for pre-styling and oil control during blow-drying. Travel-size variants are emerging as a fast-growing segment due to rising on-the-go grooming trends.

Distribution Channel Insights

Online channels lead global sales, with major e-commerce platforms and D2C brand websites offering personalized recommendations and subscription options. Offline distribution through supermarkets, salons, and beauty specialty stores remains strong, especially in the Asia-Pacific region. Influencer collaborations and social media campaigns play a pivotal role in driving product discovery and conversions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds the largest share of the global market, fueled by humid climates, dense urban populations, and growing disposable incomes. India, China, Japan, and South Korea are key contributors, with local and international brands competing through innovative herbal formulations and aggressive digital marketing.

North America

North America shows strong growth potential, with consumers increasingly seeking lightweight, clean-label, and vegan-certified sprays. The market is characterized by a high preference for scalp-friendly products, supported by the clean beauty and minimalistic lifestyle trends prevalent across the U.S. and Canada.

Europe

Europe represents a mature market with a focus on sustainable packaging, eco-certifications, and dermatologically tested formulations. The U.K., France, and Germany are major contributors, with demand particularly strong among young professionals seeking long-lasting freshness and oil balance.

Middle East & Africa

The region presents emerging opportunities driven by high temperatures and increasing personal care spending. Consumers in the Gulf countries are particularly inclined toward premium and fragrance-enhanced oil control sprays suitable for hot climates.

Latin America

Latin America is witnessing gradual adoption, particularly in Brazil and Mexico, where haircare remains a core component of beauty routines. The trend toward anti-frizz and oil-control products is growing as regional consumers embrace global beauty influences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Oil Control Spray Market

- L’Oréal S.A.

- Unilever plc

- Procter & Gamble

- Henkel AG & Co. KGaA

- Kao Corporation

- Amorepacific Group

- Johnson & Johnson Services, Inc.

- Revlon, Inc.

- Beiersdorf AG

- NatureLab Tokyo

Recent Developments

- In July 2025, L’Oréal introduced its new “EverPure Clarifying Oil Control Spray” in Asia, formulated with fermented tea extract and biodegradable packaging.

- In May 2025, Unilever launched a gender-neutral hair oil control range under its TRESemmé brand, emphasizing scalp microbiome balance.

- In February 2025, Amorepacific announced the expansion of its clean beauty portfolio in Japan, introducing oil-control sprays with green tea-derived active ingredients from Jeju Island.