Gym Bag Market Size

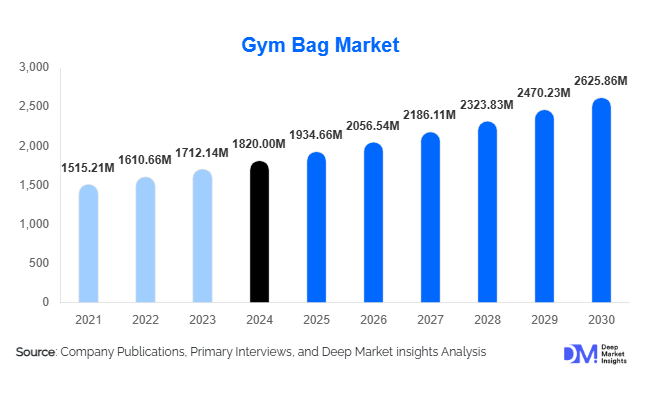

According to Deep Market Insights, the global gym bag market size was valued at USD 1,820 million in 2024 and is projected to grow from USD 1,934.66 million in 2025 to reach USD 2,625.86 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The gym bag market growth is primarily driven by increasing global fitness and wellness adoption, rising demand for athleisure lifestyle accessories, expansion of e-commerce and direct-to-consumer channels, and growing preference for multifunctional, travel-friendly bags that integrate gym, work, and casual use.

Key Market Insights

- Duffle-style gym bags remain the dominant product type globally, capturing roughly two-thirds of market revenue due to their versatile capacity and suitability for carrying workout gear, clothes, shoes, and accessories.

- Synthetic materials (polyester/nylon) lead bag manufacturing, balancing durability, water-resistance, light weight, and cost-effectiveness, making them central to budget and mid-range segments worldwide.

- Male consumers continue to drive the majority of demand, representing over half of global purchases, supported by higher gym participation rates and a tendency toward larger, utilitarian bags.

- Offline retail remains a major sales channel, especially in developing and emerging markets, where brick-and-mortar purchase preference and trust in in-person buying are still strong.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class incomes, rapid urbanization, expanding fitness culture, and increasing retail/e-commerce penetration.

- Athleisure and lifestyle trends are broadening demand beyond gyms; gym bags are increasingly used as everyday carry, work, travel, or casual-use bags, expanding the total addressable market.

Latest Market Trends

Rise of Multifunctional & Smart Gym Bags

Manufacturers are increasingly offering gym bags with built-in organizational features, dedicated shoe compartments, ventilated wet-clothes sections, water-bottle holders, padded laptop sleeves, and anti-theft pockets. Some premium variants now even claim “smart” features: RFID-enabled pockets, weather-resistant fabric, modular compartments, and designs optimized for work-to-gym-to-travel transitions. This multifunctionality appeals particularly to urban professionals who combine gym routines with work and travel, thus blurring the lines between fitness gear and everyday carry.

Sustainability & Eco-Friendly Materials Gaining Traction

With growing environmental awareness among consumers, especially younger demographics, gym bags made from recycled plastics, reclaimed synthetics, vegan leather, or other sustainable fabrics are becoming an increasingly important segment. Brands promoting “eco-friendly gym bags” are able to tap into premium pricing, brand loyalty, and socially conscious buyers. Use of recycled polyester, organic cotton blends, or upcycled materials is rising, helping manufacturers differentiate their offerings and meet demand from sustainability-oriented consumers.

Expansion of Online and Direct-to-Consumer Channels

E-commerce and D2C (direct-to-consumer) channels are playing a rapidly growing role in gym bag distribution. Especially after global supply-chain disruptions and changing consumer behavior, brands are leveraging their own websites and online marketplaces to sell directly, reducing reliance on traditional retail. This allows faster introduction of new styles, customization (colors, monograms, modular compartments), limited iteration drops, and reaching a broader global audience, including regions with underdeveloped retail infrastructure.

Gym Bag Market Drivers

Growing Global Fitness & Wellness Culture

A worldwide surge in health and fitness consciousness, driven by increasing awareness about lifestyle diseases, rising gym memberships, home workouts, and participation in sports, is fueling demand for gym bags. As more people engage in regular exercise, yoga, sports, or fitness classes, the need for reliable bags to carry workout gear, clothes, shoes, water bottles, and personal items has become a must-have, supporting consistent growth in this segment.

Rising Disposable Income & Urban Lifestyle Adoption

As disposable incomes rise, especially in emerging economies across Asia-Pacific and Latin America, a growing number of consumers can afford mid-range and premium gym bags that go beyond basic utility. Urbanization, rising working-class wages, and changing lifestyle aspirations are encouraging people to invest in quality accessories, including stylish gym bags that double as everyday or travel bags. This transition from basic to lifestyle-oriented products is boosting average selling prices and overall market value.

Influence of Athleisure and Multi-Purpose Fashion Trends

The blending of athletic wear with everyday fashion, the athleisure movement, has transformed gym bags from purely functional items to fashion accessories. Consumers now often choose gym bags that complement casual outfits or commute attire, and appreciate bags that serve dual purposes: gym, work, or travel. This shift expands the customer base beyond fitness enthusiasts to include urban professionals, travelers, and fashion-conscious individuals, driving up demand and encouraging design innovation.

Market Restraints

Raw Material Price Volatility and Cost Pressure

Gym bags, especially budget and mid-range models, heavily rely on synthetic materials like polyester and nylon. Fluctuations in raw material prices, supply-chain disruptions, or increases in labor/material costs can squeeze profit margins for manufacturers. Smaller players and those producing economy-segment bags may struggle to absorb cost hikes without raising prices, which could reduce demand in price-sensitive markets.

Intense Competition and Market Fragmentation

The gym bag industry is highly fragmented, with numerous global brands, local manufacturers, regional producers, and unbranded low-cost suppliers competing. This competition generates significant price pressure, particularly in mid-range and economy segments. In addition, counterfeit products and unbranded alternatives, often at lower prices, can erode the market share of branded or premium players, making differentiation difficult and limiting margin growth.

Gym Bag Market Opportunities

Eco-Friendly and Sustainable Product Lines

As sustainability becomes an increasingly important purchase criterion, introducing gym bags made from recycled materials, upcycled fabrics, or vegan leather opens a valuable niche. Brands that invest in eco-friendly manufacturing and transparently communicate environmental credentials can attract conscious consumers, particularly younger demographics in developed and emerging markets, and demand premium pricing, loyalty, and long-term brand equity.

Expansion via Institutional & Bulk Demand Channels

Growth of corporate wellness programs, fitness chains, educational institutions, sports clubs, and corporate gyms presents an opportunity for bulk orders of gym bags, often co-branded or customized. Supplying standardized or branded gym bags in such institutional settings offers manufacturers stable, large-volume contracts and reduces reliance on retail fluctuations. This channel can especially thrive in developing economies where fitness infrastructure is expanding rapidly.

Smart, Multifunctional & Tech-Integrated Bags for Urban Consumers

There is growing demand for gym bags that double up as commuter bags, travel bags, or work bags, integrating compartments for laptops/tablets, shoes, gym gear, water bottles, and tech accessories. Some brands could even embed features like RFID pockets, anti-theft mechanisms, USB-charge-enabled compartments, or weather-resistant exteriors. By catering to urban professionals, business-travelers, and frequent gym-goers, manufacturers can tap into a higher-margin, premium-segment market.

Product Type Insights

Within the gym bag market, products fall broadly into three price/positioning tiers: economy, mid-range, and premium. Economy gym bags, simple duffles, or drawstring bags made from basic synthetic materials continue to dominate volume sales in price-sensitive regions, driven by affordability and mass demand. Mid-range gym bags, often with better compartmentalization, durability, and modest aesthetics, appeal to regular gym-goers and urban consumers balancing price and quality. Premium gym bags, with high-end materials, sustainable fabric options, multifaceted compartments, and lifestyle-oriented design, are growing fast in developed markets and affluent urban centers. As consumers increasingly use gym bags not just for workouts but for daily commutes, travel, or casual use, the mid-range and premium segments are gaining share, helping increase the overall market’s average selling price and revenue.

Application Insights

Traditional gym and fitness usage remains the largest application for gym bags, used by gym-goers, athletes, and sports enthusiasts to carry workout clothes, shoes, towels, and gear. However, two emerging applications are reshaping demand: first, athleisure and lifestyle carry-over, where gym bags double as everyday backpacks or travel bags for commuting, work, or casual outings; second, travel and short-trip usage, where larger duffles or versatile packs are preferred by travelers for overnight stays, weekend trips, or as carry-on luggage. In addition, institutional/bulk applications, supplying gym bags to gyms, fitness centers, corporate wellness programs, sports clubs, and educational institutions, are becoming increasingly important, especially in markets where organized fitness infrastructure is expanding.

Distribution Channel Insights

Offline retail, specialty sports shops, department stores, supermarkets/hypermarkets, and fitness-center pro-shops continue to account for a major share of global gym bag sales, especially in emerging markets where e-commerce penetration is still growing. Nevertheless, online platforms and direct-to-consumer (D2C) websites are rapidly gaining ground. These channels enable brands to launch new designs quickly, offer customization, run limited-edition drops, and reach global customers without the burden of traditional retail markups or overheads. For premium, designer, or limited-series gym bags, online sales provide an efficient way to address niche consumer segments. Furthermore, institutional and bulk buyers (gyms, sports academies, corporate wellness programs) often prefer direct ordering, creating an additional distribution channel beyond retail.

Customer Demographics Insights

Gym bag demand remains highest among adults aged 18–40 years, particularly urban youth and working professionals, due to high fitness participation, commuting needs, travel, and lifestyle orientation. Within this, the 25–40 age group represents the largest share, combining disposable income with the need for versatile bags. The younger 18–24 group drives demand for budget-friendly yet stylish bags and athleisure-oriented designs. Additionally, there is growing demand among women and gender-neutral segments, especially for compact, fashionable bags, though men still represent a majority share. Preference among customers is shifting increasingly toward multi-function, durable, and aesthetically pleasing bags rather than strictly utilitarian gym gear carriers.

| By Product Type | By Material Type | s | By Distribution Channel | By End User | By Price Range |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America remains a leading region for gym bag consumption, underpinned by a well-established fitness culture, high disposable income, and preference for branded, mid-range to premium gym bags. Demand includes everyday gym-goers, commuters, and travelers, many of whom use gym bags as lifestyle accessories. Premiumization, sustainability awareness, and brand loyalty drive growth, even though the region’s growth rate is moderate compared to emerging markets. Replacement demand and upgrades to feature-rich or designer gym bags fuel steady revenue.

Europe

Europe holds a significant share of global demand, with consumers showing increasing preference for functional yet stylish and sustainable gym bags. Eco-friendly materials and minimalist, design-driven bags are popular, particularly in Western and Northern Europe. Mid-range and premium segments grow steadily, supported by rising health consciousness, urban commuting trends, and athleisure adoption. Growth is stable, but influenced by sustainability trends, fashion preferences, and e-commerce penetration.

Asia-Pacific (APAC)

APAC is the fastest-growing region and the primary growth engine for the gym bag market going forward. Rapid urbanization, rising disposable incomes, expanding middle class, increasing number of gyms and fitness centers, and growing awareness about fitness and healthy lifestyles, especially in countries such as China, India, Southeast Asia, are driving a surge in demand. Both budget and premium gym bag segments see strong growth: budget bags cater to mass-market volume demand, while rising urban affluence drives mid-range and lifestyle-oriented purchases. E-commerce expansion and the rollout of organized retail further accelerate uptake across both tier-1 and tier-2 cities in these countries.

Latin America (LATAM)

Latin America remains a smaller but steadily growing segment, with increasing interest in fitness, gym memberships, and lifestyle accessories. Urbanization, young demographics, and growing middle-class purchasing power are expanding the customer base. Rising sports culture, athleisure trends, and international travel bolster demand growth. While premium demand is still nascent compared to developed regions, budget and mid-range gym bags are witnessing steady adoption.

Middle East & Africa (MEA)

MEA represents a modest share of the global market but shows pockets of rising demand, especially in urban and Gulf countries, where fitness centers, gym culture, and lifestyle spending are growing. Expatriate populations, rising disposable income, and increasing health awareness support demand for mid-range and premium gym bags. As retail infrastructure and e-commerce expand, demand across both new and established markets in MEA may gradually increase.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Emerging Players in the Gym Bag Market

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Reebok International Ltd.

- ASICS Corporation

- New Balance Athletics, Inc.

- Herschel Supply Co.

- Lululemon Athletica Inc.

- Decathlon (brand “Quechua” / “Domyos”)

- Fila Holdings Corp.

- Briggs & Riley (for premium sports/lifestyle bags)

- Columbia Sportswear Company

- Eastpak (VF Corporation brand)

- Patagonia, Inc.