Gun Safe Market Size

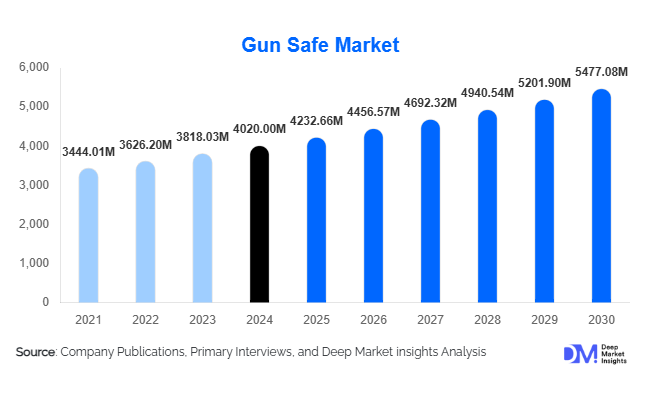

According to Deep Market Insights, the global gun safe market size was valued at USD 4,020.00 million in 2024 and is projected to grow from USD 4,232.66 million in 2025 to reach USD 5,477.08 million by 2030, expanding at a CAGR of 5.29% during the forecast period (2025–2030). Gun safe market growth is primarily driven by rising civilian firearm ownership, tightening safe-storage regulations, and increased demand for high-security, fire-rated, and smart-connected safes across residential, commercial, and institutional environments.

Key Market Insights

- Long-gun and multi-gun rifle safes dominate the market by value, supported by high average selling prices and strong demand from collectors, hunters, and home-defense users.

- Mid-range gun safes (USD 500–1,500) account for the largest revenue share, balancing affordability with certified security, fire protection, and branded quality.

- Electronic keypad safes remain the leading locking technology, while biometric and smart/IoT-connected safes are the fastest-growing segments.

- Residential and individual owners represent over 60% of global demand, driven by safe-storage laws, insurance requirements, and growing concern over accidental access and theft.

- North America dominates the global gun safe market, led by the United States, whereas Asia-Pacific and selected Middle Eastern markets are the fastest-growing regions.

- Online and e-commerce channels are rapidly gaining share, as buyers increasingly research specifications, compare reviews, and order large safes via digital platforms.

What are the latest trends in the gun safe market?

Smart and Connected Gun Safes

One of the most prominent trends in the gun safe market is the rapid adoption of smart and connected technologies. Manufacturers are launching safes equipped with Bluetooth and Wi-Fi connectivity, mobile apps for remote monitoring, and real-time alerts for unauthorized access or tampering. These safes also include digital audit trails, user profiles, time-delayed access options, and integration with broader smart-home ecosystems such as alarms and video surveillance. For institutional users, connected safes enable centralized access management and compliance reporting. This technology-driven evolution is repositioning gun safes from simple storage boxes to integrated security systems, appealing strongly to tech-savvy consumers and professional security operators.

Design, Fire Protection, and Furniture Integration

Another key trend is the emphasis on aesthetics, fire protection, and discreet integration into living and working spaces. Consumers increasingly prefer gun safes that combine robust burglary resistance with certified fire ratings for documents, electronics, and valuables. Furniture-style safes, under-bed units, in-wall safes, and concealed designs that blend into closets or cabinetry are gaining traction, especially in urban and suburban homes with limited space. Interior enhancements such as modular racks, door organizers, LED lighting, humidity control, and soft-touch shelving are now standard in mid- to high-end models. This trend supports a shift toward multi-function safes that protect broader asset categories while meeting stringent firearm-storage rules.

What are the key drivers in the gun safe market?

Rising Firearm Ownership and Expanding Collections

Steadily increasing civilian firearms ownership, along with the growth of sport shooting and hunting activities, is a fundamental driver for the gun safe market. As households acquire more firearms and higher-value optics and accessories, the economic risk of theft or damage rises, making secure storage a logical investment. Collectors and enthusiasts often upgrade from basic cabinets to larger, feature-rich safes that accommodate multiple long guns, handguns, and valuables. This shift not only boosts unit volumes but also elevates average selling prices, particularly in medium- and large-capacity safes.

Defense, Law Enforcement, and Private Security Spending

Rising defense budgets, law-enforcement modernization, and the expansion of private security services provide strong institutional demand. Police departments, federal agencies, and private security firms require certified armories, vehicle-mounted gun vaults, and modular storage systems for rifles, sidearms, and ammunition. As new bases, training facilities, and security hubs come online, secure weapon-storage systems are incorporated into standard infrastructure design. The need to comply with occupational safety regulations and internal weapons-management policies further supports recurring investment in gun safes and vault solutions.

Safe-Storage Regulations and Liability Considerations

Governments and regulators are increasingly mandating safe storage of firearms, especially in households with minors or in jurisdictions with elevated gun theft and accidental discharge risks. Legal requirements to lock firearms and store ammunition separately, combined with potential civil liability in incidents involving unsecured guns, create strong incentives for ownership of certified safes. Insurance providers and advocacy groups also promote compliant storage through discounts, campaigns, and education programs. These regulatory and liability dynamics effectively transform gun safes from optional accessories into quasi-mandatory equipment in many markets, underpinning steady long-term demand.

What are the restraints for the global market?

Policy Volatility and Firearms Control Measures

The gun safe market is indirectly exposed to volatility in firearms legislation and political sentiment. Stricter licensing rules, outright bans on certain weapon types, or significant increases in compliance burdens can reduce the number of legal firearm owners and slow the growth of the installed base that requires secure storage. At the same time, short-term surges in firearm purchases triggered by political uncertainty can be followed by periods of weak demand. This cyclical pattern complicates capacity planning for manufacturers and distributors and can restrain long-term market stability in highly regulated regions.

Price Sensitivity and Competition from Low-Cost Alternatives

Price sensitivity among entry-level consumers and small businesses remains a key restraint. Low-cost steel cabinets and basic lock boxes, often imported or produced with minimal certification, compete directly with established brands in the economy segment. Fluctuating steel prices, transportation costs, and retailer margin expectations further pressure manufacturers’ profitability. In developing markets, end users may resort to generic cabinets or improvised storage solutions that do not meet recognized safe-storage standards, limiting penetration of fully compliant, higher-margin gun safes.

What are the key opportunities in the gun safe industry?

Expansion of Mandatory Safe-Storage and Certification Frameworks

As more jurisdictions codify safe-storage obligations and technical standards, significant opportunities emerge for manufacturers that can meet or exceed these requirements. Aligning products with recognized certifications (such as burglary and fire-resistance ratings or law-enforcement armory standards) allows brands to participate in government tenders, institutional contracts, and insurance-linked programs. Proactive engagement with policymakers and industry associations also enables companies to shape standards in ways that recognize technological innovation, creating headroom for premium and smart-product tiers with enhanced profitability.

High-Growth Emerging Markets and Institutional Modernization

Emerging markets in Asia-Pacific, Latin America, and the Middle East, characterized by rising defense budgets, police modernization, and expanding private security industries, offer outsized growth potential. While civilian firearm ownership may be more restricted than in North America, institutional requirements for secure armories and vehicle-mounted gun safes are growing rapidly. Localizing manufacturing, forming partnerships with security integrators, and tailoring product portfolios for smaller living spaces or harsh climates can help manufacturers capture these new demand pools. Over time, as income levels rise and consumer awareness of safe-storage benefits increases, residential segments in these regions will also become attractive opportunities.

Product Type Insights

Long-gun and rifle safes represent the largest product segment by revenue, accounting for an estimated high-thirty-percent share of the global gun safe market. Their dominance is driven by multi-rifle households, hunting communities, and sport shooters who require tall, high-capacity safes with adjustable racking and storage for optics and ammunition. Multi-gun cabinets and vaults serve collectors and small institutional users needing mixed storage for rifles and handguns, often with upgraded fire ratings and security features. Handgun safes, including bedside and drawer-mounted configurations, are widely used in home-defense applications where rapid access is critical. Vehicle-integrated gun safes, including under-seat and trunk-mounted models, are gaining traction among law-enforcement agencies, private security fleets, and licensed concealed-carry users. Portable gun lock boxes, especially TSA-compliant pistol safes, support travel and temporary storage needs and broaden the market’s reach into mobile lifestyles.

Application Insights

Residential and individual gun owners form the core application segment, representing well over half of global demand. This segment is driven by first-time firearm buyers seeking basic security and experienced owners upgrading to larger, more advanced safes as their collections grow. Commercial firearms ecosystem users, such as gun retailers, shooting ranges, and gunsmiths, require compliant storage for display stock, rental weapons, and customer guns under repair, typically favoring larger cabinets and back-room vaults. Law-enforcement and private security agencies utilize armory-grade storage systems, vehicle-mounted safes, and secure lockers designed for rapid yet controlled access. Defense and military facilities represent a smaller but high-specification segment, demanding highly secure vault rooms, armory racks, and specialized systems integrated into base infrastructure.

Distribution Channel Insights

Online and e-commerce channels have become a critical route to market for gun safes, enabling customers to compare specifications, read reviews, and arrange delivery and installation of heavy safes with minimal friction. Specialist firearms and outdoor retailers remain highly influential, especially in North America and Europe, where in-store displays and expert consultation help consumers evaluate build quality and fit. Big-box and home-improvement chains carry a wide range of economy and mid-range gun safes, leveraging promotional events and store-wide traffic to drive volume at competitive price points. Direct institutional and project-based sales, through tenders, RFPs, and integrator partnerships, are central for police, defense, and large commercial buyers, where decisions are guided by compliance requirements, lifecycle cost, and integration into broader security systems.

End-User Insights

Individual firearm owners are the most numerous end users, spanning home-defense buyers, hunters, and sport shooters. They typically begin with compact handgun safes or small rifle cabinets and progress to medium- or large-capacity units as their firearm collections and risk awareness grow. Commercial firearms-related businesses, including retailers and shooting ranges, deploy multiple safes for inventory, rental stock, and secure after-hours storage. Private security firms use vehicle-mounted and armory safes to manage fleet-based firearms and ensure compliance with contractual and regulatory obligations. Law-enforcement agencies and defense institutions, although fewer in number, represent high-value customers that procure sophisticated storage systems in bulk as part of broader modernization and infrastructure programs.

Price Range Insights

Mid-range gun safes priced between USD 500 and USD 1,500 account for the largest share of market revenues, reflecting their strong appeal among serious firearm owners who seek certified security, reputable brands, and enhanced features without moving into luxury price brackets. Economy safes below USD 500 are volume-driven but face intense competition from low-cost imports and basic steel cabinets, limiting margin expansion. Premium and high-end safes above USD 1,500, including fire-rated, custom-finished, and large-capacity models, cater to collectors, high-net-worth individuals, and institutional buyers who prioritize performance and durability over price. These segments, while smaller in unit volume, contribute disproportionately to overall market value due to high average selling prices and frequent inclusion of advanced technology.

| Product Type | Locking & Access Mechanism | Capacity | Price Range | Application | Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market for gun safes, driven predominantly by the United States, where civilian firearm ownership is among the highest globally. A combination of cultural factors, extensive sport-shooting and hunting traditions, and rising concerns over theft and household safety underpins strong residential demand. State-level safe-storage laws and insurance considerations further support adoption. Canada contributes additional demand, particularly in hunting regions where firearms must be securely stored in accordance with federal regulations. The region also hosts many leading gun safe manufacturers, supporting quick delivery times and a full spectrum of product tiers from economy to ultra-premium.

Europe

Europe is a regulation-driven market, with strict gun control and safe-storage requirements across major countries such as Germany, the U.K., France, Italy, Spain, and the Nordics. Firearms ownership rates are generally lower than in North America, but legal obligations to store guns in certified safes sustain steady demand. Hunters, sport shooters, and small gun clubs frequently invest in mid- to high-grade safes that comply with EN-class security and fire standards. Recent increases in defense spending and internal security measures have also bolstered institutional demand for armories, vault rooms, and vehicle-integrated safes across Europe.

Asia-Pacific

Asia-Pacific is emerging as one of the fastest-growing regions for gun safes, driven largely by rising defense budgets, law-enforcement modernization, and the expansion of private security services. Countries such as China, India, Japan, South Korea, and Australia are upgrading weapon-storage infrastructure at bases, training centers, and commercial security facilities. Civilian firearm ownership is tightly regulated in many APAC markets, but in countries like Australia, safe-storage rules for hunting and sporting firearms create a stable residential segment. As income levels rise and security awareness increases, demand for certified safes, both imported and domestically produced, is expected to accelerate.

Latin America

Latin America’s gun safe market is shaped by security and crime dynamics, with Brazil, Mexico, Argentina, and Chile representing key demand centers. High concerns over burglary, firearm theft, and organized crime encourage legal gun owners and security firms to invest in secure weapon storage. Regulatory frameworks are evolving, and in some markets, authorities emphasize safe storage as part of broader gun control strategies. Economic volatility and price sensitivity mean that lower-cost safes and locally manufactured cabinets have a strong presence, but premium brands are also gaining traction among affluent consumers and professional security providers.

Middle East & Africa

The Middle East & Africa region is heavily influenced by defense and internal security spending. GCC countries invest substantially in military and police capabilities, generating demand for armory-grade storage, vault rooms, and vehicle-mounted gun safes. Africa, as a diverse region, includes both high-demand segments, such as South African civilian and security markets, and emerging institutional requirements elsewhere on the continent. Intra-regional security challenges and modernization programs are driving gradual upgrades to secure weapon-storage infrastructure, particularly for police, border forces, and private security contractors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Gun Safe Industry

- Liberty Safe

- American Security (AMSEC)

- Fort Knox Vaults

- Browning ProSteel Safes

- Winchester Safes

- Cannon Safe

- Stack-On Products

- Rhino Metals

- SentrySafe

- Vaultek Safe

- GunVault

- SnapSafe

- Barska Safe

- Sports Afield Safes

- Steelwater Gun Safes

Recent Developments

- In January 2024, Steelhead Outdoors introduced the Scout 25 High Security Gun Cabinet equipped with a UL-listed lock and eight-point vertical beam locking for improved firearm protection.

- In February 2024, the CPSC issued additional recalls for biometric gun safes from brands such as MouTec and Machir, following incidents of unauthorized access.