Guitar Head Amplifiers Market Size

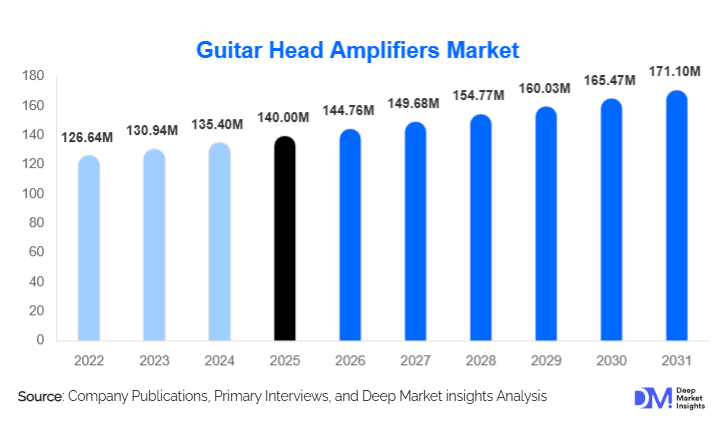

According to Deep Market Insights, the global guitar head amplifiers market size was valued at USD 140.00 million in 2024 and is projected to grow from USD 144.76 million in 2025 to reach USD 171.10 million by 2030, expanding at a CAGR of 3.4% during the forecast period (2025–2030). The market growth is primarily driven by the resurgence of live music performances, increasing adoption of home studio setups, and continuous innovation in digital and hybrid amplifier technologies. Guitar head amplifiers continue to hold strong appeal among professional and semi-professional musicians due to their modular design, tonal flexibility, and superior power handling compared to combo amplifiers.

Key Market Insights

- Tube guitar head amplifiers remain the tonal benchmark, maintaining strong demand among professional musicians despite higher costs.

- Digital and modeling amplifier heads are the fastest-growing segment, supported by integration with DAWs, impulse responses, and silent recording capabilities.

- North America dominates the global market, led by the U.S. with a dense concentration of touring artists, studios, and live venues.

- Asia-Pacific is the fastest-growing region, driven by rising music education enrollment and expanding middle-class consumer spending.

- Mid-range amplifier heads (USD 500–1,200) account for the largest revenue share, offering an optimal balance between performance and affordability.

- Offline retail channels remain critical, as musicians prefer hands-on testing before purchase, though direct-to-consumer online sales are rapidly expanding.

What are the latest trends in the guitar head amplifiers market?

Rapid Adoption of Digital & Modeling Amplifier Heads

One of the most prominent trends in the guitar head amplifiers market is the rapid adoption of digital and modeling technologies. Modern amplifier heads now feature advanced DSP-based tone modeling, cabinet simulation, MIDI compatibility, and USB audio interfaces. These capabilities allow musicians to replicate iconic amplifier tones while benefiting from portability, consistency, and lower maintenance requirements. Digital amplifier heads are increasingly preferred in home studios and professional recording environments due to their silent recording functionality and seamless DAW integration. Manufacturers are also introducing firmware-upgradable platforms, enabling long-term product relevance and software-driven feature expansion.

Lightweight, Touring-Friendly Amplifier Designs

Another key trend is the shift toward lightweight and compact amplifier head designs. Touring musicians and rental companies increasingly prioritize portability to reduce transportation costs and logistical complexity. Class-D power amplification, aluminum chassis construction, and advanced thermal management systems are enabling manufacturers to significantly reduce weight without compromising output power. This trend is particularly strong in the medium-power (21–50W) segment, which balances stage performance with ease of transport.

What are the key drivers in the guitar head amplifiers market?

Resurgence of Live Music and Touring Activity

The global revival of live concerts, festivals, and touring schedules has significantly boosted demand for professional guitar amplification equipment. Guitar head amplifiers are preferred for live performance due to their durability, modularity, and ability to deliver consistent tone across varying venue sizes. Frequent touring cycles also create recurring replacement and upgrade demand, supporting steady market growth.

Expansion of Home Studios and Independent Music Production

The rise of independent artists, content creators, and home-based recording studios is a major growth driver. Guitarists increasingly seek amplifier heads that can deliver professional-grade tones at manageable volume levels. Low- and medium-power amplifier heads with built-in load boxes, cab simulation, and recording outputs are gaining strong traction among this user base.

What are the restraints for the global market?

High Cost of Premium Tube Amplifier Heads

Premium tube guitar head amplifiers remain expensive due to rising costs of vacuum tubes, transformers, and skilled labor. This limits adoption among entry-level and hobbyist musicians, particularly in price-sensitive emerging markets. Supply volatility of tubes also creates cost uncertainty for manufacturers.

Competition from Software-Based Amp Simulations

Advanced amp simulation plugins and digital floor processors pose a substitution threat, particularly in studio and home practice applications. While physical amplifier heads retain advantages in live performance, software-based solutions are increasingly cost-effective alternatives for recording-focused users.

What are the key opportunities in the guitar head amplifiers industry?

Smart Amplifiers and Software Ecosystems

There is a strong opportunity in developing smart amplifier ecosystems that integrate mobile apps, cloud-based preset sharing, AI-assisted tone shaping, and remote firmware updates. These features enable manufacturers to differentiate products, enhance customer retention, and introduce subscription-based software services that generate recurring revenue.

Emerging Market Expansion in Asia-Pacific

Asia-Pacific presents a significant growth opportunity as music education, live entertainment, and amateur musicianship expand across China, India, Indonesia, and South Korea. Localized manufacturing, competitive pricing strategies, and mid-range product offerings can help global brands capture market share in these rapidly growing regions.

Product Type Insights

By technology, tube guitar head amplifiers dominate the market, accounting for approximately 38% of total revenue in 2024. Their dominance is driven by unmatched tonal warmth, dynamic response, and the preference of professional musicians for authentic analog sound. Tube amps continue to command premium pricing due to their perceived superior audio fidelity and stage presence. Digital/modeling amplifier heads represent the fastest-growing segment, benefiting from technological innovation, affordability, and seamless integration with modern recording setups and live sound systems. Features such as USB connectivity, software-based preset management, and silent recording functionality make them highly attractive to home studio users and semi-professional musicians. Hybrid amplifier heads, combining tube preamps with solid-state power sections, appeal to musicians seeking a balance between tonal authenticity and reliability, providing high-quality sound with reduced maintenance needs. Solid-state amplifier heads continue to serve entry-level and touring applications due to their durability, cost efficiency, and lightweight design, particularly attractive for medium-power (21–50W) applications. Across all types, innovation in modeling technology, digital integration, and lightweight construction is driving adoption and expanding market reach globally.

Application Insights

Live performance remains the leading application, accounting for nearly 36% of total market demand. Demand is fueled by an expanding live music scene, festival growth, and the resurgence of touring activity post-pandemic. Professional artists and bands increasingly prefer modular guitar head setups for portability, flexibility, and tonal consistency across diverse venues. Studio recording is a rapidly growing application as digital and hybrid amplifier heads enable silent practice, cab simulation, and seamless integration with DAWs. The rise of home studios and independent music production has further strengthened this segment. Home practice applications are also expanding, supported by compact, low-power amplifier designs that combine affordability with quality. Broadcast and commercial audio production remains a niche yet stable demand segment, leveraging amplifier heads for high-fidelity sound in live streaming, television, and content production studios. Overall, application growth is being driven by a combination of technological innovation, increased music consumption, and the professionalization of amateur music production worldwide.

Distribution Channel Insights

Offline retail stores dominate distribution with approximately 46% market share, reflecting the preference of musicians for in-person testing, expert consultation, and hands-on evaluation of tonal quality. Specialty music stores and boutique retailers remain essential for high-end tube and hybrid amplifier sales. However, direct-to-consumer (D2C) online channels are rapidly expanding as manufacturers enhance e-commerce platforms, providing global access, customization options, and convenience. Online marketplaces are also gaining traction, particularly in emerging markets where retail infrastructure is limited. Manufacturers are increasingly leveraging digital marketing, social media, and influencer collaborations to drive online adoption. The growing comfort of musicians with digital purchasing, combined with pandemic-accelerated e-commerce adoption, has made online channels a critical growth driver for the market.

End-User Insights

Professional musicians and touring artists represent the largest end-user segment, contributing around 41% of total market revenue. This group demands premium and mid-range amplifier heads with superior tonal performance, reliability, and portability for live performance and studio sessions. Semi-professional and studio musicians form a strong secondary segment, driven by home recording trends, streaming content creation, and music education. Hobbyists and home users are increasingly adopting digital and mid-range amplifier heads, drawn by affordability, software integration, and low-maintenance operation. Music institutions and academies provide consistent demand for medium-power, durable, and cost-effective amplifiers for classrooms and training facilities. Across all end-users, factors such as ease of integration with digital platforms, lightweight designs, and affordability continue to drive adoption.

| By Product Type | By Power Output | By Application | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global guitar head amplifiers market in 2024. The U.S. leads regional demand due to its robust live music ecosystem, high concentration of professional musicians, and the presence of major amplifier manufacturers. Key drivers include frequent touring, a strong festival culture, and high consumer willingness to invest in premium and boutique amplifier heads. Additionally, home studio setups and independent music production in North America are accelerating the adoption of digital and modeling amplifier heads, particularly in medium and low-power segments. Canada contributes through both live performance demand and increasing music education initiatives, supporting growth in mid-range and hybrid amplifier sales.

Europe

Europe represents around 28% of the global market share, with the U.K., Germany, and France as primary contributors. The region benefits from a dense network of live venues, strong cultural engagement in music, and widespread adoption of boutique amplifier brands. Growth is driven by professional touring circuits, music festivals, and a significant home studio segment in Western Europe. Additionally, rising demand for high-end digital and hybrid amplifier heads in Northern and Central Europe is fueled by musicians seeking portability and studio compatibility. European consumers increasingly prioritize sustainable and innovative amplifier designs, further driving adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 8% CAGR. Key countries include China, Japan, South Korea, and India. Growth drivers include rising disposable income, increasing music education enrollment, and the growing popularity of Western music genres. Expanding live performance circuits, music competitions, and social media-driven music creation encourage the adoption of mid-range and digital amplifier heads. Additionally, manufacturers are localizing product offerings and pricing strategies to cater to cost-sensitive emerging markets, further accelerating market penetration. The growth of home studios and online music content production in the region also supports demand for compact, digital, and hybrid amplifier solutions.

Latin America

Latin America shows moderate growth, with Brazil and Mexico leading regional demand. Growth is driven by expanding live music and entertainment sectors, rising participation in amateur music communities, and the gradual increase of professional touring activity. Key drivers include music festivals, local concert circuits, and a growing base of home musicians adopting mid-range and entry-level amplifier heads. Regional adoption is further supported by improving access to online retail channels, which provide musicians with more options for premium and digital amplifier products.

Middle East & Africa

The Middle East & Africa remain a niche but emerging market, led by the UAE and South Africa. Growth drivers include increasing event-based entertainment, music festivals, and corporate-sponsored live performances. The rise of youth-driven music culture, combined with high disposable income in Gulf countries, is expanding demand for premium and digital amplifier heads. In Africa, South Africa's established music festival circuit and professional touring bands drive adoption, while emerging markets within the continent are showing initial demand for entry-level and medium-power amplifier heads. Additionally, government support for arts and cultural initiatives indirectly stimulates market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Guitar Head Amplifiers Market

- Marshall Amplification

- Fender Musical Instruments

- Yamaha Corporation

- Vox Amplification

- Mesa/Boogie

- Orange Amplification

- Peavey Electronics

- Hughes & Kettner

- Blackstar Amplification

- ENGL Amplification

- Laney Amplification

- PRS Guitars

- Diezel Amplification

- Friedman Amplification

- Randall Amplifiers