Grip Tape Market Size

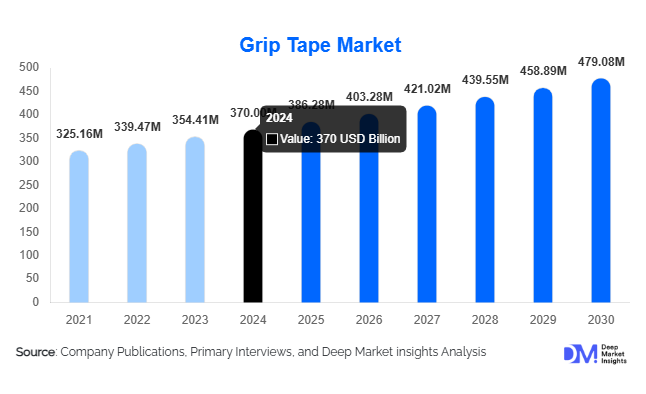

According to Deep Market Insights, the global grip tape market size was valued at USD 370 million in 2024 and is projected to grow from USD 386.28 million in 2025 to reach USD 479.08 million by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). Growth in the grip tape market is primarily driven by increasing participation in action and board sports, rising demand for slip-resistant materials across industrial and transportation sectors, and ongoing innovation in eco-friendly and high-performance adhesive technologies.

Key Market Insights

- Abrasive grip tapes dominate the market, accounting for approximately 60% of total demand in 2024, driven by applications in sports decks and industrial safety surfaces.

- PVC-based grip tapes lead material demand, representing nearly 42% of the market due to their cost-effectiveness, durability, and adaptability across multiple end uses.

- Sports and recreation applications hold the largest share, contributing about 45% of total market revenue, supported by growing participation in skateboarding, cycling, and other action sports.

- Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of 8–10% through 2030, driven by rising middle-class sports participation and industrialisation.

- Technological and sustainable innovations, including foam-backed, recyclable, and non-abrasive grip tapes, are reshaping competitive dynamics.

- The top five players hold a combined 35–40% market share, with companies such as 3M, Avery Dennison, and Tesa SE leading global production and innovation.

Latest Market Trends

Expansion of Non-Sports Applications

Grip tapes are increasingly being adopted in industrial, healthcare, and transportation sectors for anti-slip and ergonomic safety applications. Demand is growing for non-abrasive, rubberized, and foam-based tapes used in tools, stair treads, and hospital equipment. Regulatory emphasis on workplace safety is further supporting the uptake of certified anti-slip products. Manufacturers are customizing adhesives and backing materials to ensure durability and ease of installation in industrial environments.

Sustainable and Eco-Friendly Materials

The industry is witnessing a transition toward environmentally conscious materials, including recyclable plastics, solvent-free adhesives, and biodegradable backings. Producers are leveraging sustainability as a differentiator, especially in Western markets where regulations around PVC use are tightening. Eco-grip tapes made from recycled rubber and natural resins are gaining visibility, enabling brands to align with ESG objectives and attract environmentally aware consumers.

Grip Tape Market Drivers

Rising Popularity of Action and Board Sports

The revival of skateboarding, longboarding, and other board sports is fuelling consistent demand for abrasive grip tapes globally. Major sporting events and the inclusion of skateboarding in the Olympics have increased consumer interest. Youth culture and customization trends, including printed and coloured grip tapes, are expanding the product range and enhancing premiumization opportunities.

Industrial and Transportation Safety Demand

Industries are increasingly using grip tapes for tools, machinery platforms, and operator work areas to enhance safety. In transportation, grip tapes are applied on vehicle steps, flooring, and handrails across buses, aircraft, and marine vessels. Regulatory compliance with occupational safety standards (such as OSHA and ISO) has become a key demand driver, particularly in developed markets.

Innovation in Material and Surface Technology

Continuous improvements in adhesives, durability, and texture designs are creating performance differentiation. Foam-backed, transparent, and decorative grip tapes are emerging trends that meet both functional and aesthetic requirements. Enhanced adhesive technologies enable better resistance to weather and moisture, expanding applications in outdoor and marine settings.

Market Restraints

Price Competition and Commoditisation

Low entry barriers and limited product differentiation in standard grades have led to intense price competition. Sports-grade grip tapes often operate on thin margins, pressuring manufacturers to focus on cost efficiency. Premium products face resistance in price-sensitive markets, limiting widespread adoption.

Raw Material Cost Volatility

Fluctuations in petrochemical-derived materials such as PVC and synthetic adhesives significantly impact cost structures. Supply chain disruptions and environmental regulations related to solvent-based coatings add further uncertainty, particularly for smaller regional producers relying on imports.

Grip Tape Market Opportunities

Emerging Regional Markets

Asia-Pacific and Latin America present lucrative expansion opportunities. Rapid urbanisation, increasing youth sports participation, and government spending on recreational infrastructure are expanding addressable markets. Companies localising production or partnering with regional distributors can gain early-mover advantages in these fast-growing economies.

Diversification into Industrial and Healthcare Segments

Grip tapes are finding increasing use in industrial and healthcare safety applications, such as anti-slip flooring, hospital equipment, and tool grips. These segments offer higher-margin opportunities and more stable demand compared to sports-related products. Certification-driven procurement in these sectors strengthens long-term supply contracts for manufacturers.

Technological Integration and Product Customisation

Advances in adhesive chemistry, 3D surface texturing, and design printing allow producers to create grip tapes tailored for both performance and branding. Integration of smart adhesives and wear-resistant coatings enables differentiation in competitive markets. Custom colours and designs for consumer applications further enhance brand engagement.

Product Type Insights

Abrasive grip tapes lead the global market, accounting for approximately 60% of total sales in 2024, primarily due to high traction and durability. Non-abrasive variants are growing rapidly in industrial and healthcare applications where comfort and reusability are essential. The shift toward non-abrasive and foam-backed materials indicates a growing preference for safety combined with user comfort.

Application Insights

The sports and recreation sector remains the primary application area, representing around 45% of market revenue in 2024. Industrial manufacturing and transportation are emerging as strong secondary segments, driven by rising investments in workplace and public safety. Consumer goods applications, including furniture, luggage, and household items, are gradually expanding due to new aesthetic and ergonomic uses of grip materials.

| By Product Type | By Material Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for nearly 30% of the global market in 2024 (USD 156 million). The region benefits from a mature skateboarding culture, strong industrial safety standards, and demand for premium-grade tapes. Growth remains steady, supported by replacement cycles and product innovation.

Europe

Europe held approximately 20% of the market (USD 104 million in 2024). Demand is driven by industrial and transport applications, coupled with strict regulations on workplace safety. Sustainability initiatives and eco-friendly material adoption are major regional trends.

Asia-Pacific

Asia-Pacific captured around 25% of the market (USD 130 million in 2024) and is projected to be the fastest-growing region through 2030 with a CAGR of 8–10%. Rapid industrialisation, increasing sports participation, and manufacturing localisation in China, India, and Japan are driving regional growth.

Latin America

Latin America represents approximately 10% of market demand, with Brazil and Mexico leading adoption. Growth is supported by expanding urban sports infrastructure and regional export of grip materials to North America and Europe.

Middle East & Africa

The MEA region accounts for about 15% of global revenue, with the GCC countries investing heavily in transport infrastructure and public safety enhancements. South Africa shows notable demand from industrial and mining applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Grip Tape Market

- 3M Company

- Avery Dennison Corporation

- Tesa SE

- Intertape Polymer Group Inc.

- Heskins LLC

- Shurtape Technologies LLC

- INCOM Manufacturing Group

- Jessup Manufacturing Company

- Moonshine Manufacturing

- Grip-Tek Inc.

- GripGuard Pty Ltd.

- Gator Grip

- Zipker International

- BASKETO

- Safe Way Traction

Recent Developments

- In May 2025, 3M announced the expansion of its industrial safety product line, including high-traction grip tapes for manufacturing and transport sectors.

- In April 2025, Avery Dennison launched an eco-friendly, solvent-free adhesive formulation aimed at sustainable grip tape production.

- In February 2025, Tesa SE introduced a new range of non-abrasive, foam-backed grip tapes targeting the healthcare and consumer markets.