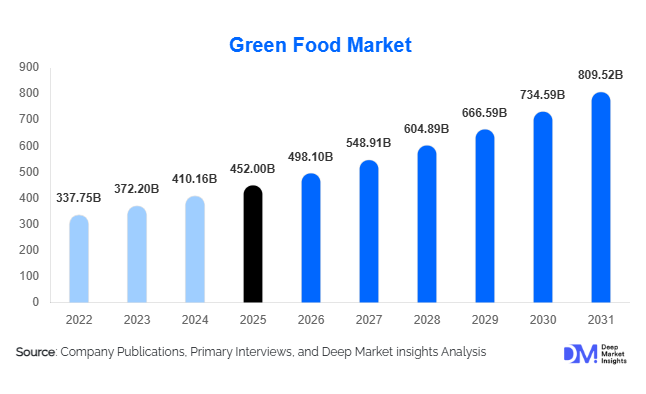

Green Food Market Size

According to Deep Market Insights, the global green food market size was valued at USD 452 billion in 2025 and is projected to grow from USD 498.10 billion in 2026 to reach approximately USD 809.52 billion by 2031, expanding at a CAGR of 10.2% during the forecast period (2026–2031). The green food market growth is primarily driven by rising consumer awareness around health, sustainability, and environmental impact, alongside increasing regulatory support for organic farming, clean-label food production, and sustainable agriculture practices worldwide.Key Market Insights

- Green food consumption is increasingly driven by health-conscious and environmentally aware consumers, prioritizing organic, non-GMO, and sustainably sourced products.

- Organic packaged foods dominate the market due to convenience, longer shelf life, and strong penetration through modern retail channels.

- North America leads global demand, supported by high organic food adoption, premium pricing tolerance, and advanced certification systems.

- Europe remains a sustainability-driven stronghold, with strict food safety regulations and strong preference for clean-label products.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, food safety concerns, and expanding urban populations.

- Technology adoption, including precision farming, vertical agriculture, and blockchain-based traceability, is reshaping production and supply chains.

What are the latest trends in the green food market?

Expansion of Plant-Based and Alternative Proteins

The green food market is witnessing strong momentum in plant-based meat, dairy, and egg alternatives as consumers reduce animal-based consumption for environmental and ethical reasons. Food manufacturers are investing heavily in R&D to improve taste, texture, and nutritional equivalence of plant-based products. Advances in fermentation-derived proteins and hybrid formulations are accelerating product innovation. Retailers are allocating more shelf space to plant-based green foods, while foodservice chains are expanding vegan and vegetarian menus, reinforcing mainstream adoption.

Growth of Regenerative and Controlled Environment Agriculture

Beyond traditional organic farming, regenerative agriculture and controlled environment farming methods such as vertical farming, hydroponics, and aquaponics are gaining traction. These methods reduce water usage, improve soil health, and enable year-round production with minimal environmental impact. Urban vertical farms are particularly expanding in North America, Europe, and East Asia, supporting local sourcing and reducing supply chain emissions. This trend is strengthening supply reliability while aligning with climate-positive food production goals.

What are the key drivers in the green food market?

Rising Health and Wellness Awareness

Consumers are increasingly associating green food consumption with long-term health benefits, including reduced exposure to synthetic chemicals, preservatives, and genetically modified ingredients. Rising incidence of lifestyle-related diseases has accelerated demand for organic, clean-label, and functional green foods. This driver is particularly strong among millennials and Gen Z, who actively seek transparency and ethical sourcing in food purchases.

Strong Regulatory and Policy Support

Governments across major economies are promoting sustainable agriculture through subsidies, tax incentives, and certification harmonization. Policies encouraging organic farming transitions, carbon reduction in agriculture, and sustainable food labeling are strengthening market confidence. Export-friendly certification frameworks are also supporting cross-border trade of green food products, expanding global market reach.

What are the restraints for the global market?

Higher Production and Pricing Costs

Green food production often involves higher input costs, including organic fertilizers, certification fees, and labor-intensive farming practices. These factors result in premium pricing compared to conventional foods, limiting affordability in price-sensitive markets. Yield variability during conversion from conventional to organic farming further constrains short-term profitability for producers.

Supply Chain and Climate Volatility

Green food supply chains are vulnerable to climate variability, seasonal yield fluctuations, and limited shelf life, particularly for fresh organic produce. Inconsistent supply and higher logistics costs pose challenges for large-scale retail distribution, especially in emerging markets with underdeveloped cold-chain infrastructure.

What are the key opportunities in the green food industry?

Government-Led Sustainable Food Initiatives

National programs supporting sustainable agriculture and food security present strong growth opportunities. Initiatives such as organic farming subsidies, climate-smart agriculture funding, and domestic sourcing mandates are reducing entry barriers for new players. Companies aligning with these programs can access financial incentives, infrastructure support, and export advantages.

Direct-to-Consumer and Digital Sales Channels

The rise of e-commerce, subscription-based food delivery, and farm-to-consumer platforms is creating new growth avenues. Digital channels enable better margin control, consumer data access, and traceability transparency. Integration of blockchain and AI-driven demand forecasting is further enhancing trust and operational efficiency in green food distribution.

Product Type Insights

Organic packaged food represents the largest product segment, accounting for approximately 32% of the 2025 market, driven by consumer preference for convenience and extended shelf life. Plant-based food products are the fastest-growing segment, supported by rising vegan and flexitarian diets. Sustainably sourced fresh produce remains a core category, particularly in developed markets, while functional and clean-label foods are gaining popularity among health-focused consumers seeking fortified and preservative-free options.

Production Method Insights

Production methods in the green food market are evolving rapidly as sustainability, yield efficiency, and regulatory compliance become central priorities. Certified organic farming dominates the market, accounting for nearly 41% market share. This leadership is primarily driven by strong regulatory recognition across developed economies, eligibility for export certifications, and high consumer trust in organic labels.

Regenerative agriculture is witnessing accelerated adoption as producers focus on long-term soil fertility, biodiversity preservation, and carbon sequestration. Growing corporate sustainability commitments and carbon credit initiatives are key drivers supporting the expansion of this method.Controlled environment farming (CEF), including vertical farming and hydroponics, is emerging as a high-growth production method, particularly in urban markets. Its growth is driven by the need for year-round production, reduced water usage, minimal pesticide application, and proximity to consumers, enabling fresher supply and lower logistics emissions.

Distribution Channel Insights

Distribution dynamics are shaped by evolving consumer purchasing behavior and expanding retail formats. Supermarkets and hypermarkets hold the largest share at approximately 38%, supported by their extensive shelf space, private-label organic offerings, and ability to offer competitive pricing through scale. Their dominance is further strengthened by consumer preference for one-stop shopping.

Online retail and direct-to-consumer (D2C) channels are growing at double-digit rates, driven by convenience, home delivery, transparent sourcing information, and subscription-based models. Increased smartphone penetration and digital payment adoption continue to accelerate this channel’s expansion.Specialty organic and health food stores remain influential, particularly for premium, niche, and locally sourced green food products. Their growth is supported by personalized customer experiences, curated product selections, and strong brand credibility among health-conscious consumers.

End-Use Insights

End-use demand for green food is primarily driven by changing dietary preferences and sustainability awareness. Household consumption dominates the market, contributing nearly 56% of total demand. The leading driver for this segment is rising consumer awareness regarding health benefits, food safety, and environmental impact, coupled with increasing availability of green food products through mainstream retail.

The foodservice sector represents the fastest-growing end-use segment. Growth is fueled by sustainability commitments from restaurants, hotels, cafes, and catering services, along with rising demand for organic, plant-based, and clean-label menu offerings among consumers.Institutional buyers, including schools, hospitals, and corporate cafeterias, are steadily increasing adoption through green procurement policies and government-supported nutrition programs. This segment benefits from long-term supply contracts, supporting consistent volume growth.

| By Product Type | By Production Method | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market share in 2025, led by the United States. Regional growth is driven by high consumer purchasing power, well-established organic certification frameworks, and widespread availability of green food products across retail channels.

Additional growth drivers include strong demand for plant-based foods, expanding private-label offerings by major retailers, and supportive government policies promoting sustainable agriculture. Canada continues to experience steady growth, particularly in organic produce and packaged green foods.

Europe

Europe accounts for around 29% of the global market share, with Germany, France, and the U.K. leading consumption. The region benefits from strict environmental and food safety regulations, including EU-wide sustainability standards that encourage organic and eco-friendly farming practices.

Growth is further supported by high consumer preference for clean-label and traceable food products, strong government subsidies for organic farming, and increasing adoption of regenerative agriculture across Western and Northern Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at over 13% CAGR. China and India are key contributors, driven by rising food safety concerns, rapid urbanization, increasing disposable incomes, and growing middle-class populations.

Japan and Australia provide stable demand for premium and certified organic products, supported by mature retail infrastructure and strong consumer focus on quality and nutrition. Government initiatives promoting sustainable agriculture also play a critical role in regional expansion.

Latin America

Latin America is emerging as both a major producer and exporter of green and organic food products, with Brazil and Mexico playing pivotal roles. Favorable climatic conditions and availability of arable land support large-scale organic farming.

Regional growth is driven by increasing export demand from North America and Europe, while domestic consumption is gradually rising due to growing health awareness and expanding urban populations.

Middle East & Africa

The Middle East & Africa market remains largely import-driven, with the UAE and Saudi Arabia leading demand for premium green food products. Growth in the region is supported by rising health consciousness, expanding modern retail formats, and government initiatives promoting food security.

Africa is gaining strategic importance as a supplier of organic raw materials and agricultural inputs to global markets, supported by increasing investments in organic farming certification and export-oriented agricultural development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Green Food Market

- Danone

- Nestlé

- General Mills

- Unilever

- Hain Celestial Group

- Kellogg’s

- Mondelez International

- Kraft Heinz

- ADM

- Cargill

- Olam Group

- Dole plc

- Chiquita Brands

- Conagra Brands

- Beyond Meat