Green Cosmetic Products Market Size

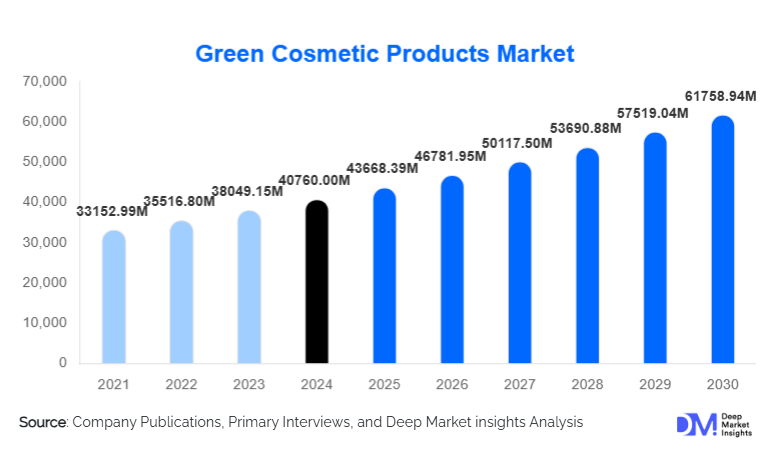

According to Deep Market Insights, the global green cosmetic products market size was valued at USD 40,760.00 million in 2024 and is projected to grow from USD 43,668.39 million in 2025 to reach USD 61,758.94 million by 2030, expanding at a CAGR of 7.13% during the forecast period (2025–2030). The green cosmetic products market growth is primarily driven by increasing consumer awareness about harmful chemicals, rising demand for natural and organic formulations, and the expansion of sustainable and cruelty-free beauty offerings across global regions.

Key Market Insights

- Consumers are increasingly prioritizing eco-friendly and clean beauty products, leading to high demand for natural, organic, and vegan formulations.

- Skincare and hair care dominate product demand globally, with face care and daily-use hair products driving the majority of market revenue.

- North America leads the market, with the U.S. being the largest contributor, supported by high awareness and strict regulations on chemical safety.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urbanization, and increasing adoption of clean beauty products in China and India.

- Technological advancements in natural ingredient extraction and sustainable packaging are enabling brands to innovate while maintaining eco-conscious positioning.

- Government initiatives and regulatory support for organic and cruelty-free products are enhancing consumer trust and market penetration.

What are the latest trends in the green cosmetic products market?

Shift Toward Natural and Organic Formulations

Consumers are gravitating toward products formulated with organic, plant-based, and biodegradable ingredients, seeking both safety and sustainability. Popular trends include vegan skincare, herbal hair care, and natural makeup formulations. Certified organic and cruelty-free labels have become key purchase drivers, with premium pricing justified by perceived health and environmental benefits. Companies are innovating with plant stem cells, bioactive compounds, and probiotic formulations to cater to this demand while maintaining efficacy and compliance with safety regulations.

Technological Integration and Sustainable Packaging

Brands are adopting innovative technologies to enhance product appeal and sustainability. Biotechnological advances allow for the extraction of high-potency natural ingredients, while AI-based research tools assist in formulation optimization. Eco-friendly packaging, including biodegradable, refillable, and recyclable containers, is increasingly standard, aligning with consumer expectations. Digital platforms and e-commerce channels are being leveraged to provide product transparency, ingredient tracking, and interactive marketing, enhancing engagement with environmentally conscious consumers.

What are the key drivers in the green cosmetic products market?

Rising Consumer Awareness and Lifestyle Changes

Increasing awareness about harmful chemicals in conventional cosmetics has shifted consumer preferences toward green alternatives. Health-conscious and environmentally aware consumers are demanding natural, organic, and vegan products. Daily-use segments like skincare and hair care benefit the most, as consumers actively seek safer, effective formulations that align with sustainable lifestyles.

Regulatory Compliance and Safety Standards

Stricter regulations in North America and Europe regarding chemical ingredients and eco-labeling have driven manufacturers to adopt green formulations. Certifications like USDA Organic, COSMOS, and Leaping Bunny reinforce consumer trust and accelerate adoption. This regulatory environment encourages innovation and facilitates market expansion for compliant green cosmetic brands.

E-Commerce and Digital Marketing Expansion

Online platforms have enabled broader consumer reach, particularly among millennials and Gen Z. Direct-to-consumer websites and e-commerce marketplaces provide transparent product information, reviews, and convenience, increasing green product penetration. Digital campaigns focusing on sustainability and ethical beauty attract tech-savvy consumers and encourage repeat purchases.

What are the restraints for the global market?

High Product Pricing

Green cosmetic products typically carry premium pricing due to high-quality organic ingredients and sustainable packaging. This limits affordability in price-sensitive markets and slows mass adoption. Budget-conscious consumers may prefer conventional alternatives, posing a challenge for market growth in emerging regions.

Limited Ingredient Availability

Sourcing high-quality, certified organic, and sustainable ingredients is challenging and can constrain production capacity. Supply chain disruptions and competition for scarce raw materials impact production scalability, sometimes leading to delays or increased costs.

What are the key opportunities in the green cosmetic products industry?

Expansion in Emerging Markets

Emerging economies such as India, China, Brazil, and South Africa offer high-growth potential for green cosmetics. Rising disposable incomes, urbanization, and increasing awareness of health and sustainability are driving adoption. Companies can capitalize on localized formulations, competitive pricing, and targeted marketing strategies to penetrate these markets.

Innovative Formulations and Technology Integration

Technological advancements, including natural ingredient extraction, biotech-based preservatives, and smart packaging solutions, provide differentiation opportunities. Brands can launch novel products like plant stem cell serums, probiotic skincare, and eco-friendly makeup. Sustainable packaging, such as refillable containers and biodegradable tubes, further enhances brand positioning and customer loyalty.

Regulatory Support and Certification Programs

Government policies encouraging organic, cruelty-free, and eco-certified products reduce barriers for new entrants. Certification programs improve consumer trust, aid in global expansion, and allow brands to leverage sustainability as a key differentiator. Public initiatives promoting green manufacturing and eco-friendly products further boost market opportunities.

Product Type Insights

Skincare dominates the market, accounting for approximately 38% of the 2024 market share. Daily-use face and body care products, along with organic sun protection, are key drivers. Hair care follows, particularly shampoos and conditioners with herbal and organic formulations. Makeup is gaining traction, with growing interest in vegan and natural color cosmetics, while personal care products like soaps, deodorants, and oral care items are steadily increasing in adoption.

Application Insights

Individual consumers represent the largest end-use segment (70% of the market), followed by professional salons and wellness centers. Skincare and hair care remain core applications, with emerging areas in spa treatments and subscription-based wellness products. Export-driven demand is notable, particularly from Europe and North America, where imported certified green products are increasingly preferred.

Distribution Channel Insights

Offline retail accounts for 45% of the 2024 market share, with hypermarkets, specialty stores, and pharmacies being dominant. However, e-commerce is rapidly growing, particularly among millennials and Gen Z, due to convenience, transparency, and access to global brands. Brand-owned websites and marketplaces like Amazon, Sephora, and regional platforms are major growth drivers. Social media and influencer-led marketing further enhance consumer awareness and engagement.

| By Product Type | By Ingredient Type | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the market with 32% share in 2024. The U.S. drives growth due to high consumer awareness, stringent regulations, and strong retail and e-commerce infrastructure. Canada contributes steadily, focusing on organic skincare and premium hair care products.

Europe

Germany, France, and the U.K. collectively account for 30% of market revenue. Consumers prioritize cruelty-free, vegan, and certified organic products. Younger European demographics increasingly drive the adoption of budget and mid-range green cosmetics through e-commerce platforms.

Asia-Pacific

China and India are emerging as the fastest-growing markets with a 9–10% CAGR. Rising urban population, middle-class income growth, and increasing clean beauty awareness fuel demand. Japan and South Korea exhibit mature, stable adoption, primarily in skincare and luxury cosmetic segments.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa show growing interest in green cosmetic products, particularly in premium and luxury segments. Government initiatives, high-income populations, and increasing exposure to global trends are driving adoption.

Latin America

Brazil and Argentina are key markets, with rising urbanization, disposable incomes, and wellness awareness supporting gradual adoption. Export-import dynamics from North America and Europe influence market growth in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Green Cosmetic Products Market

- L’Oréal

- Estée Lauder

- Unilever

- Shiseido

- Procter & Gamble

- Beiersdorf

- Johnson & Johnson

- Kao Corporation

- Amorepacific

- Coty

- Natura & Co

- The Body Shop

- Innisfree

- Yves Rocher

- Himalaya