Gold Jewelry Market Size

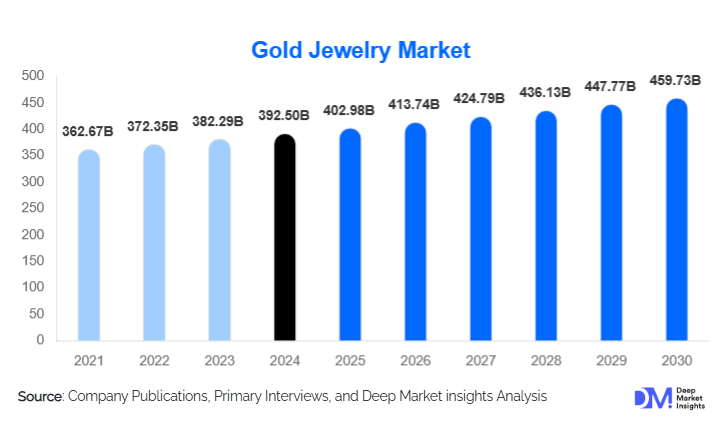

According to Deep Market Insights, the global gold jewelry market size was valued at USD 392.50 billion in 2024 and is projected to grow from USD 402.98 billion in 2025 to reach USD 459.73 billion by 2030, expanding at a CAGR of 2.67% during the forecast period (2025–2030). The gold jewelry market growth is primarily driven by rising disposable incomes, strong cultural and wedding-driven demand, increasing preference for branded and premium jewelry, and the adoption of digital and omnichannel retailing for gold products globally.

Key Market Insights

- Asia-Pacific dominates the market, led by India and China, due to strong wedding, festival, and investment-driven gold consumption.

- Bridal and wedding jewelry remain the largest end-use segment, contributing over 38% of the global demand in 2024, reflecting cultural significance in key regions.

- Offline retail stores hold the majority share, with 68% of global sales, though online and direct-to-consumer channels are growing rapidly.

- 22K gold jewelry leads by purity segment, capturing 46% of global demand, favored for its optimal balance of purity and durability.

- Women are the primary consumers, representing approximately 72% of global purchases.

- Lightweight and customizable designs, along with digital design and blockchain-based purity verification, are transforming production and sales strategies.

What are the latest trends in the gold jewelry market?

Shift Toward Lightweight and Customizable Jewelry

Consumers are increasingly favoring lightweight, modular, and personalized gold jewelry, particularly in urban and working populations. Millennials and Gen Z buyers prefer designs that allow layering, mixing metals, or incorporating diamonds and precious stones. Advanced CAD/CAM and 3D printing technologies have enabled manufacturers to offer custom designs efficiently, improving customer engagement while maintaining profitability. These trends are especially strong in Asia-Pacific and the Middle East, where fashion-forward consumers drive demand for both daily-wear and occasion-specific products.

Omnichannel and Digital Retail Expansion

The market is witnessing rapid growth in online and direct-to-consumer channels. E-commerce platforms, virtual try-on applications, and social media-driven marketing have expanded reach beyond traditional retail. Digital gold savings and investment platforms enhance trust and transparency, appealing to younger demographics and tech-savvy consumers. Retailers integrating online and offline strategies are able to provide flexible purchasing options, secure payment methods, and home delivery, contributing to sustained market expansion.

What are the key drivers in the gold jewelry market?

Cultural and Wedding-Driven Demand

Gold jewelry continues to play a pivotal role in weddings, festivals, and religious ceremonies across Asia-Pacific, the Middle East, and parts of Africa. Bridal jewelry alone contributes over 35% of global demand, providing a consistent revenue stream irrespective of economic cycles. Growing awareness of branded and hallmarked jewelry further strengthens this driver.

Rising Disposable Income and Urbanization

As middle-class populations grow in emerging economies, demand for premium, branded, and lightweight gold jewelry increases. Urban consumers prefer organized retail chains offering certified products. Rising household incomes and increased exposure to global fashion trends further amplify market growth.

Gold as a Store of Value and Investment

Gold jewelry acts as a hedge against inflation and currency fluctuations, particularly in India, China, and Middle Eastern markets. High-value purchases are often driven by investment motives in addition to aesthetics, supporting stable demand for high-purity gold products.

What are the restraints for the global market?

Price Volatility of Gold

Fluctuating gold prices can affect consumer purchasing behavior and retailer margins. Sudden spikes in metal costs may delay discretionary purchases, particularly for high-purity and luxury segments, creating short-term market instability.

Regulatory and Compliance Challenges

Mandatory hallmarking, ethical sourcing, and import duties increase operational and compliance costs for manufacturers and retailers. Small and unorganized players may struggle to adhere to evolving regulations, limiting market expansion in certain regions.

What are the key opportunities in the gold jewelry market?

Emerging Markets Expansion

Markets in India, Indonesia, Vietnam, and Nigeria present significant untapped potential. Rising disposable income, urbanization, and increasing female workforce participation are driving both daily-wear and occasion-based gold jewelry demand. Government support for formalization through hallmarking and digitization further accelerates market organization and growth.

Digitalization and Technology Integration

Online sales channels, virtual try-on applications, and blockchain-based traceability systems present opportunities for increased consumer engagement and trust. New entrants leveraging e-commerce and DTC models can bypass traditional cost-intensive retail structures and expand their reach globally.

Product Innovation and Contemporary Designs

Lightweight, modular, and hybrid gold-diamond designs are increasingly preferred by younger consumers. AI-assisted design and customization allow manufacturers to tap into new demographics while maintaining healthy margins. Innovative offerings such as a combination of 18K and 14K gold in layered jewelry further enhance appeal in urban markets.

Product Type Insights

Among gold jewelry products, necklaces and chains dominate the market, accounting for approximately 32% of the global market in 2024. Their universal appeal, high gold content, and cultural relevance in weddings and festivals contribute to their leading position. Rings and earrings follow closely, especially in bridal and festive segments where gifting traditions and ceremonial importance drive demand. Lightweight daily-wear jewelry is experiencing rapid growth among working professionals and urban consumers, who prioritize wearable, stylish, and versatile pieces suitable for both formal and casual occasions. Meanwhile, luxury and investment-grade collections cater to high-net-worth individuals seeking both aesthetic value and long-term financial security, with emphasis on 22K and 24K high-purity gold. Overall, innovation in design, customization, and hybrid gold-diamond products continues to enhance market attractiveness across all product types.

End-Use Insights

The bridal and wedding jewelry segment remains the largest end-use category, contributing over 38% of global demand in 2024. Cultural and ceremonial practices, especially in India, China, and the Middle East, drive sustained consumption in this segment. Following closely, daily-wear and festive jewelry cater to urban consumers seeking lighter, fashionable, and affordable options for everyday use and special occasions. Lightweight daily-wear jewelry is the fastest-growing sub-segment, with an estimated CAGR of 6% through 2030, reflecting changing lifestyle preferences and the rising working female population. Additionally, investment jewelry is increasingly popular among high-net-worth individuals, serving as both a fashion accessory and a tangible store of value. Emerging niches, including corporate gifting and religious institutions, are also driving incremental demand, expanding the gold jewelry market beyond traditional consumer segments.

Distribution Channel Insights

Offline retail stores continue to dominate, accounting for approximately 68% of global sales in 2024. Their dominance is largely driven by consumer trust, the ability to physically inspect and customize pieces, and the cultural importance of in-store purchasing, particularly for bridal and investment jewelry. Online platforms are growing rapidly, propelled by digital adoption, virtual try-on technologies, secure payment methods, and home delivery. Urban and tech-savvy consumers increasingly rely on e-commerce for convenience and access to a wider variety of designs. Branded chain stores and direct-to-consumer boutiques are gaining traction among younger and premium consumers, offering personalized experiences, exclusive designs, and loyalty programs, enhancing engagement and repeat purchases.

Consumer Demographic Insights

Women remain the primary buyers, representing nearly 72% of global purchases. Mass-market jewelry, which accounts for 54% of demand in 2024, leads in volume due to affordability and versatility. In contrast, premium and ultra-luxury products appeal to affluent consumers seeking exclusivity and investment value. Younger demographics drive the adoption of online and lightweight jewelry, emphasizing convenience and fashion-forward designs, while older consumers tend to favor investment-grade, high-purity, and luxury pieces. Urbanization, rising disposable income, and increasing female workforce participation further amplify demand across all demographic groups.

| By Product Type | By End Use | By Distribution Channel | By Consumer Demographics | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest regional market, holding approximately 58% of the global share, with India (24%) and China (18%) as the primary contributors. Growth in this region is driven by wedding and festival traditions, rising disposable income, urbanization, and increased adoption of branded and certified jewelry. Southeast Asia is the fastest-growing sub-region (6.2% CAGR) due to rising middle-class affluence, fashion-conscious consumers, and growing awareness of hallmarked and customizable gold jewelry. Government initiatives promoting organized retail and hallmarking, alongside e-commerce penetration, further support regional expansion.

Middle East & Africa

The Middle East (12%) and Africa (5%) remain significant markets, underpinned by high-income populations, cultural affinity for gold, and strong investment demand. UAE, Saudi Arabia, and Turkey are major contributors, driven by wedding traditions, festive gifting, and the use of gold as a store of value. Investment-driven demand is further supported by stable economic conditions and regional wealth accumulation. Expansion of luxury retail chains, tourism-related jewelry sales, and government support for hallmarking and consumer protection are key drivers in this region.

Europe

Europe accounts for approximately 12% of global demand, with Italy, the UK, and France as leading markets. Growth is primarily driven by mature consumers’ preference for premium, branded, and ethical jewelry. Sustainability-conscious segments are gaining traction, with consumers increasingly seeking responsibly sourced and hallmarked products. Innovation in design, marketing of investment-grade jewelry, and omni-channel retail strategies are enabling European markets to maintain steady growth despite cultural differences in gold consumption compared to Asia.

North America

North America holds around 9% of the market, led by the U.S. and Canada. The region’s growth is driven by fashion-oriented, premium, and investment-grade jewelry demand, supported by high disposable incomes and increasing awareness of gold as an asset class. Online and e-commerce sales are expanding rapidly, particularly for branded and luxury jewelry. Millennials and high-net-worth individuals are fueling growth in lightweight, customizable, and premium jewelry segments, aided by digital marketing and social media influence.

Latin America

Latin America contributes roughly 4% of global demand, with Brazil and Mexico as major markets. Regional growth is propelled by urbanization, rising disposable income, and increasing interest in premium and mid-range jewelry. Affluent consumers are increasingly exploring outbound luxury purchases, while domestic demand is driven by fashion and ceremonial use. Expansion of organized retail, growing online adoption, and awareness of hallmarked gold further support market growth in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gold Jewelry Market

- Chow Tai Fook

- Titan Company

- Richemont

- Malabar Gold & Diamonds

- Rajesh Exports

- Luk Fook Holdings

- Pandora

- Tiffany & Co.

- Kalyan Jewellers

- Signet Jewelers

- Shandong Gold Jewelry

- Laopu Gold

- Damiani Group

- Graff Diamonds

- Senco Gold