Glass Lens Market Size

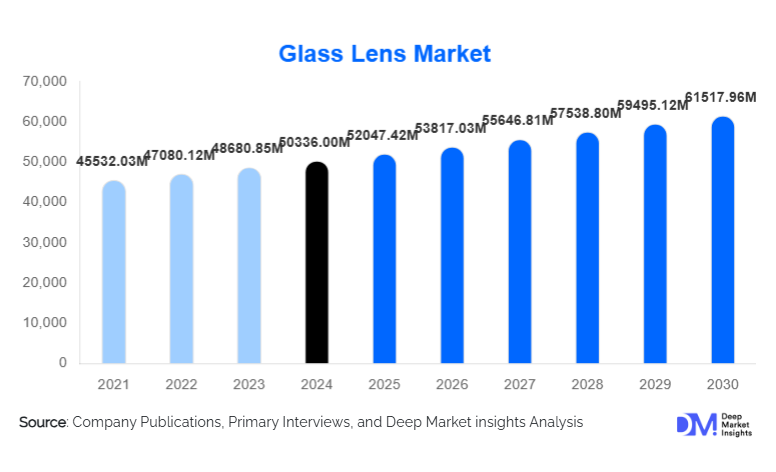

According to Deep Market Insights, the global glass lens market size was valued at USD 50,336.00 million in 2024 and is projected to grow from USD 52,047.42 million in 2025 to reach USD 61,517.96 million by 2030, expanding at a CAGR of 3.40% during the forecast period (2025–2030). The glass lens market growth is primarily driven by rising demand for high-resolution imaging systems, rapid advancements in automotive ADAS sensors, and the expanding adoption of precision optical components across medical devices, industrial automation, and consumer electronics.

Key Market Insights

- Aspheric lenses lead the global market due to superior image correction, lightweight design, and essential use in smartphone cameras, AR systems, and automotive sensors.

- Consumer electronics remains the largest application segment, accounting for nearly 38% of total 2024 demand due to multi-camera smartphone systems and wearables.

- Asia-Pacific dominates production and consumption, holding 42% share, driven by China, Japan, and South Korea’s strong electronics and optical manufacturing ecosystems.

- Medical imaging and diagnostic optics represent the fastest-growing demand center, supported by increasing surgical precision requirements and aging global populations.

- Automotive ADAS integration is significantly boosting demand for precision glass lenses capable of withstanding extreme environmental conditions.

- Advancements in micro-fabrication and precision molding are reshaping manufacturing, enabling mass production of high-accuracy lenses.

What are the latest trends in the glass lens market?

High-Precision Optics for Autonomous and Machine Vision Systems

The surge in autonomous driving technologies, robotic automation, logistics scanning systems, and AI-powered machine vision is creating unprecedented demand for high-precision glass optics. Automotive OEMs increasingly require thermally stable, low-distortion lenses for LiDAR, driver monitoring systems, and night-vision cameras. Similarly, industrial automation leverages multi-spectral and ultra-high-resolution cameras that depend on advanced glass lenses, particularly fused silica, high-index glass, and achromatic assemblies. The trend toward miniaturized optics for compact sensors is accelerating investment in micro-optics and freeform lens geometries, driving innovation across the supply chain.

Expanded Use of Aspheric and Coated Lenses in Consumer Electronics

Consumer electronics continue to evolve with multi-lens camera systems, augmented reality displays, and high-resolution imaging modules in smartphones, drones, and wearables. Aspheric lenses, which improve clarity while reducing lens stack thickness, have become standard in premium devices. Simultaneously, multi-layer AR coatings and UV/IR filters are increasingly applied to enhance transmission and reduce reflections. The growth of 3D sensing, depth mapping, and AI-enhanced photography is further pushing manufacturers toward precision glass lens assemblies. This trend is reinforcing the role of optical innovation as a key differentiator in consumer tech ecosystems.

What are the key drivers in the glass lens market?

Rising High-Resolution Imaging Requirements

The shift toward 4K/8K imaging, computational photography, and multi-camera systems across industries has significantly boosted demand for high-performance glass lenses. Medical imaging devices, endoscopes, industrial inspection systems, and scientific instruments require exceptionally precise optics capable of delivering distortion-free, high-fidelity images. As imaging becomes more central to diagnostics, automation, and quality assurance, glass lenses with superior clarity and refractive stability are becoming indispensable. This trend is a foundational pillar for market expansion.

Automotive ADAS and Autonomous Mobility Growth

Modern vehicles incorporate 10–15 cameras and sensors, a number expected to rise in advanced autonomous systems. Glass lenses are essential in LiDAR units, backup cameras, blind-spot detection, and traffic sign recognition due to their resistance to heat, vibration, and environmental stress. As global safety regulations push for ADAS adoption and electric vehicle platforms integrate more optical sensing hardware, automotive-grade glass lenses are experiencing rapid, sustained demand. This sector is projected to be one of the strongest growth contributors through 2030.

What are the restraints for the global market?

High Manufacturing and Material Costs

Producing precision glass lenses requires advanced equipment, high-skilled labor, and strict quality control. Processes such as grinding, polishing, diamond turning, and multi-layer coating significantly raise production costs. Specialty materials such as fused silica and high-index glass also face supply constraints and price volatility. These barriers create challenges for new entrants and limit cost competitiveness, particularly in high-volume segments.

Supply Chain Complexity and Material Shortages

The market depends on stable supplies of optical-grade silica, rare earth materials, and specialty glass formulations. Limited global suppliers and stringent manufacturing specifications result in long lead times and occasional shortages. Disruptions in raw materials or coating chemicals can slow production and impact pricing, particularly for high-spec lenses used in medical and aerospace applications.

What are the key opportunities in the glass lens industry?

Advanced Optics for AR/VR, Wearables, and Metaverse Devices

Immersive technologies such as AR glasses, VR headsets, mixed reality systems, smart wearables, and 3D sensing devices are creating new value pools for the glass lens industry. These devices require ultra-compact, lightweight, high-precision aspheric and freeform optics capable of delivering wide fields of view and minimal chromatic aberration. Global tech investment in metaverse hardware is accelerating, opening long-term opportunities for manufacturers able to scale micro-lens production and advanced molding techniques for mass deployment.

Medical Imaging and Surgical Optics Expansion

The healthcare industry is rapidly integrating optics into imaging systems, surgical guidance tools, diagnostic devices, and robotic surgery platforms. As populations age and healthcare access expands, demand for micro-optics and high-resolution glass lenses is rising. Manufacturers that meet medical-grade standards and offer advanced coatings resistant to sterilization have significant opportunities for long-term partnerships with device OEMs. This sector is expected to remain one of the highest-margin segments in the coming decade.

Product Type Insights

Aspheric lenses dominate the market, holding approximately 28% share in 2024. Their ability to correct optical aberrations with fewer elements reduces device thickness and weight while enhancing clarity. These properties make them central to smartphone cameras, AR devices, and automotive sensors. Spherical lenses continue to serve scientific and industrial applications requiring consistent, predictable optical behavior. Cylindrical, achromatic, and specialty IR lenses maintain strong niche demand, particularly in aerospace, defense, and laboratory research segments where performance requirements exceed consumer-grade optics.

Application Insights

Consumer electronics remain the largest application segment, representing nearly 38% of global demand. Smartphone manufacturers incorporate multiple glass lenses per module to achieve high-quality imaging and 3D sensing capabilities. Medical applications, endoscopy, diagnostics, ophthalmology, and surgical optics are the fastest-growing due to precision requirements and aging demographics. Industrial automation and machine vision rely heavily on glass lenses for high-speed inspection systems, while automotive demand continues to expand with ADAS, LiDAR, and vehicle monitoring systems.

Distribution Channel Insights

OEM supply channels account for over 56% of the market, as most glass lenses are sold directly to device manufacturers for integration into camera modules, sensors, and instruments. B2B distributors serve smaller industrial users and research laboratories, while online technical marketplaces cater to prototyping and low-volume needs. Direct digital purchasing platforms are expanding as optical manufacturers invest in e-commerce capabilities, enabling easier configuration, quoting, and procurement of specialized lenses for global buyers.

End-Use Industry Insights

Electronics manufacturing is the largest end-use industry, contributing 34% of global demand due to rapid device refresh cycles and multi-lens camera systems. Healthcare and life sciences represent the fastest-growing end-use sector, supported by increasing adoption of optical imaging in diagnostics and surgery. Automotive and transportation continue to expand as vehicles integrate more sensor-based safety systems. Emerging applications in semiconductor metrology, robotics, and scientific research are also adding incremental demand as optical precision becomes critical in advanced manufacturing environments.

| By Lens Type | By Material Type | By Manufacturing Process | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 23% of global demand, led by the U.S., which has strong clusters in medical device manufacturing, aerospace optics, and industrial automation. High investment in AI-driven machine vision and defense imaging technologies strengthens the market. Canada contributes to demand through its scientific research and imaging equipment industries.

Europe

Europe holds around 21% of the market, driven by Germany’s leadership in machine vision, optical instrumentation, and semiconductor metrology. France contributes significantly due to aerospace optics, while the U.K. remains a hub for medical imaging innovation. Strong regulatory standards and R&D funding support market growth.

Asia-Pacific

APAC dominates the global landscape with a 42% share. China leads in consumer electronics production, optical component manufacturing, and government-backed industrial upgrades. Japan remains strong in micro-optics, imaging sensors, and camera modules, while South Korea benefits from advanced smartphone and display ecosystems. India is emerging rapidly, supported by "Make in India" initiatives and rising electronics assembly activity.

Latin America

Latin America represents 7% of global demand, with Brazil and Mexico leading in automotive and electronics assembly. Industrial modernization and healthcare investments are gradually increasing regional adoption of precision optical components.

Middle East & Africa

MEA accounts for 5% of market demand, driven by scientific research, defense optical systems, and expanding healthcare infrastructure. UAE and Saudi Arabia invest heavily in surveillance and smart city technologies that require high-performance imaging optics.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Glass Lens Market

- Nikon Corporation

- Canon Inc.

- Carl Zeiss AG

- Schott AG

- HOYA Corporation

- Largan Precision

- Sunny Optical Technology

- Thorlabs Inc.

- Edmund Optics

- SEKONIX

- Zhongshan Star Optics

- Tamron Co. Ltd.

- Kinik Company (Optics Division)

- Ross Optical

- Fujifilm Optical Devices

Recent Developments

- In January 2025, Largan Precision announced the expansion of its advanced aspheric lens manufacturing line, targeting AR/VR and automotive camera applications.

- In March 2025, Zeiss introduced a new series of high-precision micro-lenses designed for next-generation medical imaging systems.

- In April 2025, Canon launched its latest high-durability coated lenses optimized for industrial machine vision and semiconductor inspection.