Glass Drinkware Market Size

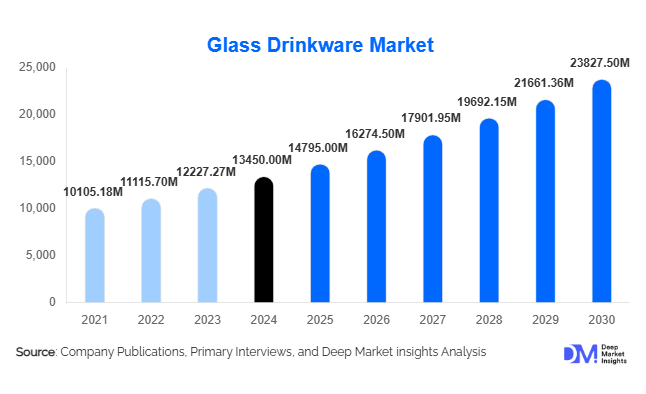

According to Deep Market Insights, the global glass drinkware market size was valued at USD 13,450 million in 2024 and is projected to grow from USD 14,795 million in 2025 to reach USD 23,827.5 million by 2030, expanding at a CAGR of 10% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for reusable and sustainable drinkware, expansion of the global hospitality and food-service sector, and increasing consumer preference for premium and aesthetically pleasing glassware across households and commercial establishments.

Key Market Insights

- Strong shift from plastic to glass drinkware globally, as consumers and businesses increasingly prefer glass for health, sustainability, and aesthetic reasons.

- Residential demand remains the backbone of the market, but commercial demand, especially from hotels, restaurants, bars, and cafés, is growing rapidly due to global hospitality expansion.

- Emerging markets in the Asia-Pacific region are gaining traction, driven by rising disposable incomes, urbanization, and growing middle-class consumption patterns.

- The premiumization trend is evident, with growing demand for wine, cocktails, beer, and specialty glassware as consumers adopt refined lifestyles, home entertaining, and home-bar culture.

- E-commerce and online retail channels are rapidly gaining share, enabling brands to reach global audiences, offer customization, and target younger, urban consumers.

- Sustainability and energy-efficient glass production are shaping manufacturing strategies, giving cost and environmental advantages to glassware suppliers over time.

Latest Market Trends

Premiumization and Lifestyle-Driven Glassware Demand

The market is witnessing a clear shift toward premium and designer glassware. Consumers are increasingly investing in wine glasses, cocktail tumblers, beer mugs, and specialty glassware, not just for utility but as a part of lifestyle and home-décor aesthetics. Home entertainment and home-bar culture are becoming more common worldwide, especially among urban millennials and Gen Z demographics who value presentation and quality. As a result, demand for high-quality stemware, borosilicate glassware, lead-free crystal drinkware, and design-oriented sets is rising steadily.

Sustainability and Reusable Product Adoption

Growing awareness about plastic pollution, health concerns related to chemical leaching, and environmental sustainability is pushing both households and commercial establishments toward glass drinkware. Glass has emerged as a preferred alternative to plastic or disposable materials because it is reusable, recyclable, durable, and perceived as safer for health, qualities that match consumers’ evolving preferences for eco-conscious choices. This trend is further amplified by regulatory efforts in some regions discouraging single-use plastics and promoting sustainable consumption.

Glass Drinkware Market Drivers

Increasing Preference for Health-Safe and Sustainable Drinkware

Consumers globally are becoming more health-conscious and environmentally aware. Glass is perceived as a safer, non-leaching, and recyclable material compared to plastic or metal. As households prioritize safe and sustainable products, demand for glass drinkware (for water, beverages, and soft drinks) has witnessed substantial growth. This shift from plastic or disposable alternatives to reusable glassware is a fundamental driver behind the expanding glass drinkware market.

Expansion of Hospitality, Food-Service, and HoReCa Sector Worldwide

The global hospitality and food-service industry, including restaurants, bars, cafés, hotels, and catering services, has been expanding rapidly, especially in emerging economies. As new establishments open and existing ones seek to upgrade ambience and customer experience, demand for glass drinkware surges. Commercial demand often involves bulk orders of standard glassware sets (tumblers, wine glasses, beer mugs, etc.), which significantly boosts overall market volume. This institutional and B2B demand is more stable and scale-driven compared to household purchases.

Growing Home-Entertainment and Premium Lifestyle Culture

Rising disposable incomes, urbanization, and changing lifestyles are resulting in more consumers embracing home dining, entertaining, and home-bar culture. There is increasing interest in cocktails, wine, beer, and specialty beverages at home, driving demand for cocktail glasses, stemware, and premium drinkware sets. Social media influence and lifestyle aspirations further amplify this trend, as consumers seek aesthetically pleasing and quality drinkware as part of their home décor and entertaining setup.

Market Restraints

Fragility and Breakage Risk of Glass Drinkware

Glass, by its very nature, is fragile. Breakage risk during manufacturing, transport, retail handling, storage, or everyday use (especially in homes with children, or in busy commercial kitchens) remains a significant deterrent. This fragility reduces adoption in certain segments or geographies where durability and convenience matter more than aesthetics. As a result, segments requiring ruggedness (e.g., outdoor use, travel, low-cost markets) may continue to favor plastic, metal, or ceramic alternatives over glass.

Competition from Alternative Materials, Price & Convenience Pressure

Plastic, metal, silicone, or ceramic drinkware often offers advantages in cost, weight, durability, portability, and convenience. In price-sensitive regions or applications where durability matters more than presentation (e.g., mass-market households, outdoor events, travel, children's use), these alternatives remain preferred. Additionally, fluctuations in raw material and energy prices for glass manufacturing can raise production costs, sometimes making glass drinkware less competitive in price-sensitive markets. This competition and cost pressure pose challenges to glass drinkware growth in certain segments.

Glass Drinkware Market Opportunities

Scaling B2B Supply to Hospitality & Institutional Buyers

The rapid growth of the global hospitality and food-service sector, particularly in Asia-Pacific, the Middle East, and Latin America, presents a major opportunity for glass drinkware manufacturers. By targeting bulk procurement orders from hotels, restaurants, cafés, bars, catering firms, and institutional buyers, manufacturers can achieve volume-driven growth. Existing players can expand production capacity to serve these buyers, while new entrants can focus on supplying cost-effective yet quality drinkware solutions tailored for commercial use. Given the repeat and bulk nature of orders, this segment offers stable demand and predictable revenue streams.

Leveraging Sustainability Trends and Eco-Friendly Branding

As awareness about environmental impact, plastic pollution, and health safety grows, glass drinkware is increasingly being marketed as a sustainable, reusable, and health-safe alternative. Manufacturers can capitalize on this trend by highlighting recyclability, durability, and eco-friendliness in their branding. New entrants have the opportunity to differentiate through sustainable production practices, for example, using recycled glass, energy-efficient furnaces, or lead-free glass. This aligns with global regulatory momentum against single-use plastics, offering long-term growth potential driven by conscious consumer behavior.

Expansion via E-Commerce, Customization, and Direct-to-Consumer Models

Online retail and direct-to-consumer (D2C) channels are growing fast, especially among younger, urban consumers and smaller buyers seeking convenience, variety, and custom options. Glassware brands can leverage e-commerce to reach global markets, offer customization (engraved glassware, bespoke sets), bundle products, and cater to niche tastes such as artisanal or design-oriented drinkware. This lowers entry barriers for new players (reducing the need for physical retail) and enables established firms to expand beyond traditional retail footprints. As internet penetration and e-commerce adoption rise in emerging economies, this channel presents a large growth opportunity.

Product Type Insights

Among product types, everyday water glasses and tumblers remain the largest segment due to their universal daily use in households and food-service establishments, covering water, soft drinks, juices, and non-alcoholic beverages. Demand for stemware, wine glasses, cocktail glasses, and beer mugs is growing faster, fueled by rising home-bar culture, social drinking, premiumization, and lifestyle-driven consumption. Specialty glassware (e.g., decanters, carafes, shot glasses) is gaining traction among consumers and hospitality buyers seeking aesthetic and functional upgrades, boosting average selling prices and improving margins. The mass-market segment remains volume-driven and price-sensitive, while premium segments focus on quality, design, and brand positioning to attract higher-margin customers.

Application Insights

Household use remains the primary application of glass drinkware globally, for everyday drinking water, soft drinks, juices, and home dining, driven by urbanization and rising living standards. However, commercial applications through hospitality (restaurants, bars, cafés, hotels), catering, and events are rapidly rising, particularly in emerging markets where food-service growth is fastest. Institutional uses, corporate canteens, event venues, and conference centers also add incremental demand. Moreover, lifestyle-oriented uses, such as home entertaining, cocktail-making, wine-tasting at home, and gifting (designer glassware sets), are emerging as new applications, especially in urban and premium consumer segments. This diversification of application supports both volume growth and premiumization in the glass drinkware market.

Distribution Channel Insights

Traditional offline retail, supermarkets, hypermarkets, department stores, specialty houseware shops, and kitchenware stores continue to dominate distribution globally due to consumers’ preference to physically examine glassware for quality, clarity, finish, and weight before purchase. This is especially true for mass-market and mid-tier glassware. However, online channels (e-commerce marketplaces and D2C brand websites) are gaining rapid share, driven by convenience, broader selection, customization options, and competitive pricing. For premium or designer glassware, online sales offer particular advantages, allowing brands to reach niche audiences globally without heavy investment in physical retail. Wholesale distribution for hospitality buyers and B2B procurement remains a significant channel for bulk orders, especially in the commercial segment.

| By Product Type | By Material Type | By Price Range | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe accounts for the largest share of glass drinkware demand globally (roughly 30–35% in 2024). The high per-capita beverage consumption, established dining and wine culture, high disposable incomes, and preference for premium, well-designed drinkware drive this dominance. Western European countries, such as Germany, France, Italy, Spain, and the UK, exhibit high demand for wine glasses, beer mugs, stemware, and premium glassware sets. Sustainability awareness and environmental consciousness further reinforce glass adoption over plastic alternatives. Demand growth remains stable, supported by replacement demand, premiumization, and steady consumption habits across households and hospitality outlets.

North America (USA & Canada)

North America contributes around 20–25% of global glass drinkware revenue in 2024. The well-developed hospitality and food-service sector, high disposable incomes, and strong culture of dining out and home entertaining fuel consistent demand. While the market is relatively mature, demand for premium and specialty glassware, wine glasses, cocktail sets, and beer mugs remains strong. Replacement demand and gradual premiumization (upgrading from basic glassware to designer or crystal-quality items) support steady market expansion.

Asia-Pacific (China, India, Southeast Asia, etc.)

Asia-Pacific is the fastest-growing region, with an estimated share of roughly 20–25% in 2024 and projected highest growth rate through 2030. Rapid urbanization, rising disposable incomes, expanding middle class, and growing hospitality and food-service sectors, especially in China, India, Southeast Asia, drive demand. As western-style dining, home entertaining, and lifestyle upgrades spread, both households and commercial establishments increasingly prefer glass drinkware over plastic or metal, fueling strong growth. Local manufacturing bases and competitive costs also enable supply to domestic and export markets.

Middle East & Africa (MEA)

MEA accounts for approximately 5–8% of the global market in 2024. Demand is concentrated in affluent Gulf countries (UAE, Saudi Arabia, Qatar), where high-income populations, luxury hospitality, tourism, hospitality expansion, and resort developments drive demand for premium glassware. As tourism and dining-out culture expand, hotels, restaurants, and resorts increasingly invest in high-quality glassware for customer service, creating steady growth opportunities. Despite a smaller absolute volume compared to larger regions, the growth rate is above average due to rising hospitality investments and tourism-led demand.

Latin America (Brazil, Mexico, Argentina, etc.)

Latin America contributed roughly 5–7% of global glass drinkware revenue in 2024. Demand is gradually increasing, although constrained by lower average disposable incomes and higher price sensitivity in many markets. Urban households, rising middle-class populations in major economies like Brazil and Mexico, and the growth of the food-service industry are slowly improving demand for glassware. However, price competition from plastic, ceramic, or metal drinkware remains significant, moderating growth compared to other regions. Overall, LATAM is a slower-growing, but steadily evolving market for glass drinkware.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Glass Drinkware Market

- Libbey

- Bormioli Rocco

- Anhui Deli Glassware

- Ocean Glass Public Company Limited

- Steelite International

- Anchor Hocking

- Cristal d’Arques Paris

- Hamilton Housewares Pvt. Ltd.

- Lifetime Brands, Inc.

- Shandong Huapeng Glass Co., Ltd.

- Pasaş Group (Pasabahce)

- Borosil (India)

- Iittala

- Duralex

- Riedel