Glass Door Coolers Market Size

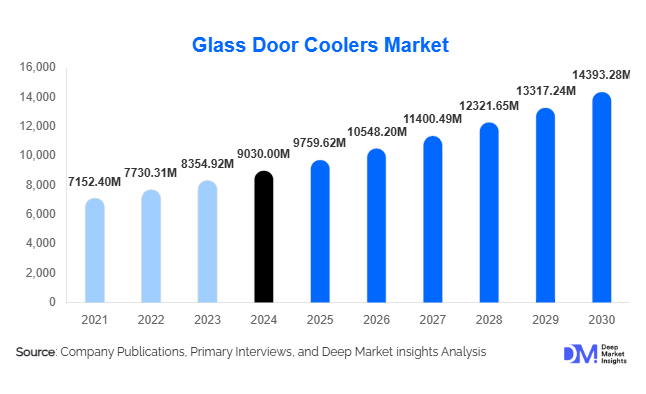

According to Deep Market Insights, the global glass door coolers market size was valued at USD 9,030.00 million in 2024 and is projected to grow from USD 9,759.62 million in 2025 to reach USD 14,393.28 million by 2030, expanding at a CAGR of 8.08% during the forecast period (2025–2030). The glass door coolers market growth is primarily driven by the rapid expansion of modern food retail and convenience formats, rising demand for high-visibility chilled merchandising for beverages and dairy, tightening energy-efficiency and refrigerant regulations, and the increasing adoption of smart, connected refrigeration solutions in supermarkets, QSR chains, and healthcare facilities.

Key Market Insights

- Double-door upright glass door coolers dominate global demand, supported by their widespread use in supermarkets, convenience stores, and HoReCa as the standard format for chilled beverage and dairy merchandising.

- Plug-in/self-contained systems account for the majority of installed base, offering retailers flexible placement, easier installation, and reduced dependence on central rack systems.

- Asia-Pacific is the largest and fastest-growing regional market, driven by organised retail expansion, rising beverage and dairy consumption, and local manufacturing in China, India, and ASEAN countries.

- Supermarkets, hypermarkets, and convenience stores together contribute the largest end-use share, as store remodels and new-builds increasingly prioritise glass-fronted refrigeration for premium visibility.

- Energy-efficient and low-GWP refrigerant models are gaining share rapidly, driven by stricter regulations and retailer commitments to sustainability and reduced operating costs.

- Top five manufacturers hold around 45–50% of market revenue, but regional OEMs and niche specialists still play a critical role in localised designs, pricing, and service.

What are the latest trends in the glass door coolers market?

Shift Toward Energy-Efficient and Low-GWP Refrigeration

One of the most prominent trends in the glass door coolers market is the transition to energy-efficient systems that utilise low global warming potential (GWP) refrigerants such as R290 and CO2. Regulatory frameworks in North America, Europe, and parts of Asia are accelerating the phase-down of legacy refrigerants and imposing stricter minimum energy performance standards. In response, manufacturers are redesigning cabinets with advanced compressors, high-performance insulation, better door gaskets, and optimised airflow systems. Retailers and beverage brands increasingly assess total cost of ownership rather than just upfront price, favouring coolers that deliver measurable reductions in energy consumption. Many new product lines now carry eco-labels, enhanced energy ratings, and lifecycle documentation, positioning glass door coolers as a visible symbol of in-store sustainability initiatives.

Smart, Connected, and Data-Driven Cooler Fleets

Digitalisation is reshaping how retailers and brands manage glass door coolers. Newer models integrate IoT gateways, wireless sensors, and cloud-based control platforms, enabling remote monitoring of temperature, door openings, power consumption, and performance anomalies in real time. This connectivity allows predictive maintenance, reducing unplanned downtime and product spoilage, while also supporting centralised control of setpoints and defrost cycles across large store fleets. Brand owners and bottlers are using data from smart coolers to optimise planograms, track stock turnover, and analyse shopper behaviour around chilled displays. Integration with energy-management systems and building automation further enhances efficiency. As connectivity becomes more affordable, smart features are migrating from premium to mid-range cabinets, making connected glass door coolers a mainstream trend in global retail and foodservice operations.

What are the key drivers in the glass door coolers market?

Expansion of Modern Retail, Convenience, and Foodservice Networks

The proliferation of supermarkets, hypermarkets, discounters, convenience stores, and QSR chains is a fundamental driver of glass door cooler demand. As retailers expand their footprints and remodel existing sites to feature larger chilled and ready-to-eat sections, they require extensive line-ups of glass-fronted cabinets to merchandise beverages, dairy, meat, and grab-and-go foods. Convenience stores and forecourt retail formats, in particular, rely heavily on glass door coolers for impulse beverage sales and chilled snacks. Similarly, coffee chains, bakeries, and fast-casual restaurants use upright and countertop coolers to showcase desserts, drinks, and prepared items, translating network expansion directly into incremental cooler installations.

Premiumisation and Visual Merchandising of Beverages and Dairy

Brands in soft drinks, energy drinks, ready-to-drink coffee and tea, flavoured milk, yoghurt, and functional beverages are investing heavily in visual merchandising, making glass door coolers a critical marketing asset. Co-branded cabinets with illuminated headers, custom graphics, and full-height LED lighting help drive impulse purchases and differentiate products at the point of sale. As beverage portfolios premiumise and diversify, retailers need more SKUs on chilled shelves, encouraging adoption of multi-door line-ups and larger capacity coolers. This focus on visibility and brand experience significantly boosts demand for high-quality glass door cabinets with attractive aesthetics, stable temperature performance, and flexible shelving configurations.

What are the restraints for the global market?

High Upfront Investment and CapEx Sensitivity

Advanced glass door coolers that meet the latest efficiency standards and use natural refrigerants typically carry higher upfront costs than basic or older-generation units. For small independent retailers, cafés, and regional HoReCa operators, these higher acquisition costs can be a barrier, especially in markets with limited access to financing or incentives. Even large chains can delay replacement cycles during periods of macroeconomic uncertainty or margin pressure, prioritising essential investments in IT, supply chain, or omnichannel infrastructure. This CapEx sensitivity slows the pace of fleet modernisation and can extend the life of less efficient installed units.

Volatile Raw Material and Component Prices

Glass door coolers depend on steel, aluminium, copper, electronic controllers, compressors, and double- or triple-glazed door assemblies. Fluctuations in global commodity prices, logistics costs, and trade tariffs can compress margins for manufacturers and distributors. When component prices spike or supply chains are disrupted, OEMs face challenges in maintaining stable pricing and delivery schedules, particularly for long-term key-account contracts. Retailers may react to price volatility by postponing large roll-outs or renegotiating specifications, creating short-term demand instability. This volatility also increases the need for lean manufacturing, localisation strategies, and alternative sourcing to stabilise supply.

What are the key opportunities in the glass door coolers industry?

Healthcare, Pharma, and High-Value Cold-Chain Applications

Beyond food and beverages, glass door coolers are increasingly deployed in hospitals, clinics, pharmacies, and laboratories for the storage of vaccines, biologics, and temperature-sensitive medicines. These applications require highly reliable temperature control, alarm systems, data logging, and regulatory compliance, supporting premium pricing and higher margins. As governments and private healthcare providers expand cold-chain capacity, particularly in emerging markets, demand for medical- and pharma-grade glass door cabinets is set to rise. Manufacturers that develop certified healthcare lines and collaborate with pharma logistics firms, hospital chains, and public health agencies can secure long-term, sticky revenue streams in this specialised segment.

Retrofit and Upgrade Cycles for Energy-Efficient Fleets

Ageing fleets of commercial coolers in supermarkets, convenience stores, and beverage outlets represent a large retrofit opportunity. Many installed cabinets still use older refrigerants and less efficient components, making them prime candidates for replacement as energy and environmental regulations tighten. OEMs and service partners that can offer turnkey retrofit packages, combining high-efficiency glass door coolers, financing options, and energy-savings guarantees, have an opportunity to capture significant upgrade demand. Programmes linked to government incentives, utility rebates, or ESG commitments by retailers and beverage companies can further accelerate adoption, positioning energy-efficient glass door coolers as a central pillar of decarbonisation strategies in food retail and foodservice.

Product Type Insights

Product segmentation in the glass door coolers market is led by double-door upright cabinets, which provide an optimal balance between storage capacity, floor footprint, and visibility. These units are the standard solution in beverage aisles, dairy sections, and mixed chilled displays across supermarkets and convenience stores, accounting for an estimated one-third of global revenue. Single-door uprights and countertop units serve smaller-format stores, cafés, and kiosks where space is constrained, while triple-door and multi-door line-ups are common in large supermarkets, hypermarkets, and warehouse clubs. Under-counter and back-bar glass door coolers are widely used in bars, restaurants, and QSR kitchens, where easy access and front-of-house visibility for beverages are critical. The breadth of form factors enables manufacturers to address diverse layout requirements, from narrow urban convenience stores to high-traffic hypermarkets.

Application Insights

Glass door coolers support a wide spectrum of applications, with food and beverage retail being the largest. In supermarkets and hypermarkets, they are used to display carbonated soft drinks, juices, water, dairy products, chilled desserts, and ready meals. Convenience stores and forecourt retailers rely on them for grab-and-go beverages and snacks that drive high-margin impulse sales. In the HoReCa and QSR segment, glass door coolers are placed both front-of-house, showcasing desserts, bottled drinks, and premium items, and back-of-house, where staff require clear visibility of stock. In food and beverage processing and distribution, branded coolers act as a last-mile marketing asset at retail points, often supplied by bottlers and dairies under long-term placement agreements. Emerging applications include healthcare, laboratories, and institutional facilities where visibility, temperature control, and compliance coexist as key requirements.

Distribution Channel Insights

The distribution landscape is split between direct OEM/key-account sales and indirect sales via distributors and refrigeration contractors. Large multinational retailers, QSR chains, and beverage companies typically engage directly with major OEMs through framework agreements, enabling customised specifications, co-branding, and multi-country deployment. These direct channels are crucial for high-volume, strategically important accounts. In contrast, regional distributors and cooling contractors dominate sales to independent supermarkets, small convenience stores, local HoReCa operators, and institutional buyers. They provide not only equipment but also installation, commissioning, and aftersales service. Online and catalog-based channels are gaining ground in small single-door and countertop units, allowing small businesses to compare prices and make faster purchasing decisions, though installation and service support remain decisive factors.

End-User Type Insights

End-user demand for glass door coolers can be grouped into four main categories: organised retail chains, independent retailers, foodservice operators, and healthcare/institutional buyers. Organised retail chains, supermarkets, hypermarkets, discounters, and major convenience networks, represent the largest and most structured demand pool, often purchasing in large batches and standardising models across store formats. Independent retailers, including small groceries, neighbourhood stores, and standalone petrol stations, typically purchase fewer units but constitute a broad base of replacement and expansion demand. Foodservice operators such as cafés, bakeries, restaurants, and QSR chains favour compact, visually appealing units that reinforce brand identity at the counter or bar. Healthcare and institutional buyers, including hospitals, labs, schools, and corporate offices, focus on reliability, compliance, and safety, often specifying cabinets with alarms, locks, and data logging capabilities.

Capacity Range Insights

By internal volume, the 401–600 litre capacity range is the most widely adopted, particularly in supermarkets and larger convenience stores, where operators need to balance shelf capacity, product variety, and limited floor space. These mid-capacity units offer enough room for multiple facings of key SKUs while maintaining ergonomic loading and customer accessibility. Smaller units up to 400 litres are popular in cafés, petrol kiosks, small restaurants, and micro-retail formats, where only a limited range of beverages or desserts is required. Larger units above 1,000 litres are primarily used in hypermarkets, warehouse clubs, and high-traffic transit hubs, often installed as part of continuous multi-door line-ups. Across all capacity bands, retailers continue to prioritise energy performance, internal lighting quality, and modular shelving to maximise sales per square metre.

| Product Type | Door Mechanism | System Design | Capacity Range | End-Use Industry | Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America is a mature, high-value market with strong penetration of glass door coolers across grocery, convenience, and foodservice channels. The U.S. leads regional demand, supported by extensive supermarket chains, big-box retailers, and well-developed convenience store and forecourt networks. Canada contributes additional demand through modern grocery and QSR expansion. The region is at the forefront of adopting energy-efficient and low-GWP refrigeration technologies, and retailers increasingly demand connected coolers integrated into enterprise energy-management systems. Replacement and upgrade cycles, rather than first-time installations, drive much of the incremental volume.

Europe

Europe combines stringent environmental regulation with a dense network of supermarkets, discounters, and convenience formats, making it a core region for high-efficiency glass door coolers. Markets such as Germany, the U.K., France, Italy, and Spain emphasise reduced GWP refrigerants and compliance with EcoDesign and F-Gas rules, steering demand towards advanced plug-in and remote systems. Discounters and large grocery chains deploy extensive glass door line-ups for beverages, dairy, and chilled convenience foods. Europe is also a major manufacturing hub for premium cabinets, exporting to other regions and serving as an innovation centre for sustainable and natural-refrigerant-based technologies.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing market, underpinned by rapid urbanisation, rising disposable incomes, and the transition from traditional trade to organised retail. China, India, Japan, South Korea, and key ASEAN economies are investing heavily in supermarkets, convenience chains, coffee shops, QSR networks, and cold-chain logistics. Local manufacturing clusters, especially in China and India, support cost-competitive production and regional exports. APAC also benefits from government initiatives aimed at boosting manufacturing, energy efficiency, and food security, which indirectly stimulate demand for modern commercial refrigeration, including glass door coolers.

Latin America

Latin America, led by Brazil, Mexico, Chile, and Colombia, presents a mix of established supermarket chains and growing convenience and HoReCa sectors. Beverage companies and dairies actively place branded glass door coolers in retail outlets to secure chilled shelf space, making this region attractive for OEMs and regional manufacturers. Economic volatility and currency fluctuations can temporarily slow large projects, but demographic trends, urbanisation, and the popularity of chilled beverages support steady medium-term growth. Upgrades to higher-efficiency units are gradually gaining traction as energy prices rise and sustainability goals become more prominent.

Middle East & Africa

The Middle East & Africa region offers high long-term potential for glass door coolers due to hot climates, population growth, and rising modern retail penetration. Gulf Cooperation Council (GCC) countries such as the UAE, Saudi Arabia, and Qatar feature premium supermarkets, hypermarkets, and forecourt networks that demand robust, climate-optimised glass door cabinets. In Africa, markets like South Africa, Kenya, Nigeria, and Egypt are central nodes for regional cold-chain and retail development. Rising imports of chilled and frozen foods, along with the growth of QSR and convenience formats, are gradually expanding the installed base of glass door coolers across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Glass Door Coolers Industry

- Hussmann Corporation (Panasonic Group)

- True Manufacturing Co., Inc.

- Liebherr Group

- Hoshizaki Corporation

- Arneg Group

- Beverage-Air Corporation

- Everest Refrigeration

- Migali Industries

- AHT Cooling Systems

- SandenVendo

- Turbo Air Inc.

- TSSC Group

- Procool/plug-in cabinet specialists

Recent Developments

- Valpro recently introduced the VP2F-48M glass door merchandiser freezer offering enhanced product visibility and energy-efficient refrigeration for retail operators.

- Gastro-Cool launched the GCGD360 ECO STAR cooler with high-efficiency compressors and fans, designed to reduce energy consumption and lower annual operating costs.

- Haier Smart Home completed the acquisition of Carrier’s commercial refrigeration business, strengthening its global position in supermarket cases and glass door merchandisers and expanding its footprint in Europe and North America.