Glamping Market Size

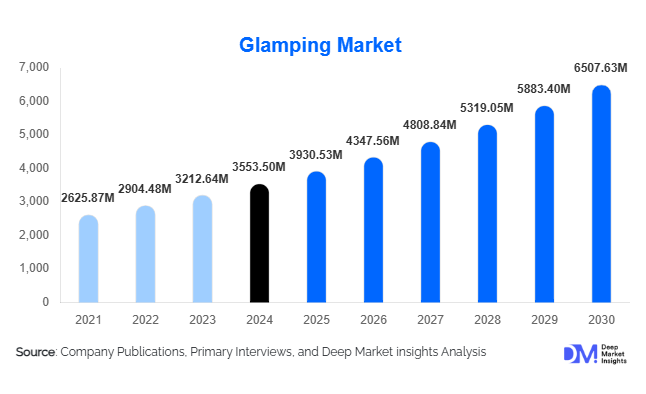

According to Deep Market Insights, the global glamping market size was valued at USD 3,553.50 million in 2024 and is projected to grow from USD 3,930.53 million in 2025 to reach USD 6,507.63 million by 2030, expanding at a CAGR of 10.61% during the forecast period (2025–2030). The glamping market growth is primarily driven by the rising consumer demand for experiential travel, eco-friendly accommodations, and high-comfort outdoor experiences that blend nature with luxury. Growing interest among millennials and Gen Z travelers, coupled with the expansion of premium glamping operators across scenic landscapes, national parks, and adventure tourism hotspots, continues to propel the industry forward.

Key Market Insights

- Glamping is rapidly shifting toward sustainable, eco-conscious stay models, with operators adopting renewable energy, modular structures, and low-impact site designs.

- Luxury tents and eco-cabins dominate the accommodation segment, driven by strong demand for premium comfort within natural environments.

- North America leads the global glamping market, driven by high outdoor recreation participation and strong weekend getaway culture.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class income and government-backed eco-tourism initiatives.

- Technology integration, smart cabins, IoT-enabled amenities, and digital concierge systems are transforming guest experiences and boosting premium pricing.

- Corporate retreats, destination events, and wellness-focused glamping packages are emerging as high-growth revenue streams for operators.

What are the latest trends in the glamping market?

Eco-Luxury & Sustainability-Driven Glamping Rising

Operators are increasingly integrating sustainable materials, renewable energy systems, and eco-friendly design into their glamping offerings. Solar-powered cabins, zero-waste operations, rainwater harvesting, and biodegradable amenities are becoming standard features. Travelers are prioritizing stays that minimize environmental impact, and many glamping brands now promote carbon-neutral or low-impact certifications. This trend also aligns with the global rise of wellness tourism, as guests seek authentic, nature-oriented experiences that support personal well-being and ecological balance. Many glamping operators also partner with conservation NGOs to offer eco-tourism learning, forest restoration activities, and wildlife awareness programs.

Technology-Enhanced Outdoor Experiences

The glamping industry is adopting technology to elevate pre-booking and on-site experiences. Smart cabins equipped with IoT lighting, climate control, keyless access, and real-time service requests are becoming popular among premium operators. Virtual reality (VR) previews help customers visualize stays before booking. Mobile apps now offer destination guides, digital concierge services, nature trail navigation, and local activity booking. High-speed Wi-Fi, solar-powered charging stations, and sustainability dashboards appeal to younger, tech-savvy travelers. Technology is also enabling remote operations and reducing staff costs through automation and smart monitoring systems.

What are the key drivers in the glamping market?

Rising Demand for Experiential & Wellness Tourism

The global shift toward experience-driven travel significantly boosts glamping’s appeal. Travelers increasingly prioritize immersive, rejuvenating, and nature-oriented journeys over traditional hotel stays. Glamping offers a unique blend of outdoor adventure and luxury, making it a preferred choice for weekend getaways, stress-relief vacations, and mindfulness retreats. Wellness tourism’s strong global growth, estimated at 8–9% annually, further strengthens demand for glamping accommodations that offer spa-like amenities, meditation decks, and natural relaxation environments.

Growing Popularity of Digital & Social Media-Driven Travel

Social media platforms such as Instagram, TikTok, and Pinterest have played a major role in popularizing glamping. Visually appealing structures, domes, treehouses, floating villas, and forest cabins drive “destination discovery” trends. User-generated content has become a powerful marketing tool, enabling rapid global awareness of unique glamping stays. Operators leveraging digital marketing and influencer collaborations have seen booking increases of up to 30%.

What are the restraints for the global market?

Regulatory & Land-Use Restrictions

Strict zoning laws, environmental protection regulations, and land-use restrictions in protected areas pose challenges for glamping operators. Obtaining development permits in forested, coastal, or mountainous regions can require lengthy government approvals and significant environmental assessments, increasing project timelines and costs. This restricts rapid expansion, especially for small and independent players.

Seasonality and Climate Limitations

Glamping demand fluctuates heavily in regions with harsh winters or extreme weather. Occupancy rates drop during off-seasons, impacting profitability. Operators relying on non-insulated tents or weather-sensitive structures face maintenance challenges, higher operating costs, and limited year-round revenue potential.

What are the key opportunities in the glamping industry?

Corporate Retreats & Wellness-Focused Glamping

The rise of hybrid work, wellness-focused corporate offsites, and team-building retreats presents a major growth opportunity. Companies increasingly seek nature-integrated venues offering privacy, productivity, and wellness amenities. Glamping operators are developing meeting-friendly cabins, group activity zones, and wellness retreat packages combining yoga sessions, forest bathing, and holistic therapies. This segment is projected to grow at over 15% annually.

Community-Based Eco-Tourism Expansion

Local community-driven glamping projects are gaining momentum, especially in rural Asia, Africa, and Latin America. These models promote local employment, cultural exchange, and indigenous-led tourism. Governments and NGOs actively support such initiatives to encourage rural development, ecological conservation, and sustainable tourism. Authentic cultural experiences, craft workshops, local cuisine, and guided nature walks are becoming key differentiation points for community-based glamping operators.

Application Insights

Glamping serves multiple use cases, with leisure tourism accounting for over 70% of demand. Event-based applications, destination weddings, adventure retreats, music festivals, and wellness events are rising rapidly. Corporate glamping retreats are gaining momentum due to rising interest in mindfulness and nature-based off-sites. Eco-volunteer stays and cultural immersion programs are attracting travelers seeking meaningful engagement with local communities and conservation efforts.

Distribution Channel Insights

Online Travel Agencies (OTAs) lead the booking landscape with a 42% share. Their extensive reach, transparent pricing, and user reviews significantly influence traveler decision-making. Brand-owned platforms and direct lodge bookings are steadily increasing as operators invest in digital transformation. Social media-driven discovery and influencer-based marketing also play pivotal roles in attracting younger travelers.

Traveler Type Insights

Millennials and Gen Z travelers dominate the market with a combined 47% share, driven by demand for immersive, photogenic, and eco-friendly experiences. Couples are key contributors to the luxury glamping segment, while families drive mid-range cabin and pod stays. Solo travelers and digital nomads prefer tech-enabled eco-cabins with remote-work-friendly amenities. Group travelers account for significant seasonal demand for festivals, corporate retreats, and adventure camps.

Age Group Insights

Travelers aged 25–40 form the largest customer segment, motivated by adventure travel, experiential stays, and social media discovery. The 40–60 age group, with higher disposable income, drives demand for premium glamping cabins, spa retreats, and extended-stay eco-resorts. Younger travelers (18–25) often opt for budget-friendly pods and tents, while the 60+ demographic favors relaxed, nature-centric glamping resorts with high comfort and accessibility features.

| By Accommodation Type | By Booking Channel | By Ownership Model | By Consumer Group | By Location |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with 38% share in 2024. The U.S. is the largest contributor, driven by a strong outdoor recreation culture, national park tourism, and the rapid rise of luxury desert and forest glamping destinations. Canada’s eco-tourism initiatives and outdoor lifestyle trends further reinforce regional dominance.

Europe

Europe accounts for 29% of the global market, led by the U.K., Germany, France, and the Nordic countries. The region benefits from a mature camping culture, high adoption of sustainable tourism practices, and widespread availability of rural and semi-urban glamping sites. Weekend getaways and nature-focused wellness retreats are strong demand drivers.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a CAGR of over 15%. China, Japan, Australia, South Korea, and India are emerging hotspots, supported by rising disposable income, government-backed eco-tourism projects, and strong adventure travel culture. Modular cabins and luxury domes are particularly popular in forested and coastal regions of APAC.

Latin America

The region is witnessing steady adoption, with Brazil, Mexico, Chile, and Costa Rica at the forefront. Adventure tourism, rainforest stays, and eco-lodges are key contributors to growth. Latin America also benefits from increasing inbound digital nomads seeking scenic, low-cost long-stay options.

Middle East & Africa

The Middle East, especially the UAE and Saudi Arabia, is investing heavily in luxury desert glamping as part of diversification strategies like Vision 2030. Africa’s glamping demand is boosted by safaris, wildlife tourism, and culturally integrated eco-lodges across Kenya, Tanzania, and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Glamping Market

- Under Canvas

- Collective Retreats

- Getaway House

- Huttopia

- Autocamp

- Tentrr

- Baillie Lodges

- Eco Retreats

- Treebones Resort

- Nightfall Camp

- Longitude 131

- Aman (Luxury Nature Resorts)

- Discovery Rottnest Island

- Canopy & Stars

- Glamping Hub (owned properties only)

Recent Developments

- In March 2025, Under Canvas announced a new expansion of its eco-luxury desert glamping sites across Arizona and Utah, integrating renewable micro-grids and low-impact infrastructure.

- In January 2025, Collective Retreats launched smart-tech-enabled premium domes equipped with IoT climate control and digital concierge systems.

- In February 2025, Huttopia revealed new eco-cabin designs using recycled wood composites and solar energy to reduce its carbon footprint across its European locations.