General Lighting Market Size

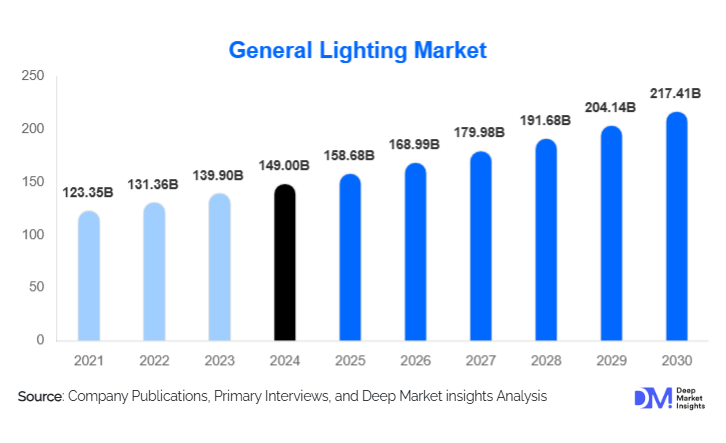

According to Deep Market Insights, the global general lighting market size was valued at USD 149 billion in 2024 and is projected to grow from USD 158.68 billion in 2025 to reach USD 217.41 billion by 2030, expanding at a CAGR of 6.50% during the forecast period (2025–2030). Market growth is primarily driven by rapid LED adoption, large-scale retrofit programs, urban infrastructure expansion, and rising demand for smart and energy-efficient lighting solutions across residential, commercial, industrial, and public infrastructure applications.

Key Market Insights

- LED lighting dominates the global market, accounting for nearly 65–70% of total revenues in 2024, driven by energy efficiency, long lifespan, and declining costs.

- Luminaires/fixtures represent the largest product category, supported by high commercial, industrial, and street-lighting installation volumes.

- APAC leads global demand, contributing nearly 35–40% of the total market, with China and India driving large-scale urban and infrastructure investments.

- North America and Europe remain strong retrofit-driven markets, supported by strict energy regulations and building-efficiency mandates.

- Smart lighting and IoT-enabled systems are reshaping the market, creating opportunities for lighting-as-a-service (LaaS) models and connected building ecosystems.

- Government policies phasing out inefficient lamps (incandescent, fluorescent) are accelerating LED penetration globally.

What are the latest trends in the General Lighting Market?

LED and Smart Lighting Becoming Global Standards

The market is witnessing a global shift toward LED and smart lighting solutions as countries update building codes and adopt energy-efficiency regulations. Connected lighting systems, equipped with sensors, dimming controls, and automation, are increasingly integrated into commercial buildings, industrial sites, and public infrastructure. Smart lighting platforms allow real-time monitoring, predictive maintenance, energy analytics, and remote operations, contributing to operational cost reductions. As smart cities expand, IoT-enabled street-lighting systems are becoming foundational components of urban energy management strategies.

Retrofit Boom Across Commercial and Public Infrastructure

A significant trend shaping the market is the widespread retrofitting of outdated lighting systems across offices, shopping malls, hospitals, airports, warehouses, and municipal infrastructure. The urgency to replace older fluorescent and incandescent lamps with high-efficiency LED luminaires is driven by cost savings, regulatory compliance, and sustainability targets. Governments are also upgrading streetlights to LED-based smart poles, integrating cameras, EV-charging modules, and environmental sensors, creating new revenue streams for lighting manufacturers and solution providers.

What are the key drivers in the General Lighting Market?

Growing Demand for Energy Efficiency and Cost Reduction

Rising electricity costs and tightening global efficiency standards are driving accelerated adoption of LED lighting. LEDs consume up to 50–70% less energy than fluorescent or incandescent options, significantly reducing electricity bills for residential, commercial, and municipal users. As sustainability becomes a central theme for organizations and governments, energy-efficient lighting upgrades are a priority across built environments.

Urbanization, Construction Growth, and Infrastructure Development

Rapid urban development in APAC, the Middle East, and Africa is fueling demand for general lighting products in new housing, commercial complexes, factories, public buildings, transportation hubs, and roadways. As cities expand vertically and horizontally, the demand for architectural, functional, and outdoor lighting grows in parallel. Commercial construction, especially offices, retail centers, and hospitality, continues to be a strong volume driver globally.

Supportive Regulations and Government Initiatives

Governments worldwide have implemented policies phasing out inefficient incandescent and fluorescent lamps. Building codes now require high-efficiency lighting, pushing both new installations and retrofit markets toward LED solutions. Public-sector investments in smart cities, sustainable buildings, street-light modernization, and energy-efficiency programs further strengthen industry growth. Incentive schemes in the U.S., EU, India, and ASEAN nations continue to support the adoption of energy-efficient lighting technologies.

High Upfront Costs & Slow Replacement Cycles

Despite long-term cost savings, the initial cost of LEDs and smart lighting systems can be high for price-sensitive markets, slowing adoption in some residential and small-business segments. Additionally, in regions where legacy lighting systems remain functional, replacement cycles are slow, limiting near-term market expansion.

Infrastructure Gaps and Technical Limitations

In developing regions, limited access to stable electricity, poor distribution networks, and a lack of skilled installers hinder rapid lighting modernization. Technical challenges, such as compatibility with existing fixtures and lack of awareness of smart-lighting benefits, also restrict uptake.

What are the key opportunities in the General Lighting Market?

Massive Retrofit Potential Across Developed Economies

Developed nations across North America, Europe, Japan, and Australia possess vast installed bases of outdated lighting technologies. This presents a multi-billion-dollar opportunity for LED replacements, retrofit kits, and intelligent lighting controls. Governments increasingly offer rebates and tax incentives for energy-efficient upgrades, creating long-term contracts for lighting manufacturers and service providers.

Smart Lighting, IoT Integration, and Lighting-as-a-Service (LaaS)

The fusion of lighting with IoT, building automation systems, and cloud analytics is opening high-margin opportunities. Smart lighting is becoming essential in commercial buildings, logistics hubs, schools, airports, and smart cities. Lighting-as-a-Service (LaaS) allows customers to shift lighting expenses from CapEx to OpEx, enabling widespread adoption without upfront investment. This model is gaining traction among municipalities and large enterprises seeking predictable cost structures and automatic upgrades.

Strong Growth Potential in Emerging Markets

Countries in Asia-Pacific, Latin America, Africa, and the Middle East are rapidly urbanizing and electrifying rural regions. Infrastructure development, including smart street lights, transportation hubs, industrial corridors, and affordable housing, creates substantial demand for general lighting. China and India remain manufacturing powerhouses, offering cost-efficient production capabilities and large-scale domestic markets.

Product Type Insights

LED luminaires dominate the market, accounting for nearly 75–78% of total product revenue in 2024. Their widespread use in offices, commercial buildings, factories, and public infrastructure makes them the largest and fastest-growing product category. LED lamps/bulbs continue to witness strong demand in residential settings due to falling prices and government-led awareness campaigns. Retrofit kits are also rising in demand, driven by the large-scale replacement of legacy fluorescent fixtures in commercial and industrial environments.

Application Insights

Indoor lighting, comprising residential, commercial, and institutional spaces, represents the largest share of global demand. Residential lighting continues to dominate unit volumes, while commercial buildings generate the highest revenue due to premium fixture requirements. Outdoor lighting, particularly street and roadway illumination, is experiencing rapid growth as cities adopt smart street-lighting systems equipped with sensors, cameras, and adaptive controls. Industrial applications, including logistics warehouses and factories, are growing steadily due to stringent safety and productivity standards.

Distribution Channel Insights

Offline distribution, including electrical wholesalers, retailers, and specialized distributors, still leads global sales due to the technical nature of lighting products and the need for consultation in large commercial projects. However, online channels are growing rapidly as consumers increasingly purchase LED bulbs and fixtures via e-commerce platforms. Manufacturers are strengthening D2C channels, offering configuration tools, remote consultations, and installation services.

End-User Insights

Residential end users remain the largest by volume, driven by continuous home renovations and rising awareness of LED cost savings. Commercial end users, offices, retail, hospitality, and education, contribute the highest revenue due to complex lighting requirements and premium fixtures. Industrial and municipal end users are among the fastest-growing segments, supported by smart city investments, industrial automation, and warehouse expansions. New-age applications, such as horticulture lighting, stadium lighting, and transportation hubs, are creating additional high-value opportunities.

| By Light Source / Technology | By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents a mature but high-value market dominated by large-scale retrofits in commercial buildings and public infrastructure. The U.S. leads the region with strong adoption of smart lighting and advanced building automation systems. Stringent efficiency standards and rebate programs accelerate LED upgrades in offices, schools, hospitals, and street lighting.

Europe

Europe remains a regulatory-driven market emphasizing sustainability, carbon neutrality, and energy efficiency. Nations such as Germany, France, the U.K., and the Nordic countries have aggressive lighting efficiency mandates, creating sustained demand for LEDs and intelligent controls. Retrofit projects remain a major growth channel across residential and institutional buildings.

Asia-Pacific

APAC is the fastest-growing region, accounting for nearly 35–40% of the global market in 2024. China dominates manufacturing and consumption, while India, Japan, South Korea, and ASEAN countries contribute rapidly rising demand across residential, commercial, and industrial sectors. Huge infrastructure investments and expanding urban populations drive demand for street, architectural, and industrial lighting.

Latin America

LATAM is emerging as a promising market, driven by urban development in Brazil, Mexico, Colombia, and Argentina. Adoption of energy-efficient lighting is rising as governments roll out efficiency standards and low-income housing programs. Commercial real estate development supports strong growth in premium fixtures.

Middle East & Africa

MEA is experiencing steady growth fueled by smart city initiatives, mega-construction projects, and large-scale infrastructure investments. Gulf nations, including the UAE, Saudi Arabia, and Qatar, lead regional adoption of high-end commercial and architectural lighting. African countries such as Kenya, Nigeria, and South Africa are seeing increased demand for residential and rural electrification lighting solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the General Lighting Market

- Signify (Philips Lighting)

- Acuity Brands

- OSRAM (ams-OSRAM)

- Zumtobel Group

- Hubbell Lighting

- GE Lighting (Savant Systems)

- Cree Lighting

- Panasonic Lighting

- Havells

- Opple Lighting

- NVC Lighting

- Eaton Lighting

- Fagerhult Group

- Dialight

- Thorn Lighting

Recent Developments

- In March 2025, Signify expanded its smart lighting portfolio with advanced IoT-enabled streetlights designed for smart city ecosystems.

- In January 2025, Acuity Brands announced enhanced building automation integrations across its LED luminaire lineup, focusing on commercial retrofits.

- In November 2024, OSRAM launched a new series of high-efficiency industrial luminaires targeting the warehousing and logistics sectors.