Gear Bicycle Market Size

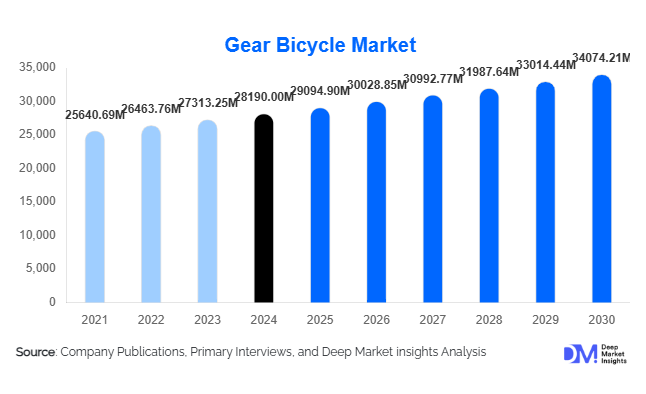

According to Deep Market Insights, the global gear bicycle market size was valued at USD 28,190.00 million in 2024 and is projected to grow from USD 29,094.90 million in 2025 to reach USD 34,074.21 million by 2030, expanding at a CAGR of 3.21% during the forecast period (2025–2030). The gear bicycle market growth is driven by rising urban mobility needs, increasing global participation in fitness and adventure cycling, and rapid adoption of advanced gear technologies including electronic shifting, CVT systems, and integrated e-bike gearing solutions.

Key Market Insights

- Derailleur gear bicycles dominate the market, accounting for over half of global sales due to affordability, versatility, and widespread availability.

- Mountain bikes (MTBs) lead the product category, supported by the rapid rise of outdoor sports and global trail development initiatives.

- Europe remains the largest regional market, driven by pro-cycling policies, high commuter adoption, and well-developed cycling infrastructure.

- Asia-Pacific is the fastest-growing region, supported by expanding middle-class incomes and strong manufacturing ecosystems.

- E-bikes with advanced gear systems are reshaping the market, integrating automatic shifting, torque optimization, and smart diagnostics.

- Aluminum alloy frames maintain the largest share due to their ideal balance of durability, performance, and cost efficiency.

What are the latest trends in the gear bicycle market?

Integration of Intelligent and Electronic Gear Systems

Manufacturers are rapidly integrating electronic shifting, automatic gear adjustment, and continuously variable transmission (CVT) systems into both traditional bicycles and e-bikes. These technologies enhance rider comfort, improve shifting precision, and reduce maintenance requirements. Growth in urban commuting and long-distance touring has accelerated demand for user-friendly gear systems that adapt to terrain and riding style automatically. Integrated smart diagnostics, Bluetooth connectivity, and app-based gear tuning are becoming mainstream features in premium models. As consumers seek smoother, optimized riding experiences, technology-enabled gear bicycles are driving market differentiation across major brands.

Rise of Adventure and Performance Cycling

The global surge in adventure sports and fitness-oriented cycling is dramatically reshaping product demand. Mountain biking, gravel riding, endurance road racing, and touring have expanded rapidly across North America, Europe, and Asia-Pacific. This trend is supporting high sales of multi-speed, performance-oriented bicycles with advanced gear ratios and lightweight carbon or hybrid frames. The proliferation of cycling events, community riding clubs, and adventure tourism destinations has elevated demand for premium gear bicycles. Social media and influencer-driven cycling culture are further amplifying the popularity of performance cycling, creating opportunities for specialized gear systems that enhance speed, handling, and efficiency.

What are the key drivers in the gear bicycle market?

Growing Consumer Focus on Health and Fitness

Rising global awareness of physical fitness continues to be a major demand driver for gear bicycles. Post-pandemic lifestyle shifts have accelerated outdoor recreational activity, with cycling emerging as one of the most preferred forms of low-impact exercise. Gear bicycles allow riders to control intensity across various terrains, making them attractive for both beginners and advanced cyclists. With fitness-driven purchases accounting for over 40% of global demand in 2024, this driver will remain influential through the forecast period.

Rapid Technological Advancements in Bicycle Components

Innovation in gear systems, materials, and integrated electronics has significantly enhanced bicycle performance and durability. Electronic shifting, lightweight carbon frames, precision-engineered derailleurs, and maintenance-free hub gears are transforming product capabilities. Increased R&D investments by leading brands, coupled with consumer willingness to upgrade to technologically advanced models, are accelerating market development. The premium bicycle segment grew more than 12% year-on-year, driven by tech-enabled gear innovations.

Government Support for Cycling Infrastructure

Cycling is increasingly promoted as a sustainable mobility solution that reduces congestion and carbon emissions. Investments in bicycle lanes, commuter corridors, and public bike-sharing networks are strengthening bicycle adoption across major cities globally. Europe invested over USD 2.5 billion in cycling infrastructure in 2024, while APAC and North American cities are expanding mobility programs that directly stimulate gear bicycle demand. Subsidies for bicycles and e-bikes in several countries further support affordability and market penetration.

What are the restraints for the global market?

High Cost of Premium Gear Bicycles

Advanced gear systems such as electronic shifting, integrated braking-gear modules, and carbon fiber frames significantly increase manufacturing costs. These high-end models remain inaccessible to many consumers, particularly in emerging markets. Maintenance expenses for premium components also reduce adoption among budget-conscious riders, slowing market expansion in middle- and low-income regions.

Competition from Low-Cost Alternatives and Public Mobility Programs

In many developing countries, single-speed bicycles continue to dominate due to their affordability and ease of maintenance. Additionally, public bike-sharing systems in major cities reduce the need for personal bicycle ownership. These alternatives limit gear bicycle penetration, especially in regions with limited disposable income or underdeveloped recreational cycling culture.

What are the key opportunities in the gear bicycle industry?

Expansion of Smart City and Urban Mobility Projects

Global urbanization is fueling demand for efficient, eco-friendly commuting solutions. Gear bicycles, especially commuter and hybrid models, stand to benefit from investments in cycling lanes, safety infrastructure, and city-wide mobility networks. Governments are promoting alternative transportation modes to reduce pollution and traffic congestion. As urban cycling becomes mainstream, gear bicycle manufacturers can expand product lines tailored to commuters and capitalize on long-term infrastructure upgrades.

Growing Demand for Gear-Integrated E-Bikes

The e-bike market is rapidly expanding, creating significant opportunities for advanced gear systems. Automatic shifting, hub gears, and torque-optimized CVT units enhance rider comfort and battery efficiency. As e-bikes gain popularity for last-mile connectivity and leisure riding, manufacturers with strong gear technology capabilities will capture substantial market share. Emerging markets such as India, China, and Southeast Asia represent high-potential zones for gear-integrated electric bicycles.

Product Type Insights

Mountain bikes (MTBs) dominate the gear bicycle market, contributing 38% of total sales in 2024. Their versatility, off-road capability, and wide gear ratios make them ideal for recreational and adventure cyclists. Full-suspension and hardtail models continue to gain traction as outdoor sports participation increases globally. Road bikes account for a major secondary share, supported by competitive cycling and endurance sports. Hybrid and commuter bicycles appeal to urban riders seeking comfort, durability, and efficient multi-gear performance for daily commuting. Gravel bikes are among the fastest-growing segments due to rising demand for mixed-surface cycling experiences.

Application Insights

Fitness and recreational cycling remain the leading applications for gear bicycles, driven by global adoption of cycling as a health-enhancing activity. Commuter cycling is growing rapidly, supported by urban mobility programs and sustainability-driven lifestyle changes. Professional cycling applications—including competitive racing and endurance touring—fuel demand for high-performance gear systems and lightweight frames. Adventure applications, such as mountain trekking, trail riding, and gravel exploration, are expanding the market for multi-terrain and high-durability gear bicycles.

Distribution Channel Insights

Offline retail dominates the distribution landscape, accounting for 58% of global gear bicycle sales in 2024. Specialty bicycle stores, sports retailers, and exclusive brand showrooms provide test rides, expert guidance, and professional servicing, making them the preferred channel for premium purchases. Online retail is expanding rapidly through e-commerce marketplaces and direct-to-consumer (D2C) brand platforms, offering competitive pricing, extensive product comparisons, and doorstep delivery. Social media marketing, influencer collaborations, and virtual product demos are further accelerating online sales.

End User Insights

Recreational cyclists represent the largest end-user segment, contributing 41% of global demand. Fitness-oriented buyers are increasingly investing in mid-range and premium models featuring advanced gear systems. Urban commuters form the fastest-growing segment, supported by global sustainability trends and government-backed mobility initiatives. Professional cyclists and athletes drive demand for ultra-lightweight carbon fiber bicycles with high-speed gear ratios. Students and young riders remain an emerging demographic, particularly in APAC and Europe, where cycling culture is deeply established.

Age Group Insights

Riders aged 25–45 account for the largest share of gear bicycle purchases, driven by fitness goals, commuting needs, and interest in adventure sports. The 18–24 segment fuels demand for budget and mid-range models, influenced by digital marketing, cycling clubs, and campus mobility. Older demographics, particularly ages 46–65, increasingly prefer premium and comfort-oriented gear bicycles for wellness and recreational use. The above-65 segment, though smaller, is showing rising interest in gear-integrated e-bikes due to ease of use and reduced physical strain.

| By Product Type | By Gear Type | By Frame Material | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 27% of global gear bicycle demand, driven by strong cycling participation, high disposable income, and growing interest in outdoor fitness. The U.S. is the region’s largest market, with rising demand for MTBs, gravel bikes, and performance road bicycles. Canada shows strong adoption of commuter and recreational bicycles, supported by expanding cycling trails and government-backed mobility initiatives.

Europe

Europe leads the market with 32% share in 2024, supported by pro-cycling regulations, extensive cycling infrastructure, and strong commuter culture. Germany, the Netherlands, Denmark, and France are major markets with high penetration of both commuter and premium gear bicycles. The U.K. is one of the fastest-growing markets in the region, driven by cycling sports, fitness trends, and government investments in active transportation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, forecast to expand at over 9% CAGR. China, India, Japan, Indonesia, and South Korea are key contributors. China remains the global manufacturing hub, exporting millions of bicycles annually. India’s rapidly growing middle class is accelerating demand for mid-range and premium gear bicycles used for fitness and commuting. Japan and South Korea maintain strong demand for technologically advanced models.

Latin America

Latin America is witnessing growing adoption of gear bicycles, particularly in Brazil, Mexico, Argentina, and Colombia. Urban mobility initiatives and rising recreational cycling culture are key market stimulators. Brazil accounts for nearly 45% of regional demand, supported by expanding cycling lanes and fitness trends.

Middle East & Africa

The region is experiencing rising adoption driven by increasing interest in recreational and professional cycling. The UAE and Saudi Arabia are investing heavily in cycling infrastructure and hosting competitive events that boost gear bicycle sales. Africa, particularly South Africa and Kenya, is seeing growing interest in adventure cycling supported by tourism and community sports programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The gear bicycle market share is moderately concentrated, with the top five players collectively accounting for approximately 28% of global revenue. The market includes premium performance brands, mass-market leaders, and technologically advanced component manufacturers serving both professional and recreational cyclists. Increasing competition is driven by product innovation, expanding global distribution channels, and rising consumer preference for high-performance gear systems.

Key Players in the Gear Bicycle Market

- Giant Manufacturing Co.

- Trek Bicycle Corporation

- Specialized Bicycle Components

- Merida Industry Co.

- Cannondale

- Scott Sports

- Canyon Bicycles

- Santa Cruz Bicycles

- Cervélo Cycles

- Bianchi

- Cube Bikes

- Ghost Bikes

- Norco Bicycles

- Fuji Bikes

- Orbea

Recent Developments

- In March 2025, Trek launched a new series of electronically shifted commuter bicycles featuring automatic terrain-adaptive gear technology.

- In January 2025, Giant Manufacturing expanded its Taiwan production facility to increase carbon frame output by 20%, targeting the growing premium segment.

- In November 2024, Shimano introduced an upgraded derailleur system designed for gravel and endurance cycling, offering improved durability and shifting precision.