Garment Packing Machines Market Size

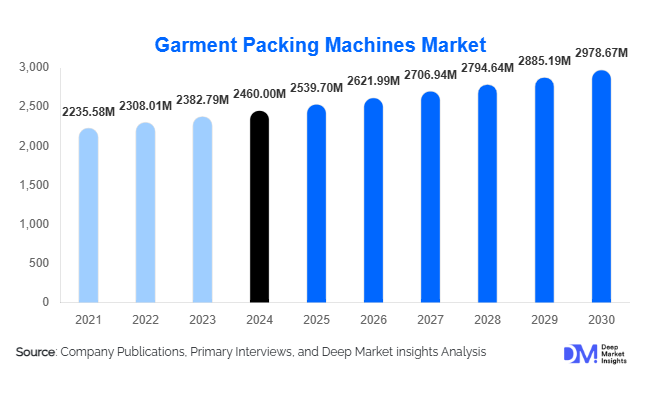

According to Deep Market Insights, the global garment packing machines market size was valued at USD 2,460.00 million in 2024 and is projected to grow from USD 2,539.70 million in 2025 to reach USD 2,978.67 million by 2030, expanding at a CAGR of 3.24% during the forecast period (2025–2030). Market growth is primarily driven by the expansion of global apparel and home textile production, rising labour costs pushing automation, the rapid scale-up of e-commerce apparel fulfilment, and the shift toward sustainable, digitally integrated packaging solutions within garment supply chains.

Key Market Insights

- Asia-Pacific dominates the garment packing machines market, accounting for around 45% of global demand in 2024, led by export-oriented manufacturing hubs in China, India, Bangladesh, and Vietnam.

- Integrated folding–bagging lines and fully automatic systems hold the largest revenue share, as factories increasingly favor end-to-end automated solutions that minimize manual handling.

- Polybag-based packaging remains the leading format, representing nearly 58% of machine revenues, though recyclable films and paper-based options are growing rapidly.

- Apparel manufacturers account for over half of global demand, with strong incremental growth from e-commerce fulfilment centres, 3PLs, and home textile producers.

- Industry 4.0 and IoT integration are becoming standard, with customers expecting remote diagnostics, performance analytics, and connectivity with ERP/WMS systems.

- Sustainability pressures are reshaping machine design, driving demand for equipment capable of running recycled films, thinner gauges, biodegradable bags, and paper mailers without sacrificing speed or seal integrity.

What are the latest trends in the garment packing machines market?

Industry 4.0 and Smart Garment Packing Lines

A defining trend in the garment packing machines market is the rapid adoption of Industry 4.0-enabled, data-driven packing lines. Modern systems increasingly feature PLC and servo control, sensor networks, and edge computing to monitor folding quality, bag seals, temperature, air pressure, and throughput in real time. Machine vision systems identify garment types, verify fold accuracy, and check barcodes or labels for correctness, enabling dynamic adjustment of folding parameters and bag sizes. Connectivity to MES, ERP, and warehouse management platforms supports order-based packing, OEE dashboards, and predictive maintenance, reducing unplanned downtime and improving asset utilisation. For large multi-plant apparel groups, standardized digital platforms across factories allow benchmarking of performance, centralized recipe management, and remote technical support, making automation a strategic lever for global competitiveness.

Sustainable and E-Commerce-Ready Packaging Solutions

Another prominent trend is the convergence of sustainable packaging requirements and e-commerce fulfilment needs. Global brands and retailers are committing to reduce virgin plastic usage and packaging waste, forcing a shift from traditional polybags to recycled-content films, mono-material solutions, and paper-based mailers. Garment packing machines must therefore handle a broader range of materials, often thinner, stiffer, or more delicate, without compromising seal strength or throughput. At the same time, e-commerce and direct-to-consumer models demand single-piece, branded packaging with printed barcodes, QR codes, and return labels. This is driving demand for compact, modular machines that combine folding, bagging, print-and-apply labelling, and, in some cases, cartonization in one line. Short-run, frequent changeovers, SKU variation, and on-demand personalization are now key design criteria for next-generation garment packing equipment.

What are the key drivers in the garment packing machines market?

Expansion of Global Apparel and Home Textile Production

The garment packing machines market is tightly linked to the performance of the apparel and home textile industries. With the global apparel market valued at well over USD 1.7 trillion and growing steadily, export-oriented manufacturing clusters in Asia, Eastern Europe, and parts of Africa continue to expand capacity. At the same time, home textiles, bed linen, towels, curtains, and upholstery, form a sizeable and growing segment that relies on efficient packing of bulky, foldable items. Large export orders, strict retailer standards, and seasonal spikes in demand make automated folding, bagging, and boxing essential for meeting shipping windows and maintaining consistent presentation quality. Every incremental increase in sewn garment output has a direct, lagged effect on investments in end-of-line packing automation.

Rising Labour Costs and Need for Consistency

In key garment-producing countries, labour costs are rising and manual packing roles suffer from high turnover. Repetitive folding and bagging tasks are difficult to staff and maintain at high quality over time. Automated garment packing machines offer a compelling value proposition: they cut direct labour per packed garment, stabilize output quality, and reduce dependency on operator skill. For large factories running multiple shifts, the payback period can be attractive when accounting for labour savings, reduced rework, and fewer customer chargebacks due to labelling or presentation errors. As wage inflation persists and compliance pressures increase, the relative cost of manual packing rises, pushing more plants, especially mid- to large-scale units, toward fully automatic or semi-automatic packing lines.

E-Commerce, Fast Fashion, and Service-Level Expectations

The continued growth of e-commerce apparel and fast fashion models has fundamentally changed how garments are packed and shipped. Rather than sending only bulk-packed cartons to retail distribution centres, brands now ship a higher proportion of single-piece orders directly to consumers or store pick-up points. Lead times are shorter, SKU variety is higher, and return rates are significant. These dynamics require packing lines capable of frequent style changes, variable folding templates, integrated barcoding, and ready-to-ship packaging. Automated garment packing machines engineered for omni-channel logistics help brands meet service-level agreements, marketplace performance metrics, and consumer expectations for neat, clearly labelled, and easily returnable parcels, reinforcing automation as a core growth driver.

What are the restraints for the global market?

High Initial Capital Investment and Payback Concerns

One of the main restraints is the high upfront capital expenditure required for advanced garment packing machines, particularly fully automatic or robotic systems. While large export factories can often justify investments through labour and quality savings, smaller workshops and mid-scale manufacturers may find the payback period too long, especially in markets where wages remain relatively low or production volumes are volatile. Financing constraints, limited access to credit, and competing capex priorities (such as sewing or dyeing equipment) can delay adoption. Many small and medium enterprises continue to rely on low-cost manual or semi-automatic setups, which slows the overall penetration of high-end garment packing automation.

Regulatory and Trade Uncertainty in Textile Machinery

Another restraint stems from regulatory and trade uncertainties affecting textile and related machinery imports. Technical regulations, quality control orders, and certification requirements can change the economics of sourcing packing machines from particular countries or regions. Sudden adjustments in import duties or trade agreements can delay purchasing decisions or force buyers to switch suppliers. For example, new technical norms on textile machinery, safety standards, or energy efficiency can necessitate redesigns, re-certification, and additional testing. These factors increase the cost and complexity of market entry for OEMs and may cause buyers to postpone or phase investments, thereby dampening short-term market growth.

What are the key opportunities in the garment packing machines industry?

AI-Enabled, Connected Packing Lines and Smart Services

A major opportunity lies in the development of AI-enabled, fully connected garment packing lines that integrate seamlessly with digital factory ecosystems. Machine vision and artificial intelligence can be used to auto-detect garment type, colour, size, and thickness, then select optimal folding patterns and bag dimensions, significantly reducing changeover time and error rates. Cloud-connected machines can provide predictive maintenance alerts, automatically order wear parts, and offer performance benchmarking across multi-plant networks. OEMs that pair advanced hardware with subscription-based software, remote support, and analytics services can unlock recurring revenue streams and differentiate via lifecycle value rather than initial price. This positions garment packing machinery as a strategic element of smart factories rather than a standalone equipment purchase.

Sustainable Packaging and E-Commerce-Specific Machine Designs

The shift toward sustainable, e-commerce-ready packaging opens another high-value opportunity. Apparel brands and retailers are under pressure to reduce plastic, adopt recyclable/biodegradable materials, and optimize shipping volumes. Garment packing machines that can reliably run recycled-content films, mono-material plastics, compostable bags, and paper mailers at industrial speeds will be in strong demand. Additionally, equipment tailored to e-commerce workflows, such as compact lines that integrate printing and applying of shipping and return labels, auto-insertion of invoices or promotional materials, and automated carton erection and sealing, can help 3PLs and brands handle surging online order volumes without proportionate labour increases. OEMs that design modular systems for easy retrofits and upgrades will be well positioned to serve both greenfield and brownfield opportunities.

Product Type Insights

Within product types, integrated folding–bagging lines account for the largest share of the garment packing machines market, capturing an estimated 32% of global revenues in 2024. These lines bundle folding, bagging, and sealing, and often labelling and basic carton handling, into a single automated flow, delivering the highest labour savings and throughput per square metre of floor space. Stand-alone folding machines and bagging/sealing units remain important, particularly for smaller plants that upgrade stepwise. Cartoning and boxing systems are gaining prominence in e-commerce and home textile applications where garments or textiles must be packed directly into branded or shipper cartons. Labelling and tagging machines, including print-and-apply units, are increasingly integrated or synchronized with primary packing equipment to ensure barcode and RFID accuracy in highly automated fulfilment environments.

Application Insights

Apparel manufacturing is the leading application segment, accounting for roughly 55% of global garment packing machine revenues in 2024. Export-focused knitwear and woven garment factories require high-throughput, standardized packing to meet retailer and brand specifications. E-commerce and omni-channel fulfilment centres represent the fastest-growing application, as they rely on single-piece packing, SKU-rich operations, and tight delivery windows that favour automation. Home textile and décor manufacturers use larger-format folding and bagging equipment for towels, bed linen, and curtains, contributing steady mid-single-digit growth. Additional applications emerge in industrial workwear and uniform suppliers, rental and laundering services, and technical textile processing, where hygienic, compressed, or special-purpose packaging formats are essential for service delivery.

Distribution Channel Insights

Sales of garment packing machines are primarily driven through direct OEM channels and system integrators. Large apparel groups and multinational brands often engage directly with equipment manufacturers to specify integrated lines, factory layouts, and digital interfaces. System integrators bundle garment packing machines with sewing, pressing, finishing, conveyors, and warehouse automation into turnkey projects, particularly in newly developed textile parks. Regional distributors and agents play a critical role for semi-automatic and entry-level equipment, supporting smaller factories with installation and basic service. The industry is also seeing a gradual rise in digital sales and support models: virtual demonstrations, remote commissioning, and online spare parts portals make it easier for OEMs to serve geographically dispersed textile clusters while maintaining high service standards.

End-User Type Insights

From an end-user perspective, large export-oriented garment manufacturers remain the most important buyers, as they operate multi-line facilities with high daily output and strict performance KPIs. These companies typically invest in fully automatic, integrated lines to ensure consistent folding, bagging, and labelling at scale. Branded apparel and sportswear companies that manage captive or semi-captive manufacturing also invest in sophisticated packing automation to protect brand image and comply with global packaging and labelling standards. Third-party logistics providers and e-commerce fulfilment centres represent a rising user group, focusing on flexible, SKU-agnostic systems that integrate closely with WMS and order management platforms. Finally, laundry and rental textile service providers adopt garment packing machines to poly-pack or bag garments for delivery, especially in hospitality, healthcare, and industrial uniform contracts.

Plant Size and Automation Level Insights

The market can also be segmented by plant size and automation level. Large, high-throughput factories processing more than 2,000 garments per hour per line are the main adopters of fully automatic systems, favouring servo-driven integrated lines and, increasingly, robotic pick-and-place solutions. Mid-scale plants with capacities of 500–2,000 garments per hour often adopt semi-automatic combinations of folding and bagging machines, gradually upgrading to full automation as volumes and labour costs rise. Smaller units and workshops still rely heavily on manual packing benches, perhaps supported by basic sealing or labelling equipment, but are starting to explore compact semi-automatic solutions as they target export markets. Across all plant sizes, there is a clear trend toward higher automation, with fully automatic systems already accounting for about 46% of global market revenues in 2024 and expected to increase their share over the coming decade.

| By Machine Type | By Automation Level | By Packaging Format | By End-use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents around 20% of the global garment packing machines market in 2024 and is characterized by high-spec, technologically advanced installations. The U.S. and Canada house a mix of niche apparel and technical textile production, alongside very large retail and e-commerce fulfilment infrastructures that handle imported garments. Investments focus on fully automatic lines with strong digital integration, allowing real-time visibility into performance and maintenance. Demand is supported by reshoring and near-shoring initiatives for specific apparel categories, uniform and workwear contracts, and a strong emphasis on sustainability and labour substitution.

Europe

Europe accounts for roughly 22% of global demand and combines premium fashion, home textiles, and advanced machinery manufacturing. Italy, Germany, Spain, Turkey, and parts of Eastern Europe are key markets. European buyers place strong emphasis on packaging sustainability, worker safety, and compliance with strict regulatory frameworks, driving demand for energy-efficient machines capable of running recycled and recyclable materials. European OEMs are also important exporters of high-precision garment packing and textile finishing equipment to global markets, and often lead in Industry 4.0 and eco-design features.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, with an estimated 45% share of global garment packing machine revenues in 2024. China, India, Bangladesh, Vietnam, and other Southeast Asian countries host the bulk of global garment and home textile production, making APAC the core manufacturing engine for the world’s apparel brands. Export-oriented factories rely on automated packing lines to meet large order volumes, strict buyer codes, and compressed lead times. Growth is further supported by supportive industrial policies, textile parks, and logistics infrastructure development. Countries such as India, Bangladesh, and Vietnam are expected to post the highest growth rates as they deepen their participation in global apparel supply chains and upgrade from manual to automated packing solutions.

Latin America

Latin America holds around 6% of the garment packing machines market in 2024, with Brazil, Mexico, and Central American countries as the primary demand centres. These regions service both domestic markets and near-shore production for North American retailers. While import duties, currency fluctuations, and policy uncertainty can slow investment, the push for near-shoring and regional garment clusters is driving demand for cost-effective, robust packing equipment. Mid-scale, semi-automatic systems are common, with gradual upgrades underway as manufacturers look to align with the automation levels seen in Asia and Europe.

Middle East & Africa

The Middle East & Africa region represents about 7% of global demand but is gaining prominence as selected countries scale up apparel and textile exports. Turkey is a major player with strong links to European fashion brands and a solid textile machinery ecosystem. Countries such as Egypt, Ethiopia, and Kenya are positioning themselves as alternative sourcing destinations, often supported by special economic zones and investment incentives. As export volumes rise, these markets increasingly require automated folding, bagging, and boxing lines to meet international standards. Within the Gulf, rising investments in logistics hubs and free zones also support demand for integrated packing and fulfilment solutions for imported garments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The garment packing machines market is moderately concentrated at the high end and fragmented among smaller players. The top five global manufacturers are estimated to collectively account for around 35–40% of total market revenues in 2024, with the remainder shared by regional OEMs and niche specialists. Larger companies dominate segments such as high-speed integrated folding–bagging lines and digitally connected systems, while numerous local players compete in semi-automatic and entry-level machines on the basis of price and service proximity. Competition is increasingly shifting from pure hardware performance to a combined offering of machines, software, lifecycle service, and sustainability-oriented design.

Key Players in the Garment Packing Machines Market

- U-Packaging Machinery

- Hangzhou Youngsun Intelligent Equipment Co., Ltd.

- Qingdao Feifan Packing Machinery Co., Ltd.

- Shandong Sinolion Machinery Corp. Ltd.

- Technical Systems (UK) Ltd.

- Thermotron

- Oshima Co., Ltd.

- WorldePack

- YILI

- UBL Packing Machinery

- Beyago Machinery Technology Co., Ltd.

- Amscomatic

- LC Auto

- Stefab India Ltd.

- Impress Apparel Machines Pvt. Ltd.

Recent Developments

- In 2025, Axcess IT showcased a garment bagging automation system combining Metalprogetti machinery with Clean Touch EPOS software to streamline packing and storage operations.