Garment Interlining Market Size

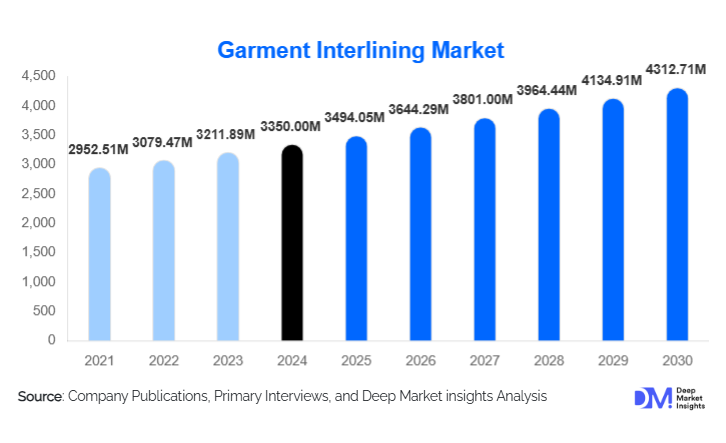

According to Deep Market Insights, the global garment interlining market size was valued at USD 3,350.00 million in 2024 and is projected to grow from USD 3,494.05 million in 2025 to reach USD 4,312.71 million by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). The garment interlining market growth is primarily driven by rising global apparel production, increasing adoption of fusible and knitted interlinings, and growing demand for structured, durable, and performance-oriented garments across formal, casual, and sportswear categories.

Key Market Insights

- Fusible interlining dominates the market due to its compatibility with automated garment manufacturing and cost efficiency.

- Asia-Pacific accounts for the largest production and consumption share, supported by large-scale apparel manufacturing hubs in China, India, Bangladesh, and Vietnam.

- Polyester-based interlinings lead material demand, driven by durability, wrinkle resistance, and affordability.

- Sustainability is reshaping product development, with increasing use of recycled fibers, bio-based resins, and solvent-free coatings.

- Sportswear and athleisure applications are the fastest-growing end-use segments, supported by demand for lightweight and stretchable interlinings.

- Direct sales to apparel manufacturers dominate distribution, reflecting long-term sourcing contracts and technical collaboration.

What are the latest trends in the garment interlining market?

Sustainable and Eco-Friendly Interlinings Gaining Momentum

Sustainability has emerged as a key trend in the garment interlining market, driven by global apparel brands’ environmental commitments. Manufacturers are increasingly adopting recycled polyester, organic cotton, and biodegradable adhesive systems to reduce environmental impact. Compliance with OEKO-TEX®, REACH, and other textile regulations is becoming mandatory, particularly for suppliers serving European and North American markets. Additionally, waterless coating technologies and energy-efficient production processes are being implemented to lower carbon footprints. These developments are positioning sustainable interlinings as a value-added differentiator rather than a niche offering.

Rising Adoption of Knitted and Lightweight Interlinings

The growing popularity of athleisure, sportswear, and stretch garments is accelerating demand for knitted and lightweight interlinings. These products offer enhanced flexibility, breathability, and comfort while maintaining garment structure. Apparel manufacturers increasingly prefer lightweight interlinings below 100 GSM for modern silhouettes and performance wear. This trend is particularly strong in premium casual wear and activewear segments, where consumer preference is shifting toward comfort-driven apparel without compromising durability.

What are the key drivers in the garment interlining market?

Expansion of Global Apparel Manufacturing

The steady expansion of the global apparel industry remains the most significant driver of the garment interlining market. Growing population, urbanization, and rising disposable incomes—particularly in emerging economies—are increasing apparel consumption. As interlinings are essential components in most garments, market demand is directly correlated with apparel output volumes. Export-oriented garment manufacturing in the Asia-Pacific continues to generate large-scale demand for cost-effective and high-quality interlinings.

Shift Toward Automated and Mass Garment Production

Garment manufacturers are increasingly adopting automation to improve efficiency and consistency. Fusible interlinings support automated fusing processes, reducing labor dependency and production time. This shift has significantly boosted demand for fusible products across formal and casual wear segments. Manufacturers also benefit from reduced defect rates and improved garment aesthetics, further reinforcing adoption.

Technological Advancements in Textile Coating and Resins

Continuous innovation in resin chemistry and coating uniformity has improved bonding strength, wash resistance, and fabric compatibility. These advancements allow interlinings to be used across a wider range of fabrics, including lightweight and delicate textiles, thereby expanding application scope and supporting premium garment manufacturing.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in prices of polyester fibers, polyamide resins, and petrochemical-based adhesives pose a key challenge for manufacturers. Rising input costs can compress margins and lead to pricing instability, particularly for small and mid-sized producers with limited procurement leverage.

Environmental Compliance and Regulatory Costs

Stringent environmental regulations related to chemical usage, emissions, and waste management increase operational costs. Compliance requires continuous investment in cleaner technologies, posing challenges for manufacturers operating in cost-sensitive markets.

What are the key opportunities in the garment interlining industry?

Growth of Sustainable Apparel Supply Chains

Global apparel brands are increasingly prioritizing suppliers aligned with ESG goals. Interlining manufacturers offering certified sustainable products and transparent supply chains can secure long-term contracts and premium pricing, particularly in Europe and North America.

Expansion in Emerging Apparel Manufacturing Regions

Countries such as India, Vietnam, Indonesia, and Ethiopia are gaining share in global apparel exports. Establishing localized interlining manufacturing facilities or strategic partnerships in these regions presents strong growth opportunities by reducing lead times and logistics costs.

Product Type Insights

Fusible interlining dominates the market, accounting for approximately 68% of global revenue in 2024, driven by efficiency and automation compatibility. Non-fusible interlinings continue to serve niche applications, particularly in high-end tailoring and delicate fabrics where traditional sewing methods are preferred.

Material Type Insights

Polyester interlining leads the market with nearly 54% share, supported by durability, cost-effectiveness, and wide applicability. Cotton and blended fiber interlinings are gaining traction in sustainable and premium apparel segments, while polyamide-based products dominate high-performance applications.

End-Use Apparel Insights

Formal wear remains the largest end-use segment, contributing about 29% of total demand due to extensive use of structured components such as collars, cuffs, and waistbands. Casual wear represents high-volume consumption, while sportswear and activewear are the fastest-growing segments, expanding at over 7% CAGR due to rising athleisure demand.

Distribution Channel Insights

Direct sales to apparel manufacturers dominate distribution, accounting for nearly 61% of the market. This reflects the importance of long-term sourcing agreements, technical customization, and consistent quality supply. Textile wholesalers and B2B online platforms serve smaller manufacturers and regional buyers.

| By Product Type | By Material Type | By Application | By End-Use Apparel | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the garment interlining market with approximately 52% share in 2024. China alone accounts for nearly 28% of global demand, supported by its integrated textile ecosystem. India is the fastest-growing market in the region, driven by export-oriented garment production and government initiatives such as “Make in India.”

Europe

Europe holds around 19% market share, led by Germany, Italy, France, and Turkey. Demand is driven by premium apparel manufacturing and a strong emphasis on sustainable and certified textile inputs.

North America

North America accounts for about 16% of global demand, with the United States being the primary consumer. Reshoring trends and demand for high-quality interlinings in branded apparel support regional growth.

Latin America

Latin America represents nearly 7% of the market, with Brazil and Mexico leading demand due to regional apparel supply chains and growing domestic consumption.

Middle East & Africa

The Middle East & Africa region contributes approximately 6%, supported by emerging garment manufacturing hubs in Turkey and Egypt and growing regional apparel exports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Garment Interlining Market

- Freudenberg Performance Materials

- Chargeurs PCC

- Wendler Interlining Group

- Kufner Textile Corporation

- Yi Yi Interlining

- JMD Interlining

- Diamond Textile

- King Pad Industrial

- Jianghuai Interlining

- Yantai Shenda

- H&C Interlining

- Zhejiang Xinhe

- Zhejiang Lida

- Hexin Interlining

- Anhui Joyful Interlining