Gardening Pots Market Size

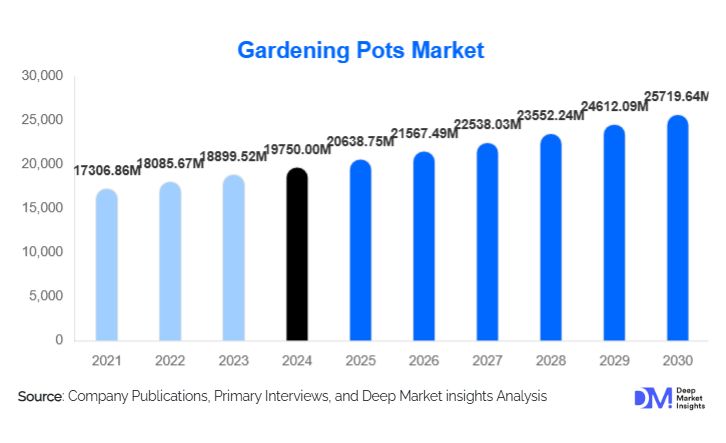

According to Deep Market Insights, the global gardening pots market size was valued at USD 19750 million in 2024 and is projected to grow from USD 20638.75 million in 2025 to reach USD 25719.64 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The gardening pots market growth is primarily driven by the increasing adoption of home gardening, urban farming, sustainable landscaping projects, and expanding usage of decorative and functional pots in both residential and commercial spaces.

Key Market Insights

- Plastic pots dominate the market due to their lightweight structure, affordability, and versatility for both indoor and outdoor gardening.

- The residential gardening segment contributes nearly 46% of total demand, driven by lifestyle, décor preferences, and rising interest in home-based urban greenery.

- Asia-Pacific is the fastest-growing region, supported by urbanization, government greening initiatives, and smart city landscaping programs.

- Medium-sized pots (5–15L) are the preferred choice globally, accounting for 37% of market share due to suitability for balconies, indoor décor, and terrace gardens.

- Online distribution channels are rapidly expanding, enabling wider access to designer, customized, and smart pot products.

- Smart pots with self-watering and moisture tracking capabilities are increasingly being adopted in high-tech indoor and vertical farming solutions.

What are the latest trends in the gardening pots market?

Smart Pots and Technology-Integrated Gardening Solutions

Technology integration in gardening pots is redefining user experience, especially among urban residents and vertical farming enthusiasts. Smart pots equipped with built-in sensors can monitor soil moisture, pH levels, and irrigation needs in real time. They synchronize with mobile applications to alert users when plants require watering or nutrient adjustments. These innovations appeal to young urban gardeners who seek automation and data-driven planting solutions. Self-watering pots and climate-adaptive grow bags are also gaining traction in commercial and residential spaces. The adoption of smart pots is boosting demand in premium segments, particularly in North America, Europe, and Japan.

Eco-Friendly and Designer Pots Gaining Popularity

A strong shift toward sustainability has led to rising demand for eco-friendly gardening pots made from recycled plastics, bamboo composites, biodegradable fiber, and coconut husk. Designer ceramic, terracotta, and concrete pots are increasingly preferred in commercial architecture, hospitality, and home décor segments. Governments promoting green building certifications such as LEED and BREEAM are encouraging the use of natural-material-based pots in landscaping projects. Lightweight but durable composite pots that mimic high-end stone and ceramic finishes are also trending due to their portability, aesthetics, and weather resistance.

What are the key drivers in the gardening pots market?

Rising Home Gardening and Wellness-Oriented Lifestyles

Home gardening has emerged as both a wellness-driven activity and a décor trend across urban households worldwide. Approximately 40% of urban homes in developed markets now feature indoor or balcony-based plant setups. Gardening pots, particularly decorative ceramic, wooden, and fiberglass ones, are being adopted to support indoor plants, herbs, and ornamental flora for aesthetic and health benefits such as improved air quality and stress reduction.

Expansion of Commercial Landscaping and Smart City Development

Commercial buildings, malls, hospitality groups, and government facilities are increasingly implementing sustainable and aesthetic landscaping solutions. Gardening pots play a critical role in modular greenery installations across public parks, airports, hotels, smart city walkways, and corporate campuses. Large-format concrete, wooden, and terracotta pots are widely used in these applications, driving B2B demand and long-term adoption.

What are the restraints for the global market?

Volatile Raw Material Costs

Fluctuating prices of ceramic, clay, metal, and polymer-based materials pose challenges for manufacturers. Energy-intensive production of ceramic and fiberglass pots leads to cost increases during high fuel price periods, impacting overall product affordability and supply stability.

Limited Awareness and Import Dependence in Emerging Regions

In some developing markets, awareness of premium gardening pot products remains limited, and domestic manufacturing capacity is low. The dependency on imports leads to higher prices, reduced availability, and logistical challenges, restricting large-scale adoption beyond major urban centers.

What are the key opportunities in the gardening pots industry?

Vertical Gardening and Urban Farming Expansion

Growing interest in urban farming, rooftop cultivation, and compact balcony gardens is creating strong demand for lightweight, modular, and stackable gardening pots. Vertical planters and railing pots offer opportunities for innovation in small-space gardening solutions.

Premium Corporate Landscaping and Hospitality Growth

The hospitality, real estate, and corporate sectors are increasingly investing in high-end designer pots to enhance aesthetic appeal. Ceramic, terracotta, and composite pots are becoming essential décor elements in hotels, restaurants, airports, and luxury retail environments, opening new B2B revenue channels.

Product Type Insights

Plastic pots hold the largest market share at 34%, owing to their affordability, lightweight design, and durability. Ceramic and terracotta pots are preferred for premium indoor décor and commercial landscaping due to their natural aesthetics and heat retention benefits. Fabric grow bags are gaining popularity in urban farming and hydroponic applications due to their excellent aeration and root-support qualities. Smart pots with irrigation monitors and sensor-based technology are emerging as niche premium products, particularly in high-tech gardening and indoor botanical displays.

Application Insights

The residential gardening segment leads with 46% global market share, fueled by increasing interest in balcony gardens, home décor, and indoor plant collections. Commercial landscaping, including hotels, malls, airports, corporate buildings, and event venues, is growing rapidly, supported by green infrastructure spending. Urban farms, nurseries, and greenhouse applications are also gaining significance due to the rising demand for fresh produce cultivation in metro regions.

Distribution Channel Insights

Offline sales channels, including garden centers, specialty décor stores, and home improvement retailers, dominate the market with 62% share, driven by product tangibility and customer preference for physical inspection. However, online channels are the fastest-growing segment, registering over 9% CAGR, as e-commerce platforms offer broader product variety, customization options, and convenient delivery.

End User Insights

Residential users remain the largest consumer segment, driven by household gardening, balcony décor, and indoor landscaping trends. Corporate offices, hospitality chains, real estate developers, and government parks represent key commercial end users. Urban farming and greenhouse operations are expanding rapidly, particularly in North America, Europe, and Asia-Pacific, contributing significantly to the long-term demand for specialized pots and grow bags.

| Product Type | Pot Size | Shape & Design | Application | Distribution Channel | Mobility & Installation Type | Price Range |

|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global market share. The United States leads demand due to strong interest in home décor, landscaping, and wellness gardening. High adoption of smart pots and urban farming systems is driving growth in metropolitan regions.

Europe

Europe accounts for 25% of the market, led by Germany, the UK, France, and the Netherlands. The region is strongly focused on sustainability, favoring recycled and biodegradable pot materials. EU green building policies encourage the use of container-based landscaping solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing market, projected to register nearly 8.9% CAGR, fueled by rapid urbanization, smart city initiatives, and expanding exports of ceramic and plastic pots from China, India, and Vietnam. Premium designer pots are also gaining traction in Japan, South Korea, and Singapore.

Latin America

Brazil and Mexico are emerging markets, with growing adoption in home gardening and artisanal ceramic pot manufacturing. Urban farming initiatives in major cities are stimulating future demand.

Middle East & Africa

Demand is increasing in the UAE, Saudi Arabia, and Qatar, especially for commercial landscaping, resort décor, and mall installations. South Africa and Kenya show strong potential in both manufacturing and regional distribution.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The gardening pots market is moderately fragmented, with the top five players holding nearly 32% of the global market. Competition is increasing around eco-friendly, designer-grade, and smart pot product innovations. Manufacturers are investing in automation, composite materials, and digital supply chain integration to capture premium segments.

Key Players in the Gardening Pots Market

- Elho

- Nursery Supplies Inc.

- HC Companies

- Lechuza

- East Jordan Plastics

- Keter Group

- Planters Unlimited

- Scheurich GmbH

- Crescent Garden

- Novelty Manufacturing

- Teraplast

- Desch Plantpak

- Japi

- GCP Group

- Stefanplast

Recent Developments

- In August 2024, Elho launched a new line of recycled plastic pots featuring built-in moisture control technology for urban farming applications.

- In May 2024, HC Companies announced its expansion into Europe with a manufacturing facility producing eco-friendly composite planters.

- In February 2024, Keter Group introduced premium weather-resistant fiberglass pots designed for commercial real estate and luxury hospitality landscaping.