Garden Sheds Market Size

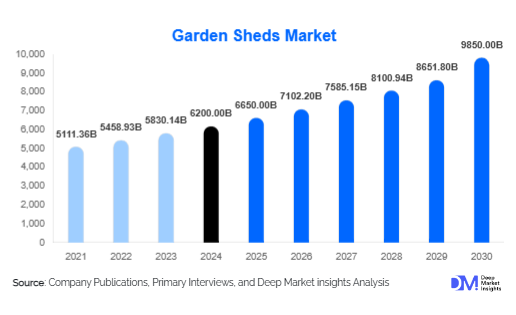

According to Deep Market Insights, the global garden sheds market size was valued at USD 6,200 million in 2024 and is projected to grow from USD 6,650 million in 2025 to reach USD 9,850 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025-2030). The garden sheds market growth is primarily driven by increasing urbanization, rising adoption of home gardening and outdoor living trends, and growing demand for organized storage solutions across residential and commercial landscapes.

Key Market Insights

- Wooden garden sheds remain the most popular globally, accounting for over 40% of the market in 2024, due to their aesthetic appeal and customization flexibility.

- North America dominates the garden sheds market, with the U.S. and Canada capturing nearly 34% of the global market share, driven by backyard landscaping and DIY culture.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, rising disposable incomes, and increasing demand in India and China.

- E-commerce channels are gaining traction, expected to expand at a CAGR of 8.5% through 2030, as consumers prefer online customization and doorstep delivery.

- Metal and resin sheds are rising in popularity due to their low maintenance and weather-resistant properties.

- Smart shed technologies, including IoT security, modular shelving, and solar-powered lighting, are emerging trends reshaping product innovation.

What are the latest trends in the garden sheds market?

Outdoor Living and Home Gardening Surge

Consumers increasingly use garden sheds not only for storage but also as home offices, hobby rooms, gyms, or workshops. This trend is most pronounced in North America and Europe, where lifestyle-oriented sheds with insulation, ventilation, and smart lighting are gaining popularity. The pandemic accelerated this trend as homeowners sought flexible backyard solutions, which continues to fuel market growth.

Sustainable and Eco-Friendly Materials

Manufacturers are focusing on eco-friendly garden sheds using responsibly sourced wood, recycled plastic composites, and corrosion-resistant metals. Modular and sustainable sheds integrated with solar panels or rainwater harvesting systems are entering the premium segment, appealing to environmentally conscious buyers.

What are the key drivers in the garden sheds market?

Rising Demand for Organized Outdoor Storage

As residential spaces shrink, homeowners increasingly use garden sheds to store tools, bicycles, lawn equipment, and seasonal items. Multipurpose shed designs enhance utility, driving growth in both urban and suburban regions.

Urbanization and Landscaping Growth

Rapid urbanization and rising disposable income support investments in backyard aesthetics. In emerging markets like India and China, gated communities with private gardens are boosting demand for mid-range and premium garden sheds.

E-commerce and Direct-to-Consumer Expansion

Digital platforms facilitate in-store purchases by offering product comparisons, reviews, and home delivery. Younger homeowners increasingly prefer online customization and purchase, fueling e-commerce growth in this sector.

What are the restraints for the global market?

High Cost of Premium Sheds

Premium sheds with insulation, smart lighting, and modular features are expensive, limiting adoption in price-sensitive markets. Installation and maintenance further constrain broader penetration.

Fluctuating Raw Material Prices

Volatility in wood, steel, and polymer prices affects production costs, creating pricing inconsistencies. Lumber shortages, steel tariffs, and supply chain disruptions may slow growth in some regions.

What are the key opportunities in the garden sheds industry?

Smart Shed Integration

IoT-enabled sheds with security sensors, remote monitoring, temperature control, and solar lighting offer opportunities for premium product differentiation, meeting demand for technologically advanced solutions.

Expansion in Emerging Economies

Asia-Pacific and Latin America present significant growth opportunities due to urban housing expansion and increasing outdoor lifestyle adoption. Affordable modular solutions tailored for compact spaces could unlock new demand.

Sustainable & Modular Designs

Eco-friendly and modular sheds attract environmentally conscious buyers. Investments in recyclable materials, modularity, and carbon-neutral production can help manufacturers capture a larger market share.

Product Type Insights

Wooden sheds dominate, contributing 41% of market revenue in 2024, thanks to aesthetic appeal and customization. Metal sheds grow steadily due to durability, while plastic/resin sheds gain traction for lightweight, low-maintenance solutions. Hybrid/composite sheds are an emerging segment blending strength with sustainability.

Application Insights

Residential use accounts for nearly 75% of total demand in 2024, with sheds utilized for storage, leisure, and hobby purposes. Commercial applications—including nurseries, landscaping firms, and recreational facilities—are projected to grow at a CAGR of 7.5% through 2030.

Distribution Channel Insights

Offline retail dominates with ~65% of sales in 2024. However, online sales are growing fastest, expected to reach 40% of the total market by 2030, driven by AR-based design tools, customization, and direct-to-consumer delivery.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America led the market in 2024 with a 34% share, driven by U.S. and Canadian demand for backyard organization, DIY culture, and lifestyle-oriented sheds. Customized and eco-friendly designs are popular in this region.

Europe

Europe held 29% of the market in 2024, with high adoption in the U.K., Germany, and France. Germany is increasingly investing in modular and sustainable sheds, while the U.K. shows strong demand for gardening-focused products.

Asia-Pacific

APAC is the fastest-growing region, projected to expand at a CAGR of 8.5%, driven by China and India. Japan and Australia are mature markets with steady demand for premium and smart sheds.

Latin America

Latin America, led by Brazil and Mexico, is emerging as a niche market with growing adoption of outdoor lifestyle solutions and increasing disposable incomes.

Middle East & Africa

Affluent markets like the UAE and South Africa are adopting garden sheds in gated communities. Urban greening initiatives and rising interest in backyard aesthetics support steady growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Garden Sheds Market

- Lifetime Products Inc.

- Forest Garden Ltd.

- Keter Group

- Duramax Building Products

- Palram Applications Ltd.

- Biohort GmbH

- Rowlinson Garden Products

- Suncast Corporation

- Backyard Products LLC

- Tuff Shed Inc.

- Omar Products Ltd.

- Grosfillex SAS

- Trimetals Ltd.

- Cheshire Sheds Ltd.

- Arrow Storage Products

Recent Developments

- In June 2025, Keter Group launched modular resin sheds with solar-powered ventilation systems targeting eco-conscious urban buyers.

- In May 2025, Biohort GmbH opened a North American distribution center to meet rising demand for premium garden sheds.

- In March 2025, Tuff Shed Inc. partnered with a major U.S. home improvement retailer to offer AR-enabled customizable shed designs.