Garden Furniture Market Size

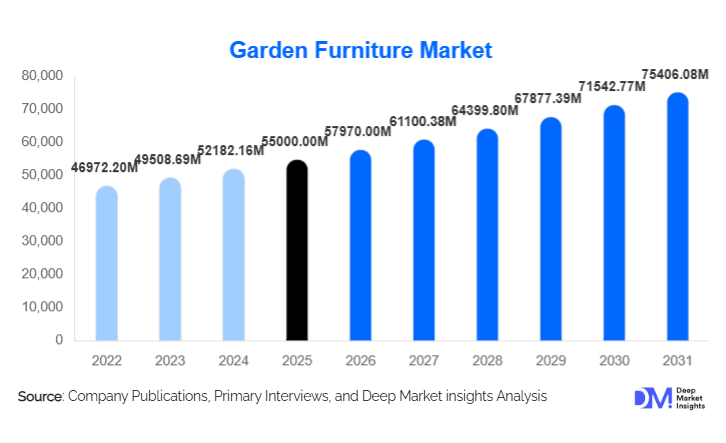

According to Deep Market Insights, the global garden furniture market size was valued at USD 55,000.00 million in 2025 and is projected to grow from USD 57,970.00 million in 2026 to reach USD 75,406.08 million by 2031, expanding at a CAGR of 5.4% during the forecast period (2026–2031). The market growth is primarily driven by rising residential and commercial outdoor living trends, increasing adoption of weather-resistant and sustainable materials, and the expansion of e-commerce channels enabling wider consumer access to high-quality garden furniture.

Key Market Insights

- Seating sets and outdoor lounges dominate the product mix, offering multifunctional comfort and acting as centerpiece purchases in residential and commercial outdoor spaces.

- Wood remains the preferred material globally, particularly premium hardwoods like teak, due to durability, aesthetics, and sustainability certifications.

- Residential segment leads demand, with homeowners investing in patios, gardens, and terraces as part of lifestyle and home improvement trends.

- Online retail channels are growing rapidly, driven by customization options, convenience, and competitive pricing.

- Asia-Pacific is the largest regional market, led by urbanization, rising middle-class incomes, and expanding retail and e-commerce distribution networks.

- Sustainability and eco-friendly furniture adoption are increasing, with consumers preferring recycled plastics, certified woods, and low-impact manufacturing.

What are the latest trends in the garden furniture market?

Smart and Technology-Integrated Furniture

Manufacturers are increasingly introducing technology-enabled garden furniture with features such as solar-powered lighting, integrated device charging, and IoT-enabled weather sensors. These innovations cater to tech-savvy consumers and premium commercial buyers seeking high-value, multifunctional furniture. Smart furniture not only improves user convenience but also enhances the product’s lifespan and appeal, creating new niche segments and higher average selling prices.

Sustainable and Eco-Friendly Designs

There is a rising preference for furniture made from certified hardwoods, recycled plastics, and biodegradable composites. Sustainability is a key differentiator in competitive positioning, particularly in Europe and North America. Companies are investing in circular production processes, waste reduction, and low-carbon supply chains to meet growing regulatory and consumer expectations. Eco-friendly designs are also opening new export opportunities to regions with high environmental awareness.

What are the key drivers in the garden furniture market?

Growing Outdoor Lifestyle Trends

Consumers are increasingly viewing gardens, patios, and balconies as extensions of indoor living spaces. This has accelerated demand for premium and modular furniture that enhances comfort, aesthetics, and outdoor experiences. Urban housing developments, terrace gardens, and home renovation projects are significant contributors to growth.

Rapid Expansion of E-commerce and Omni-Channel Distribution

Online retail channels have enabled broader market penetration by offering consumers more variety, price transparency, and customization. E-commerce has particularly expanded access in emerging markets, supporting both volume growth and higher-value premium sales.

Hospitality and Commercial Infrastructure Investments

Hotels, resorts, and recreational facilities increasingly seek durable, design-oriented furniture for outdoor dining, lounges, and event spaces. Commercial buyers favor weather-resistant and maintenance-friendly options, driving demand for premium segments and contract-based bulk orders.

What are the restraints for the global market?

Material Durability and Weather Challenges

Exposure to sunlight, rain, and temperature fluctuations limits furniture longevity. Consumers are cautious about maintenance and replacement costs, which can slow high-end furniture adoption. Material selection and protective coatings are key to addressing these concerns.

Supply Chain Volatility and Raw Material Costs

Fluctuations in raw materials like aluminum, resin, and teak, along with rising logistics costs, can negatively affect margins and pricing stability. Seasonal demand peaks also create challenges for consistent production and inventory management.

What are the key opportunities in the garden furniture market?

Smart and Multi-Functional Furniture

Integrating technology into garden furniture, such as solar panels, lighting, and IoT features, presents high-value opportunities for premium segments. Tech-enabled outdoor products appeal to affluent residential buyers and commercial hospitality clients seeking differentiated offerings.

Sustainability and Circular Economy Adoption

Eco-friendly materials and low-waste production techniques offer companies a way to differentiate products and enter environmentally conscious markets. Sustainable practices also improve brand reputation and long-term customer loyalty.

Urbanization and Residential Renovation Trends

Rapid urban housing development, growing middle-class disposable income in Asia-Pacific, and home improvement trends in mature markets are driving increased residential demand. Institutional projects, such as public parks and commercial terraces, provide additional B2B growth opportunities.

Product Type Insights

Seating sets represent the dominant product type in the global garden furniture market, accounting for the largest revenue share due to their multifunctionality, higher average selling prices, and role as centerpiece products for outdoor living spaces. These sets typically combine sofas, loungers, and coordinated tables, making them highly attractive to both residential consumers and commercial buyers seeking cohesive outdoor aesthetics. The leading driver for seating set dominance is the growing consumer preference for complete, ready-to-use outdoor living solutions that replicate indoor comfort.

Tables, chairs, and dining sets continue to support core market volumes, particularly in residential patios and outdoor dining environments, while hammocks, swings, umbrellas, and canopies address niche and seasonal demand linked to leisure and shade requirements. From a material perspective, wood-based furniture, especially teak, acacia, and cedar, leads the premium segment due to its natural aesthetics, durability, and sustainability certifications. In contrast, resin, plastic, and aluminum dominate the economy and mid-tier segments owing to their lightweight nature, lower maintenance requirements, and cost efficiency. Modular and customizable outdoor furniture is emerging as a key growth sub-segment, driven by urban housing constraints, flexible space utilization needs, and increasing demand from luxury hospitality projects requiring scalable and design-consistent furniture solutions.

Application Insights

Residential applications remain the largest end-use segment in the garden furniture market, supported by rising investments in private gardens, balconies, terraces, and rooftop spaces. The primary growth driver for residential demand is the increasing emphasis on outdoor lifestyle enhancement, home renovation activities, and the perception of outdoor areas as extensions of indoor living spaces. This trend is particularly strong in urban and suburban households seeking multifunctional and space-efficient furniture solutions. Commercial applications, including hotels, resorts, cafés, restaurants, and event venues, constitute a high-value segment due to their preference for premium, weather-resistant, and design-oriented furniture. Growth in this segment is driven by hospitality infrastructure expansion, outdoor dining culture, and experiential guest engagement strategies. Commercial buyers typically favor durable materials such as aluminum, treated wood, and composites that offer long service life and low maintenance.

Institutional and public space applications, such as parks, recreational zones, and urban landscaping projects, are a steadily growing segment. Government-led urban beautification initiatives and smart city projects are increasing demand for standardized, vandal-resistant, and long-lasting outdoor furniture, creating export opportunities for manufacturers supplying large-volume public contracts.

Distribution Channel Insights

Online retail channels account for a significant and rapidly expanding share of global garden furniture sales, driven by convenience, broader product selection, competitive pricing, and access to customization features. The leading driver behind online channel growth is increased digital adoption by consumers, supported by augmented product visualization tools, virtual showrooms, and flexible delivery options. E-commerce platforms have also enabled manufacturers to reach untapped markets, particularly in emerging economies.

Brick-and-mortar specialty furniture stores and home improvement centers continue to play a critical role, especially for premium and high-involvement purchases where consumers prefer physical inspection, material assessment, and design consultation. These channels remain strong in mature markets such as North America and Europe. Direct B2B distribution through OEM contracts and project-based sales supports bulk procurement by hotels, resorts, real estate developers, and public institutions. Increasing integration of online customization platforms and direct-to-business portals is enhancing buyer engagement, shortening procurement cycles, and improving margin realization across regions.

| By Product Type | By Application | By Distribution Channel | By Material | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the global garden furniture market in 2024, led by the United States and Canada. The primary regional growth driver is the strong outdoor living culture, supported by large residential spaces, backyard usage, and high per-household spending on home improvement. Demand is further driven by premiumization trends, eco-conscious purchasing behavior, and widespread adoption of durable, weather-resistant materials. Growth in outdoor hospitality spaces and renovation-led spending continues to sustain market expansion.

Europe

Europe contributes around 25% of the global market, with Germany, the UK, France, and Italy as key demand centers. Regional growth is driven by terrace and garden-centric lifestyles, strong café and outdoor dining culture, and high consumer awareness regarding sustainability. European buyers prioritize eco-certified wood, modular furniture designs, and recyclable materials. Regulatory emphasis on sustainable sourcing and circular economy practices further supports innovation and premium product adoption across the region.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, accounting for approximately 43–46% of global revenue in 2024. Growth is driven by rapid urbanization, rising middle-class incomes, increasing residential construction, and expanding e-commerce penetration across China, India, Japan, Australia, and Southeast Asia. Smaller living spaces are accelerating demand for compact, modular, and multifunctional furniture, while commercial real estate and hospitality development are boosting mid- to premium-tier product adoption.

Latin America

Latin America represents an emerging growth region, led by Brazil, Mexico, and Argentina. Regional expansion is supported by urban middle-class growth, rising interest in home outdoor living, and increased availability of affordable furniture through retail and online channels. Demand is primarily concentrated in durable, cost-effective, and multifunctional furniture suited to tropical climates and seasonal outdoor usage.

Middle East & Africa

The Middle East & Africa region continues to gain importance due to strong hospitality investments, residential expansions, and luxury real estate development. Growth in the Gulf countries is driven by high-income consumers, premium outdoor living trends, and large-scale hospitality and tourism projects. In Africa, countries such as South Africa are witnessing increased demand from residential upgrades and commercial leisure spaces, supported by urban development and tourism-led infrastructure investments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Garden Furniture Industry

- IKEA

- Ashley Furniture Industries

- Trex Company

- Kettal Group

- Brown Jordan

- Gloster Furniture

- Century Furniture

- Polywood

- Wayfair

- Woodard Furniture

- Home Depot

- Lowe’s

- Fermob

- Sunset West

- Terra Outdoor Living