Garden Equipment Battery Market Size

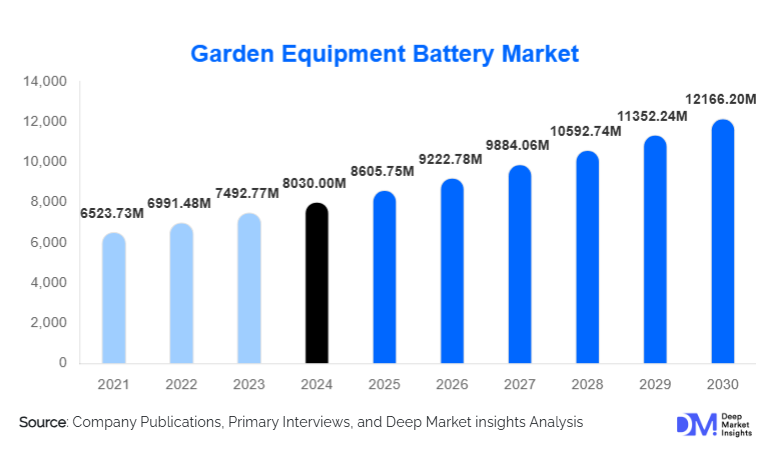

According to Deep Market Insights, the global garden equipment battery market size was valued at USD 8,030.00 million in 2024 and is projected to grow from USD 8,605.75 million in 2025 to reach USD 12,166.20 million by 2030, expanding at a CAGR of 7.17% during the forecast period (2025–2030). The market growth is primarily driven by the rapid shift toward electrified outdoor power tools, tightening environmental regulations, rising adoption of lithium-ion battery platforms, and increasing household demand for cordless garden equipment such as lawn mowers, trimmers, blowers, and chainsaws.

Key Market Insights

- Lithium-ion batteries dominate the market, accounting for over 72% of global demand due to superior energy density, longer runtime, and compatibility with multi-tool ecosystems.

- North America leads global demand, driven by strong residential adoption and regulatory initiatives restricting gasoline-powered equipment.

- Asia-Pacific is the fastest-growing market, supported by rapid urbanization, increasing disposable incomes, and expanding commercial landscaping sectors.

- OEM-integrated battery systems represent the largest sales channel, fueled by the rising popularity of ecosystem-based cordless platforms.

- Commercial landscaping companies are accelerating their transition to battery-powered equipment due to noise restrictions, environmental policies, and improved battery performance.

- Technological advancements, including smart battery diagnostics, heat management systems, and fast-charging platforms, are reshaping performance expectations in the garden equipment industry.

What are the latest trends in the garden equipment battery market?

Electrification and Zero-Emission Equipment Adoption Accelerate

The garden equipment industry is undergoing a major transition toward zero-emission, battery-powered tools, propelled by regulations banning or phasing out gas-powered lawn equipment in North America and Europe. As urban noise sensitivity rises, consumers and municipalities increasingly prefer quieter, low-maintenance alternatives. Manufacturers are responding by expanding high-voltage battery platforms and integrating advanced motor technologies that deliver professional-grade performance. This shift is reshaping OEM product portfolios, with many brands reducing gasoline tool development in favor of fully electric ecosystems. Solid-state battery research and higher-density lithium-ion cells are expected to enhance runtime, reduce charging time, and expand suitability for commercial landscaping applications.

Smart and Connected Batteries Gain Momentum

Integration of intelligent battery systems is becoming a defining trend in modern garden equipment. Smart batteries equipped with diagnostics, Bluetooth connectivity, temperature regulation, and real-time charge monitoring help users optimize performance and longevity. These features appeal particularly to commercial landscapers who manage multiple tools and require reliable data for operational efficiency. OEMs are also developing unified platforms that allow a single battery to power a wide range of equipment, improving convenience and reducing overall ownership costs. As IoT-driven predictive maintenance capabilities evolve, connected battery solutions are expected to become a standard across premium garden equipment lines.

What are the key drivers in the garden equipment battery market?

Accelerating Consumer Shift Toward Cordless Convenience

Homeowners are increasingly adopting battery-powered tools due to their ease of use, reduced noise, and minimal maintenance requirements compared to gasoline alternatives. The rise of DIY gardening culture, suburban housing developments, and online retail access is boosting demand. Cordless tools eliminate the need for fuel storage, pull-starting mechanisms, and complex engine maintenance, making them especially attractive to new homeowners and aging populations.

Environmental Regulations Supporting Electrified Equipment

Government policies restricting noise pollution and carbon emissions are key drivers of market expansion. Several U.S. states, European municipalities, and Asian urban centers have introduced limits on gasoline-powered landscaping tools, accelerating the adoption of battery platforms. Municipalities are transitioning entire fleets to electric equipment, creating sustained demand for high-voltage, long-runtime batteries suitable for professional use.

Technological Advancements in Lithium-Ion Batteries

Rapid improvements in lithium-ion battery chemistry, including higher energy density, improved thermal stability, and faster charging, are enabling cordless tools to match or exceed the performance of gasoline equipment. The development of advanced battery management systems and longer life cycles is encouraging commercial landscapers to adopt electrified solutions for daily operations. Continued innovation is expanding the range of applications, from robotic mowers to heavy-duty professional chainsaws.

What are the restraints for the global market?

High Upfront Costs Limiting Adoption in Price-Sensitive Regions

Although long-term operational costs are lower, lithium-ion-powered garden tools carry higher initial price points. This presents a challenge in markets with lower purchasing power or where gasoline tools remain more affordable. Many commercial landscaping companies also face high transition costs, requiring multiple batteries and chargers for sustained operations.

Runtime Limitations for Heavy-Duty Applications

Despite significant advancements, battery runtime remains a constraint for equipment used in continuous or intensive workloads, such as large-area mowing, prolonged trimming, or heavy brush cutting. Commercial users often require multiple charged batteries or backup packs, increasing costs and complicating logistics. While fast-charging technology is improving, charging still cannot fully substitute the instant refueling of gasoline equipment.

What are the key opportunities in the garden equipment battery industry?

Expansion of Modular, Interchangeable Battery Platforms

The growing popularity of ecosystem-based battery platforms presents a major opportunity for OEMs and battery suppliers. By designing batteries compatible across dozens of tools, companies can significantly increase customer lifetime value, improve brand loyalty, and expand aftermarket revenues. Innovations in thermal management, higher-voltage systems, and extended cycle life are positioned to unlock new revenue streams in both residential and commercial markets.

Growth in Urban Landscaping and Commercial Grounds Maintenance

Increasing urbanization in Asia-Pacific, Latin America, and the Middle East is driving demand for professional landscaping services, public garden maintenance, and roadside vegetation management. These markets require robust, long-runtime battery solutions capable of supporting daily operations. With governments investing in green spaces and clean public areas, suppliers offering high-efficiency battery systems can tap into large procurement contracts and long-term municipal tenders.

Product Type Insights

Lawn mowers represent the largest product category, accounting for 32% of market share in 2024. This dominance is attributed to the widespread adoption of battery-powered walk-behind and robotic models in residential areas. Leaf blowers and trimmers are also seeing significant growth as battery efficiency improves and noise regulations tighten. Chainsaws, hedge trimmers, and pressure washers are expanding steadily, supported by higher-voltage battery systems and enhanced motor technologies that allow cordless tools to match gasoline-powered performance.

Application Insights

Residential use dominates the garden equipment battery market with 52% market share, driven by the growing preference for cordless convenience among homeowners. Commercial landscaping is the fastest-growing application segment as noise and emission regulations push professional landscapers toward electric fleets. Municipalities and public-sector maintenance teams are increasingly procuring electric tools for parks, roadside vegetation, and public gardens. Emerging applications include horticulture farms, golf courses, resorts, and theme parks, all adopting battery-powered equipment for safety, efficiency, and sustainability benefits.

Distribution Channel Insights

OEM-integrated sales account for 56% of the market, as consumers increasingly purchase bundled tool-and-battery kits. Online retail channels are expanding rapidly due to transparent pricing, broad product availability, and rising DIY culture. Specialty equipment stores remain significant for professional landscapers requiring expert guidance and reliable after-sales support. Aftermarket battery replacements are emerging as a strong growth area, driven by the need for backup batteries and extended runtime solutions.

User Type Insights

Residential users form the largest base of demand, while commercial landscaping companies represent a high-value, fast-growing segment with large fleet requirements. Municipal and public-sector users are adopting battery-powered tools at accelerating rates due to government sustainability mandates. Large estates, golf courses, and resorts represent niche but expanding markets for premium, high-capacity battery systems.

| By Battery Chemistry | By Equipment Type | By Voltage Rating | By Capacity Rating | By Distribution Channel | By End User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for 32% of global market share, driven by high residential tool ownership, early regulatory adoption, and widespread preference for cordless equipment. The U.S. remains the single largest national market, with a strong DIY culture and rapidly growing commercial landscaping electrification. Canada shows rising adoption due to noise restrictions in urban zones and growing environmental awareness.

Europe

Europe represents 28% of global demand and remains a leader in sustainability-driven adoption. Germany, the U.K., France, Sweden, and the Netherlands dominate regional consumption. Robotic mowers, powered exclusively by batteries, are especially popular in Scandinavia, contributing significantly to battery demand. Strict noise and emission regulations continue to fuel growth across residential and municipal applications.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market (CAGR 11%), supported by expanding urban infrastructure, rising homeownership, and strong domestic manufacturing. China leads in both production and consumption, while India shows rapid growth due to urban landscaping initiatives and government incentives for electric machinery. Japan and South Korea demand premium, compact, high-tech equipment with advanced battery systems.

Latin America

Brazil, Mexico, and Argentina are witnessing rising uptake of cordless tools as urban landscaping expands. Warm climates and year-round garden maintenance needs strengthen demand for battery-powered equipment. Growth is slower than APAC but steady, supported by increasing residential tool ownership and commercial landscaping services.

Middle East & Africa

Demand is growing in the UAE, Saudi Arabia, and South Africa, driven by large-scale infrastructure, landscaping around commercial estates, and government investments in green spaces. Heat-resistant battery chemistries and durable designs are particularly valued in the region’s harsh climates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Garden Equipment Battery Market

- Techtronic Industries (TTI)

- Stanley Black & Decker

- Husqvarna Group

- Stihl

- Makita Corporation

- Bosch Power Tools

- EGO Power+ (Chervon Group)

- HiKOKI (Hitachi Koki)

- Honda Motor Co. (Battery division)

- Greenworks Tools (Globe Group)

- Worx (Positec Group)

- John Deere (Battery equipment division)

- MTD Products

- Kobalt Tools

- Einhell Germany AG

Recent Developments

- In March 2025, Husqvarna announced the expansion of its high-capacity lithium-ion battery line to support commercial robotic mowers and heavy-duty landscaping tools.

- In February 2025, TTI launched a new 60V modular battery platform designed for extended runtime in professional-grade outdoor power equipment.

- In January 2025, Makita introduced a next-generation LFP (lithium iron phosphate) battery system, offering enhanced thermal stability for high-temperature regions.