French Press Market Size

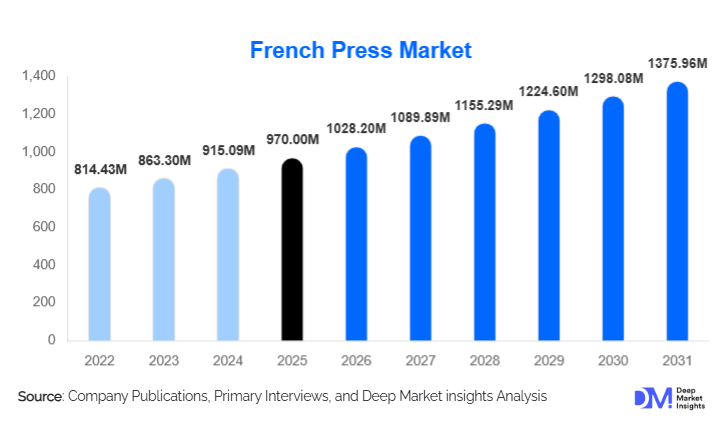

According to Deep Market Insights, the global french press market size was valued at USD 970.00 million in 2025 and is projected to grow from USD 1028.20 million in 2026 to reach USD 1375.96 million by 2031, expanding at a CAGR of 6.0% during the forecast period (2026–2031). The French press market growth is primarily driven by the global expansion of home coffee brewing culture, increasing consumer preference for manual and sustainable brewing methods, and rising adoption of premium kitchenware products across both developed and emerging economies.

Key Market Insights

- French press coffee makers continue to benefit from the global shift toward home-based specialty coffee consumption, supported by affordability, simplicity, and minimal maintenance requirements.

- Residential households dominate global demand, accounting for nearly half of total consumption as consumers invest in premium yet accessible brewing equipment.

- North America leads the market due to strong specialty coffee culture, high disposable income, and widespread adoption of manual brewing tools.

- Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, café culture expansion, and rising middle-class spending.

- Online direct-to-consumer and e-commerce platforms are reshaping distribution, enabling global reach, brand storytelling, and higher margins for manufacturers.

- Sustainability and durability are key purchase drivers, with reusable filters and non-electric operation strengthening long-term demand.

What are the latest trends in the French press market?

Premiumization and Design-Led Product Innovation

The French press market is witnessing a clear shift toward premium materials and design differentiation. Consumers are increasingly opting for stainless steel, ceramic, and double-wall insulated French presses that offer improved heat retention, durability, and visual appeal. Premium finishes, minimalist aesthetics, and color customization are gaining traction, particularly among urban households and specialty coffee enthusiasts. This trend has allowed manufacturers to command higher price points while improving margins, especially in developed markets where kitchenware is viewed as a lifestyle purchase rather than a utility item.

Sustainability-Focused Brewing Solutions

Sustainability remains a defining trend in the French press market. The absence of disposable pods, paper filters, and electricity aligns French presses with eco-conscious consumer values. Manufacturers are increasingly using recyclable materials, plastic-free packaging, and long-life components to strengthen sustainability credentials. This trend is particularly strong in Europe and North America, where environmentally responsible consumption is influencing kitchenware purchasing decisions.

What are the key drivers in the French press market?

Expansion of Home Coffee Brewing Culture

The rapid growth of home brewing, accelerated by remote work trends and rising café-style consumption at home, is a key driver for the French press market. Consumers view French presses as an affordable entry point into specialty coffee, offering control over brewing variables without requiring technical expertise or electricity.

Cost Efficiency and Accessibility

French presses remain significantly more affordable than espresso machines and capsule systems. Their low upfront cost, minimal maintenance, and long product lifespan make them attractive across both mature and price-sensitive markets, supporting consistent global demand.

What are the restraints for the global market?

Competition from Alternative Brewing Devices

The French press market faces competition from pour-over systems, capsule machines, and fully automatic coffee makers that emphasize convenience and speed. These alternatives, particularly pod-based systems, continue to attract urban consumers with limited time for manual brewing.

Perceived Brewing Skill Requirement

Some consumers perceive French press brewing as requiring greater effort or precision compared to automated machines. This perception limits adoption among convenience-driven buyers, particularly first-time coffee consumers.

What are the key opportunities in the French press industry?

Emerging Market Demand in Asia-Pacific and Latin America

Rapid growth in café culture and disposable income across China, India, Vietnam, Brazil, and Mexico presents a major opportunity for French press manufacturers. Localized sizing, region-specific designs, and competitive pricing strategies can unlock significant untapped demand.

Corporate, Institutional, and Gifting Applications

Corporate offices, training institutes, and premium gifting segments are emerging as attractive growth avenues. French presses are increasingly used in office pantries, coffee education programs, and curated gift sets, expanding demand beyond traditional household usage.

Product Type Insights

Glass French presses dominate the global market, accounting for approximately 38% of total revenue in 2025, due to affordability, transparency, and widespread availability. Stainless steel French presses are the fastest-growing segment, driven by durability, insulation benefits, and premium positioning. Plastic French presses maintain relevance in entry-level and travel applications, while ceramic and hybrid models cater to design-focused and premium consumers seeking differentiation.

Capacity Insights

The 350–600 ml capacity segment leads the market with around 34% share, reflecting its suitability for individual and small-family consumption. Below 350 ml models are popular among single users and travel applications, while capacities above 1,000 ml are primarily used in commercial cafés, offices, and hospitality settings.

Distribution Channel Insights

Online direct-to-consumer and e-commerce marketplaces account for nearly 44% of global sales, supported by product discoverability, customer reviews, and global shipping capabilities. Specialty coffee and kitchenware stores continue to play a critical role in premium product sales, while supermarkets and HoReCa supply channels support volume-driven distribution.

End-Use Insights

Residential households represent the largest end-use segment, contributing approximately 46% of global demand. Commercial cafés and specialty coffee shops are the fastest-growing end-use category, driven by demand for table-side brewing and specialty offerings. HoReCa establishments and corporate offices are increasingly adopting French presses to enhance beverage experiences and reduce operational costs.

| By Product Type | By Capacity | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of global French press market revenue in 2025, led by the United States, which alone contributes nearly 26% of global demand. The region benefits from a deeply entrenched specialty coffee culture, high per-capita coffee consumption, and widespread adoption of home brewing equipment. Strong consumer awareness around sustainability, coupled with a preference for non-electric and reusable brewing solutions, continues to support demand. In addition, the presence of established premium kitchenware brands and robust e-commerce penetration enables faster product replacement cycles and higher average selling prices, reinforcing North America’s market leadership.

Europe

Europe represents around 27% of the global market, with Germany, France, the U.K., and Nordic countries driving demand. The region’s long-standing café culture, emphasis on quality brewing methods, and strong environmental regulations favor the adoption of manual coffee solutions such as French presses. European consumers show a high preference for durable materials, minimalist design, and sustainable sourcing, which supports demand for stainless steel and ceramic variants. Additionally, strong penetration of specialty coffee shops and widespread availability through specialty kitchenware retailers contribute to steady and resilient market growth.

Asia-Pacific

Asia-Pacific holds nearly 29% market share and is the fastest-growing region, expanding at an estimated CAGR of over 6%. China, India, Japan, South Korea, and Australia are key growth markets, supported by rapid urbanization, expanding middle-class populations, and growing exposure to global coffee culture. Rising café density in major cities and increased adoption of home brewing among younger consumers are accelerating market expansion. E-commerce platforms play a critical role in market penetration, enabling international brands to reach price-sensitive and first-time buyers across emerging economies.

Latin America

Latin America accounts for approximately 6% of global demand, with Brazil and Mexico leading regional growth. As major coffee-producing countries, these markets are witnessing a gradual shift toward value-added coffee consumption and home brewing. Increasing urbanization, rising disposable incomes, and growing interest in specialty coffee are driving household adoption of French presses. While market penetration remains lower than in North America and Europe, improving retail infrastructure and online sales channels are supporting consistent demand growth across urban centers.

Middle East & Africa

The Middle East and Africa collectively represent around 4% of the global market, led by the UAE and South Africa. Premium coffee consumption is rising across major urban hubs, supported by strong café culture, hospitality sector expansion, and high consumer spending on lifestyle products. In the Middle East, demand is driven by premium and luxury French press models aligned with high-end kitchenware trends. In Africa, South Africa acts as the primary growth engine, supported by increasing specialty coffee adoption and expanding retail availability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The French press market is moderately fragmented. The top five manufacturers collectively account for approximately 42% of global market share, reflecting strong brand concentration alongside a long tail of regional and niche players.