Freeze-Dried Fruit & Vegetable Powder Market Size

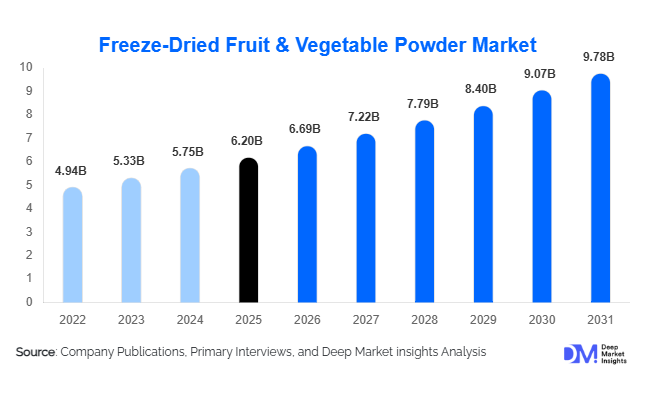

According to Deep Market Insights, the global freeze-dried fruit & vegetable powder market size was valued at USD 6.2 billion in 2025 and is projected to grow from USD 6.69 billion in 2026 to reach USD 9.78 billion by 2031, expanding at a CAGR of 7.9% during the forecast period (2025–2031). The market growth is primarily driven by rising demand for clean-label ingredients, increasing consumption of functional and preventive nutrition products, and growing adoption of nutrient-dense powders across food & beverage, dietary supplements, and cosmetic formulations.

Key Market Insights

- Fruit-based powders dominate the market, accounting for over 60% of global demand due to strong use in beverages, supplements, and natural flavoring applications.

- Food & beverage applications remain the largest demand segment, driven by clean-label bakery, dairy alternatives, and ready-to-drink beverages.

- North America leads global consumption, supported by high supplement intake and strong nutraceutical manufacturing capacity.

- Asia-Pacific is the fastest-growing regional market, led by China and India due to expanding middle-class demand and export-oriented processing.

- B2B direct supply contracts dominate distribution, reflecting long-term procurement agreements with food and supplement manufacturers.

- Technological advancements in freeze-drying and milling are improving cost efficiency and enabling customized powder formulations.

What are the latest trends in the freeze-dried fruit & vegetable powder market?

Rising Adoption in Functional & Preventive Nutrition

Freeze-dried fruit and vegetable powders are increasingly used in functional foods, immunity boosters, gut-health formulations, and sports nutrition products. Manufacturers prefer freeze-dried formats due to superior nutrient retention, clean-label compatibility, and longer shelf life compared to conventional drying methods. Powders derived from berries, leafy greens, and root vegetables are particularly popular for antioxidant, detox, and energy-enhancing formulations. This trend is strengthening demand from nutraceutical brands and private-label supplement manufacturers globally.

Customization and Clean-Label Innovation

Product customization has emerged as a key trend, with manufacturers offering tailored blends, micronized particle sizes, and single-origin powders to meet specific application requirements. Demand for organic, non-GMO, and traceable ingredients continues to rise, particularly in North America and Europe. Technological improvements in low-temperature drying and precision milling are enabling manufacturers to develop application-specific powders without compromising flavor, color, or nutritional integrity.

What are the key drivers in the freeze-dried fruit & vegetable powder market?

Growing Demand for Clean-Label and Natural Ingredients

Consumers are increasingly avoiding synthetic additives, artificial colors, and preservatives, driving food and beverage manufacturers toward natural fruit and vegetable powders. Freeze-dried powders offer a clean-label solution while maintaining stability, taste, and nutritional value. This driver is particularly strong in bakery, dairy alternatives, and beverage formulations.

Expansion of Dietary Supplements and Sports Nutrition

The global dietary supplement industry continues to expand due to aging populations and increasing health awareness. Freeze-dried powders are widely used in capsules, tablets, and ready-to-mix formats, benefiting from high bioavailability and nutrient density. Sports nutrition brands increasingly incorporate vegetable and fruit powders into plant-based protein blends and recovery products.

What are the restraints for the global market?

High Capital and Energy Costs

Freeze-drying technology requires substantial capital investment and energy-intensive operations, which increases production costs. Smaller processors often face entry barriers, while manufacturers remain sensitive to energy price fluctuations that can affect operating margins.

Raw Material Price Volatility

Seasonal availability of fruits and vegetables and climate-related disruptions impact raw material prices. This volatility can affect cost predictability and profitability, particularly for manufacturers operating under fixed-price supply contracts.

What are the key opportunities in the freeze-dried fruit & vegetable powder industry?

Emerging Market Demand and Export Growth

Asia-Pacific, Latin America, and the Middle East are witnessing rising demand for freeze-dried powders, driven by urbanization, dietary shifts, and growth in packaged food consumption. Export-oriented production hubs and localized processing facilities offer significant growth opportunities for manufacturers.

Cosmetics and Personal Care Applications

Freeze-dried fruit and vegetable powders are increasingly used in skincare, haircare, and color cosmetics due to their antioxidant and functional properties. Demand for natural and plant-based cosmetic ingredients is creating new revenue streams beyond traditional food and supplement applications.

Product Type Insights

Among product types, fruit powders dominate the global freeze-dried fruit & vegetable powder market with approximately 60.5% share. This segment’s leadership is driven primarily by high demand for berry powders (strawberry, blueberry, raspberry) and tropical fruit powders (mango, pineapple, banana), as well as citrus-based powders, which are widely used in beverages, bakery, confectionery, and functional food applications. Their natural sweetness, antioxidant content, and color-retention properties make fruit powders particularly attractive for clean-label and nutrient-fortified formulations.

Vegetable powders account for the remaining market share and are gaining traction due to increasing use of leafy greens, beetroot, carrot, kale, and functional vegetables such as mushrooms and ginger. Their growth is particularly driven by rising incorporation into nutraceuticals, clinical nutrition, plant-based products, and savory applications. The growing global emphasis on immune-supportive diets and functional nutrition has further accelerated the adoption of vegetable powders, making them a strategic focus for manufacturers aiming to cater to health-conscious consumers.

Application Insights

By application, food & beverage remains the largest segment, contributing nearly 47.6% of global demand. Its dominance is underpinned by the widespread use of fruit and vegetable powders in bakery, dairy alternatives, smoothies, ready-to-drink beverages, and flavoring agents. Consumers increasingly prefer clean-label, nutrient-enriched food options, which has bolstered the adoption of freeze-dried powders in industrial food manufacturing.

Dietary supplements and nutraceuticals follow closely, driven by preventive healthcare trends, aging populations, and a growing focus on immunity and overall wellness. Cosmetic and personal care formulations are emerging as high-potential applications, where natural antioxidants and plant-derived compounds are in demand for skin, hair, and anti-aging products. Infant nutrition and animal feed segments are also witnessing steady growth, fueled by rising consumer awareness about nutrient fortification and functional health benefits.

Distribution Channel Insights

The market is largely dominated by B2B direct sales, which account for over 62% of global distribution. Long-term supply contracts with food processors, beverage manufacturers, and nutraceutical companies drive this dominance. Ingredient distributors play a critical role in reaching small and medium-sized food manufacturers, while online specialty retailers are increasingly catering to premium, organic, and single-origin powder demand. The rise of e-commerce and D2C models is facilitating direct access to smaller buyers, enhancing market reach and transparency. Strong B2B partnerships also allow for collaborative product development and customized solutions, reinforcing this distribution model.

| By Product Type | By Application | By Form | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents approximately 34% of the global market, led by the United States. Market growth is driven by high consumer adoption of dietary supplements and functional foods, extensive clean-label awareness, and advanced food processing infrastructure. The U.S. regulatory emphasis on natural ingredients and strong retail penetration further boosts adoption. Additionally, demand is fueled by innovative product launches in beverages, bakery, and sports nutrition, as manufacturers seek to offer high-antioxidant, nutrient-rich powders that cater to health-conscious consumers.

Europe

Europe accounts for nearly 24% of global demand, with Germany, France, and the U.K. leading consumption. Market growth is supported by stringent regulatory standards, organic certifications, and strong consumer preference for premium, natural ingredients. Increasing health-consciousness and the rise of functional foods in the bakery, dairy, and beverage sectors are driving the adoption of both fruit and vegetable powders. Manufacturers are capitalizing on trends in plant-based diets, antioxidant-rich formulations, and clean-label fortification to expand their regional footprint.

Asia-Pacific

Asia-Pacific holds around 29% market share and is the fastest-growing region, led by China, India, and Japan. Key growth drivers include rising disposable incomes, rapid urbanization, and expanding nutraceutical and food processing industries. The region’s export-oriented manufacturing hubs provide freeze-dried powders to global beverage and supplement companies, while increasing local demand for immunity-boosting and functional foods accelerates adoption. Social media and e-commerce are also enhancing awareness and availability, particularly among the urban middle class.

Latin America

Latin America is an emerging market, with Brazil and Mexico leading growth. The market is driven by the expansion of food processing facilities and the rising popularity of dietary supplements. Manufacturers are leveraging increased consumption of fruit-based beverages and bakery products to boost freeze-dried powder adoption. Growing health-consciousness among consumers, coupled with government incentives for functional food manufacturing, further supports regional growth.

Middle East & Africa

This region is witnessing steady growth, driven by increasing imports of fruit and vegetable powders for food processing, dietary supplements, and functional beverages. High-income populations in GCC countries (UAE, Saudi Arabia, Qatar) are demanding premium nutrition products, while African countries are gradually increasing local production to meet export and domestic demand. Urbanization, rising disposable incomes, and enhanced cold-chain logistics are supporting broader adoption of freeze-dried powders across both food and supplement sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Freeze-Dried Fruit & Vegetable Powder Market

- Olam Group

- Kerry Group

- Archer Daniels Midland (ADM)

- Döhler Group

- Sensient Technologies

- Van Drunen Farms

- Mercer Foods

- European Freeze Dry

- Chaucer Foods

- Kanegrade

- Nestlé (Ingredients Division)

- Mevive International

- Paradise Fruits

- Saipro Biotech

- NutraDry