Fragrance Ingredients Market Size

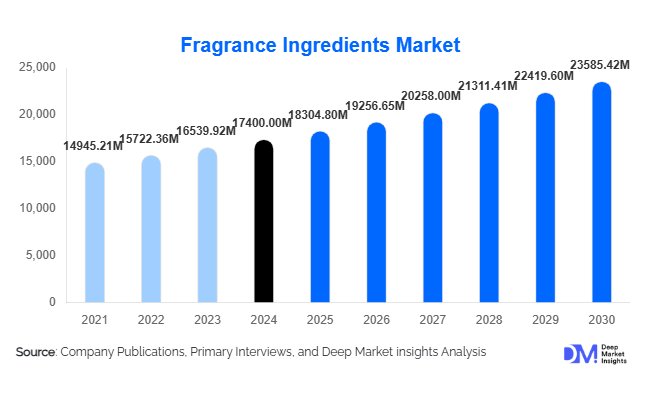

According to Deep Market Insights, the global fragrance ingredients market size was valued at USD 17,400.00 million in 2024 and is projected to grow from USD 18,304.80 million in 2025 to reach USD 23,585.42 million by 2030, expanding at a CAGR of 5.2% during the forecast period (2025–2030). Growth is driven by rising demand for premium personal care products, rapid expansion of household fragrance applications, and increasing adoption of natural, clean-label, and biotech-derived fragrance molecules across global consumer markets.

Key Market Insights

- Growing demand for natural, botanical, and clean-label fragrance ingredients is reshaping product development strategies across cosmetics, home-care, and fine fragrances.

- Synthetic aroma-chemicals remain dominant due to cost efficiency, stability, and scalability, accounting for nearly 60% of the 2024 market.

- Asia-Pacific leads global consumption, driven by increasing penetration of personal care and household products in India, China, and Southeast Asia.

- North America and Europe maintain strong premium and specialty segment demand, supported by advanced R&D, strict compliance standards, and preference for luxury fragrances.

- Biotechnology and green chemistry innovations are enabling the production of allergen-safe, sustainable, and novel fragrance molecules.

- Household & home-care applications are expanding rapidly, driven by rising hygiene awareness and demand for scented detergents, fabric care, and room fresheners.

What are the latest trends in the fragrance ingredients market?

Rising Shift Toward Natural, Botanical & Clean-Label Ingredients

Consumers are increasingly demanding natural and clean-label products across personal care, cosmetics, and home-care categories. This has accelerated the use of botanical extracts, essential oils, plant-derived aroma molecules, and sustainably sourced materials. Brands are investing heavily in ingredient transparency, allergen-free formulations, and eco-certified sourcing practices. Regulatory pressure, particularly in Europe, is reinforcing the shift toward safe, low-toxicity, and environmentally responsible ingredients. As a result, fragrance houses are expanding their natural ingredient portfolios, partnering with agricultural cooperatives, and developing tracking systems for ingredient traceability. The industry is witnessing significant investment in organic farming, natural distillation technologies, and biodegradable aroma compounds to meet consumer expectations.

Technology-Driven Scent Development and Biotech Innovations

Technology is reshaping fragrance creation and ingredient production. AI-driven scent modeling is helping perfumers design new olfactory profiles aligned with regional preferences and demographic insights. Biotechnology companies are engineering yeast and microbe-based fermentation systems to replicate rare scents such as natural musks, exotic woods, and florals without harming ecosystems. Green chemistry is enabling the development of low-emission, allergen-safe synthetic ingredients that comply with modern safety standards. Digital odor analysis tools, algorithmic blending, and sensory analytics platforms are becoming common in R&D labs, improving precision and reducing development time. These trends are ushering in a new era of sustainable, customized, and scientifically advanced fragrance ingredients.

What are the key drivers in the fragrance ingredients market?

Expanding Personal Care & Cosmetics Consumption Worldwide

Rising disposable incomes, urbanization, and wider adoption of daily grooming routines across emerging markets are fueling the consumption of perfumes, deodorants, skincare, and haircare products. As consumers seek personalized, long-lasting, and sophisticated fragrances, demand for specialty and fine fragrance ingredients continues to grow. The premiumization trend, especially in Asia-Pacific and the Middle East, is significantly boosting demand for high-value fragrance molecules.

Growing Household & Home-Care Demand

Fragrance use in detergents, air fresheners, fabric softeners, surface cleaners, and home ambiance products has surged, driven by heightened hygiene awareness and lifestyle upgrades. The home has become a wellness and comfort space, increasing consumer preference for ambient scents and long-lasting fragrance profiles. This shift expands demand beyond the traditional fine fragrance domain, supporting stable, recurring ingredient consumption.

Innovation in Sustainable and Allergen-Free Ingredients

Regulatory agencies worldwide are tightening standards for chemical safety, allergens, and environmental impact. This is driving manufacturers to innovate in green chemistry, biotech fermentation, and sustainable sourcing. Companies investing in eco-friendly, compliant, and high-performance alternatives are gaining a competitive advantage, as brands increasingly seek environmentally responsible fragrance solutions.

What are the restraints for the global market?

Raw Material Supply Volatility and Sustainability Challenges

Botanical ingredients depend heavily on climate conditions, crop cycles, and geographical availability. Climate change, overharvesting, and biodiversity pressures can lead to shortages of essential oils and natural extracts, causing price volatility. Suppliers facing inconsistent raw material availability must navigate compliance risks, quality issues, and sustainability concerns, which increase operational complexity.

Stringent Regulatory Standards and Allergen Restrictions

Global regulatory scrutiny, especially in Europe, limits the use of certain synthetic chemicals due to allergenicity, toxicity, or environmental concerns. Reformulating fragrances to meet evolving guidelines increases costs and slows product development cycles. Manufacturers must continuously upgrade compliance systems and invest in safer, cleaner, and regulatory-aligned alternatives.

What are the key opportunities in the fragrance ingredients industry?

Sustainability & Green-Fragrance Innovations

Growing demand for eco-friendly, ethically sourced, and biodegradable fragrance ingredients presents a major opportunity. Companies developing clean-label molecules, carbon-neutral production methods, and traceable sourcing systems will be well-positioned for long-term growth. Investment in renewable raw-material cultivation and circular production processes can differentiate ingredient portfolios and command premium pricing.

Expansion of Home-Care & Ambient Fragrance Applications

Home care has become one of the fastest-growing application segments globally. Scented detergents, fabric-care products, candles, diffusers, and room sprays require specialized ingredients with stability, longevity, and safe inhalation profiles. As consumers increasingly prioritize home ambiance and sensory comfort, ingredient suppliers can diversify into innovative, application-specific fragrance compounds, unlocking sustained demand growth.

Biotech-Derived & AI-Designed Aroma Molecules

Biotechnology is enabling the production of rare or endangered scents without harming biodiversity. AI-driven scent design tools assist in predicting consumer preferences and creating customized molecular structures. These technologies open avenues for new product categories, allergen-safe molecules, and scalable alternatives to natural extracts. Manufacturers who adopt biotech and digital fragrance creation early can secure a long-term competitive advantage.

Product Type Insights

Synthetic ingredients dominate with nearly 60% of the market, driven by their cost efficiency, stability, and ease of mass production. They are widely used in deodorants, perfumes, soaps, and household products that require consistent olfactory performance. Natural ingredients, including essential oils, plant extracts, and botanicals, are the fastest-growing category due to rising demand for clean-label and sustainable formulations. Specialty and premium ingredients, including biotech-derived molecules and niche natural extracts, cater to luxury fragrances, fine perfumes, and artisanal brands seeking unique olfactory signatures. This product-type diversification ensures that both mass-market and premium brands have a suitable ingredient ecosystem.

Application Insights

Personal care & cosmetics remain the largest application segment, accounting for nearly 50% of global demand. Perfumes, deodorants, lotions, and haircare products rely heavily on fragrance ingredients for differentiation and consumer appeal. Household & home-care applications are expanding rapidly, driven by rising demand for scented detergents, surface cleaners, air fresheners, and fabric care products. Industrial & ambient scenting applications, including hospitality, retail, automotive, and public spaces, are emerging strongly as companies leverage ambient scenting for customer experience and brand identity. Food & beverage applications represent a niche but stable segment, primarily involving aroma-enhancing compounds.

Distribution Channel Insights

Direct B2B sales from ingredient manufacturers to fragrance houses, cosmetic brands, and home-care formulators dominate the industry. Specialized distributors support regional supply for niche markets and natural ingredients. Digital supply-chain systems and online chemical procurement platforms are increasingly being adopted for transparency, documentation, and regulatory compliance. Large fragrance houses leverage integrated distribution networks, while natural ingredient suppliers often operate through partnerships with growers, co-operatives, and specialty brokers.

End-Use / Buyer Insights

Personal care brands, home-care manufacturers, and fine fragrance houses are the primary buyers of fragrance ingredients. Demand is particularly strong among cosmetics companies targeting premium and clean-label product categories. Household product manufacturers purchase large volumes of synthetic and application-specific fragrance molecules for detergents, cleaners, and ambient products. Specialty buyers include automotive companies, hospitality chains, and retailers using ambient scenting to elevate customer engagement. Growing demand from emerging markets and online D2C beauty brands is also expanding the customer base.

| By Source | By Form | By Application | By Price / Quality Tier |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents 20–25% of global demand, driven by high spending on premium personal care, fine fragrances, and home-care products. The U.S. leads the region, supported by strong consumer preference for innovative, long-lasting, and clean-label fragrances. The market benefits from advanced R&D capabilities and stringent regulatory standards, pushing the adoption of allergen-free and sustainable ingredients.

Europe

Europe holds approximately 20–22% of the global share and remains the hub of luxury fragrance creation. France, Germany, Italy, and the U.K. drive demand for fine fragrances and high-compliance ingredients. Strict regulatory norms (e.g., REACH) accelerate innovation in safe and sustainable fragrance molecules. Niche perfumery and artisanal fragrance brands reinforce Europe's leadership in sophisticated scent development.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, accounting for 30–35% of global demand. The booming personal care markets in China, India, Indonesia, and Vietnam are driving significant growth. Expanding middle-class populations and rising household product consumption are fueling demand for both mass-market and premium fragrance ingredients. Local manufacturing investments and increasing Western beauty influence further support long-term expansion.

Latin America

Latin America is experiencing rising demand for personal care and household products, driven by growing urbanization and cultural affinity for fragranced products. Brazil and Mexico are the largest contributors, with strong domestic cosmetic industries. Growth in mid-range and mass-market personal care products is expected to boost fragrance ingredient consumption over the next decade.

Middle East & Africa

The region demonstrates strong demand for fine fragrances, attars, and high-intensity scent profiles rooted in cultural preferences. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing rising consumption of premium perfumes and luxury home scents. Local perfume manufacturing expansion and strong import demand make this a lucrative region for global ingredient suppliers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fragrance Ingredients Market

- Givaudan SA

- BASF SE

- DSM-Firmenich

- International Flavors & Fragrances (IFF)

- Symrise AG

- Mane SA

- Takasago International Corporation

- Robertet Group

- Sensient Technologies Corporation

- Kao Corporation

- Bell Flavors & Fragrances

- Vigon International

- Ungerer & Co.

- Frutarom Industries

- Peppermint Essential Oils Co.

Recent Developments

- In March 2025, Givaudan announced the expansion of its natural ingredient production facility, integrating biotech fermentation units to scale sustainable aroma molecules.

- In January 2025, Symrise introduced a new portfolio of clean-label fragrance ingredients designed to meet EU allergen compliance updates.

- In December 2024, DSM-Firmenich launched a biotech-based sandalwood alternative, offering improved sustainability and reduced ecological impact.