Fragrance Diffuser Market Size

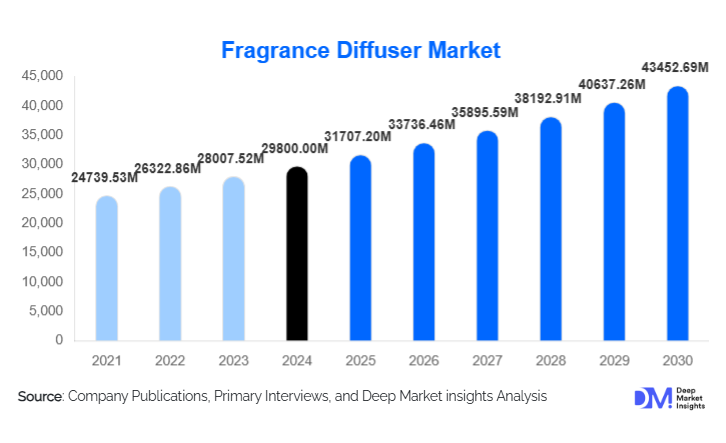

According to Deep Market Insights, the global fragrance diffuser market size was valued at USD 29,800.00 million in 2024 and is projected to grow from USD 31,707.20 million in 2025 to reach USD 43,452.69 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). The fragrance diffuser market growth is primarily driven by increasing consumer awareness about home wellness, rising adoption of smart and IoT-enabled diffusers, and expanding demand across residential, hospitality, and commercial segments globally.

Key Market Insights

- Smart and IoT-enabled diffusers are gaining prominence, offering remote control, automated scheduling, and app integration for personalized fragrance experiences.

- Residential adoption dominates, fueled by the rising interest in home aromatherapy, stress relief, and lifestyle-driven fragrance products.

- North America leads the global market, with high disposable income and a preference for smart home wellness products driving demand.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising middle-class income, and increasing interest in premium and commercial diffusers.

- Eco-friendly and sustainable diffusers are emerging as a key trend, with biodegradable materials, energy-efficient designs, and refillable fragrance pods gaining consumer acceptance.

- Commercial adoption is expanding, particularly in hotels, spas, wellness centers, and office spaces, where scent marketing enhances customer experience.

What are the latest trends in the fragrance diffuser market?

Smart and Connected Diffusers

Consumers increasingly prefer smart diffusers integrated with apps and voice assistants, enabling scheduling, intensity control, and remote monitoring. The integration of IoT technology allows for personalized fragrance experiences, subscription-based refill services, and automation in commercial spaces. The trend is particularly strong in North America and Europe, where smart home adoption is widespread. Manufacturers are focusing on multi-functional devices that combine scent diffusion with lighting or humidification, providing both aesthetic appeal and wellness benefits.

Sustainability and Eco-Friendly Designs

Eco-conscious consumers are driving demand for sustainable diffusers made from biodegradable, recyclable, or low-energy materials. Energy-efficient ultrasonic diffusers, refillable fragrance pods, and low-noise devices are becoming standard in premium and mid-range categories. Regulatory requirements in Europe for eco-labeling, alongside growing consumer awareness in APAC, are further accelerating the adoption of sustainable fragrance products. Companies investing in environmentally friendly technologies are achieving higher brand loyalty and market differentiation.

What are the key drivers in the fragrance diffuser market?

Rising Demand for Home Wellness

The shift toward wellness and self-care is driving the global adoption of fragrance diffusers. Consumers increasingly seek aromatherapy, stress relief, and home ambiance enhancement, leading to higher residential sales. Remote working trends and urban lifestyles have further amplified the need for personalized, calming environments, boosting demand for both premium and mid-range diffusers.

Technological Advancements

Advancements such as ultrasonic and nebulizing diffusion technologies, along with IoT-enabled features, have improved efficiency, customization, and user convenience. Smart diffusers allow scheduling, intensity adjustment, and integration with home automation systems, attracting tech-savvy consumers. Continuous innovation has expanded the product portfolio and driven replacement cycles, particularly in North America and Europe.

Hospitality and Commercial Adoption

Hotels, resorts, wellness centers, and office spaces are investing in high-quality diffusers to enhance ambiance and customer experience. Premium and smart diffusers are widely used in luxury hospitality environments, contributing to the growth of the commercial segment. Corporate wellness programs are also incorporating scent-based solutions to improve employee satisfaction and productivity.

What are the restraints for the global market?

High Initial Costs

Premium and smart diffusers remain relatively expensive, limiting adoption in price-sensitive markets. High upfront costs can deter consumers in emerging economies from purchasing feature-rich devices, slowing penetration in key growth regions.

Dependency on Fragrance Supply

Fragrance diffusers require consistent replenishment of essential oils or scent cartridges. Fluctuating prices of natural oils, supply chain disruptions, and limited availability of high-quality fragrances can restrict market expansion and affect consumer retention.

What are the key opportunities in the fragrance diffuser industry?

Integration with Smart Home Ecosystems

Fragrance diffusers can leverage IoT and home automation trends to offer app-based control, voice command functionality, and automated scent scheduling. Subscription-based models for fragrance refills and remote monitoring provide new revenue streams for manufacturers. This creates opportunities for differentiation in developed regions with high smart home adoption.

Expansion into Emerging Markets

Emerging economies such as India, China, Brazil, and Southeast Asia are witnessing rising disposable incomes, urbanization, and lifestyle-driven consumption. These markets present growth potential for mid-range and premium diffusers, both in residential and commercial applications, supported by wellness and hospitality initiatives.

Sustainable and Eco-Friendly Innovations

Manufacturers focusing on biodegradable materials, energy-efficient devices, and refillable fragrance pods can tap into environmentally conscious consumer segments. Sustainable product design not only meets regulatory standards in Europe but also provides differentiation and premium pricing potential in global markets.

Product Type Insights

Ultrasonic diffusers dominate the market, accounting for 38% of global market share in 2024, due to their quiet operation, multifunctionality, and energy efficiency. Nebulizing diffusers are gaining popularity in premium and commercial settings for concentrated fragrance delivery, while heat-based and evaporative diffusers are preferred in budget segments. Consumer preference is shifting toward devices offering additional wellness and smart functionalities, supporting growth across product tiers.

Technology Insights

Smart/IoT-enabled diffusers hold the largest share of 42% in 2024, as consumers increasingly demand app-based control, automated scheduling, and remote monitoring. Non-smart diffusers maintain a stable market presence in emerging regions, but overall growth is driven by connected devices with integrated features such as humidification, lighting, and aroma customization.

Distribution Channel Insights

Online retail dominates the fragrance diffuser market, representing 45% of global sales in 2024. E-commerce platforms provide convenience, a wide product selection, and access to premium global brands. Offline retail, including department stores and specialty stores, continues to capture a significant share, particularly in emerging regions where consumer trust in physical stores remains strong. Commercial channels, such as hotels and spas, contribute to high-value recurring orders, supporting overall market growth.

End-Use Insights

Residential users represent the largest end-use segment, accounting for 50% of global demand in 2024. The hospitality sector, particularly luxury hotels and wellness resorts, is rapidly adopting premium diffusers, while office spaces and commercial facilities are integrating scent marketing as part of wellness initiatives. Emerging applications in healthcare, such as hospitals and eldercare facilities, offer untapped growth potential, particularly for therapeutic aromatherapy solutions.

| By Product Type | By Technology | By Distribution Channel | By End-Use Industry | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 32% of the global market in 2024, led by the U.S. and Canada. High disposable income, smart home adoption, and consumer awareness about wellness drive demand. Premium residential and commercial applications dominate, with increasing uptake of smart and eco-friendly diffusers.

Europe

Europe accounts for 28% of the global market, led by Germany, France, and the UK. Eco-friendly and technologically advanced diffusers are preferred, with strong adoption in both residential and hospitality sectors. Regulations and sustainability trends further influence product design and consumer choices.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and Australia. Rising urbanization, disposable income, and social media influence are fueling premium and smart diffuser adoption. China is projected to grow at a CAGR of 9% from 2025–2030, making it a critical market for both global and domestic players.

Middle East & Africa

Luxury hotels in the UAE, Saudi Arabia, and South Africa are driving regional demand. High-income populations and hospitality-focused adoption support steady growth in MEA, with increasing interest in eco-friendly and premium devices.

Latin America

Brazil and Argentina are emerging markets for fragrance diffusers. While residential adoption is growing, premium hospitality and office-based applications are still developing. Overall regional market share remains below 10% but presents potential for future expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|