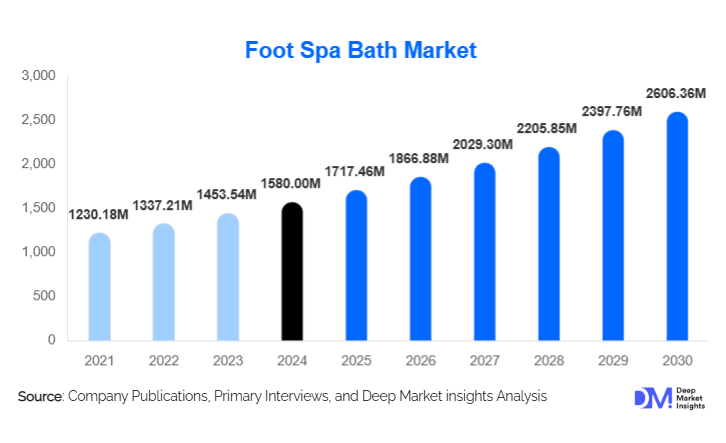

Foot Spa Bath Market Size

According to Deep Market Insights, the global foot spa bath market size was valued at USD 1,580.00 million in 2024 and is projected to grow from USD 1,717.46 million in 2025 to reach USD 2,606.36 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). The foot spa bath market growth is primarily driven by the rising focus on home-based wellness, increasing prevalence of foot-related health conditions, and growing adoption of non-invasive therapeutic devices across residential and professional settings.

Key Market Insights

- Home wellness adoption is accelerating globally, as consumers increasingly invest in personal care and relaxation products that offer therapeutic benefits.

- Multi-function and digitally controlled foot spa baths dominate demand, reflecting consumer preference for advanced features such as heat therapy, vibration, and massage rollers.

- Asia-Pacific represents the largest manufacturing and consumption hub, supported by a strong wellness culture, cost-effective production, and expanding middle-class populations.

- North America remains a high-value market, driven by premium product demand, aging demographics, and strong e-commerce penetration.

- Medical and therapeutic applications are emerging as a fast-growing segment, particularly for diabetic foot care, rehabilitation, and circulation improvement.

- E-commerce channels lead distribution, supported by D2C brands, online promotions, and growing consumer trust in digital purchasing.

What are the latest trends in the foot spa bath market?

Premiumization and Multi-Function Product Demand

The foot spa bath market is witnessing strong premiumization trends, with consumers increasingly opting for multi-function devices that combine heating, bubble therapy, vibration massage, and infrared or EMS technologies. These advanced products provide comprehensive foot care benefits, including pain relief, stress reduction, and improved blood circulation. Premium models command higher price points and margins, contributing significantly to overall market value growth. Manufacturers are focusing on ergonomic designs, durable materials, and aesthetic appeal to position foot spa baths as lifestyle wellness products rather than basic utility devices.

Integration of Smart and Digital Technologies

Smart and digitally controlled foot spa baths are gaining traction, particularly in developed markets. Features such as digital temperature control, programmable massage settings, app-based operation, and safety sensors are enhancing user convenience and personalization. This trend aligns with the broader adoption of smart home and connected wellness devices. While smart foot spa baths currently represent a smaller share of the market, they are among the fastest-growing sub-segments, especially in North America, Europe, and parts of Asia-Pacific.

What are the key drivers in the foot spa bath market?

Rising Focus on Preventive Healthcare and Self-Care

Consumers are increasingly prioritizing preventive healthcare and self-care solutions to manage stress, fatigue, and chronic discomfort without relying on medication. Foot spa baths offer an accessible and affordable way to improve relaxation, circulation, and foot health at home. This shift toward wellness-oriented lifestyles has significantly boosted residential demand, particularly among working professionals and elderly populations.

Aging Population and Foot Health Awareness

The global aging population is a key driver for the foot spa bath market. Older adults are more prone to conditions such as arthritis, poor circulation, and plantar fasciitis, for which foot spa therapy is commonly recommended. Rising awareness of foot health, supported by healthcare professionals and wellness practitioners, is driving adoption in both home and clinical settings, especially in regions such as North America, Europe, and Japan.

Product Innovation and Feature Differentiation

Continuous innovation in heating mechanisms, massage technologies, and materials has enhanced product performance and safety. Manufacturers are introducing energy-efficient heating systems, quieter motors, and easy-to-clean designs, improving overall user experience. These innovations are supporting repeat purchases and brand differentiation in a moderately competitive market.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Despite growing awareness, price sensitivity remains a challenge in developing economies. Premium and smart foot spa baths may be perceived as non-essential or luxury products, limiting adoption among middle- and lower-income consumers. Manufacturers must balance feature enhancements with cost optimization to expand penetration in price-sensitive regions.

Durability, Maintenance, and Safety Concerns

Concerns related to product durability, electrical safety, and hygiene can negatively impact consumer confidence. Issues such as leakage, heating malfunctions, or difficulty in cleaning can affect brand reputation. Compliance with electrical safety standards and improved quality control are critical to overcoming this restraint.

What are the key opportunities in the foot spa bath industry?

Expansion into Medical and Therapeutic Applications

Medical and therapeutic use of foot spa baths presents a significant growth opportunity. These products are increasingly used in diabetic foot care, physiotherapy, and rehabilitation programs to improve circulation and reduce pain. Partnerships with clinics, hospitals, and wellness centers can open new institutional sales channels and support long-term demand growth.

Growth in Emerging Economies and Urban Centers

Rapid urbanization, rising disposable incomes, and expanding middle-class populations in Asia-Pacific, Latin America, and parts of the Middle East are creating untapped demand for home wellness products. Localized product offerings, competitive pricing, and digital marketing can help manufacturers capture these high-growth markets.

Product Type Insights

Multi-function foot spa baths dominate the market, accounting for the largest share of global revenue in 2024, driven by strong consumer preference for comprehensive therapy solutions. Bubble and heat therapy models represent a significant mid-range category, balancing affordability and functionality. Basic soaking-only foot spa baths continue to serve entry-level demand, particularly in price-sensitive markets, while smart and infrared-enabled models are emerging as a premium niche with strong growth potential.

Application Insights

Residential use remains the largest application segment, supported by increasing home wellness adoption and work-from-home lifestyles. Commercial applications, including spas and salons, provide steady demand for durable, high-capacity models. Medical and therapeutic applications are the fastest-growing segment, driven by rising healthcare awareness and the integration of foot spa therapy into rehabilitation and chronic care routines. Hospitality applications, such as hotels and resorts, are emerging as a high-value niche, particularly in luxury wellness offerings.

Distribution Channel Insights

Online retail channels dominate the foot spa bath market, accounting for the largest share of global sales. E-commerce platforms and D2C websites offer extensive product variety, competitive pricing, and customer reviews, influencing purchasing decisions. Specialty wellness and healthcare stores remain important for premium and medical-grade products, while supermarkets and hypermarkets cater to mass-market demand. Professional equipment suppliers serve commercial and institutional buyers.

End-User Insights

Residential consumers represent the majority of end users, driven by demand for convenient and affordable wellness solutions. Commercial users, including spas and salons, prioritize durability and performance, contributing stable revenue streams. Medical and therapeutic users are rapidly increasing, supported by clinical recommendations and institutional procurement. Hospitality users, while smaller in volume, contribute disproportionately to revenue due to higher-priced, customized products.

| By Product Type | By Technology & Features | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global foot spa bath market in 2024, led by the United States. High consumer spending on wellness products, an aging population, and a strong e-commerce infrastructure support sustained demand. Premium and smart foot spa baths are particularly popular in this region.

Europe

Europe represents around 22% of the global market share, with strong demand from Germany, the UK, France, and Italy. Aging demographics, preventive healthcare awareness, and preference for energy-efficient products drive market growth. Regulatory emphasis on product safety and sustainability also shapes product development.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, accounting for approximately 34% of global demand. China, Japan, and South Korea dominate due to strong wellness culture and manufacturing capacity, while India and Southeast Asia are emerging as high-growth markets driven by urbanization and rising disposable incomes.

Latin America

Latin America holds a smaller but growing share of the market, led by Brazil and Mexico. Increasing awareness of self-care and expanding e-commerce penetration are supporting gradual market expansion.

Middle East & Africa

The Middle East & Africa region represents an emerging market, with growth concentrated in the UAE, Saudi Arabia, and South Africa. Demand is driven by luxury wellness trends, hospitality investments, and rising healthcare awareness.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Companies in the Foot Spa Bath Market

- Panasonic Corporation

- Conair Corporation

- Beurer GmbH

- HoMedics

- OSIM International

- Brookstone

- RENPHO

- Kendal Healthcare

- Marnur

- Revlon