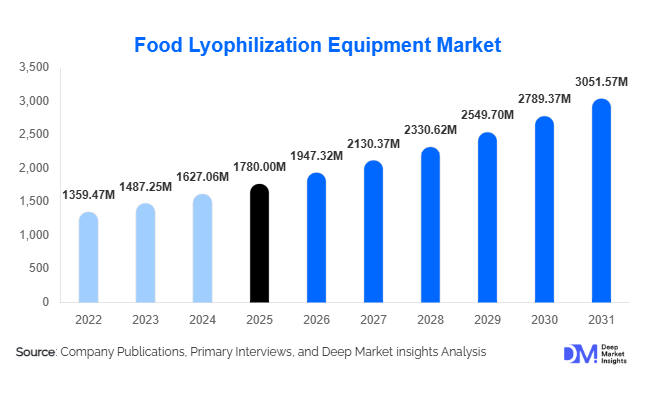

Food Lyophilization Equipment Market Size

According to Deep Market Insights, the global food lyophilization equipment market size was valued at USD 1,780 million in 2025 and is projected to grow from USD 1,947.32 million in 2026 to reach USD 3,051.57 million by 2031, expanding at a CAGR of 9.4% during the forecast period (2026–2031). Market growth is primarily driven by rising demand for long shelf-life foods, increasing consumption of freeze-dried fruits, meals, and pet food, and growing investments in advanced food processing technologies across both developed and emerging economies.

Key Market Insights

- Freeze-dried fruits, vegetables, and ready meals are gaining strong traction due to clean-label preferences and superior nutrient retention.

- Industrial tray freeze-dryers dominate equipment demand, accounting for the largest installed base globally.

- North America leads global demand, supported by premium food, pet nutrition, and emergency food supply applications.

- Asia-Pacific is the fastest-growing region, driven by export-oriented food processing in China, India, and Southeast Asia.

- Automation and energy-efficient lyophilization systems are becoming key purchase criteria for food manufacturers.

- Pet food and functional nutrition segments are emerging as high-growth end uses for freeze-drying equipment.

What are the latest trends in the food lyophilization equipment market?

Shift Toward Automated and Smart Freeze Drying Systems

Food manufacturers are increasingly adopting fully automated and PLC-integrated lyophilization systems to improve batch consistency, reduce labor dependency, and enhance food safety compliance. Smart systems equipped with IoT sensors and real-time process monitoring are gaining popularity, particularly among large-scale processors and contract manufacturers. These technologies allow predictive maintenance, energy optimization, and tighter moisture control, which directly improve yield and operating margins. Automation has become especially critical in export-oriented facilities that require standardized quality across large volumes.

Rising Adoption in Premium and Functional Food Categories

Freeze drying is increasingly used in premium food categories such as superfoods, functional ingredients, and high-protein snacks. Manufacturers favor lyophilization due to its ability to preserve flavor, color, texture, and bioactive compounds. This trend is particularly evident in berries, tropical fruits, dairy powders, and nutraceutical ingredients. As consumer willingness to pay for high-quality, minimally processed foods increases, demand for advanced lyophilization equipment continues to rise.

What are the key drivers in the food lyophilization equipment market?

Growing Demand for Shelf-Stable and Convenience Foods

Urbanization and changing consumer lifestyles have significantly increased demand for shelf-stable, lightweight, and easy-to-prepare food products. Freeze-dried meals and ingredients meet these requirements while maintaining nutritional integrity. This has driven strong investments in lyophilization equipment among ready-to-eat meal producers, emergency food suppliers, and outdoor nutrition brands.

Expansion of Premium Pet Food and Animal Nutrition

The premium pet food segment is a major growth driver, as freeze-dried pet food offers superior protein preservation and palatability. North America and Europe have seen rapid capacity expansion in pet food freeze-drying facilities, directly boosting demand for medium- and large-scale equipment. Pet food manufacturers are increasingly upgrading from conventional drying technologies to lyophilization to capture higher margins.

What are the restraints for the global market?

High Capital and Energy Costs

Food lyophilization equipment requires significant upfront capital investment, particularly for large-capacity and fully automated systems. This limits adoption among small and mid-sized food processors. Additionally, freeze drying is energy-intensive, and rising electricity costs can impact operating economics, especially in regions with limited access to low-cost power.

Operational Complexity and Skilled Labor Requirements

Operating lyophilization systems requires technical expertise in vacuum systems, refrigeration, and process control. Limited availability of skilled operators in emerging markets can slow adoption and increase training costs, acting as a restraint to market expansion.

What are the key opportunities in the food lyophilization equipment industry?

Export-Oriented Food Processing in Asia-Pacific

Asia-Pacific offers significant opportunities as countries such as China, India, Vietnam, and Thailand expand exports of freeze-dried fruits, vegetables, seafood, and instant meals to North America and Europe. Investments in modern food processing infrastructure and government support for value-added food exports are accelerating demand for industrial-scale lyophilization equipment.

Integration of Energy-Efficient and Sustainable Technologies

Manufacturers that develop energy-efficient refrigeration systems, heat recovery technologies, and low-carbon freeze dryers can capitalize on sustainability-driven procurement trends. Food processors are increasingly prioritizing equipment that reduces energy consumption and aligns with ESG goals, creating strong opportunities for technology-focused suppliers.

Equipment Type Insights

Industrial tray freeze-dryers dominate the global food lyophilization equipment market, accounting for approximately 42% of the 2025 market share. Their leadership is driven by their high versatility, modular design, and ability to process a wide range of food products, including fruits, vegetables, ready meals, dairy, and pet food. Industrial tray systems offer flexible batch sizing, uniform drying performance, and easier compliance with food safety regulations, making them the preferred choice for both large food processors and contract manufacturers.

In addition, tray freeze-dryers provide scalability advantages, allowing manufacturers to expand capacity incrementally without major process redesign. This makes them particularly attractive in markets with fluctuating demand and diversified product portfolios. Continuous freeze-drying systems, while holding a smaller share, are gaining momentum in high-volume, export-oriented facilities, especially for standardized products such as fruit slices, powders, and instant meal components. These systems are favored where consistent throughput, reduced labor intervention, and lower per-unit processing costs are critical. Rotary and manifold freeze-dryers serve niche and small-scale applications, including specialty ingredients, herbs, and pilot-scale production, where precision and limited batch sizes are required. From a capacity perspective, medium-scale systems (100–500 kg per batch) continue to see strong demand, particularly among contract food manufacturers and mid-sized processors seeking an optimal balance between capital investment, operational efficiency, and output flexibility.

Application Insights

Fruits and vegetables represent the largest application segment in the food lyophilization equipment market, contributing nearly 31% of global demand in 2025. This leadership is driven by strong global consumption of freeze-dried berries, tropical fruits, leafy vegetables, and vegetable powders, which are widely used in snacks, cereals, smoothies, infant food, and functional nutrition products. Freeze drying is preferred in this segment due to its ability to preserve natural color and flavor, texture, and nutritional content, which is critical for premium food positioning.

Prepared meals and instant foods are the fastest-growing application segment, supported by rising demand for convenience foods, outdoor and adventure nutrition, military rations, and emergency food supplies. Freeze-dried meals offer long shelf life, lightweight packaging, and rapid rehydration, making them ideal for both consumer and institutional use. This trend is particularly strong in North America, Europe, and parts of the Asia-Pacific. Dairy products, meat, seafood, and functional ingredients continue to expand steadily as manufacturers increasingly use freeze drying for high-value applications such as probiotic cultures, protein-rich snacks, and specialty ingredients. Premiumization trends, combined with growing demand for clean-label and minimally processed foods, are supporting sustained investments in lyophilization equipment across these applications.

End-Use Insights

Food processing companies account for approximately 55% of total lyophilization equipment demand, driven by large-scale production of freeze-dried fruits, meals, dairy powders, and ingredients for domestic consumption and export markets. These companies prioritize industrial and automated systems to ensure consistent quality, regulatory compliance, and cost efficiency. Contract food manufacturers represent the second-largest end-use segment, benefiting from increased outsourcing by food brands seeking flexibility and reduced capital exposure. Contract manufacturers typically invest in medium- to large-scale systems that can accommodate diverse product specifications and frequent changeovers.

Pet food manufacturers are the fastest-growing end-use segment, expanding at over 11% CAGR. Demand is fueled by the rapid premiumization of pet nutrition, particularly in North America and Europe, where freeze-dried pet food commands higher price points due to superior protein retention and palatability. Nutraceutical and functional food producers are also emerging as high-value customers, adopting advanced lyophilization systems to preserve bioactive compounds, probiotics, and functional ingredients.

| By Equipment Type | By Operation Mode | By Capacity | By Application | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global food lyophilization equipment market, led by the United States, which alone represents nearly 27% of global demand. Regional dominance is driven by strong demand from premium food manufacturers, a rapidly expanding pet food industry, and government-supported emergency food and defense reserves. High adoption of advanced automation, early uptake of energy-efficient technologies, and stringent food safety standards further support continuous equipment upgrades and replacements across the region.

Europe

Europe holds around 29% of the global market share, with Germany, France, and the U.K. as the primary demand centers. Growth is supported by strict food quality and safety regulations, strong emphasis on clean-label and sustainable food processing, and a well-established export market for freeze-dried ingredients and meals. European manufacturers also benefit from robust R&D activity and government incentives that promote energy-efficient and low-emission food-processing technologies.

Asia-Pacific

Asia-Pacific represents approximately 24% of the global market and is the fastest-growing region, expanding at an estimated 11.2% CAGR. China and India are the key growth engines, driven by export-oriented food manufacturing, rising domestic consumption of convenience foods, and government-backed food processing initiatives. Increasing investments in cold chain infrastructure, rapid industrialization, and growing demand from Southeast Asian countries for freeze-dried fruits and seafood are further accelerating regional growth.

Latin America

Latin America is experiencing steady growth, particularly in Brazil, Mexico, and Chile, supported by abundant agricultural output and rising exports of freeze-dried fruits and vegetables. Growing integration into global food supply chains and increased focus on value-added food processing are encouraging investments in medium-scale lyophilization systems across the region.

Middle East & Africa

The Middle East & Africa market is driven by food security initiatives, emergency food programs, and expanding food processing infrastructure. Countries such as the UAE, Saudi Arabia, and South Africa are investing in advanced food preservation technologies to reduce import dependency, support defense and humanitarian supply chains, and meet rising demand for shelf-stable foods in arid and logistics-constrained environments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Food Lyophilization Equipment Market

- GEA Group

- Bühler Group

- SP Scientific

- IMA Group

- Telstar (Azbil Group)

- Martin Christ

- Tofflon Technology

- Millrock Technology

- Cuddon Freeze Dry

- Hosokawa Micron