Folding Helmet Market Size

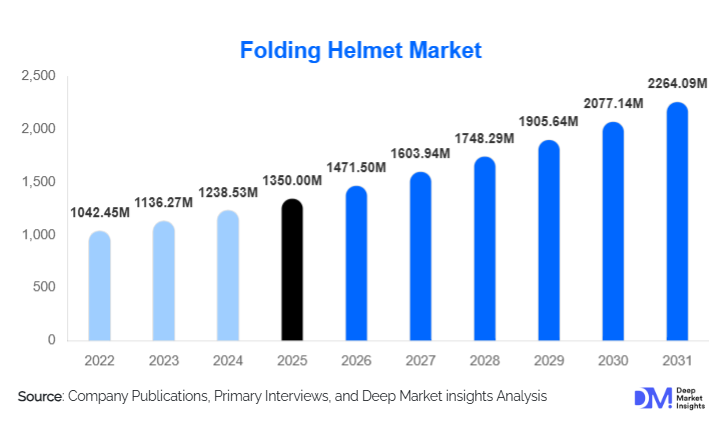

According to Deep Market Insights, the global folding helmet market size was valued at USD 1350.00 million in 2025 and is projected to grow from USD 1471.50 million in 2026 to reach USD 2264.09 million by 2031, expanding at a CAGR of 9.0% during the forecast period (2026–2031).

The folding helmet market growth is primarily driven by the rapid expansion of urban micromobility, increasing safety regulations for cyclists and e-scooter users, and growing consumer demand for compact, portable protective equipment suited to multi-modal commuting.

Key Market Insights

- Urban commuting and micromobility applications account for the largest share of demand, supported by the widespread adoption of bicycles, e-bikes, and electric scooters in major cities.

- Tri-fold and modular folding helmet designs dominate global revenues, offering an optimal balance between compactness, safety compliance, and durability.

- Europe leads the global market, driven by strong cycling infrastructure, strict safety standards, and high consumer awareness.

- Asia-Pacific is the fastest-growing regional market, supported by rapid urbanization, government-led sustainable transport initiatives, and rising middle-class adoption.

- Mid-range price tiers (USD 50–120) capture the highest market share, balancing affordability, safety certification, and product innovation.

- Direct-to-consumer and e-commerce channels are reshaping distribution, enabling brands to improve margins and customer engagement.

What are the latest trends in the folding helmet market?

Rising Adoption in Shared Mobility Ecosystems

Folding helmets are increasingly being adopted within shared mobility ecosystems, including bike-sharing and e-scooter rental platforms. Operators are under growing regulatory pressure to enhance rider safety while maintaining convenience. Folding helmets provide a practical solution due to their compact design, enabling easy storage within docking stations or portable kits. Several mobility providers are piloting bundled safety solutions that include folding helmets as part of subscription-based or corporate mobility programs, reinforcing steady institutional demand.

Advancements in Lightweight and Modular Materials

Manufacturers are investing in advanced materials such as reinforced polycarbonate, hybrid composites, and carbon-fiber blends to improve impact absorption while reducing weight. Innovations in hinge engineering and modular shell architecture are enabling folding helmets to achieve safety certifications comparable to traditional rigid helmets. These advancements are expanding consumer trust and accelerating adoption across both commuter and recreational segments.

What are the key drivers in the folding helmet market?

Growth of Urban Micromobility Infrastructure

Governments worldwide are investing heavily in cycling lanes, pedestrian-friendly zones, and low-emission transport infrastructure. This has directly increased daily usage of bicycles and electric scooters, driving consistent demand for portable safety gear. Folding helmets address the long-standing inconvenience associated with carrying conventional helmets, making them particularly attractive to urban commuters.

Strengthening Safety Regulations and Awareness

Mandatory helmet regulations for cyclists and e-scooter riders are expanding across Europe, North America, and parts of Asia-Pacific. In parallel, heightened public awareness around road safety and accident prevention is encouraging voluntary helmet adoption. Employers in delivery, logistics, and gig-economy sectors are also mandating protective equipment, further supporting market growth.

What are the restraints for the global market?

Higher Product Costs Compared to Conventional Helmets

Folding helmets typically command higher prices due to complex engineering, premium materials, and certification requirements. This price premium limits adoption in cost-sensitive markets and among casual users, particularly in developing economies where traditional helmets remain widely available at lower price points.

Residual Consumer Perception Challenges

Despite improved certifications and performance testing, some consumers continue to perceive folding helmets as less durable than rigid alternatives. Overcoming this perception requires sustained marketing, education, and independent safety validation, which can slow near-term adoption rates.

What are the key opportunities in the folding helmet industry?

Integration with Corporate and Institutional Mobility Programs

Corporate sustainability initiatives and employee mobility programs present significant growth opportunities. Folding helmets are well-suited for workplace bike schemes, university campuses, and public-sector commuting programs, offering scalable, contract-based demand for manufacturers.

Expansion in Emerging Urban Markets

Rapid urbanization in Asia-Pacific, Latin America, and parts of the Middle East is expanding the addressable consumer base for micromobility safety products. Localized manufacturing, tiered pricing strategies, and region-specific designs can unlock high-volume growth in these markets.

Design Type Insights

Tri-fold folding helmets dominate the global market, accounting for approximately 38% of total revenue in 2025. These designs offer superior compactness without compromising structural integrity, making them suitable for daily commuting. Bi-fold helmets maintain steady demand among entry-level users, while advanced multi-segment modular designs are gaining traction in premium categories due to enhanced fit customization and safety performance.

Material Type Insights

Polycarbonate-based folding helmets lead the market with an estimated 42% share in 2025, driven by cost efficiency, impact resistance, and ease of large-scale manufacturing. Hybrid composite helmets are expanding rapidly within premium segments, while carbon fiber–reinforced models remain niche due to higher pricing.

End-Use Application Insights

Urban commuting and micromobility applications represent the largest end-use segment, accounting for 46% of global demand. Recreational cycling follows, supported by fitness trends and leisure riding. Shared mobility and rental fleets are the fastest-growing segment, driven by safety mandates and fleet standardization initiatives.

Distribution Channel Insights

Direct-to-consumer channels account for approximately 34% of global sales, reflecting strong brand-led purchasing and customization options. E-commerce marketplaces continue to expand reach, while specialty cycling retailers remain relevant for premium and professional-grade products.

Price Tier Insights

Mid-range folding helmets priced between USD 50 and USD 120 dominate the market with a 44% share, balancing affordability, safety certification, and design innovation. Premium helmets above USD 120 capture high margins but remain limited in volume, while economy models drive entry-level adoption.

| By Design Type | By Material Type | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global folding helmet market with approximately 34% market share in 2025, driven by Germany, France, the Netherlands, and the U.K. Strong cycling infrastructure, strict safety regulations, and high environmental awareness support sustained demand.

Asia-Pacific

Asia-Pacific accounts for nearly 29% of global revenue and represents the fastest-growing region, expanding at an estimated CAGR of over 13%. China, Japan, South Korea, and India are key contributors, supported by urban congestion, government-led sustainable transport policies, and rising consumer adoption.

North America

North America holds approximately 24% of the global market, led by the United States and Canada. Growth is supported by urban cycling adoption, delivery workforce expansion, and premium product demand.

Latin America

Latin America represents a smaller but growing share, driven by Brazil and Mexico. Increasing urban cycling initiatives and rising safety awareness are gradually supporting adoption.

Middle East & Africa

The Middle East & Africa region is emerging steadily, led by the UAE and South Africa. Investments in smart city infrastructure and recreational cycling are contributing to gradual market expansion.

Company Market Share

The folding helmet market is moderately concentrated, with the top five manufacturers accounting for approximately 52–55% of global revenue. Market leaders maintain competitive advantage through patented designs, safety certifications, and strong direct-to-consumer presence.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|