Flush Mount Photo Album Market Size

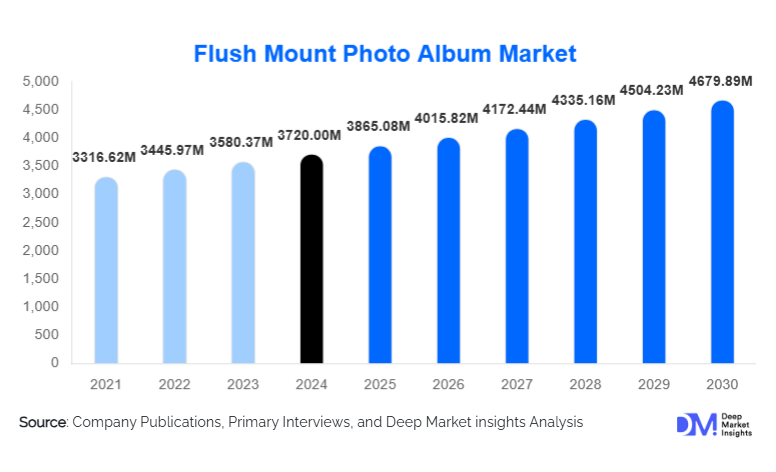

According to Deep Market Insights, the global flush mount photo album market size was valued at USD 3720 million in 2024 and is projected to grow from USD 3865.08 million in 2025 to reach USD 4679.89 million by 2030, expanding at a CAGR of 3.9% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for premium and personalized photo albums in weddings and events, the rising adoption of digital printing technology, and the expansion of online retail channels, facilitating customized album offerings globally.

Key Market Insights

- Weddings and professional photography are the largest end-use segments, accounting for nearly 70% of global demand, due to increasing disposable incomes and premiumization trends.

- Digital printing and online customization platforms are transforming consumer preferences, enabling high-quality, on-demand, and personalized album production.

- North America dominates the market, with the U.S. contributing the largest share due to high wedding expenditures and professional photography studio density.

- Asia-Pacific is the fastest-growing region, led by India and China, driven by rising middle-class wealth, premium gifting trends, and the growing popularity of professional photography.

- Luxury and genuine leather albums dominate, capturing over 30% of the market share due to durability, aesthetics, and premium consumer preference.

- Technological adoption, including AI-based album design, AR previews, and automated binding systems, is reshaping production efficiency and personalization in the market.

What are the latest trends in the flush mount photo album market?

Premiumization and Customization Driving Demand

Consumers are increasingly seeking premium-quality flush mount albums with customizable covers, page layouts, and personalized designs. High-end materials such as genuine leather, linen, and fabric finishes are preferred for weddings, corporate gifting, and special events. Digital printing innovations and AR-based album preview tools allow users to tailor albums to specific aesthetics and occasions. The growing emphasis on durability, aesthetics, and personalization positions flush mount albums as both keepsakes and luxury products, differentiating them from standard photo albums.

Integration of Digital Printing Technologies

Digital printing and UV printing technologies are being widely adopted, offering high-resolution, scratch-resistant albums with faster turnaround times. Professional studios and online retailers increasingly leverage these technologies to provide on-demand, customized products. Automation and software-driven design platforms enhance efficiency and reduce production costs, while supporting premium pricing strategies. Emerging trends include AI-powered layout suggestions and photo enhancement, improving consumer satisfaction and driving repeat purchases.

What are the key drivers in the flush mount photo album market?

Rising Demand from Weddings and Events

Weddings remain the primary driver of flush mount album demand, with couples and event planners preferring high-quality keepsakes. Increasing wedding expenditures, particularly in North America, Europe, and APAC, drive the adoption of premium leather, linen, and customizable albums. Professional photography studios are a key channel for distributing high-end albums, ensuring recurring sales and client loyalty. The wedding segment contributes around 42% of the overall market, reflecting its strong influence on growth.

Growth of Professional Photography Studios

Expansion of professional studios worldwide fuels demand for bulk, high-quality flush mount albums. Studios require premium, durable products to meet client expectations for weddings, corporate events, and special occasions. APAC and North America are the largest contributors, with increasing B2B orders supporting steady revenue streams. The adoption of digital design and printing technology by studios enhances operational efficiency and market competitiveness.

Technological Advancements in Album Production

Technologies such as AI-based design, AR previews, UV printing, and automated binding systems are enhancing product quality and customization. These innovations enable faster production, reduced errors, and superior finishes. Consumers benefit from higher-quality images, personalized layouts, and durable albums. Technological adoption is particularly prevalent in online retail and premium professional photography segments, driving market differentiation and growth.

What are the restraints for the global market?

High Cost of Premium Albums

Premium flush mount albums, especially those with genuine leather covers and advanced printing, are expensive. High costs limit adoption among price-sensitive consumers, particularly in emerging markets, where digital and DIY photo solutions remain attractive alternatives. The pricing gap between premium and mid-tier albums presents a barrier to mass-market penetration.

Competition from Digital Photo Sharing

With increasing cloud storage, social media, and digital photo display solutions, some consumers prefer digital alternatives over physical albums. This trend challenges market growth, requiring manufacturers to emphasize premium quality, customization, and the emotional value of physical keepsakes to maintain demand.

What are the key opportunities in the flush mount photo album industry?

Emerging Markets Expansion

Rising disposable incomes and wedding expenditures in countries such as India, China, and Brazil present high-growth opportunities. Localized designs, culturally relevant themes, and e-commerce-enabled customization can attract new customers. These regions are projected to become significant contributors to global demand, driven by urbanization and growing awareness of premium photography products.

Technology-Driven Customization

AI and AR integration in album design, combined with cloud-based on-demand printing, provides opportunities to enhance consumer experience. Manufacturers can differentiate offerings with personalized layouts, design previews, and faster delivery. Technology adoption reduces production errors, increases efficiency, and strengthens brand loyalty, offering long-term growth potential.

Corporate and Institutional Market Penetration

Corporate adoption for portfolios, annual reports, and promotional materials is increasing. Targeting B2B segments can generate recurring bulk orders, reduce seasonal dependency, and enhance profitability. Government and institutional initiatives supporting premium presentation materials provide additional avenues for growth, particularly in developed regions.

Product Type Insights

Leather flush mount albums dominate the global flush mount photo album market, representing approximately 35% of total market revenue in 2024. The leadership of this segment is driven by its superior durability, premium aesthetic appeal, and strong association with milestone occasions such as weddings, anniversaries, and high-end corporate gifting. Genuine leather albums, in particular, command higher price points and margins, making them the preferred choice for professional photography studios and luxury consumers. The emotional value attached to leather-bound keepsakes further strengthens repeat purchases and word-of-mouth demand.

Linen and fabric-based flush mount albums are gaining steady traction within the mid-tier segment, supported by demand for modern, minimalist aesthetics and affordability relative to leather. These products are especially popular among urban consumers and boutique wedding photographers seeking elegant yet cost-effective options. Synthetic leather albums continue to expand their footprint due to price competitiveness, consistent quality, and ease of mass production.

Application Insights

Weddings and social events represent the largest application segment, contributing over 42% of global demand in 2024. The dominance of this segment is driven by rising wedding expenditures, increasing preference for professional photography, and the cultural importance of preserving life events through high-quality physical albums. Flush mount albums are positioned as premium keepsakes, often bundled into photography packages, ensuring consistent bulk demand from studios.

Professional photography studios form the second-largest application segment, leveraging flush mount albums as value-added offerings for weddings, portraits, and commercial shoots. Studios benefit from recurring orders and premium margins, making this segment a stable revenue contributor. Corporate and institutional applications, including company portfolios, annual reports, commemorative albums, and promotional gifts, are growing at a faster pace, driven by branding needs and demand for high-quality presentation materials.

Distribution Channel Insights

Online retail channels dominate the global flush mount photo album market, accounting for approximately 28% of total sales in 2024. Growth in this channel is driven by direct-to-consumer business models, easy-to-use customization interfaces, transparent pricing, and doorstep delivery. E-commerce platforms enable manufacturers to reach global customers without physical retail constraints, while offering advanced design tools such as drag-and-drop layouts, AI-assisted photo selection, and AR-based previews.

Offline retail channels, including professional photography studios, specialty photo stores, and premium gift shops, continue to play a critical role in the high-end segment. These channels offer personalized consultations, material sampling, and bundled photography services, which are particularly valued by wedding and corporate clients. Corporate B2B sales represent a stable and recurring distribution channel, driven by bulk orders and long-term contracts. The increasing digitalization of sales processes, combined with omnichannel strategies, is strengthening overall market accessibility and driving sustained growth across regions.

Buyer Type Insights

Group purchases dominate the market, primarily driven by wedding photography packages, event documentation, and corporate bulk orders. These purchases benefit from economies of scale, standardized production, and predictable demand cycles, making them attractive for manufacturers and studios alike.

Couples and individual buyers represent a high-value segment, favoring premium and personalized albums for weddings, anniversaries, and personal milestones. Corporate clients prioritize professional presentation, durability, and branding customization, supporting demand for leather and high-quality fabric albums. Household and personal users contribute significantly to mid-tier and entry-level album sales, particularly through online platforms. Growing e-commerce adoption across buyer types, especially in APAC and North America, is improving market penetration and driving incremental volume growth.

Age Group Insights

Consumers aged 31–50 years account for the largest share of the flush mount photo album market, supported by higher disposable incomes, peak marriage rates, and strong participation in professional photography services. This demographic favors premium and mid-range albums that balance quality, aesthetics, and long-term durability. The 18–30 age group is a key growth driver for online customization and mid-tier albums. Younger consumers are highly influenced by social media, digital photography, and gifting trends, leading to increased adoption of customizable and affordable flush mount albums.

Older consumers aged 51–65 years represent an important premium segment, preferring high-quality, durable albums for legacy preservation, family gifting, and commemorative purposes. The availability of easy-to-use digital design tools has broadened adoption across all age groups, supporting overall market expansion.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the global flush mount photo album market in 2024, with the United States being the largest contributor. Growth in this region is driven by high wedding expenditures, a mature professional photography ecosystem, and strong consumer preference for premium and personalized products. The widespread adoption of e-commerce, coupled with high disposable income and a gifting culture, further accelerates demand. Technological leadership in digital printing and customization platforms also strengthens North America’s market dominance.

Europe

Europe holds around 25% of the global market share, led by Germany, the U.K., and France. Demand is driven by a strong appreciation for craftsmanship, luxury gifting, and sustainable, long-lasting products. European consumers show high adoption of online customization platforms and premium materials. The U.K. is the fastest-growing European market, supported by digital-first purchasing behavior, strong wedding photography demand, and cross-border e-commerce within the EU.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at an estimated CAGR of 8%. Growth is driven by rising middle-class incomes, increasing wedding budgets, and the rapid expansion of professional photography services in countries such as India, China, and Japan. Cultural emphasis on weddings and family events, combined with cost-effective manufacturing capabilities, positions APAC as both a major consumption and production hub. Strong digital adoption and mobile-first e-commerce platforms are further accelerating regional growth.

Latin America

Latin America accounts for approximately 10% of global demand, with Brazil and Mexico leading the market. Growth is supported by the strong cultural importance of weddings and family celebrations, rising urbanization, and increasing access to professional photography services. While price sensitivity remains a factor, growing demand for mid-range and personalized albums is improving regional market penetration.

Middle East & Africa

The Middle East, led by GCC countries such as the UAE, Saudi Arabia, and Qatar, is characterized by high demand for luxury and premium flush mount albums, driven by affluent consumers, high-end weddings, and corporate gifting. Africa’s domestic market remains comparatively small; however, luxury events, expatriate populations, and increasing professional photography adoption are supporting niche growth. Government-led diversification initiatives and expanding retail infrastructure are expected to gradually enhance regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flush Mount Photo Album Market

- Pixum

- WhiteWall

- Saal Digital

- Blurb

- Mpix

- Graphistudio

- Renaissance Albums

- Album Epoca

- Queensberry

- Miller’s Professional Imaging

- Fundy Designer

- AdoramaPix

- Bay Photo Lab

- Jostens

- Miller’s Proline