Floor Heating Thermostats Market Size

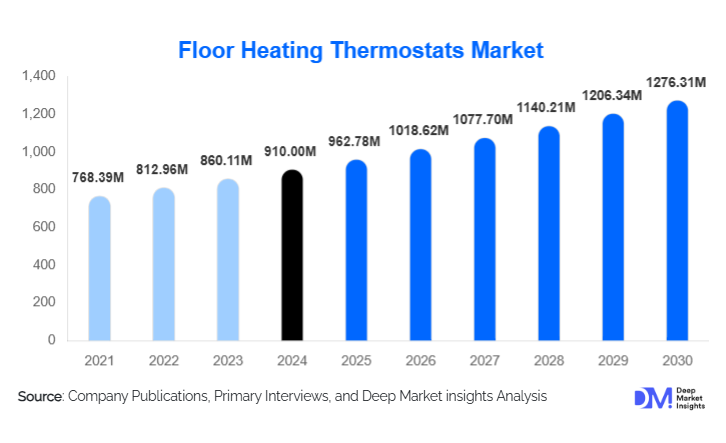

According to Deep Market Insights, the global floor heating thermostats market size was valued at USD 910.00 million in 2024 and is projected to grow from USD 962.78 million in 2025 to reach USD 1,276.31 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). Market growth is primarily driven by rising adoption of energy-efficient underfloor heating systems, increasing penetration of smart home technologies, and strong demand from residential renovation and retrofit projects across developed economies.

Key Market Insights

- Smart and Wi-Fi-enabled thermostats are rapidly gaining traction, driven by integration with home automation ecosystems and energy monitoring capabilities.

- Residential applications dominate global demand, supported by housing renovations, luxury real estate growth, and consumer focus on comfort and efficiency.

- Europe remains the largest regional market, led by Germany, the U.K., and Nordic countries with high underfloor heating penetration.

- North America represents a major retrofit-driven market, particularly in the U.S., supported by smart thermostat adoption.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and premium housing development.

- Energy efficiency regulations and green building standards are accelerating adoption across both residential and commercial buildings.

What are the latest trends in the floor heating thermostats market?

Rapid Adoption of Smart and Connected Thermostats

Smart floor heating thermostats equipped with Wi-Fi connectivity, mobile app control, voice assistant compatibility, and AI-based learning algorithms are transforming the market landscape. These devices allow users to remotely control heating schedules, monitor energy consumption, and optimize indoor comfort. Integration with broader smart home platforms, such as voice assistants and home energy management systems, is increasing product stickiness. Smart thermostats now account for a growing share of new installations, particularly in premium residential and commercial applications, as consumers increasingly prioritize convenience and long-term energy savings.

Growth in Retrofit and Renovation Installations

The surge in residential renovation activity across Europe and North America has significantly boosted demand for retrofit-compatible floor heating thermostats. Aging housing stock, combined with government incentives for energy-efficient upgrades, is encouraging homeowners to replace conventional heating controls with programmable or smart thermostats. Manufacturers are responding with simplified installation designs, multi-voltage compatibility, and modular interfaces that reduce labor complexity and installation costs.

What are the key drivers in the floor heating thermostats market?

Rising Demand for Energy-Efficient Heating Solutions

Escalating energy prices and increasing awareness of carbon emissions are driving demand for efficient heating control solutions. Floor heating thermostats enable precise temperature regulation and zoning, reducing energy wastage by up to 20% compared to traditional systems. Governments across Europe and parts of North America are enforcing stricter building energy codes, directly boosting thermostat adoption in both new construction and retrofit projects.

Expansion of Smart Homes and Building Automation

The rapid proliferation of smart homes and automated buildings is a major growth catalyst. Consumers increasingly prefer connected devices that offer remote access, automation, and data-driven insights. Floor heating thermostats are becoming integral components of intelligent HVAC ecosystems, particularly in high-end residential developments, offices, and hospitality projects.

What are the restraints for the global market?

High Upfront Costs of Smart Thermostats

Advanced smart floor heating thermostats are significantly more expensive than manual or non-programmable alternatives. Higher hardware costs, combined with professional installation requirements, can deter adoption in price-sensitive markets and developing economies. This limits penetration beyond premium residential and commercial segments.

Installation and Compatibility Challenges

Variations in heating systems, voltage standards, and regional wiring practices can complicate thermostat installation. Lack of skilled installers in emerging markets further increases deployment costs and slows adoption, especially for hydronic floor heating systems.

What are the key opportunities in the floor heating thermostats industry?

Integration with Renewable Energy and Heat Pump Systems

The growing deployment of heat pumps and renewable energy-based heating systems presents a major opportunity for thermostat manufacturers. Floor heating thermostats capable of optimizing energy usage based on renewable supply availability and dynamic pricing models can significantly enhance system efficiency. Such integration is increasingly favored in net-zero and green-certified buildings.

Untapped Growth in Emerging Markets

Emerging economies in the Asia-Pacific, the Middle East, and Eastern Europe present strong long-term growth opportunities. Rising urbanization, expanding middle-class populations, and increasing investment in premium residential and hospitality infrastructure are driving demand for underfloor heating solutions, creating new avenues for thermostat adoption.

Product Type Insights

Smart and Wi-Fi-enabled floor heating thermostats dominate the global market, accounting for the largest share of overall revenue, driven by their advanced functionality and alignment with smart home ecosystems. These thermostats offer remote access via mobile applications, AI-based learning algorithms, real-time energy analytics, and seamless integration with voice assistants and home automation platforms. The leading growth driver for this segment is the rising consumer preference for connected, energy-optimizing solutions that reduce heating costs while enhancing comfort and convenience. In developed markets, smart thermostats are increasingly specified in both premium residential projects and commercial buildings due to their ability to support zoning, demand-based heating, and compliance with energy efficiency regulations.

Programmable floor heating thermostats continue to hold a strong position in mid-range applications, particularly in cost-sensitive residential and light commercial settings. Their ability to deliver scheduled heating cycles at a lower price point makes them attractive for homeowners seeking efficiency without the premium cost of fully smart devices. Non-programmable thermostats remain relevant in entry-level and budget installations, especially in emerging markets and small residential projects, where affordability, simplicity, and basic temperature control are the primary purchase drivers.

Heating System Compatibility Insights

Electric floor heating thermostats account for the majority of global installations, supported by their ease of deployment, lower upfront costs, and strong suitability for residential retrofit applications. The leading driver for electric-compatible thermostats is their widespread adoption in bathrooms, kitchens, and living spaces, where electric underfloor heating mats are preferred due to faster installation and minimal structural modification. These systems are particularly popular in North America and Europe, where electric heating aligns well with renovation-driven demand.

Hydronic-compatible floor heating thermostats are gaining traction in large commercial buildings, institutional facilities, and multi-family residential complexes. Their growth is driven by superior energy efficiency and lower operating costs for large floor areas, especially when paired with heat pumps and district heating systems. This segment benefits from long-term operational savings and growing adoption of renewable-based heating infrastructure in commercial construction.

Installation Type Insights

Retrofit installations represent the largest share of the floor heating thermostats market, driven by extensive renovation activity across mature housing markets in Europe and North America. The leading driver for this segment is the aging residential building stock, combined with government incentives for energy-efficient upgrades and growing homeowner awareness of heating optimization. Manufacturers are increasingly designing retrofit-friendly thermostats with flexible voltage compatibility and simplified wiring to address this demand.

New construction installations remain an important segment, particularly in large residential complexes, mixed-use developments, and commercial buildings. Growth in this segment is closely tied to construction cycles and urban development trends. In new builds, thermostats are often specified as part of integrated HVAC and building automation systems, supporting centralized energy management and regulatory compliance.

End-Use Insights

The residential sector dominates global demand for floor heating thermostats, supported by rapid smart home adoption, rising renovation activity, and increasing consumer preference for underfloor heating in bathrooms, bedrooms, and living areas. The leading driver for residential demand is the desire for enhanced thermal comfort combined with lower energy bills, particularly in colder climates. Smart thermostats are increasingly becoming a standard feature in premium and mid-range housing projects.

Commercial applications, including offices, hotels, healthcare facilities, and retail spaces, are growing steadily due to stricter energy efficiency mandates, indoor comfort standards, and operational cost optimization goals. Hotels and healthcare facilities, in particular, are driving adoption due to the need for precise temperature control and occupant comfort. Industrial and institutional usage remains niche but is expanding in laboratories, research facilities, and educational institutions where controlled indoor environments are essential.

Distribution Channel Insights

HVAC and electrical distributors account for the largest share of floor heating thermostat sales globally, as they serve professional installers, contractors, and large project developers. The leading driver for this channel is its strong presence in renovation and commercial projects, where technical support, product availability, and installer relationships are critical.

Direct OEM sales are prominent in large commercial and institutional projects, where thermostats are bundled with heating systems and building automation solutions. Meanwhile, online and e-commerce channels represent the fastest-growing distribution segment, driven by DIY renovation trends, direct-to-consumer smart thermostat sales, and increasing consumer comfort with online purchasing of connected home devices.

| By Product Type | By Heating System Compatibility | By Installation Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global floor heating thermostats market, accounting for approximately 36% of total revenue in 2024. Germany, the U.K., France, Italy, and the Nordic countries are major contributors. The primary drivers for regional growth include widespread underfloor heating adoption, stringent building energy efficiency regulations, and strong government support for low-carbon heating solutions. High renovation activity across aging residential buildings and strong penetration of hydronic heating systems further support sustained demand for advanced thermostats.

North America

North America holds around 31% of the global market, led by the United States. Growth in this region is driven by high smart home penetration, strong retrofit demand, and increasing consumer awareness of energy efficiency and heating cost optimization. Electric floor heating systems dominate residential installations, particularly in bathrooms and remodeled living spaces, supporting steady demand for line-voltage and smart thermostats.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, with demand accelerating in China, Japan, South Korea, Australia, and India. Key growth drivers include rapid urbanization, premium housing development, and expanding middle-class wealth. Increasing adoption of smart home technologies and rising investment in modern residential and commercial infrastructure are driving strong demand for smart and programmable floor heating thermostats across the region.

Latin America

Latin America represents a smaller but steadily growing market, led by Brazil and Chile. Growth is primarily driven by luxury residential developments, high-end hospitality projects, and increasing awareness of underfloor heating benefits among affluent consumers. While adoption remains limited compared to developed regions, rising investment in premium real estate is supporting gradual market expansion.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing rising adoption of floor heating thermostats in luxury residential and hospitality projects. Growth is driven by premium construction activity, increasing focus on indoor comfort in high-end developments, and integration of smart building technologies. Africa remains a niche market, with demand concentrated in high-end commercial and institutional developments, supported by selective infrastructure investment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Floor Heating Thermostats Market

- Schneider Electric

- Honeywell International

- Danfoss

- Siemens

- Emerson Electric

- Legrand

- ABB

- Resideo Technologies

- Google Nest

- Bosch

- Johnson Controls

- OJ Electronics

- Warmup Plc

- Salus Controls

- Mysa Smart Thermostats