Flatware Market Size

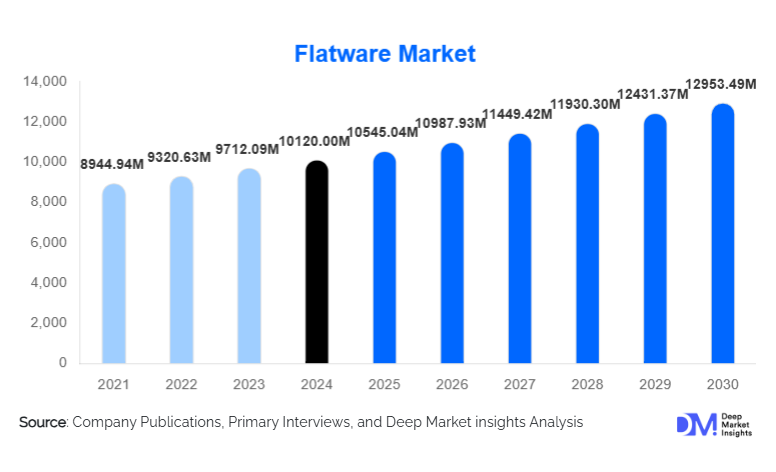

According to Deep Market Insights, the global flatware market size was valued at USD 10,120 million in 2024 and is projected to grow from USD 10,545.04 million in 2025 to reachUSD 12,953.49 million by 2030, expanding at a CAGR of 4.2% during the forecast period (2025–2030). The flatware market growth is primarily driven by rising household consumption, increasing demand from the hospitality sector, and growing adoption of premium and eco-friendly flatware across global markets.

Key Market Insights

- Stainless steel continues to dominate the market, preferred for its durability, corrosion resistance, and affordability, accounting for 62% of the 2024 market.

- Household end-use remains the largest segment, representing 58% of total market demand due to urbanization and growing interest in home dining aesthetics.

- North America and Europe collectively account for over 50% of the global market, with high disposable incomes and a premium dining culture driving adoption.

- APAC is the fastest-growing region, fueled by urbanization, an expanding middle-class population, and rising hotel and restaurant infrastructure.

- E-commerce and online retail are transforming distribution, enabling direct-to-consumer access, greater variety, and international export opportunities.

- Innovation in eco-friendly and ergonomic flatware, along with custom designs for hospitality and gifting, is reshaping consumer preferences.

What are the latest trends in the flatware market?

Premiumization and Design Innovation

Consumers are increasingly seeking premium, aesthetically appealing, and ergonomically designed flatware. This trend is particularly strong in North America and Europe, where households and hotels prefer silver-plated or high-grade stainless steel flatware. Mid-range and luxury segments are expanding, integrating features such as polished finishes, engraved patterns, and innovative ergonomic designs. Premiumization allows manufacturers to differentiate their products and command higher margins, while mid-range flatware continues to capture the growing urban middle class in APAC.

Eco-Friendly and Sustainable Flatware

Environmental consciousness is driving demand for flatware made from biodegradable, recycled, or bamboo materials. Eco-friendly flatware is gaining traction in Europe, North America, and APAC among households and hospitality establishments aiming to meet sustainability goals. Companies investing in eco-conscious manufacturing, antibacterial coatings, and minimal-waste packaging are gaining a competitive edge. This trend aligns with broader consumer shifts toward sustainable and health-conscious kitchen products.

What are the key drivers in the flatware market?

Rising Household Disposable Income

Increased disposable income, especially in APAC countries like China and India, allows consumers to upgrade from basic flatware to premium stainless steel and silver-plated sets. The rising urban middle class is actively seeking high-quality, durable, and stylish flatware, boosting household demand globally.

Hospitality Sector Expansion

The global hotel, restaurant, and catering industries are rapidly expanding, particularly in APAC and the Middle East. Premium hotels and resorts are increasingly purchasing bulk flatware for fine-dining and branded experiences. The commercial segment’s growing requirement for high-volume, durable, and visually appealing flatware significantly supports market growth.

Growth of Organized Retail and E-Commerce

Modern retail formats and online platforms have expanded access to flatware for urban and semi-urban consumers. E-commerce enables consumers to compare products, access customization options, and receive faster delivery. This distribution shift has increased sales in both domestic and export markets.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in stainless steel, silver, and alloy prices impact production costs, affecting profit margins for manufacturers. Maintaining product quality while managing costs remains a challenge, particularly for mid-range and premium segments.

Competition from Low-Cost Imports

Cheap imports from countries like China and Southeast Asia create pricing pressures, especially in developed markets. Domestic manufacturers often face challenges in competing solely on price, necessitating differentiation through quality, design, and branding.

What are the key opportunities in the flatware market?

Hospitality and Institutional Demand

Rising global investment in hotels, restaurants, resorts, and catering services presents opportunities for large-volume flatware suppliers. Demand for custom-designed, premium flatware sets is growing, particularly in luxury and fine-dining establishments. Companies can capitalize on this by offering durable, ergonomic, and aesthetically appealing collections.

Expansion in E-Commerce and Exports

Online retail provides manufacturers access to international markets, bypassing traditional distribution channels. APAC, Latin America, and Africa are emerging as high-potential export markets due to increasing disposable income and urbanization. Strategic export initiatives can drive revenue growth for both mid-range and premium segments.

Innovation in Eco-Friendly and Smart Materials

Developing flatware from sustainable materials such as bamboo, recycled metals, or biodegradable alloys offers an emerging growth avenue. Additionally, ergonomic designs and antibacterial coatings appeal to health-conscious consumers, enhancing product differentiation and brand value.

Product Type Insights

Spoons dominate the global flatware market, accounting for approximately 35% of total market revenue in 2024 (USD 1,838 million). This leadership is primarily driven by the universal and high-frequency usage of spoons across both household and commercial dining environments. Tea spoons and soup spoons, in particular, benefit from daily consumption habits across cultures, making them essential components of every flatware set. In addition, spoons are widely used across restaurants, cafés, institutional catering, and healthcare food services, further strengthening their demand base.

The gifting and hospitality sectors also play a critical role in sustaining spoon demand, as complete flatware sets, often spoon-heavy, are commonly purchased for weddings, festivals, and corporate gifting. Forks and knives collectively represent a substantial share of the remaining market, supported by Western dining habits and increasing adoption of continental cuisines in emerging economies. Meanwhile, specialty flatware such as ladles, serving spoons, and tongs is witnessing accelerated growth within the commercial and hospitality segment, driven by the expansion of buffet-style dining, cloud kitchens, and large-scale catering operations globally.

Material Insights

Stainless steel remains the dominant material in the flatware market, holding approximately 62% market share in 2024 (USD 3,255 million). Its leadership is driven by a combination of durability, corrosion resistance, affordability, and ease of maintenance, making it the preferred choice for both households and institutional buyers. Among stainless steel variants, 18/10 stainless steel commands strong demand in premium and mid-to-high-end segments due to its superior shine, resistance to staining, and extended product lifespan.

Silver-plated flatware continues to maintain a niche but high-value presence, particularly in luxury households, fine-dining restaurants, and premium gifting applications in North America and Europe. At the same time, bamboo, wooden, and recycled-material flatware is gaining traction in eco-conscious markets, especially in Europe and parts of APAC. These materials are increasingly favored in sustainable dining concepts, outdoor catering, and environmentally responsible hospitality operations, aligning with global sustainability and plastic-reduction initiatives.

Distribution Channel Insights

Offline retail channels account for approximately 55% of global flatware sales, supported by strong consumer preference for physical inspection, tactile experience, and perceived quality assurance. Specialty kitchenware stores, department stores, and large-format supermarkets remain key contributors, particularly for mid-range and premium flatware purchases. In-store promotions, wedding registries, and bundled flatware sets further reinforce offline channel dominance.

Online distribution channels, including e-commerce marketplaces and direct-to-consumer (D2C) brand websites, are witnessing rapid growth, especially in Asia-Pacific and North America. Online platforms offer broader product variety, competitive pricing, customization options, and international shipping, making them increasingly attractive to younger consumers and urban households. The shift toward digital-first purchasing, coupled with improved logistics and cross-border e-commerce, is enabling manufacturers to expand their global footprint without heavy investments in physical retail infrastructure.

End-Use Insights

The household segment remains the largest end-use category, contributing approximately 58% of global market revenue in 2024 (USD 3,045 million). Growth in this segment is driven by urbanization, rising disposable income, and increasing consumer interest in aesthetically pleasing home dining experiences. Social media influence, home entertaining trends, and premium kitchenware adoption are further accelerating household flatware consumption.

Growth is supported by rising tourism, an increasing number of quick-service restaurants (QSRs), cloud kitchens, and luxury dining establishments. Export-driven demand is also a key growth pillar, especially from manufacturing hubs such as China and India. The global flatware export market was valued at approximately USD 1,250 million in 2024, with sustained growth supported by international hospitality expansion and private-label sourcing by global retailers.

| By Product Type | By Material | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 28% of the global flatware market in 2024 (USD 1,470 million), led by the United States and Canada. Regional growth is driven by high disposable income, a strong culture of home dining and entertaining, and widespread adoption of premium flatware. The hospitality sector, including luxury hotels and fine-dining restaurants, continues to invest in high-quality stainless steel and silver-plated flatware. Additionally, strong penetration of e-commerce platforms and brand-led D2C sales models is accelerating product accessibility and replacement demand across the region.

Europe

Europe represents approximately 25% of the global market (USD 1,312 million), with Germany, France, and the U.K. serving as key demand centers. Growth in the region is driven by a strong preference for premium craftsmanship, sustainable materials, and design-led flatware. European consumers show high sensitivity toward eco-friendly and recyclable products, supporting demand for bamboo, wooden, and recycled-metal flatware. A mature retail ecosystem, combined with strict food safety and sustainability regulations, further encourages innovation and premiumization in the regional flatware market.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, valued at approximately USD 1,350 million in 2024 and expanding at a CAGR of 6.2%. Growth is fueled by rapid urbanization, rising middle-class income, and expanding hospitality infrastructure in China and India. Increasing adoption of western dining habits, growth of international hotel chains, and rising export-oriented manufacturing capacity are further strengthening regional demand. E-commerce penetration and affordable mid-range flatware offerings are also accelerating household adoption across urban and semi-urban markets.

Middle East & Africa

The Middle East & Africa region accounts for approximately 12% of the global flatware market, driven largely by premium hospitality and tourism investments in the UAE, Saudi Arabia, and South Africa. Government-led tourism development programs, luxury hotel construction, and international events are boosting demand for premium and customized flatware. The commercial segment dominates regional consumption, with increasing preference for durable and high-aesthetic stainless steel flatware in hotels, resorts, and catering services.

Latin America

Latin America contributes approximately 10% of global market revenue, led by Brazil, Mexico, and Argentina. Regional growth is supported by urbanization, expanding middle-income households, and steady development of hospitality infrastructure. Demand is largely concentrated in mid-range stainless steel flatware, while export opportunities are emerging as regional distributors increasingly source competitively priced products for domestic and neighboring markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|