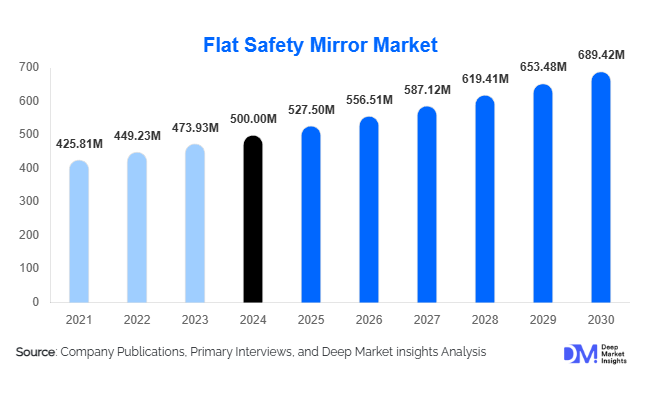

Flat Safety Mirror Market Size

According to Deep Market Insights, the global flat safety mirror market size was valued at USD 500 million in 2024 and is projected to grow from USD 527.50 million in 2025 to reach USD 689.42 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Market growth is driven by increasing workplace and public-infrastructure safety regulations, the rapid expansion of industrial and logistics facilities, and innovations in mirror materials and coatings that enhance durability and clarity in demanding environments.

Key Market Insights

- The industrial and logistics sectors lead market demand, accounting for nearly 30% of global flat safety mirror installations in 2024.

- Glass remains the dominant material type with approximately 45% market share, valued for its optical clarity and affordability.

- Asia-Pacific represents the largest and fastest-growing regional market, contributing 40% of global revenue in 2024, driven by rapid urbanization and warehouse expansion.

- Smart and anti-fog mirror technologies are emerging trends, offering enhanced safety and longer product life in outdoor and high-humidity settings.

- Government safety mandates and insurance incentives are boosting retrofits across North America and Europe, supporting replacement demand.

- Rising export activity from Asia is reshaping supply chains, with regional manufacturers supplying affordable safety mirrors to developed markets.

What are the latest trends in the Flat Safety Mirror Market?

Adoption of Smart and Coated Mirror Technologies

Manufacturers are introducing anti-fog, anti-glare, and impact-resistant coatings to enhance mirror performance in industrial and outdoor applications. Integration of sensors and IoT-based monitoring for accident prevention in warehouses and parking facilities is gaining traction. These smart features transform traditional passive mirrors into proactive safety tools, enabling improved data collection and compliance tracking. The trend is particularly visible in high-tech manufacturing zones and automated logistics centers seeking greater visibility and reduced accident rates.

Infrastructure Retrofits and Public Safety Upgrades

Governments and municipal bodies are undertaking safety retrofits across aging infrastructure such as public garages, hospitals, schools, and industrial facilities. Flat safety mirrors are integral to these upgrades, providing low-maintenance, cost-effective visibility enhancement solutions. With increased funding under infrastructure modernization programs in the U.S., Europe, and Asia, the retrofit segment has become a primary growth vector. Contractors and mirror suppliers partnering on these initiatives are witnessing consistent order inflow.

What are the key drivers in the Flat Safety Mirror Market?

Stringent Safety Regulations and Insurance Compliance

Workplace safety standards and building codes increasingly specify safety mirrors to prevent accidents and meet compliance metrics. Insurance providers also encourage adoption by linking lower premiums to improved on-site visibility measures, fueling consistent demand across industrial and commercial sectors.

Expansion of Industrial and Logistics Infrastructure

Global growth in manufacturing, warehousing, and e-commerce logistics hubs has amplified the requirement for safety equipment. Flat safety mirrors are widely used at vehicle crossings, loading docks, and inspection zones. The surge in automated vehicle movement within warehouses has made high-accuracy, distortion-free visibility solutions indispensable.

Advancements in Mirror Materials and Design

Innovations in tempered glass, polycarbonate, and acrylic materials are improving mirror durability and optical clarity while reducing replacement frequency. Modular and adjustable mounting systems enhance versatility, promoting use across both permanent and temporary installations in construction and industrial environments.

What are the restraints for the global market?

High Installation and Replacement Costs

Premium-grade mirrors with specialized coatings or weatherproofing entail higher upfront and installation costs. Ceiling- or overhead-mounted units require skilled installation, which can deter cost-sensitive buyers, especially in developing markets.

Substitution from Digital Surveillance Technologies

Camera-based monitoring, sensor systems, and AI-enabled visibility solutions are emerging alternatives, particularly in advanced industrial facilities. While these technologies are costlier, they reduce human error and provide real-time analytics, challenging long-term mirror deployment in certain segments.

What are the key opportunities in the Flat Safety Mirror Industry?

Government-Backed Infrastructure and Safety Programs

Public investments in transportation hubs, parking garages, and smart-city safety systems are expanding opportunities for mirror suppliers. Mandated safety enhancements in public facilities provide recurring procurement prospects for certified mirror manufacturers.

Integration with Smart and IoT Systems

Developing mirrors with embedded sensors, cameras, or connectivity for automated safety monitoring represents a major technological opportunity. These smart solutions can integrate with warehouse management systems and traffic control platforms, creating a new premium segment.

Emerging Demand in Developing Regions

Industrial expansion in Asia-Pacific, Latin America, and Africa presents untapped markets. Localized manufacturing, combined with cost-effective designs, can enable new entrants to capture share in rapidly urbanizing economies focused on accident prevention and industrial modernization.

Product Type Insights

Glass mirrors dominate the market due to superior clarity and affordability, holding around 45% share of total revenues in 2024. Acrylic and polycarbonate variants are rapidly gaining ground for outdoor and heavy-duty applications thanks to their impact resistance. Composite and stainless-steel mirrors serve niche industrial and extreme-environment needs. Overall, material innovation continues to define product differentiation and pricing tiers.

Mounting Type Insights

Wall-mounted flat safety mirrors represent approximately 35% of global installations, driven by simple installation, versatility, and wide applicability across industrial, retail, and healthcare facilities. Ceiling-mounted mirrors cater to high-clearance warehouses, while portable designs are gaining traction for temporary construction and event setups.

End-Use Insights

Industrial and warehouse facilities remain the largest end-use segment, contributing about 30% of global demand in 2024. The e-commerce boom and rise in third-party logistics operations have intensified mirror deployment in distribution centers and assembly lines. Automotive, commercial, and healthcare sectors follow closely, utilizing mirrors for inspection, corridor safety, and public access areas. Emerging uses in robotics labs, autonomous testing zones, and smart parking infrastructure signal new growth potential.

| By Product Type | By Mounting Type | By End-Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for roughly 25% of the global market (USD 125 million in 2024), driven by stringent OSHA safety regulations, insurance-linked compliance, and strong retrofit activity. Growth remains steady as facilities upgrade legacy safety systems.

Europe

Europe holds a 20% share (USD 100 million in 2024) and is characterized by early safety adoption, high-quality standards, and a sustainability focus. Replacement demand in industrial corridors and parking structures drives market consistency, while Eastern Europe adds incremental new-build opportunities.

Asia-Pacific

Asia-Pacific dominates with a 40% share (USD 200 million in 2024) and the fastest CAGR of 7–8%. Massive infrastructure investments in China, India, and Southeast Asia underpin strong mirror demand for factories, logistics hubs, and public safety installations.

Latin America

Latin America contributes around 8% of revenue, led by Brazil and Mexico. Growing industrial zones and commercial construction are increasing mirror demand, though macroeconomic volatility can affect project timelines.

Middle East & Africa

This region accounts for 7% share (USD 35 million in 2024) with expansion driven by construction in GCC countries and South Africa. Large-scale smart-city projects and parking developments are creating opportunities for durable, outdoor-rated safety mirrors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flat Safety Mirror Market

- Saint-Gobain

- AGC Inc. (Asahi Glass)

- Guardian Industries

- Fuyao Group

- Nippon Sheet Glass Co., Ltd. (NSG)

- Pilkington

- Taiwan Glass Industry Corp. (TGI)

- Vitro S.A.B. de C.V.

- Central Glass Co., Ltd.

- Schott AG

- DuraVision

- Ashtree Vision & Safety

- Clarke’s Safety Mirrors

- Smartech Safety Solutions

- Safe Fleet

Recent Developments

- June 2025 – Saint-Gobain launched a new line of anti-glare tempered safety mirrors designed for industrial warehouses and high-humidity environments.

- April 2025 – Guardian Industries announced the expansion of its production facility in Poland to serve growing European retrofit demand for safety-certified mirrors.

- February 2025 – Fuyao Group introduced impact-resistant polycarbonate mirror panels targeting heavy-duty logistics and construction markets in the Asia-Pacific.