Fitness Mirrors Market Size

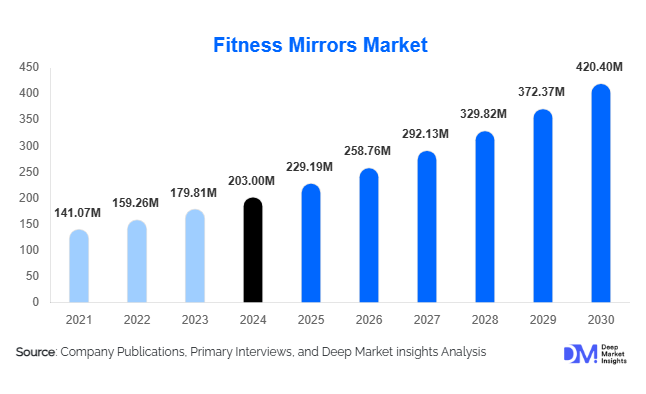

According to Deep Market Insights, the global fitness mirrors market size was valued at USD 203.00 million in 2024 and is projected to grow from USD 229.19 million in 2025 to reach USD 420.40 million by 2030, expanding at a CAGR of 12.90% during the forecast period (2025–2030). Market growth is driven by rising global preference for home-based fitness, integration of AI-enabled coaching, and accelerating adoption of smart home technologies that support connected fitness ecosystems.

Key Market Insights

- Smart/connected fitness mirrors dominate adoption due to integrated sensors, AI guidance, and on-demand content libraries.

- Residential/home fitness represents the largest application segment, driven by convenience-oriented workouts and subscription-based fitness content.

- North America leads the global market, while Asia-Pacific is the fastest-growing regional segment due to rising disposable incomes and an expanding urban middle class.

- Software & services account for the largest revenue share owing to subscription-based coaching, AI analytics, and premium interactive content.

- Mid-range and premium fitness mirrors are gaining traction as consumers seek durable hardware paired with personalized training features.

- Technological innovation, including posture-correction AI, IoT connectivity, and biometric tracking, continues to elevate product functionality and user engagement.

What are the latest trends in the fitness mirrors market?

AI-Enabled Personalized Coaching is Transforming User Experience

Fitness mirrors are increasingly integrating artificial intelligence to deliver personalized workout recommendations, real-time posture correction, and adaptive training programs. These AI-driven features enhance user engagement, improve workout accuracy, and simulate the experience of a personal trainer. Integration with wearables and health platforms allows for continuous tracking of vital metrics, offering customized routines based on fitness goals, movement data, and user preferences. This trend is becoming a major differentiator for premium fitness mirror brands targeting tech-savvy consumers.

Smart Home Fitness Ecosystems Driving Device Interoperability

As smart homes become widespread, fitness mirrors are evolving into central hubs within connected fitness ecosystems. Users can sync mirrors with smart speakers, smart home gyms, wrist wearables, heart-rate monitors, and mobile fitness apps. This interoperability enables automated workout tracking, voice-assisted navigation, and seamless access to live classes. Cloud-based platforms now allow households to access multi-user profiles and curated content, broadening market appeal and fostering recurring subscription-based revenues for brands.

What are the key drivers in the fitness mirrors market?

Increasing Adoption of At-Home and Hybrid Fitness Models

Driven by lifestyle shifts, remote working, and post-pandemic fitness habits, home workouts have become a mainstream preference. Fitness mirrors offer a compact, aesthetically appealing, and highly convenient alternative to bulky gym equipment, making them ideal for urban households. The ability to follow on-demand or live classes from home continues to fuel demand, particularly among time-constrained professionals.

Growing Awareness of Health, Wellness, and Preventive Fitness

Global consumer awareness of the importance of daily exercise, muscle conditioning, and preventive health is surging. Fitness mirrors cater directly to these needs by offering guided workouts, rehabilitation routines, and wellness programs in one device. The trend toward holistic well-being, including yoga, stretching, and mindfulness, is increasing adoption in both residential and rehabilitation studio settings.

Rapid Expansion of Smart Home Technology and IoT Connectivity

Fitness mirrors are part of a broader wave of connected home devices. With increasing household penetration of IoT-enabled products, consumers now expect integrated digital experiences. Fitness mirrors leverage sensors, cloud analytics, and mobile synchronization to deliver immersive and interactive content. This aligns with consumer demand for technology-driven lifestyle products and is a major growth catalyst.

What are the restraints for the global market?

High Upfront Costs and Subscription Dependencies

Premium fitness mirrors equipped with integrated displays, motion sensors, and advanced AI software often carry high price tags, restricting adoption in price-sensitive markets. Monthly subscription fees for workout classes and content libraries add to the total cost of ownership, limiting reach among middle-income consumers and slowing adoption in emerging economies.

Limited Awareness and Market Penetration in Developing Regions

In many developing markets, concepts like connected fitness and smart mirrors are still emerging. Low awareness, insufficient digital infrastructure, and preference for traditional gyms hinder adoption. Without localized content, culturally aligned fitness programs, and affordable product tiers, growth may remain concentrated in urban, high-income segments.

What are the key opportunities in the fitness mirrors industry?

Advanced AI and Software Ecosystem Monetization

The largest opportunity lies in building robust software ecosystems powered by AI for posture correction, biometric tracking, gamified workouts, and individualized fitness programs. Companies can significantly increase recurring revenue through subscription packages offering coaching, virtual classes, health analytics, and multi-user family plans. Integration with VR/AR experiences represents the next frontier.

Expansion into Emerging Markets and Urban Middle-Class Segments

Asia-Pacific, Latin America, and parts of the Middle East present high-growth opportunities due to rising disposable income, urbanization, and increasing acceptance of home fitness. Offering affordable mid-tier mirrors with localized content and multi-language interfaces can accelerate penetration. Partnerships with local fitness influencers and regional wellness brands may further boost adoption.

Commercial and Institutional Adoption (Gyms, Rehabilitation, Corporate Wellness)

Fitness mirrors have strong potential in corporate wellness programs, boutique fitness studios, and physiotherapy centers. For rehabilitation, mirrors provide guided low-impact routines and posture correction. For corporate offices, they offer compact wellness solutions for employee fitness. This B2B expansion broadens target markets beyond residential users and allows companies to secure higher-value institutional contracts.

Product Type Insights

Wall-mounted smart fitness mirrors dominate the global market, accounting for nearly 45–50% of 2024 demand. Their slim profile, space efficiency, and affordability compared to floor-standing units make them the preferred choice for residential consumers. Floor-standing models appeal to premium buyers and gyms, while traditional (non-smart) mirrors maintain moderate demand in studio environments. Smart mirrors with integrated resistance systems are gaining attention among advanced fitness users seeking compact full-body workout systems.

Application Insights

Home fitness is the leading application category, representing 55–60% of global demand in 2024. Urban households prioritize convenience, privacy, and structured workout guidance, driving smart mirror adoption. In commercial applications, boutique studios and gyms use mirrors to provide virtual classes and augment trainer-led sessions. Physiotherapy clinics and rehabilitation centers increasingly use fitness mirrors for posture analysis and guided movement therapy, contributing to a small but fast-growing medical applications segment.

Distribution Channel Insights

Online channels lead the market with an estimated 40–45% share in 2024. D2C websites and e-commerce platforms enable users to explore brands, compare features, and order devices with installation support. Offline specialty fitness retailers continue to play a role in premium equipment sales, especially in high-income markets. B2B institutional sales are gaining traction as enterprises and commercial fitness centers adopt connected fitness ecosystems.

End-Use Insights

Residential users remain the fastest-growing end-use segment due to rising adoption of home-gym ecosystems. Commercial end users, including gyms, boutique studios, corporate offices, hotels, and co-living spaces, are increasingly integrating smart mirrors to enhance customer offerings. In rehabilitation centers and physiotherapy clinics, mirrors assist with form correction and guided recovery routines. Export demand is growing as manufacturers in North America and Europe supply smart mirrors to the Asia-Pacific, the Middle East, and Latin American emerging markets.

| By Product Type | By Application | By Distribution Channel | By Price Range | By Component |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the market, contributing 35–40% of global revenue in 2024. High health-consciousness, extensive smart-home adoption, and strong preference for subscription-based workout platforms support continued dominance. The U.S. is the regional powerhouse, driven by established brands, advanced fitness ecosystems, and premium consumer spending patterns.

Europe

Europe represents 20–25% of global demand, led by the U.K., Germany, France, and Nordic nations. Wellness-centric lifestyles, compact living spaces, and strong acceptance of digital fitness solutions fuel adoption. Boutique studios and hybrid fitness programs contribute significantly to commercial demand.

Asia-Pacific

APAC is the fastest-growing region, accounting for roughly 20–25% of the market in 2024 but projected to grow rapidly through 2030. China and India drive demand with expanding middle classes, urban lifestyles, and rising disposable income. Japan, South Korea, and Australia form mature submarkets for premium fitness mirrors.

Latin America

Latin America holds a 5–7% share of the global market. Brazil, Mexico, and Argentina lead adoption as digital fitness culture grows. Rising e-commerce penetration and increasing interest in compact home-gym solutions support long-term growth potential.

Middle East & Africa

MEA accounts for 3–4% of global demand, with GCC countries showing strong uptake due to high per capita income and technology-forward consumers. Adoption in Africa is nascent but supported by growing wellness initiatives and expanding urban populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fitness Mirrors Market

- Lululemon (MIRROR)

- Tonal

- NordicTrack

- Echelon

- Tempo

- ProForm

- Vaha

- MyShape

- QAIO

- Fitshike

- KARA Smart Fitness

- JAXJOX

- Fiture

- Forme Life

- HouseFit

Recent Developments

- In March 2025, Tonal expanded its AI engine to incorporate advanced motion analytics and personalized coaching based on real-time performance data.

- In January 2025, Lululemon announced updates to its MIRROR platform, adding multilingual live classes aimed at boosting adoption in APAC and Europe.

- In December 2024, Tempo introduced a new smart mirror model integrated with adjustable resistance tools designed for compact home gyms.