Fishing Tackle Bags Market Size

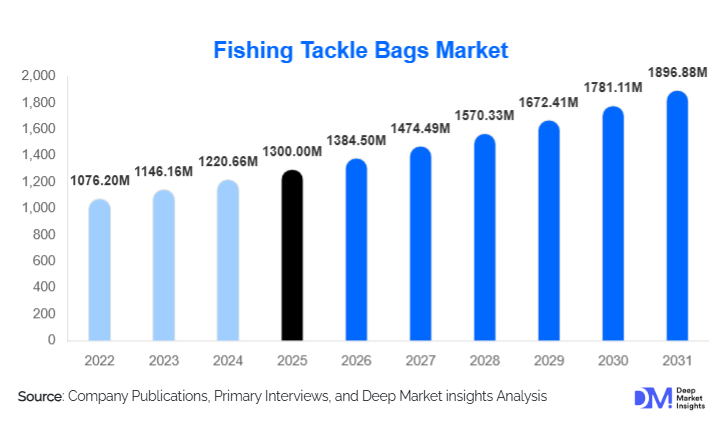

According to Deep Market Insights, the global fishing tackle bags market size was valued at USD 1300.00 million in 2025 and is projected to grow from USD 1384.50 million in 2026 to reach USD 1896.88 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The fishing tackle bags market growth is primarily driven by rising participation in recreational fishing, increasing spending on organized fishing gear, and growing demand for durable, waterproof, and modular storage solutions among hobbyist and professional anglers.

Key Market Insights

- Recreational anglers dominate global demand, accounting for over 60% of total fishing tackle bags consumption in 2025.

- Soft tackle bags remain the leading product category, supported by affordability, lightweight construction, and wide applicability across fishing styles.

- North America leads the global market, driven by high fishing participation rates and strong replacement demand.

- Asia-Pacific is the fastest-growing region, supported by rising inland fishing activity, aquaculture expansion, and increasing disposable incomes.

- Mid-range priced tackle bags generate the highest revenue share, balancing durability, functionality, and affordability.

- E-commerce and D2C channels are rapidly reshaping distribution, supported by digital marketing, influencer-driven sales, and direct brand engagement.

What are the latest trends in the fishing tackle bags market?

Shift Toward Modular and Multi-Compartment Designs

Manufacturers are increasingly focusing on modular fishing tackle bags that allow anglers to customize storage layouts based on lure type, reel size, and fishing technique. Adjustable dividers, removable boxes, and expandable compartments are becoming standard features, particularly in mid-range and premium products. This trend is driven by anglers seeking efficient organization, faster access to gear, and improved protection for high-value equipment. Modular systems are also encouraging repeat purchases, as users expand or upgrade their storage setups over time.

Rising Demand for Waterproof and Ruggedized Bags

Waterproof and water-resistant tackle bags are gaining strong traction due to increased saltwater fishing, kayak fishing, and boat-based angling. Fully waterproof materials, sealed zippers, and corrosion-resistant components are becoming key purchasing criteria. These features extend product lifespan and reduce gear damage, making them especially attractive to professional and tournament anglers who operate in harsh environments.

What are the key drivers in the fishing tackle bags market?

Growth in Recreational and Sport Fishing Participation

The steady rise in recreational fishing participation across North America, Europe, and Asia-Pacific is a primary growth driver. Fishing is increasingly viewed as a wellness-oriented outdoor activity, boosting demand for beginner and mid-level fishing accessories, including tackle bags. Seasonal fishing licenses, urban fishing programs, and tourism-led angling activities continue to support consistent market expansion.

Premiumization of Fishing Accessories

Anglers are increasingly willing to invest in higher-quality gear storage to protect expensive rods, reels, and lures. This has driven demand for premium tackle bags featuring ergonomic designs, reinforced bases, and high-performance fabrics. As a result, average selling prices are rising, supporting value growth even in mature markets.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

While fishing participation is rising in developing regions, high-quality tackle bags remain relatively expensive for entry-level anglers. This limits penetration of premium products and slows value growth in price-sensitive markets.

Volatility in Raw Material Costs

Fluctuating prices of synthetic fabrics, EVA plastics, and waterproof coatings impact manufacturing costs and margin stability. Manufacturers often face challenges in passing cost increases to consumers without affecting demand.

What are the key opportunities in the fishing tackle bags industry?

Sustainable and Eco-Friendly Product Development

The growing emphasis on environmental responsibility among outdoor enthusiasts presents opportunities for brands to introduce tackle bags made from recycled fabrics and low-impact materials. Sustainable product lines are gaining preference, particularly in Europe and North America, where regulatory and consumer pressure is stronger.

Expansion in Emerging Fishing Markets

Asia-Pacific and Latin America offer strong long-term opportunities as governments promote inland fishing, aquaculture, and coastal tourism. Affordable, durable tackle bags tailored to local fishing practices can help brands scale volumes rapidly in these regions.

Product Type Insights

Soft tackle bags dominate the global market, accounting for approximately 34% of total revenue in 2025, driven by versatility and cost efficiency. Tackle backpacks are the fastest-growing segment, benefiting from ergonomic designs and hands-free convenience. Hard tackle bags and modular storage systems cater to professional anglers seeking maximum protection and organization, contributing a higher share of premium revenues.

Material Type Insights

Polyester and nylon-based bags lead the market with nearly 48% share, supported by durability, lightweight properties, and improved water resistance. EVA and molded plastic bags are gaining traction in saltwater and commercial fishing applications, while canvas-based bags remain a niche segment focused on aesthetics and durability.

Distribution Channel Insights

Offline sporting goods and specialty fishing stores remain the largest sales channel, supported by product trials and expert recommendations. However, online channels now account for nearly 29% of global sales and are growing rapidly, driven by direct-to-consumer platforms, competitive pricing, and wider product visibility.

End-Use Insights

Recreational anglers account for around 62% of global demand, followed by professional and tournament anglers who contribute disproportionately to revenue due to higher spending on premium products. Commercial fishing operators represent a smaller share but provide stable demand in coastal regions.

| By Product Type | By Material Type | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America held approximately 36% of the global fishing tackle bags market in 2025, led by the United States and Canada. High fishing participation rates across freshwater and saltwater segments continue to support consistent demand. Strong replacement cycles, driven by wear-and-tear from frequent use, sustain repeat purchases. In addition, consumers in the region show a clear preference for premium, durable, and compartmentalized storage solutions, reinforcing higher average selling prices.

Europe

Europe accounts for around 27% of global demand, supported by established angling cultures in Germany, the UK, France, and Nordic countries. Recreational fishing remains well-organized through clubs and associations, driving steady equipment investment. Sustainability-focused purchasing behavior is influencing product design, with increased demand for recycled fabrics, modular layouts, and long-life materials. Regulatory emphasis on environmental responsibility further shapes supplier strategies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 7% CAGR, led by China, Japan, Australia, and Southeast Asia. Growth is supported by rising disposable incomes and increasing participation in recreational fishing among urban and semi-urban consumers. Expanding inland fishing infrastructure, including managed lakes and reservoirs, is broadening the user base. E-commerce penetration also improves product accessibility across tier-2 and tier-3 markets.

Latin America

Latin America represents nearly 6% of global demand, with Brazil and Mexico leading regional growth. Freshwater and coastal fishing remain popular leisure activities, supporting steady baseline demand. Increasing sport fishing tourism, particularly in coastal and river-rich regions, is contributing to gradual market expansion. Product demand is largely mid-range, with durability and weather resistance prioritized over advanced features.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global demand, supported primarily by coastal fishing activity. South Africa, Morocco, and the UAE are key markets due to established recreational and small-scale commercial fishing practices. Demand remains concentrated around functional, rugged designs suited for harsh climates, with limited but growing interest in organized sport fishing and tourism-driven purchases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The fishing tackle bags market is moderately fragmented, with the top five players collectively accounting for approximately 40% of global revenue. Competition is driven by brand recognition, product durability, and pricing across mid-range and premium segments.

Key Players in the Fishing Tackle Bags Market

- Shimano

- Daiwa

- Rapala VMC

- Plano Molding

- Berkley

- Okuma Fishing

- Abu Garcia

- Fox International

- Savage Gear

- Mustad

- Lew’s

- KastKing

- SpiderWire

- Flambeau Outdoors

- Tackle Warehouse (Private Label)