Fishing Rod Racks Market Size

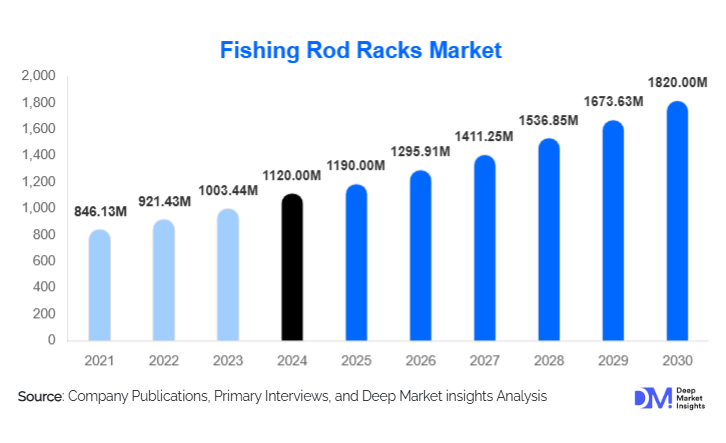

According to Deep Market Insights, the global fishing rod racks market size was valued at USD 1,120 million in 2024 and is projected to grow from USD 1,190 million in 2025 to reach USD 1,820 million by 2030, expanding at a CAGR of 8.9% during the forecast period (2025–2030). The market growth is driven by the increasing popularity of recreational and sport fishing, rising adoption of organized storage solutions for fishing gear, and the expanding consumer base for premium and customized fishing accessories across North America, Europe, and Asia-Pacific.

Key Market Insights

- The rising popularity of recreational fishing and outdoor sports is fueling global demand for durable and aesthetic fishing rod storage systems.

- Technological advancements in materials, including corrosion-resistant alloys, carbon fiber composites, and UV-stabilized polymers, are enhancing product lifespan and functionality.

- Wall-mounted and ceiling-mounted rod racks dominate the market, offering space-efficient storage for residential and commercial users.

- Europe and North America together account for over 55% of the market share, supported by strong fishing cultures and robust retail distribution channels.

- Asia-Pacific is the fastest-growing region, led by increasing participation in freshwater and marine fishing activities in Japan, Australia, and Southeast Asia.

- Online sales channels are witnessing significant traction, offering wide product visibility, user reviews, and direct-to-consumer pricing advantages.

Latest Market Trends

Growth in Premium and Customizable Fishing Storage Solutions

Manufacturers are increasingly focusing on designing high-end and customizable fishing rod racks tailored for both residential and commercial use. Premium racks featuring adjustable components, built-in LED lighting, and smart locking mechanisms are gaining popularity among professional anglers. Aesthetic integration of wood, stainless steel, and carbon fiber elements is transforming fishing rod racks into lifestyle accessories rather than just storage utilities. The trend toward garage organization systems and modular outdoor setups is further driving the adoption of premium fishing rod rack designs that combine functionality with aesthetics.

Rising Adoption of Eco-Friendly and Lightweight Materials

The use of sustainable and lightweight materials, such as bamboo, recycled plastics, and aluminum alloys, is emerging as a key trend in the fishing rod racks market. Manufacturers are prioritizing eco-conscious design strategies to appeal to environmentally aware consumers. Lightweight racks not only improve portability but also reduce transportation costs for online distribution. Eco-labeling and green certifications are becoming differentiating factors for brands targeting premium and international markets, especially in Europe and North America.

Fishing Rod Racks Market Drivers

Expansion of Recreational and Sport Fishing Activities

The surge in global participation in recreational and sport fishing is a major growth driver for the fishing rod racks market. According to industry reports, over 200 million people globally engage in fishing activities annually, creating strong demand for accessories that enhance storage, safety, and convenience. Growth in fishing tournaments, angling clubs, and coastal tourism is also fueling sales of both portable and fixed rod storage systems. As disposable incomes rise and consumers seek nature-based leisure activities, fishing continues to expand as a lifestyle pursuit, directly stimulating market demand for related storage solutions.

Rising Demand for Organized and Safe Fishing Gear Storage

Growing awareness of equipment safety and organization has increased consumer investment in rod racks that protect high-value fishing rods from damage. Compact homes and garages are driving demand for vertical and wall-mounted systems, while commercial fishing operators are increasingly adopting industrial-grade storage units to manage multiple rods efficiently. Moreover, the trend of home-based fishing setups, fueled by online tutorials and hobbyist culture, has boosted sales of entry-level and modular fishing rod racks.

Market Restraints

Seasonal Demand Fluctuations

Fishing activities are highly seasonal, leading to fluctuations in sales of fishing accessories, including rod racks. Manufacturers often face challenges in maintaining consistent production cycles due to off-season slowdowns in certain regions. Seasonal patterns, influenced by climatic conditions and fishing regulations, can impact retail turnover and inventory management, especially for small-scale producers and distributors.

Availability of Low-Cost, Unbranded Products

The market faces competition from low-cost, unbranded alternatives that dominate local markets and online platforms. These inexpensive imports, primarily from Asia, exert downward pressure on average selling prices, impacting the profit margins of established brands. Quality inconsistencies and product duplication also undermine brand reputation, making it difficult for premium players to maintain differentiation in a price-sensitive consumer environment.

Fishing Rod Racks Market Opportunities

Smart Storage Systems Integration

The integration of IoT-enabled storage solutions and smart monitoring features presents new opportunities for market expansion. Companies are experimenting with digital innovations such as RFID-based rod identification, environmental condition sensors, and automated locking systems to appeal to professional and tech-savvy consumers. Smart storage systems can monitor temperature, humidity, and usage patterns, offering enhanced rod protection and extending product life.

Expansion of Online and Specialty Retail Channels

Growing e-commerce penetration and the rise of specialty outdoor equipment retailers are providing lucrative growth avenues for manufacturers. Direct-to-consumer (D2C) models enable brands to target niche fishing communities and promote custom-made storage systems. Online marketplaces like Amazon, Bass Pro Shops, and Cabela’s have enhanced product visibility, enabling smaller brands to scale globally. Strategic collaborations with fishing influencers and community-based marketing campaigns are also expected to drive online sales growth in the coming years.

Product Type Insights

Wall-mounted fishing rod racks dominate the market due to their efficient use of space and easy accessibility, particularly in homes, garages, and boats. Freestanding racks are gaining popularity among retail and commercial users for their flexibility and storage capacity. Ceiling-mounted racks cater to space-constrained environments, offering premium organization for multiple rods. Portable and foldable racks represent a growing niche segment, driven by demand from traveling anglers and competitive fishers who require lightweight, mobile storage options.

Material Type Insights

Metal-based racks, especially those made from stainless steel and aluminum, hold a dominant share due to their strength and corrosion resistance. Wooden racks remain popular for indoor and decorative purposes, appealing to premium consumers seeking aesthetic value. Plastic and composite racks are witnessing increased adoption in budget and mid-range categories due to their affordability, lightweight design, and moisture resistance. Hybrid racks that combine wood, polymer, and metal elements are emerging as the preferred choice for consumers valuing durability and visual appeal.

Distribution Channel Insights

Online retail represents the fastest-growing channel, driven by convenience, variety, and user-generated reviews. E-commerce giants and specialized outdoor stores have expanded their product catalogs to include diverse rack configurations and brands. Offline channels, including specialty fishing stores, sporting goods retailers, and marine equipment outlets, continue to serve professional and enthusiast consumers who prefer product trials before purchase. The growing adoption of omnichannel strategies by leading brands ensures consistent pricing and inventory across physical and digital platforms.

End-User Insights

Residential users account for the largest market share, driven by hobbyist fishers and home-based storage solutions. Commercial users, including marinas, fishing clubs, and retail stores, represent a steady demand base for multi-rod systems and industrial-grade racks. The expanding network of fishing resorts and charter services is creating additional demand for large-capacity and weather-resistant storage solutions. Educational and institutional users, such as angling schools and research organizations, also contribute to niche demand for custom configurations.

| By Product Type | By Material Type | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market for fishing rod racks, driven by widespread recreational fishing culture in the U.S. and Canada. The presence of major manufacturers, strong e-commerce infrastructure, and organized retail channels supports steady market expansion. Rising investments in lakeside resorts, fishing tournaments, and private angling clubs continue to create favorable demand for both residential and professional-grade rod racks.

Europe

Europe holds a significant share of the market, with strong participation in freshwater and saltwater fishing across the U.K., Germany, France, and the Nordic countries. The demand for eco-friendly materials and compact design solutions aligns with regional sustainability goals. Growing emphasis on garage organization and lifestyle home improvement further supports the steady adoption of fishing rod racks across European households.

Asia-Pacific

Asia-Pacific is projected to exhibit the fastest growth through 2030, supported by the rising popularity of fishing as a leisure and sporting activity in China, Japan, South Korea, and Australia. Government initiatives promoting recreational angling and marine tourism, coupled with expanding online retail penetration, are fueling rapid market growth. Domestic manufacturers are increasingly exporting cost-effective yet durable racks to global markets, enhancing regional competitiveness.

Latin America

Latin America, led by Brazil, Mexico, and Argentina, is experiencing gradual market development driven by growing interest in coastal and inland fishing. The expanding network of sports fishing clubs and tourism-driven demand along coastal regions is opening new opportunities for international brands to establish localized distribution networks.

Middle East & Africa

The Middle East & Africa region represents an emerging market, supported by the growing popularity of sport fishing in coastal nations such as the UAE, Oman, and South Africa. Increased participation in offshore fishing expeditions and government investments in marine recreation are expected to drive steady market expansion. Premium and corrosion-resistant racks are witnessing rising demand due to harsh climatic conditions and saltwater exposure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fishing Rod Racks Market

- Rush Creek Creations

- Organized Fishing

- Berkley Fishing

- ColdTuna

- Big Sky Racks

- Rapala VMC Corporation

- Plano Synergy

- Cap Rack

- Gear-Up Storage

- Rogue Rod Racks

Recent Developments

- In August 2025, Rush Creek Creations launched a new line of eco-friendly fishing rod racks made from recycled polymers and sustainably sourced wood, targeting environmentally conscious anglers.

- In May 2025, Berkley introduced modular, portable fishing rod racks designed for competitive anglers, featuring corrosion-resistant aluminum and quick-assembly features.

- In February 2025, Organized Fishing expanded its distribution network across Europe and Australia, emphasizing premium wall-mounted and freestanding rack systems.