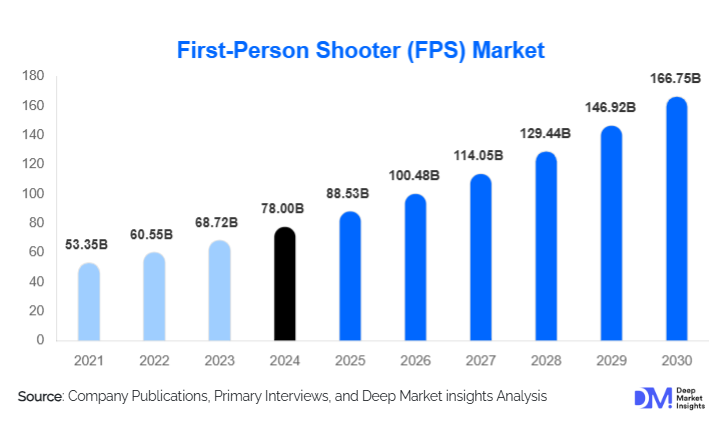

First-Person Shooter (FPS) Market Size

According to Deep Market Insights, the global first-person shooter market size was valued at USD 78.00 billion in 2024 and is projected to grow from USD 88.53 billion in 2025 to reach USD 166.75 billion by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). The FPS market growth is primarily driven by the sustained popularity of competitive multiplayer gaming, the dominance of free-to-play monetization models, and continuous technological advancements in game engines, graphics, and online infrastructure.

Key Market Insights

- Multiplayer and live-service FPS titles dominate global revenues, supported by recurring monetization through battle passes, cosmetics, and seasonal content.

- Console and PC platforms remain the revenue backbone, while mobile FPS games are expanding rapidly in emerging markets.

- Asia-Pacific leads global demand, driven by China, Japan, South Korea, and fast-growing adoption in India and Southeast Asia.

- North America maintains strong market leadership, supported by high console penetration, esports ecosystems, and subscription gaming services.

- Digital distribution accounts for over 90% of FPS sales, reflecting the decline of physical retail formats.

- Cloud gaming and cross-platform play are reshaping accessibility and player engagement worldwide.

What are the latest trends in the FPS market?

Rise of Live-Service and Free-to-Play FPS Games

The FPS market has increasingly shifted toward live-service and free-to-play models that emphasize long-term player engagement rather than one-time purchases. Developers are prioritizing frequent content updates, seasonal battle passes, cosmetic customization, and limited-time events to extend game life cycles. This trend has significantly increased average revenue per user (ARPU) while maintaining large active player bases. Free-to-play FPS titles now account for nearly half of total market revenue, particularly in competitive multiplayer and battle royale formats.

Cross-Platform and Cloud-Based FPS Gaming

Cross-platform functionality has become a critical differentiator, allowing players across consoles, PCs, and mobile devices to compete within the same ecosystem. This has strengthened network effects and expanded addressable audiences. Cloud gaming is also gaining traction, reducing hardware dependency and enabling FPS access on lower-end devices. As latency and network reliability improve, cloud-based FPS gaming is expected to unlock new demand in cost-sensitive regions and emerging economies.

What are the key drivers in the FPS market?

Expansion of Competitive Esports and Streaming Ecosystems

FPS titles form the backbone of global esports and game streaming ecosystems. Professional tournaments, sponsorships, and content creation on platforms such as Twitch and YouTube are driving sustained engagement and brand visibility. Esports-focused FPS games benefit from long-term monetization opportunities through in-game purchases, media rights, and partnerships, reinforcing their commercial success.

Technological Advancements in Game Development

Advances in game engines, artificial intelligence, and graphics technologies are significantly enhancing realism, player immersion, and performance. Features such as ray tracing, AI-driven matchmaking, and advanced physics engines improve user experience and retention. Continuous innovation in development tools enables studios to deliver larger multiplayer environments and more responsive gameplay, supporting long-term market growth.

What are the restraints for the global FPS market?

High Development and Operational Costs

AAA FPS titles require substantial upfront investments, with development and marketing budgets often exceeding USD 100 million. Ongoing costs related to live-service maintenance, cybersecurity, and content updates further increase financial risk. These high entry barriers limit new entrants and place pressure on profitability, particularly for mid-sized studios.

Regulatory and Content Restrictions

FPS games face increasing scrutiny related to violent content, loot box mechanics, and data privacy regulations. Restrictions in certain countries can limit distribution or monetization opportunities. Compliance with evolving regulations adds complexity and cost for developers operating across multiple regions.

What are the key opportunities in the FPS industry?

Mobile FPS Growth in Emerging Markets

Mobile FPS gaming represents a major growth opportunity, particularly in India, Brazil, Southeast Asia, and the Middle East. Rising smartphone penetration, affordable data plans, and localized content are expanding the player base. Optimizing FPS titles for low- and mid-range devices enables publishers to capture large, previously underserved audiences.

Integration of AI, VR, and Immersive Technologies

Artificial intelligence is being increasingly used for smarter non-player characters, adaptive difficulty levels, and enhanced anti-cheat systems. Meanwhile, VR-based FPS games, though niche, command premium pricing and offer differentiated experiences. Early adoption of immersive technologies positions developers for future shifts in gaming platforms.

Platform Insights

Console-based FPS games account for approximately 42% of the global market in 2024, driven by optimized controls, exclusive titles, and strong online communities. PC-based FPS games remain highly popular among competitive players and esports professionals. Mobile FPS games are the fastest-growing platform segment, benefiting from mass-market accessibility and free-to-play monetization. Cloud-based FPS gaming, while still emerging, is expected to gain share as infrastructure improves.

Monetization Model Insights

Free-to-play FPS games lead the market with nearly 48% share, supported by microtransactions, cosmetic items, and battle passes. Premium one-time purchase models continue to generate revenue for established franchises, while subscription-based access through gaming services is steadily increasing. Ad-supported FPS games remain limited but are gaining relevance in mobile-first markets.

Gameplay Format Insights

Multiplayer competitive FPS games dominate the market, accounting for approximately 46% of total revenue in 2024. Battle royale FPS formats continue to attract large player bases, while co-operative and tactical FPS games appeal to niche but loyal audiences. Single-player campaign-focused FPS titles remain relevant, particularly within premium console and PC segments.

End-Use Insights

Consumer entertainment represents over 85% of FPS market demand, driven by casual and competitive gaming. Esports and professional gaming are the fastest-growing end-use segments, expanding at double-digit growth rates due to sponsorships, media rights, and organized tournaments. Emerging applications include military and defense simulation training, VR arcades, and educational gamification, though these segments currently represent a smaller share of total demand.

| By Platform | By Monetization Model | By Gameplay Format | By Distribution Channel | By Connectivity Mode |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global FPS market revenue in 2024, led by the United States. High console ownership, a well-established PC gaming base, and advanced broadband infrastructure support sustained demand. A strong esports ecosystem, combined with the widespread adoption of subscription-based gaming services, continues to reinforce market leadership. Demand is primarily driven by competitive multiplayer formats and premium live-service FPS titles with ongoing content updates.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, contributing nearly 38% of global revenue. China, Japan, and South Korea dominate overall demand due to strong PC café culture, esports penetration, and publisher investments. India is the fastest-growing country, expanding at a CAGR exceeding 14%, supported by rising smartphone penetration and affordable mobile data. Mobile FPS gaming and increasing esports participation remain the core growth drivers across the region.

Europe

Europe represents a mature but stable market, with the U.K., Germany, and France as key contributors. Strong console adoption, high-quality PC gaming communities, and steady esports participation support consistent demand. Digital distribution channels and cross-platform play continue to improve player retention and monetization across established FPS franchises.

Latin America

Latin America is emerging as a high-growth region, led by Brazil and Mexico. Rising smartphone adoption, improving internet access, and a young gaming population are expanding the FPS player base. Free-to-play and mobile-first FPS titles are gaining traction, supported by localized content and competitive pricing strategies.

Middle East & Africa

The Middle East and Africa region is gaining traction, driven by increasing investments in gaming infrastructure and government-backed esports initiatives. A young, digitally engaged population supports long-term growth potential. Saudi Arabia and the UAE are key markets, benefiting from expanding esports events, gaming hubs, and rising consumer spending on digital entertainment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the First-Person Shooter Market

- Activision Blizzard

- Electronic Arts

- Tencent

- Valve Corporation

- Epic Games

- Ubisoft

- Take-Two Interactive

- Microsoft Gaming

- NetEase Games

- Sony Interactive Entertainment

- Krafton

- Square Enix

- Bandai Namco

- Embracer Group

- Nexon

Recent Developments

- In May 2025, Activision launched a major content update for Call of Duty, introducing new multiplayer maps and competitive modes aimed at sustaining long-term live-service engagement.

- In April 2025, Ubisoft confirmed continued post-launch support and seasonal content expansions for its FPS titles, reinforcing recurring revenue models.

- In February 2025, Microsoft highlighted FPS franchises as a core growth driver for Xbox Game Pass, integrating shooter titles into its cross-platform ecosystem strategy.