Firearm Sights Market Size

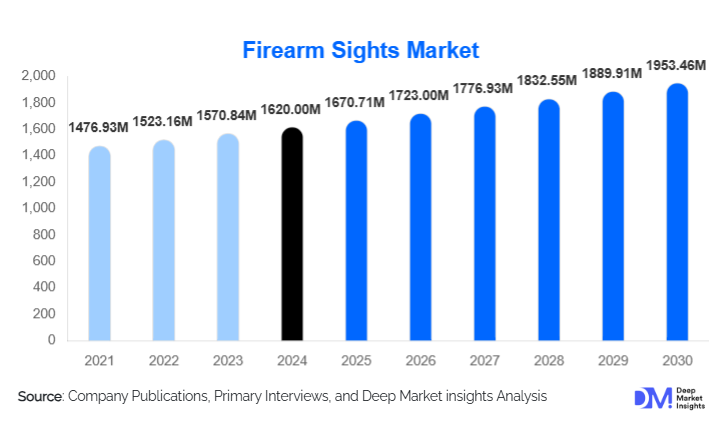

According to Deep Market Insights, the global firearm sights market size was valued at USD 1,620.00 million in 2024 and is projected to grow from USD 1,670.71 million in 2025 to reach USD 1,953.46 million by 2030, expanding at a CAGR of 3.13% during the forecast period (2025–2030). The market growth is primarily driven by rising defense modernization programs, increasing adoption of shooting sports and hunting activities, and technological advancements in firearm sighting systems, including optical, red dot, laser, and smart-connected sights.

Key Market Insights

- Optical and red dot sights dominate global demand, supported by precision, quick target acquisition, and multi-environment applicability for military, law enforcement, and civilian use.

- Technological innovations, such as holographic, night vision, and smart-connected sights, are reshaping the market, enhancing operational efficiency, and broadening civilian applications.

- North America remains the largest market, driven by high civilian firearm ownership, shooting sports culture, and continuous military upgrades.

- Asia-Pacific is emerging as the fastest-growing region, led by defense spending in China and India and rising interest in sport shooting and hunting.

- Government initiatives and defense procurement programs, including Make in India and China 2025, are boosting local production and technological adoption in firearm sight manufacturing.

- Export-driven demand, particularly from North America and Europe to LATAM and APAC, is expanding the global market footprint for premium and tactical sights.

What are the latest trends in the firearm sights market?

Technological Integration and Smart Sights

Firearm sights are increasingly integrating technology to improve precision and ease of use. Smart sights with Bluetooth connectivity, ballistic calculators, and AR-assisted targeting are gaining traction among military and law enforcement agencies. Civilian demand for connected red dot, hybrid, and holographic sights is also rising, particularly in competitive shooting sports and hunting. Manufacturers are focusing on improving battery life, durability, and environmental adaptability, catering to both tactical and recreational applications. Such technology-driven enhancements are allowing shooters to track performance metrics, customize reticle settings, and access real-time operational data.

Rising Adoption of Civilian and Sporting Applications

Recreational shooting and hunting continue to grow globally, especially in North America and Europe. Civilian shooters are increasingly adopting high-performance optical, red dot, and hybrid sights for precision and safety. Competitive sports and firearm enthusiast communities are demanding lightweight, durable, and versatile sights, driving manufacturers to introduce premium and mid-range products tailored to these segments. Emerging digital platforms allow consumers to compare products, review performance features, and access educational content, further fueling adoption in civilian markets.

What are the key drivers in the firearm sights market?

Rising Defense and Military Modernization

Defense budgets are steadily increasing across the globe, with countries like the USA, China, and India prioritizing modern small arms and precision sighting systems. Investments in optical, red dot, laser, and night sights are enabling armed forces to enhance accuracy, response times, and operational capabilities. Modernization programs and battlefield upgrades remain significant growth drivers for the global firearm sights market.

Technological Advancements

Advancements in holographic, laser, and smart-connected sight technologies are boosting demand. These innovations provide improved target acquisition, low-light performance, and integration with mobile or tactical systems. Military, law enforcement, and civilian users benefit from increased functionality, leading to wider adoption and market expansion.

Growth in Shooting Sports and Hunting Activities

The popularity of hunting, sport shooting, and competitive firearm events, especially in North America and Europe, continues to rise. Consumers are seeking precision, reliability, and ergonomic designs in sight, creating a strong market pull for high-quality optical and red dot products. Recreational demand complements defense-driven growth, forming a balanced global market expansion.

What are the restraints for the global market?

Regulatory Constraints

Strict firearm laws and import/export regulations in key regions such as Europe, APAC, and LATAM limit the distribution and adoption of advanced firearm sights. Compliance requirements, licensing challenges, and regional restrictions act as barriers to market penetration, particularly for smart and laser sight systems.

High Product Costs

Premium sights, including holographic, smart-connected, and night vision models, remain expensive for civilian users. High costs limit adoption in price-sensitive markets and restrict the scalability of advanced technologies outside defense and professional applications.

What are the key opportunities in the firearm sights industry?

Smart and Connected Sight Technologies

Technological innovation presents substantial opportunities, including smart-connected sights with AR integration, ballistic calculators, and mobile app connectivity. These products enable performance tracking, customization, and enhanced operational efficiency for both tactical and civilian use, creating high-value market segments.

Emerging Regional Markets

APAC and MEA are becoming attractive markets for firearm sights due to rising defense expenditures, increasing shooting sports popularity, and local government initiatives. India, China, Saudi Arabia, and the UAE are investing in domestic production and procurement programs, offering new avenues for global manufacturers to expand their footprint.

Growing Civilian and Hunting Segments

North America and Europe are witnessing increasing demand from recreational hunters and sport shooters. There is a strong opportunity to provide mid-range and premium optical and hybrid sights tailored to consumer preferences for lightweight, versatile, and durable designs. Integration with technology and customization options enhances appeal and opens revenue potential in civilian markets.

Product Type Insights

Optical sights dominate the market, accounting for approximately 42% of 2024 global demand, due to precision, versatility, and long-range targeting capabilities. Red dot sights, representing 28% market share, are growing fastest because of quick target acquisition and reliability across multiple environments. Holographic and hybrid sights are emerging segments, particularly in military and law enforcement applications, while laser and night sights are steadily gaining traction for specialized use cases. Rail-mounted configurations remain highly preferred, with 55% of users adopting modular systems for tactical flexibility.

Application Insights

Military and defense applications account for 38% of the global market, driven by modernization programs and procurement of advanced small arms. Law enforcement is another critical application, with the adoption of red dot, night, and smart sights for tactical operations. Civilian usage in sporting and hunting is expanding rapidly, with competitive shooting events, recreational hunting, and personal defense driving demand. Emerging applications include smart and app-integrated sights for performance tracking and virtual training tools for competitive shooters.

Distribution Channel Insights

Distribution is increasingly direct-to-consumer through manufacturer websites and specialized online retailers. E-commerce platforms, including OTAs for firearms accessories, are facilitating broader reach, product comparisons, and real-time reviews. Direct government procurement and B2B defense contracts also represent significant distribution channels. Traditional specialized retail stores continue to serve sporting and hunting communities, while trade shows, exhibitions, and tactical expos are promoting awareness and technology adoption.

End-User Insights

Military remains the largest end-user segment, followed by law enforcement, sporting, and hunting communities. Recreational shooters and civilian hunters are emerging as fast-growing end-users due to increasing interest in competitive shooting, hunting sports, and precision firearms. Export-driven demand is increasing from North America and Europe to APAC and LATAM, creating opportunities for manufacturers to diversify regional sales.

| By Product Type | By Technology | By Mounting Type | By End-Use Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, with the USA accounting for nearly 28% of global demand due to high civilian firearm ownership, defense modernization programs, and shooting sports culture. Canada contributes around 5%, driven by hunting and sport shooting demand. The region continues to adopt technologically advanced sights for both military and civilian users.

Europe

Germany and France together account for approximately 12% of global demand. Military upgrades, competitive shooting, and civilian hunting activities drive market growth. The UK and Italy are additional contributors, with demand for precision optical, red dot, and smart sights increasing steadily.

Asia-Pacific

China and India are emerging as the fastest-growing markets, with defense modernization, shooting sports, and civilian hunting driving adoption. Japan and Australia are mature markets with steady growth, particularly in photography-focused hunting and sporting activities.

Middle East & Africa

Saudi Arabia and the UAE are key markets, driven by military procurement. Africa contributes significantly as a sourcing region and for localized manufacturing initiatives. Intra-regional military demand is gradually expanding.

Latin America

Brazil and Argentina are the primary contributors, with growth focused on civilian hunting and recreational shooting. Outbound imports from North America are increasing, driven by demand for premium and precision sights.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|