Filling & Topping Ingredients Market Size

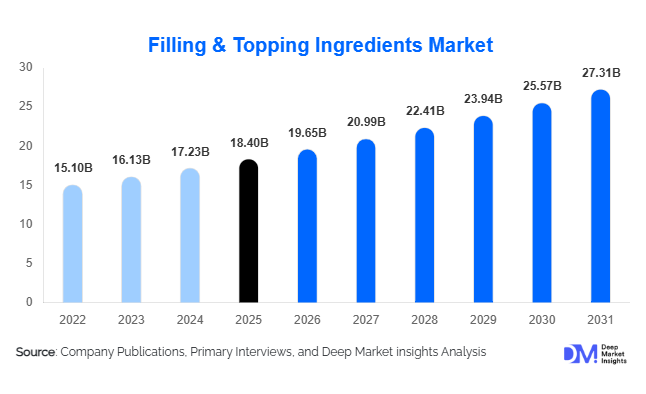

According to Deep Market Insights, the global filling & topping ingredients market size was valued at USD 18.4 billion in 2025 and is projected to grow from USD 19.65 billion in 2026 to reach USD 27.31 billion by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The market growth is primarily driven by rising consumption of bakery and confectionery products, increasing demand for premium and indulgent food offerings, and growing adoption of clean-label, fruit-based, and functional filling solutions across industrial food manufacturing.

Key Market Insights

- Fruit-based fillings and toppings dominate the market, supported by clean-label demand and reduced-sugar formulations.

- Bakery applications account for the largest share, driven by industrial cakes, pastries, and filled biscuits.

- Europe and North America together hold over 60% of global market share due to established bakery and confectionery industries.

- Asia-Pacific is the fastest-growing region, fueled by rapid industrialization of bakery and QSR sectors in China and India.

- Premiumization of desserts and chocolates is increasing demand for specialty fillings such as nut pralines and compound chocolates.

- Technological innovation in heat-stable and freeze-thaw stable formulations is reshaping product development.

What are the latest trends in the filling & topping ingredients market?

Shift Toward Clean-Label and Reduced-Sugar Formulations

Food manufacturers are increasingly reformulating fillings and toppings to align with clean-label and reduced-sugar trends. Consumers are actively avoiding artificial colors, flavors, and preservatives, driving demand for fruit-based purees, natural sweeteners, and fiber-enriched formulations. Ingredient suppliers are investing heavily in enzymatic processing, natural preservation technologies, and sugar-reduction systems that maintain taste, texture, and shelf stability. This trend is particularly strong in Europe and North America, where regulatory pressure and consumer awareness are highest.

Premium and Multi-Texture Ingredient Innovation

Premiumization is accelerating the adoption of multi-texture and layered filling solutions. Manufacturers are introducing inclusions such as fruit pieces, nut fragments, and chocolate flakes within semi-solid bases to enhance sensory appeal. This trend is especially evident in premium bakery, artisanal chocolates, and frozen desserts. Customized textures tailored to specific baking or freezing conditions are becoming a key differentiator, strengthening long-term supplier–manufacturer relationships.

What are the key drivers in the filling & topping ingredients market?

Rising Global Bakery and Confectionery Consumption

Growth in packaged bakery products, premium pastries, and filled confectionery remains the strongest driver for filling and topping ingredients. Urbanization, busy lifestyles, and increased snacking habits are boosting demand for filled croissants, cakes, and cookies. Industrial bakeries rely on standardized ingredient solutions for scalability and consistency, directly increasing bulk ingredient demand across global markets.

Expansion of Frozen and Ready-to-Eat Food Categories

The rapid expansion of frozen desserts, ready-to-eat snacks, and microwaveable bakery items is driving demand for advanced filling ingredients with freeze-thaw stability and extended shelf life. Ingredient manufacturers offering application-specific solutions are becoming integral to customers’ product development pipelines, supporting sustained market growth.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of cocoa, dairy, sugar, and nuts remain a significant challenge. Cocoa price volatility has particularly impacted chocolate-based fillings, compressing margins and forcing manufacturers to reformulate or implement frequent price revisions. This volatility increases operational risk for both suppliers and end-use manufacturers.

Regulatory and Labeling Complexity

Stringent food safety, allergen disclosure, and sugar-reduction regulations vary across regions, increasing compliance costs. Smaller manufacturers often struggle to meet these requirements, slowing innovation cycles and market entry.

What are the key opportunities in the filling & topping ingredients industry?

High-Growth Demand from Asia-Pacific

Asia-Pacific presents a major growth opportunity, driven by rapid expansion of industrial bakeries, QSR chains, and packaged food consumption in China, India, and Southeast Asia. Localized flavor innovation and regional manufacturing expansion can unlock significant volume and margin growth for ingredient suppliers.

Functional and Specialty Ingredient Development

There is growing opportunity in protein-enriched, sugar-free, and plant-based filling solutions for use in functional foods, sports nutrition snacks, and vegan desserts. Advances in formulation technology are enabling new applications beyond traditional bakery and confectionery.

Product Type Insights

Fruit-based ingredients dominated the global market in 2025, accounting for approximately 32% of total revenue. This leadership is primarily driven by strong consumer preference for clean-label, natural, and minimally processed ingredients, alongside their broad versatility across bakery, dairy, confectionery, and frozen dessert applications. Fruit fillings and inclusions benefit from rising demand for reduced artificial additives and are widely used in premium and mass-market formulations alike.

Chocolate-based fillings represent a high-value premium segment, supported by indulgence-driven consumption trends, particularly within confectionery, pastries, and seasonal specialty products. The segment benefits from sustained demand for premium cocoa, artisanal chocolates, and flavor innovation, including dark, single-origin, and ethically sourced variants. Nut-based and specialty functional ingredients are experiencing steady growth due to premiumization trends and increasing health consciousness. Almond, hazelnut, pistachio, and protein-enriched fillings are gaining traction, especially in high-protein snacks, plant-based desserts, and functional bakery products targeting health-focused consumers.

Application Insights

Bakery products remain the largest application segment, contributing nearly 41% of total market revenue in 2025. The segment’s dominance is driven by high-volume consumption of cakes, pastries, doughnuts, croissants, and filled biscuits, where fillings and inclusions enhance texture, flavor differentiation, and visual appeal. Continuous product innovation and premium bakery expansion further support demand.

Confectionery applications represent the second-largest segment, with strong uptake in chocolates, pralines, molded candies, and seasonal assortments. Demand is driven by gifting culture, festive consumption, and growing interest in premium and customized confectionery offerings. Dairy and frozen desserts are emerging as high-growth application areas, particularly for fruit-based, caramel, and sauce-style toppings. The expansion of flavored yogurts, ice creams, and plant-based frozen desserts is accelerating the adoption of innovative fillings with enhanced stability and flavor intensity.

Distribution Channel Insights

Direct B2B sales dominate the market, accounting for over 65% of total revenue in 2025. This dominance reflects long-term supply agreements, bulk purchasing, and the growing need for customized formulations tailored to specific processing requirements of industrial manufacturers.

Industrial ingredient distributors play a supporting role, particularly in regional and mid-sized markets where local sourcing, logistical flexibility, and technical support are critical. Meanwhile, foodservice suppliers are gaining strategic importance, supported by the rapid expansion of QSR chains, café formats, and dessert-focused foodservice concepts.

End-Use Industry Insights

Industrial bakeries represent the largest end-use segment, driven by high-volume production of packaged baked goods and private-label products. This is followed by confectionery manufacturers and dairy processors, which rely on fillings to differentiate products and support premium positioning.

Foodservice operators and QSR chains are the fastest-growing end users, benefiting from menu innovation, seasonal promotions, and rising consumer spending on premium desserts. Customizable fillings and inclusions are increasingly used to create limited-time offerings and signature products.Emerging end-use industries include protein snacks, plant-based desserts, and hybrid convenience foods, where functional and clean-label fillings are used to enhance both nutritional value and sensory appeal.

| By Product Type | By Product Function | By Physical Form | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe accounted for approximately 32% of global market share in 2025, led by Germany, France, Italy, and the U.K. The region’s dominance is supported by a strong bakery heritage, high per-capita consumption of baked goods, and robust demand for premium confectionery. Growth is further driven by widespread adoption of clean-label standards, organic ingredients, and stringent food quality regulations that favor high-quality fillings.

North America

North America held around 28% of the global market share, primarily driven by the United States. Key growth drivers include large-scale industrial bakery manufacturing, continuous innovation in frozen desserts, and strong consumer demand for premium chocolate and indulgent bakery products. The region also benefits from advanced food processing infrastructure and high adoption of customized ingredient solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, projected to expand at a CAGR exceeding 8.5%. China, India, and Japan are major contributors, supported by rising disposable incomes, urbanization, and rapid industrialization of the food processing sector. Western-style bakery adoption, expanding middle-class populations, and increased demand for packaged and convenience foods are key growth drivers.

Latin America

Latin America represents a steadily growing market, led by Brazil and Mexico. Growth is driven by expanding packaged food consumption, increasing bakery product penetration, and the modernization of local food manufacturing facilities. Rising urban populations and improving cold-chain infrastructure further support market expansion.

Middle East & Africa

The Middle East market is driven by premium bakery and confectionery demand, particularly in the UAE and Saudi Arabia, where high disposable incomes and strong hospitality sectors support consumption. In Africa, the market shows gradual expansion through developing urban food processing hubs, increasing investment in local manufacturing, and growing demand for packaged baked goods.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Filling & Topping Ingredients Market

- Barry Callebaut

- Cargill

- ADM

- Puratos Group

- Kerry Group

- Ingredion

- Tate & Lyle

- Olam Food Ingredients

- AAK

- Fuji Oil

- Dawn Foods

- DSM-Firmenich

- Sensient Technologies

- Blommer Chocolate

- Nestlé (Ingredients Division)