Ice Cream Market Size

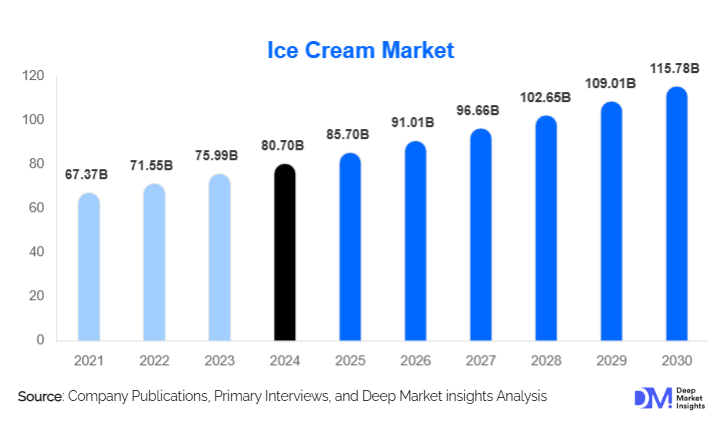

According to Deep Market Insights, the global ice cream market was valued at USD 80.7 billion in 2024 and is projected to grow to approximately USD 85.70 billion in 2025 and reach USD 115.78 billion by 2030, expanding at a CAGR of approximately 6.2% during the forecast period (2025–2030). This growth is driven by rising demand for premium and impulse formats, increasing penetration of plant-based ice creams, and the rapid development of cold-chain infrastructure across emerging markets.

Key Market Insights

- Dairy-based ice cream dominates the market, accounting for the vast majority of sales globally due to established consumer preference and mature supply chains.

- Impulse formats (bars & novelty sticks) lead in terms of format growth, driven by convenience retail and innovation in coatings and fillings.

- Retail (supermarkets, convenience stores) is the largest distribution channel, making up the bulk of sales as most consumption still happens at home.

- Asia Pacific is the largest regional market, with strong volume growth supported by urbanization, cold-chain expansion, and rising disposable incomes.

- Premium and super-premium ice creams are among the fastest-growing tiers, fueled by consumer willingness to pay more for craftsmanship, novel flavors, and artisanal positioning.

- Plant-based and functional ice creams (e.g., protein-fortified, low-sugar) are emerging as high-growth segments, with health-conscious and flexitarian consumers driving demand.

What are the latest trends in the Ice Cream Market?

Premiumization and Flavor Innovation

Ice cream makers are investing heavily in novel flavors, mix-ins, inclusions, and spiral swirls, targeting consumers who are trading up to premium and super-premium tubs. This trend is not only about indulgence but also about uniqueness, limited-edition flavors, single-origin ingredients, and collaborations are helping brands command higher price points.

Rise of Plant-based & Functional Ice Creams

Non-dairy ice creams made from oat, almond, coconut, and other plant bases are making serious inroads, especially among flexitarians and consumers with dairy sensitivities. On top of that, fortified products, like high-protein, probiotic, or collagen-enriched ice creams, are gaining ground, appealing to the health-conscious segment without compromising the indulgent experience.

Channel Innovation & Subscriptions

E-commerce, quick-commerce, and DTC subscription models are changing how consumers buy ice cream. Brands are launching flavor subscription boxes, limited-edition drops, and online-only pints, enabling frequent engagement and a more direct feedback loop. Meanwhile, foodservice tie-ups (QSRs, cafes) are expanding frozen dessert menus, helping to create new consumption occasions beyond traditional scooping parlours.

What are the key drivers in the ice cream market?

Premiumization Fuels Higher-Value Sales

Consumers are increasingly willing to pay more for an elevated ice cream experience, whether through gourmet ingredients, craftsmanship, or unique flavors. This shift toward premium and super-premium offerings drives up value even where volume growth is slower.

Changing Dietary Preferences

The growing demand for plant-based diets, lactose-free options, and functional foods (like protein- or probiotic-fortified ice cream) is expanding the traditional ice cream consumer base. These products allow companies to innovate while tapping into health-and-wellness trends.

Expansion of Cold-Chain Infrastructure

Improved refrigerated logistics and last-mile cold storage, particularly in emerging markets, are enabling wider distribution of frozen desserts. As cold-chain infrastructure strengthens, ice cream companies can enter new geographies with lower spoilage risk and cost-efficient logistics.

What are the restraints for the global market?

Volatile Input Costs

Dairy commodity prices (milk solids, butterfat), sugar, and energy for freezing and storage are subject to significant volatility. These fluctuations can squeeze margins for ice cream manufacturers, especially smaller players who have less hedging capacity or scale.

Regulatory and Labeling Challenges

Strict and varying regulations around labeling, nutrition claims, and definitions of “ice cream” vs. “frozen dessert” can slow down innovation. Non-dairy formulations may face restrictions or extra certifications in certain markets, increasing compliance costs.

What are the key opportunities in the ice cream industry?

Expansion of Plant-Based & Functional Products

There is a huge opportunity in scaling plant-based and fortified ice creams. Brands that can deliver dairy-like creaminess from plant bases, or offer high-protein or probiotic variants, can command premium prices and attract both health-conscious consumers and flexitarians.

Impulse & Novelty Innovation

Impulse formats, especially bars and coated novelties, offer significant margin potential. By introducing creative coatings, fillings, or alcohol-/functional-infused bars, companies can expand into new retail channels and drive frequent, repeat purchases.

Localized Manufacturing & Cold-Chain Investments in Emerging Markets

Investing in regional production facilities and cold-chain infrastructure in fast-growing markets like India, China, and Latin America can reduce logistics costs and import exposure. Local manufacturing also allows lower packaging costs (smaller tubs) and better alignment with regional taste preferences.

Product Type Insights

Dairy-based ice cream continues to be the dominant product type worldwide, supported by deeply entrenched consumer preferences, strong dairy processing capacity, and cost-efficient supply chains that enable competitive pricing across mass retail channels. The widespread availability of milk, cream, and butterfat in major dairy-producing countries further stabilizes pricing and ensures predictable year-round production volumes. This segment benefits from ongoing flavor innovation, clean-label reformulations, and premiumization, especially in mature markets where indulgence-oriented products remain resilient despite economic fluctuations.

Meanwhile, non-dairy and plant-based ice cream have emerged as the fastest-growing product categories. Their rapid expansion is driven by flexitarian diets, rising lactose intolerance awareness, and a surge in vegan and climate-conscious consumers. Advances in oat, almond, coconut, and pea-protein bases have closed the sensory gap with dairy options, enabling mainstream retail adoption. Gelato and frozen yogurt maintain strong premium and functional niches, respectively, gelato due to its artisanal texture and dense flavor profile, and frozen yogurt due to probiotic benefits and perceived health orientation. Together, these segments reflect a market that is diversifying rapidly while still anchored by the global popularity of traditional dairy-based formulations.

Application Insights

At-home consumption remains the largest and most stable application category, driven by the consistent demand for family tubs, pints, and multi-packs sold across supermarkets, hypermarkets, and convenience stores. This segment has benefited from lifestyle shifts toward home-based leisure, supported further by strong demand for premium pints and limited-edition flavors. Impulse consumption, comprising on-the-go single-serve cones, bars, sandwiches, and novelty sticks, continues to accelerate as brands expand their novelty ranges and introduce innovative flavor combinations targeted at younger consumers.

Foodservice applications are equally important, with scoop shops, cafés, bakeries, and QSR chains increasingly integrating premium, artisanal, and plant-based frozen desserts into their menus. These channels play a strategic role in brand discovery and seasonal demand spikes. Additionally, B2B applications, including ice cream base and semi-finished mix supply to bakery chains, dessert parlors, and institutional buyers, provide manufacturers with high-volume, recurring revenue streams, making them a stabilizing pillar of the overall value chain.

Distribution Channel Insights

Retail channels such as supermarkets, hypermarkets, and convenience stores dominate the global distribution landscape due to the overwhelming share of at-home consumption. These outlets enable broad SKU availability, strong promotional visibility, and regular household replenishment. At the same time, e-commerce and direct-to-consumer (DTC) subscription models are growing at double-digit rates, powered by improved cold-chain logistics and the popularity of limited-batch flavor drops. Online channels also allow smaller gourmet brands to bypass traditional retail entry barriers.

Foodservice partnerships, including collaborations with cafés, restaurants, and QSR chains, are expanding rapidly as consumers increasingly seek premium dessert experiences outside the home. Institutional sales and bulk B2B packaging remain crucial for hotels, schools, hospitals, and catering companies, offering large manufacturers steady, predictable order volumes throughout the year.

Consumer Type Insights

Households remain the largest consumer group globally, purchasing multi-serve tubs and pints for shared consumption occasions. This demographic drives consistent baseline demand and responds positively to value packs, family-sized formats, and promotional bundles. On-the-go consumers, particularly millennials and Gen Z, are key drivers of single-serve bars, sticks, and novelty formats, fueling high-frequency, impulse-oriented purchases. Their openness to limited-edition launches and innovative product formats accelerates category experimentation.

Health-conscious consumers increasingly gravitate toward low-sugar, high-protein, and plant-based variations, reflecting a shift toward permissible indulgence. At the same time, premium-seeking customers prefer artisanal, gourmet, and chef-inspired creations, often prioritizing high-quality ingredients and unique textures. This dual demand from health-driven and premium-driven consumers continues to reshape product development strategies across global markets.

Age Group Insights

Adults aged 25–44 represent a crucial demographic segment due to their strong purchasing power, brand experimentation, and preference for premium frozen desserts. This group actively explores new formats such as plant-based tubs, protein-enriched scoops, and gourmet single serves. Millennials and older Gen Z consumers remain highly responsive to novelty bars, artisanal small-batch products, and globally inspired flavors, contributing significantly to market momentum.

Older consumers aged 45+ still drive demand for traditional dairy tubs and nostalgic flavor profiles. However, this segment is increasingly shifting toward occasional premium indulgence, especially in products perceived as high-quality, natural, or heritage-inspired. Their steady purchasing patterns support stable demand across mature markets.

| By Product Type | By Flavor Category | By Distribution Channel | By Category | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is one of the most lucrative global ice cream markets, led by the U.S., which has one of the highest per-capita ice cream consumptions globally. Growth is driven by strong premiumization trends, continual novelty innovation, and the dominance of pint-sized premium brands. Robust cold-chain infrastructure, wide retail reach, and the rapid rise of DTC ice cream delivery models further strengthen regional performance.

The U.S. market benefits from product premiumization, widespread acceptance of plant-based dessert innovations, and rapid expansion of functional frozen treats (high-protein, low-calorie). Canada contributes through rising artisanal and organic ice cream production, along with a strong demand for dairy-rich, indulgent flavors. Altogether, the region’s high disposable incomes and established manufacturing base ensure sustained growth.

Europe

Europe’s ice cream market is defined by a mix of long-standing artisanal traditions, particularly gelato in Italy, and steady innovation in clean-label, lactose-free, and reduced-sugar products. Major countries such as Germany, the U.K., Spain, and France display high seasonal consumption with a strong preference for premium tubs, bars, and regionally inspired flavors.

Europe benefits from strong regulatory emphasis on ingredient transparency, which drives demand for clean-label and sustainably packaged ice cream. Increasing tourism in Southern Europe boosts artisanal scoop sales, while rising adoption of plant-based diets accelerates the growth of vegan ice cream lines across Western Europe.

Asia-Pacific

Asia-Pacific is the world’s fastest-growing ice cream market, led by China, India, Indonesia, and Japan. Rapid urbanization, expanding cold-chain networks, and rising disposable incomes are enabling millions of new consumers to access modern-format frozen desserts. Premium tubs, yogurt-based desserts, fruit-forward flavors, and novelty sticks are gaining significant traction among younger demographics.

APAC growth is driven by Western flavor adoption, rising penetration of modern retail, and strong dairy production in markets such as India and Australia. China’s booming e-commerce landscape accelerates premium tub sales, while India’s growing middle class is fueling mass-market volume expansion.

Latin America

Latin America showcases rising demand for both value-oriented tubs and indulgent novelty bars. Brazil and Mexico dominate regional consumption due to strong dairy production, expanding retail infrastructure, and youthful consumer demographics. Premium imports and artisanal domestic brands are gaining traction in urban centers.

Growth is supported by expanding cold-chain logistics, rising urban incomes, and increasing penetration of convenience stores. Local flavor innovation, such as fruit-based and dulce de leche profiles, continues to attract younger buyers.

Middle East & Africa

The Middle East & Africa region benefits from consistently warm climates, rising tourism, and strong demand for both value brands and imported premium ice cream. The GCC countries import substantial volumes of novelties and international premium brands, while Africa, led by South Africa, continues to scale up domestic production as cold-chain access improves.

Growth is propelled by expanding modern retail formats, rising hospitality sector investments, and increased availability of cold-storage distribution networks. Premium novelty products gain strong traction in the GCC, while Africa’s widening middle class drives steady long-term demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ice Cream Market

- Unilever

- Nestlé

- Froneri

- General Mills

- Yili Group

- Amul (GCMMF)

- Meiji Holdings

- Lotte Confectionery

- Wells Enterprises

- Blue Bell Creameries

- Danone (frozen dessert lines)

- Ferrero (ice cream division)

- Mengniu

- Havmor / Vadilal (region-specific large players)

- Other prominent artisanal or regional manufacturers

Recent Developments

- In 2025, major ice cream players increased investments in plant-based R&D, launching new oat- and almond-based premium pints to capture flexitarian demand.

- In early 2025, several companies announced expansion of regional production in Asia-Pacific and Latin America, with modular plants and cold-chain partnerships to reduce import dependence and logistics costs.

- Also in 2025, subscription-based DTC models gained traction, with some brands launching monthly flavor boxes for direct-to-consumer customers, improving margins and customer loyalty.