Filament Tapes Market Size

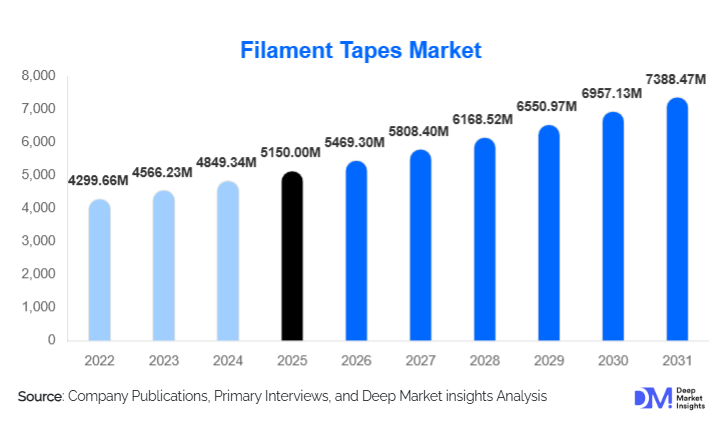

According to Deep Market Insights, the global filament tapes market size was valued at USD 5,150.00 million in 2024 and is projected to grow from USD 5,469.30 million in 2025 to reach USD 7,388.47 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The filament tapes market growth is primarily driven by rising industrialization, increasing logistics and e-commerce activities, technological advancements in adhesives and backing materials, and growing adoption across packaging, automotive, and construction sectors.

Key Market Insights

- Double-sided filament tapes are leading the market globally, favored for industrial assembly, surface bonding, and packaging applications requiring high tensile strength.

- Asia-Pacific dominates the market, with China and India driving demand through industrial expansion and growing export-oriented manufacturing.

- North America remains a key mature market, led by automotive, logistics, and packaging sectors, with increasing automation adoption.

- Technological integration, including high-strength fiber reinforcement, smart adhesives, and eco-friendly formulations, is transforming product differentiation.

- Sustainability trends are encouragingthe adoption of recyclable and low-VOC filament tapes, particularly in Europe and North America.

- Emerging applications in electric vehicles, aerospace, and specialty industrial sectors are creating niche, high-margin opportunities.

What are the latest trends in the filament tapes market?

Eco-Friendly and Sustainable Product Adoption

Manufacturers are increasingly introducing bio-based adhesives, recyclable backings, and solvent-free tapes to meet sustainability goals and regulatory requirements. These products appeal to environmentally conscious logistics and packaging companies, especially in Europe and North America. Adoption of eco-friendly filament tapes not only reduces carbon footprint but also enhances brand perception, creating premium market positioning opportunities. Some manufacturers are embedding life-cycle assessments and eco-certifications into product lines, aligning with corporate ESG strategies.

Smart and Specialty Tapes for Industrial Applications

Filament tapes are evolving beyond traditional bonding and reinforcement. Specialty tapes integrated with RFID tracking, heat-resistant formulations, and high-performance fibers are increasingly used in automotive wiring harnesses, aerospace assembly, and electronics manufacturing. These innovations improve traceability, durability, and operational efficiency. Industries are also exploring smart tapes with sensors that detect tampering, temperature exposure, or stress on secured packages, opening new revenue streams for high-value applications.

What are the key drivers in the filament tapes market?

Growth of Global Logistics and E-Commerce

The expansion of e-commerce and cross-border supply chains is a major growth driver. Filament tapes provide superior carton sealing, strapping, and load containment, reducing shipment damage. Automated fulfillment centers increasingly rely on high-strength tapes, boosting volume consumption. The rise of express delivery networks and last-mile logistics further strengthens demand for high-performance filament tapes.

Industrial Growth and Manufacturing Expansion

Industrial sectors such as automotive, electronics, and construction require durable adhesive solutions for bundling, reinforcement, and temporary fixture applications. Rising industrial output, particularly in the Asia-Pacific, increases the need for filament tapes in assembly lines and component packaging. Government infrastructure projects and private CapEx in factories and warehouses are directly fueling market expansion.

Material and Product Innovation

Advancements in adhesive chemistry and backing materials enhance durability, temperature resistance, and eco-compliance. Acrylic-based adhesives, polypropylene and polyester backings, and hybrid fiber reinforcements are widely adopted due to their performance and versatility. High-performance tapes enable applications in extreme environments, such as aerospace, EV manufacturing, and outdoor packaging.

What are the restraints for the global market?

Raw Material Price Volatility

Price fluctuations for polymer backings (PP, PET) and adhesive resins directly impact manufacturing costs. This affects pricing strategies and margins, especially for mid-tier players without vertically integrated operations. Crude oil price instability adds further uncertainty, occasionally limiting growth in price-sensitive segments.

Substitute Technologies and Alternatives

Alternative solutions such as polyimide tapes, silicone adhesives, and automated strapping systems pose a substitution threat for some industrial applications. High-performance niche requirements may lead industries to select specialty tapes over conventional filament tapes, constraining growth in certain markets.

What are the key opportunities in the filament tapes market?

Emerging Industrial Applications

Electric vehicles, aerospace, and advanced electronics present a growing demand for high-strength, temperature- and chemical-resistant tapes. Manufacturers developing customized solutions for wire harnessing, insulation, and component assembly can capture premium segments.

Regional Industrialization in Asia-Pacific

Rapid manufacturing expansion in China, India, and Southeast Asia drives filament tape adoption. Government initiatives supporting industrial corridors, trade facilitation, and packaging automation create opportunities for local and global producers.

Integration of Sustainable and Smart Products

Eco-friendly formulations and smart tapes with embedded sensors offer differentiation. Sustainability and traceability requirements in Europe and North America provide avenues for high-value product lines and regulatory compliance solutions, giving early adopters a competitive edge.

Product Type Insights

Double-sided filament tapes continue to dominate the global market, accounting for approximately 60% of total revenue in 2024. Their high utility in industrial bonding, packaging reinforcement, and surface assembly applications makes them the preferred choice across automotive, electronics, logistics, and construction sectors. The compatibility of double-sided tapes with automated application processes and conveyor systems further enhances operational efficiency, reducing labor costs and improving throughput in large-scale manufacturing and warehouse environments. Additionally, advancements in adhesive formulations and backing materials have expanded their application into specialty sectors such as aerospace insulation, EV component assembly, and high-strength industrial strapping.

Single-sided filament tapes maintain steady adoption, primarily for standard strapping, bundling, and carton sealing applications where cost efficiency is a key consideration. While they hold a smaller market share relative to double-sided tapes, their ease of use, adaptability in manual operations, and lower production costs ensure continued relevance in traditional packaging, shipping, and small-to-medium industrial operations. Market trends indicate that single-sided tapes are increasingly enhanced with higher tensile strength and eco-friendly adhesives to maintain competitiveness, especially in regions with sustainability mandates such as Europe and North America.

Application Insights

Carton sealing is the leading application, representing roughly 35% of global market value in 2024. Growth is primarily driven by the exponential rise in e-commerce, rapid expansion of third-party logistics (3PL) services, and increasing export packaging requirements. Filament tapes provide superior tensile strength, tear resistance, and load retention compared to conventional adhesive tapes, ensuring safe shipment of heavier goods across global supply chains.

Other key applications include bundling, surface protection, and reinforcement, which are witnessing steady adoption, particularly in automotive, electronics, and construction sectors. For instance, bundling applications are growing alongside increasing EV production, where tapes are used for wire harness stabilization and temporary assembly support. Surface protection tapes are increasingly utilized during industrial painting, metal fabrication, and delicate component handling. Reinforcement applications, such as pallet stabilization and heavy carton sealing, remain essential for logistics-heavy economies.

End-Use Insights

The logistics & shipping sector continues to dominate demand, accounting for roughly 32% of the 2024 global market. This is driven by the rapid growth of e-commerce, cross-border trade, and the proliferation of automated warehousing solutions. Filament tapes are preferred in this segment for their high tensile strength, consistent adhesion, and reliability in high-volume shipping operations. The packaging sector ranks closely, with growth fueled by the expansion of consumer goods, industrial goods, and cold-chain logistics. Filament tapes provide secure carton sealing, load reinforcement, and bundling solutions essential for maintaining product integrity during transit. The industrial manufacturing segment also represents a significant end-use category, encompassing automotive, electronics, aerospace, and heavy machinery industries, where filament tapes are applied in assembly lines, surface protection, and component reinforcement.

The automotive and electronics segments are the fastest-growing end uses due to increasing adoption of electric vehicles, automated manufacturing processes, and high-precision electronics assembly. Export-driven economies such as China, the U.S., and Germany further amplify demand through robust supply chains, large-scale warehousing, and advanced logistics infrastructure. The shift towards automated packaging and smart tape solutions, including temperature-resistant and sensor-integrated tapes, is expected to sustain end-use sector growth over the forecast period.

| By Product Type | By Application | By End-Use |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest regional market, accounting for approximately 40% of global revenue in 2024. China (20%) and India (7–8%) lead adoption due to rapid industrialization, infrastructure development, and the proliferation of export-oriented manufacturing hubs. Drivers include growth in e-commerce logistics, increased automotive and electronics production, and government-led initiatives promoting industrial parks and smart manufacturing zones. Emerging economies such as Vietnam and Indonesia are registering the fastest growth, supported by expanding industrial corridors, increasing warehousing capacities, and rising consumer goods export volumes. The region’s strong focus on automation, low-cost manufacturing, and supply chain optimization further accelerates filament tape demand.

North America

North America represents roughly 26% of the global market, with the U.S. being the largest contributor. Demand is driven by established automotive, logistics, and packaging sectors. Key drivers include widespread adoption of automated packaging lines, industrial consolidation, and investment in sustainable and high-performance tape products. The rise of e-commerce fulfillment centers, cold-chain logistics, and high-value shipments further supports filament tape consumption. Additionally, regulations promoting eco-friendly adhesives and recyclable backing materials are driving growth in premium and specialty segments.

Europe

Europe accounts for approximately 20% of global demand, led by Germany, France, and the U.K. Growth drivers include stringent packaging standards, widespread adoption of sustainable and eco-certified filament tapes, and strong manufacturing and export bases in automotive, aerospace, and electronics sectors. Investments in industrial automation, robotics, and warehouse optimization are increasing the need for high-strength, reliable tapes. The growing focus on environmental compliance, low-VOC adhesives, and recyclable backings is further boosting the adoption of advanced filament tape solutions.

Latin America

Latin America (7%) shows steady growth, primarily in Brazil and Mexico, driven by packaging and industrial applications in export logistics. Regional growth is supported by increasing cross-border trade, rising adoption of e-commerce logistics, and expanding manufacturing sectors. Local manufacturers and logistics operators are gradually investing in higher-performance filament tapes to improve packaging efficiency, reduce product damage during transit, and support export growth.

Middle East & Africa

This region (5%) sees modest demand, led by the UAE, Saudi Arabia, and South Africa, with growth primarily in construction, industrial manufacturing, and logistics sectors. Drivers include government investment in infrastructure and industrial modernization, expanding intra-regional trade, and rising adoption of high-strength packaging solutions to support export-oriented manufacturing. Increasing demand from construction and heavy industry applications, combined with logistics upgrades in Gulf ports, is expected to gradually expand the filament tapes market in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Filament Tapes Market

- 3M

- Tesa SE

- Intertape Polymer Group

- Avery Dennison

- Scapa Group

- Berry Global

- Saint-Gobain Performance Plastics

- Sekisui Chemical

- Shurtape Technologies

- Canadian Technical Tape Ltd.

- PPM Industries S.p.A.

- Cosmos Tapes & Labels Pvt. Ltd.

- Euro Tapes Pvt. Ltd.

- Pro Tapes & Specialties Inc.

- Yongguan Adhesive Products Co., Ltd.