Fiction Books Market Size

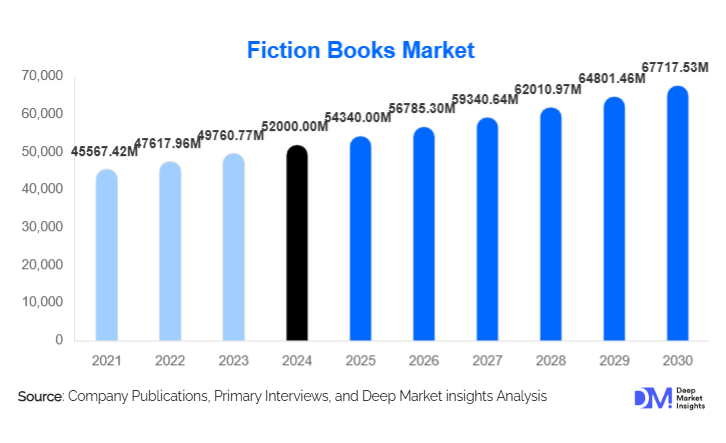

According to Deep Market Insights, the global fiction books market size was valued at USD 52,000.00 million in 2024 and is projected to grow from USD 54,340.00 million in 2025 to reach USD 67,717.53 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The fiction books market growth is supported by the enduring cultural relevance of storytelling, rising demand for digital reading formats, and the increasing monetization of fiction intellectual property across film, streaming, and gaming industries.

Key Market Insights

- Romance and mystery fiction dominate global demand, driven by high repeat readership and strong performance across both print and digital formats.

- Printed fiction books remain the largest revenue contributor, supported by gifting culture, collector editions, and physical retail presence.

- Digital fiction formats, especially audiobooks, are the fastest-growing segment, benefiting from mobile consumption and subscription-based platforms.

- North America leads global revenues, while Asia-Pacific is the fastest-growing regional market.

- Entertainment adaptations of fiction titles are increasingly driving book sales and long-term IP value.

- Direct-to-consumer (D2C) publishing models are reshaping distribution economics and customer engagement.

What are the latest trends in the fiction books market?

Rapid Growth of Audiobooks and Serialized Digital Fiction

Audiobooks and mobile-first serialized fiction are transforming how readers consume stories. Busy lifestyles, improved voice narration technology, and the rise of subscription-based platforms have driven strong audiobook adoption, particularly in North America and Europe. Serialized fiction apps are gaining popularity in the Asia-Pacific region, where episodic storytelling aligns with mobile consumption habits. These formats are expanding readership among younger demographics while creating recurring revenue models for publishers.

Cross-Media Adaptation Driving Book Sales

Film, television, and streaming adaptations of fiction titles are increasingly influencing purchasing behavior. Popular adaptations frequently result in sharp increases in book sales, backlist rediscovery, and global translations. Publishers are prioritizing IP-driven commissioning strategies, focusing on scalable story universes that can be monetized across multiple entertainment platforms, strengthening long-term revenue visibility.

What are the key drivers in the fiction books market?

Resurgence of Reading as Leisure and Wellness

Fiction reading has re-emerged as a preferred leisure and wellness activity, offering mental escape and emotional engagement. Consumers across age groups are increasingly turning to fiction as an alternative to screen-heavy entertainment, supporting steady demand for novels, short stories, and genre fiction. This behavioral shift has reinforced fiction’s role as a resilient content category.

Digital Accessibility and Global Reach

Digital publishing has lowered barriers to access, enabling instant global distribution of fiction content. eBooks and audiobooks allow publishers to reach international audiences without physical logistics, while AI-driven translation tools are accelerating entry into non-English markets. These developments are driving incremental demand from emerging economies.

What are the restraints for the global market?

Pricing Pressure in Digital Formats

Digital fiction formats face persistent pricing pressure due to consumer expectations of low-cost access and subscription-based consumption. Aggressive discounting by online platforms compresses publisher margins and shifts revenue dependence toward high-volume sales, challenging profitability for smaller and mid-sized publishers.

Content Saturation and Discoverability Challenges

The rise of self-publishing and digital platforms has significantly increased content volume, making discoverability a major challenge. Marketing costs and algorithm-driven visibility increasingly influence success, creating barriers for new authors and limiting organic market entry despite growing overall demand.

What are the key opportunities in the fiction books industry?

Regional Language and Local Author Expansion

Demand for fiction in regional and native languages is expanding rapidly, particularly in the Asia-Pacific, Latin America, and parts of Africa. Governments and cultural institutions promoting local literature are supporting this growth. Publishers investing in localized storytelling, indigenous authors, and culturally relevant narratives can unlock substantial untapped market potential.

Direct-to-Consumer and Community-Led Publishing Models

D2C sales models allow publishers to build stronger reader relationships, capture first-party data, and improve margins. Community-driven platforms, crowdfunding-based publishing, and subscription fan communities are emerging as viable alternatives to traditional retail-heavy models, particularly for genre fiction and niche audiences.

Genre Insights

Romance fiction leads the global market, accounting for approximately 27% of 2024 revenues, driven by high publication volumes and strong digital adoption. Mystery and crime fiction follow closely, supported by a loyal readership and frequent series releases. Science fiction and fantasy continue to gain popularity, particularly among younger audiences and through adaptation-driven visibility. Children’s and young adult fiction remain stable contributors, supported by educational demand and parental purchasing behavior.

Format Insights

Printed fiction books account for nearly 62% of global revenues, supported by hardcover and paperback sales. eBooks represent a mature but steady segment, while audiobooks, holding roughly 11% market share, are the fastest-growing format. Collector editions and illustrated fiction are supporting premium pricing within print formats.

Distribution Channel Insights

Online channels contribute approximately 44% of global fiction book sales, driven by e-commerce platforms, subscription services, and publisher D2C websites. Offline bookstores remain important for discovery, gifting, and impulse purchases, particularly in developed markets. Subscription-based reading platforms are emerging as influential channels for digital fiction consumption.

End-Use Insights

Individual consumer accounts for over 85% of the total demand. Libraries and educational institutions provide stable institutional demand, particularly for children’s and literary fiction. Entertainment adaptation represents a high-growth indirect end-use, with fiction content increasingly serving as source material for films, series, and interactive media.

| By Genre | By Format | By Distribution Channel | By Target Audience |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global fiction books market, led by the United States. High disposable income, strong digital adoption, and a mature publishing ecosystem support steady demand across print, e-books, and audiobooks. Subscription-based audiobook platforms and strong performance of genre fiction, particularly romance, fantasy, and crime, continue to reinforce regional market stability.

Europe

Europe accounts for roughly 26% of global revenues, with the U.K., Germany, and France as key markets. Demand is supported by a deep-rooted reading culture, strong independent publishing networks, and well-developed public library systems. Literary fiction, historical novels, and translated works maintain consistent traction across both physical and digital channels.

Asia-Pacific

Asia-Pacific represents about 29% of the market and is the fastest-growing region, with a CAGR exceeding 6.5%. China, India, Japan, and South Korea drive expansion through mobile-first reading platforms, serialized digital fiction, and rising regional-language publishing. Increasing middle-class consumption and younger reader demographics further support sustained growth.

Latin America

Latin America contributes approximately 7% of global demand, led by Brazil and Mexico. Growth is supported by improving digital infrastructure, wider smartphone penetration, and increasing availability of affordable e-books. Young adult fiction, fantasy, and translated international titles are key demand drivers across urban markets.

Middle East & Africa

The Middle East & Africa region accounts for nearly 6% of the market, with rising demand in the UAE, Saudi Arabia, and South Africa. Government-backed literacy programs, education investments, and growing digital publishing platforms are expanding access to fiction content. English and Arabic-language fiction continue to see gradual but consistent uptake.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fiction Books Market

- Penguin Random House

- HarperCollins

- Hachette Livre

- Macmillan Publishers

- Simon & Schuster

- Scholastic Corporation

- Kodansha

- Shogakukan

- Shueisha

- Egmont Group

- Pan Macmillan

- Bloomsbury Publishing

- China Publishing Group

- Kadokawa Corporation

- Grupo Planeta

Recent Developments

- In April 2025, Penguin Random House announced new global fiction releases supported by simultaneous print, e-book, and audiobook launches, reflecting evolving consumption habits.