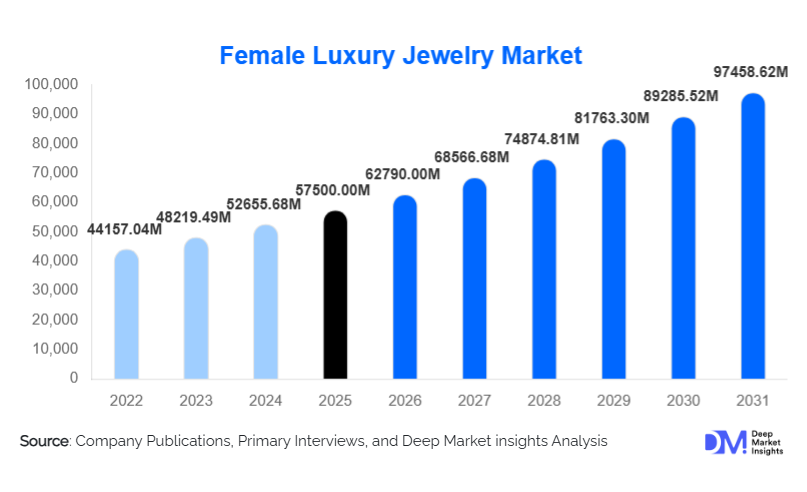

Female Luxury Jewelry Market Size

According to Deep Market Insights, the global female luxury jewelry market size was valued at USD 57500 million in 2025 and is projected to grow from USD 62790 million in 2026 to reach USD 97458.62 million by 2031, expanding at a CAGR of 9.2% during the forecast period (2026–2031). The market growth is primarily driven by increasing disposable incomes among female consumers, rising adoption of digital luxury channels, and growing demand for bespoke, ethically sourced, and culturally significant jewelry.

Key Market Insights

- Necklaces and gold jewelry dominate the market, reflecting cultural significance, investment value, and fashion visibility.

- Premium luxury tier remains the largest revenue contributor, accounting for nearly 40% of market value, as high-net-worth female consumers seek exclusive, high-carat pieces.

- Asia Pacific is the fastest-growing region, led by China, India, and Southeast Asia, due to rising affluence and bridal/ceremonial demand.

- Offline retail continues to dominate, but online channels are rapidly expanding, leveraging AR/VR customization tools and digital showrooms.

- Ethical sourcing and sustainable luxury practices are emerging as critical differentiators for brand preference among younger female consumers.

- Luxury collaborations and lifestyle integrations, such as fashion and wedding partnerships, are reshaping consumer engagement and driving incremental sales.

What are the latest trends in the female luxury jewelry market?

Digital Customization and Omni-Channel Retail

Luxury jewelry brands are increasingly investing in digital technologies to enhance personalization and customer engagement. Virtual try-ons, online configurators, and AI-driven recommendations allow female consumers to design bespoke necklaces, rings, and bracelets from anywhere in the world. This trend is particularly popular among younger, affluent women who prioritize uniqueness and convenience. Omni-channel strategies combining flagship boutiques with seamless digital interfaces have strengthened brand loyalty and increased average purchase value.

Ethical and Sustainable Luxury

Consumers are now seeking jewelry that aligns with ethical and sustainable principles. Demand for conflict-free diamonds, recycled gold, and traceable gemstones is rising. Luxury brands are responding by embedding blockchain provenance, certification labels, and transparent sourcing initiatives into their collections. This enhances brand trust, attracts environmentally conscious consumers, and allows companies to charge premium pricing for responsibly sourced jewelry.

What are the key drivers in the female luxury jewelry market?

Rising Affluent Female Consumer Base

The growth of high-net-worth female consumers globally, particularly in the Asia Pacific and the Middle East, is driving demand for luxury jewelry. Increased disposable income allows women to purchase high-value pieces as self-expression, gifts, or investments. Bridal and gifting demand further amplifies the market, with necklaces, gold jewelry, and high-carat rings being particularly sought after. Wealth accumulation among Millennials and Gen Z women has accelerated digital purchases, enabling brands to target new segments effectively.

Experiential and Emotional Purchasing

Luxury jewelry purchases are often tied to personal milestones, ceremonies, and celebrations. Brands that provide emotional storytelling, heritage-backed collections, and personalized shopping experiences are outperforming competitors. Exclusive services such as private showrooms, bespoke designs, and customization events encourage repeat purchases and premium spending among female consumers.

Technology Adoption in Retail and Marketing

The integration of AR, VR, and AI in online and offline channels is transforming the shopping experience. Customers can virtually try on rings, bracelets, and necklaces, receive AI-based style recommendations, and interact with virtual sales assistants. These innovations are particularly impactful for tech-savvy women seeking convenience, personalization, and immersive luxury experiences, expanding the addressable market beyond physical boutique reach.

What are the restraints for the global market?

Price Sensitivity Amid Economic Uncertainty

Despite luxury positioning, high retail prices and precious metal cost fluctuations can restrain purchase behavior. During economic slowdowns or periods of inflation, discretionary spending on luxury jewelry may decline, particularly for high-ticket premium items. This limits market expansion in price-sensitive regions or among emerging affluent segments.

Supply Chain and Ethical Compliance Challenges

Luxury jewelry production faces scrutiny over gemstone provenance, environmental impacts of mining, and responsible sourcing. Non-compliance with ethical standards or regulatory requirements can negatively affect brand reputation and sales. Investments in traceability, responsible sourcing, and supply chain transparency are costly and can constrain operational flexibility, posing a restraint to broader market growth.

What are the key opportunities in the female luxury jewelry industry?

Expansion into Emerging Affluent Markets

Rapidly growing HNW female populations in China, India, Southeast Asia, and GCC countries create significant opportunities for luxury jewelry brands. Cultural traditions such as bridal jewelry purchases and gifting ceremonies further boost demand. Establishing physical stores, targeted marketing campaigns, and e-commerce strategies in these regions can generate substantial revenue growth.

Integration with Digital and Lifestyle Platforms

Luxury jewelry can leverage digital channels and collaborations with fashion, wedding, and lifestyle brands. Online bespoke configurators, AR/VR virtual try-ons, and influencer marketing help brands engage with younger consumers. Lifestyle collaborations, including limited-edition collections, fashion week tie-ins, and celebrity endorsements,s strengthen brand visibility and drive aspirational purchases.

Ethical, Sustainable, and Customized Jewelry

Brands focusing on sustainability, conflict-free diamonds, and recycled precious metals can capture growing consumer interest. Customized and heritage-inspired designs, particularly in bridal jewelry, are highly appealing. Blockchain-based traceability and ethical sourcing initiatives offer opportunities for differentiation and premium pricing.

Product Type Insights

Among product types, necklaces continue to dominate the global female luxury jewelry market, capturing approximately 30% of the 2024 market value. This dominance is driven by their high visibility, fashion relevance, gifting significance, and versatility across occasions. Necklaces are often considered centerpiece jewelry for celebrations, bridal ceremonies, and milestone gifting, making them a preferred investment and style statement for affluent women. Rings and earrings follow closely, supported by increasing personalization trends, digital customization options, and social media-driven fashion adoption. Bracelets and bangles are experiencing steady growth, particularly in regions with cultural jewelry traditions, such as India and the Middle East, and among consumers seeking mix-and-match fashion pieces. Luxury watches for women are a rising sub-segment, blending functional utility with aesthetic appeal, and appealing to high-net-worth consumers seeking both investment value and style. Bridal jewelry, especially in APAC and MEA, drives seasonal demand spikes due to weddings, cultural festivals, and ceremonial gifting, further reinforcing the leadership of necklaces and high-end jewelry in overall market value. The strong brand loyalty, customization capabilities, and status-symbol perception continue to reinforce the growth of this segment globally.

Application Insights

Bridal and gifting applications remain the largest revenue contributors, representing nearly 50% of total market demand, with India, China, and the Gulf countries being the most significant contributors.The growing integration of luxury jewelry with premium bridal wear collections is further boosting demand, as brides increasingly seek coordinated, high-end ensembles for weddings and ceremonies. These markets value high-carat, culturally relevant jewelry for weddings, engagements, and milestone celebrations. Personal self-purchase is rising among affluent female consumers, driven by a desire for self-expression, exclusivity, and social signaling, particularly in North America and Europe. Collectible and investment-grade pieces, such as high-carat diamonds and bespoke heritage designs, are increasingly sought by HNW individuals globally. Additionally, occasional cultural, ceremonial, and festival-driven purchases supplement steady demand, particularly in APAC and MEA. The integration of online platforms and digital marketing has introduced new use cases, including virtual gifting, personalized design services, and investment-focused jewelry purchases, allowing brands to tap into a wider, tech-savvy female consumer base.

Distribution Channel Insights

Offline retail remains the primary distribution channel, accounting for approximately 60% of global sales. Flagship stores and high-end boutiques provide tactile and immersive experiences that build trust, reinforce brand heritage, and drive high-value purchases. Online channels, including brand e-commerce platforms and luxury marketplaces, are expanding at two-to-three times the rate of offline growth. Drivers for online expansion include younger female consumers’ preference for convenience, customization, and AR/VR-enabled virtual try-ons, AI-powered recommendations, and real-time configurators. The combination of offline experiential touchpoints and online convenience continues to shape the omni-channel growth strategy of leading luxury brands.

Consumer Insights

Demand for female luxury jewelry is highest among self-purchasing consumers and gifting purchasers. Millennials and Gen Z women are the primary drivers of growth in digital channels and customization services, valuing unique designs and interactive purchasing experiences. High-net-worth older demographics prioritize premium, bespoke, and heritage collections. Bridal and ceremonial demand maintains regional peaks, particularly in APAC and MEA, while corporate gifting and collectible jewelry segments provide incremental volume. This multi-layered consumer base ensures diversified demand drivers and continuous growth for the market across regions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents approximately 26% of the global market, led by the U.S. and Canada. Strong brand awareness, high disposable incomes among female consumers, and a well-established gifting culture underpin demand. Premium and high-luxury tiers dominate the market, while digital adoption is driving growth in online purchases. Key drivers include status-driven self-purchase trends, gifting traditions for anniversaries and milestones, and increasing customization via online platforms. North American consumers are also attracted to heritage brands and sustainable luxury, which further supports demand for ethically sourced, high-end jewelry.

Europe

Europe accounts for roughly 24% of market value, with France, Italy, Switzerland, and Germany as the primary hubs. Demand is driven by heritage luxury brands, high tourist inflows, and ethical sourcing preferences. Experiential and sustainable luxury adoption is particularly high among younger demographics, while traditional buyers continue to value craftsmanship and exclusivity. Drivers for growth include tourism-driven purchases, strong brand loyalty, and rising interest in ethically sourced, premium jewelry. High disposable income and cultural appreciation for design and artistry also support consistent consumption in this mature market.

Asia-Pacific

APAC is the fastest-growing region, capturing approximately 36% of global market value. China and India lead due to increasing affluence, the deep cultural significance of bridal jewelry, and expanding luxury retail infrastructure. Southeast Asia contributes through emerging HNW segments and fashion-conscious Millennials. Key growth drivers include rapid urbanization, strong bridal and ceremonial jewelry demand, rising self-purchase trends among affluent women, and digital luxury adoption through AR/VR and online customization platforms. Government initiatives promoting domestic luxury retail, growing tourism, and high exposure to global luxury campaigns further amplify regional growth potential.

Latin America

Latin America represents approximately 7% of market share, with Brazil and Mexico as key contributors. Demand is supported by outbound luxury purchases to Europe and the U.S., complemented by domestic HNW female consumers seeking bespoke and statement jewelry pieces. Growth drivers include increasing exposure to international fashion trends, growing urban affluence, and expansion of luxury retail channels. Younger, digitally savvy consumers are further fueling online sales, particularly in customization and mid-range luxury jewelry.

Middle East & Africa

MEA accounts for about 7% of global market value, with the UAE, Saudi Arabia, and Qatar leading demand. Growth is underpinned by high disposable incomes, a cultural preference for gold and high-carat jewelry, and tourism-driven luxury consumption. The region’s fastest-growing segment is bridal and ceremonial jewelry, fueled by weddings and festivals. Additional drivers include government-supported luxury retail infrastructure, high-gifting culture, digital adoption of luxury platforms, and tourism-driven retail traffic. The UAE market is projected to grow at above 10% CAGR through 2030, highlighting strong regional potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Female Luxury Jewelry Market

- Richemont

- LVMH

- Tiffany & Co.

- Bulgari

- Chanel

- Harry Winston

- Van Cleef & Arpels

- Chopard

- Mikimoto

- Graff

- Buccellati

- Messika

- David Yurman

- Pomellato

- De Beers Jewellers