Female Condoms Market Size

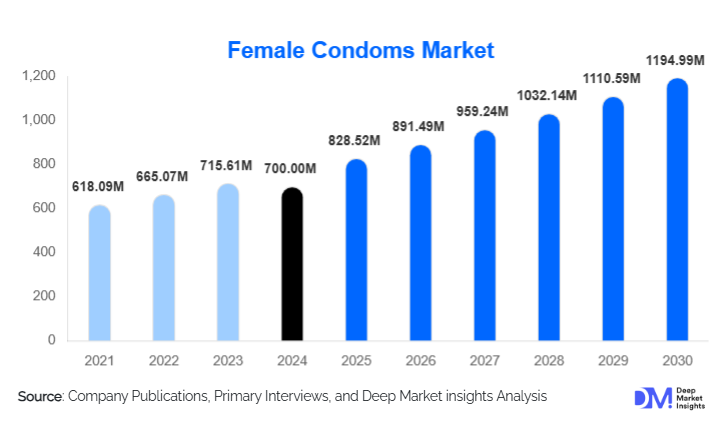

According to Deep Market Insights, the global female condoms market size was valued at USD 770.00 million in 2024 and is projected to grow from USD 828.52 million in 2025 to reach USD 1,194.99 million by 2030, expanding at a CAGR of 7.6% during the forecast period (2025–2030). The female condoms market growth is primarily driven by rising emphasis on women-controlled contraception, increasing STI/HIV prevention initiatives, expanding public-health procurement, and rapid improvements in product materials and comfort.

Key Market Insights

- Global health programs and NGOs are significantly scaling institutional procurement of female condoms, strengthening supply chains in Africa, APAC, and Latin America.

- Material innovationespecially polyisoprene and nitrile condomscontinues to improve comfort and user acceptance, promoting wider adoption.

- E-commerce is becoming the fastest-growing distribution channel, driven by rising demand for privacy, convenience, and direct-to-consumer brand models.

- APAC leads the global market share, fueled by population growth, increasing sexual health awareness, and expanding retail penetration.

- MEA (particularly Sub-Saharan Africa) remains the fastest-growing region due to strong HIV/STI prevention programs and donor-funded public-health initiatives.

- Unit prices remain structurally higher than male condoms, but manufacturing upgrades and volume procurement are slowly reducing costs.

What are the latest trends in the female condoms market?

Public-Health–Synchronized Procurement & Distribution

Global health organizations and national governments are integrating female condoms into HIV/STI prevention frameworks and family planning initiatives. Large-scale bulk procurement and subsidized distribution through clinics, community health workers, and outreach programs are accelerating adoption across Africa, South Asia, and Latin America. Female condoms are increasingly positioned as dual-protection toolspreventing both unintended pregnancies and sexually transmitted infections. Public-sector procurement is encouraging manufacturers to scale production efficiently, stabilize pricing, and innovate toward durable, more comfortable materials.

Product Material Enhancements & Comfort-Oriented Design Improvements

Modern female condoms are transitioning from polyurethane to softer, more elastic polyisoprene and nitrile. Newer generations reduce noise, enhance lubrication, and offer ergonomic designs that improve sexual comfort and ease of insertion. Design upgradessuch as contoured shapes, softer outer rings, and integrated insertion aidsare addressing historical user pain points. These advancements are reducing resistance among first-time users, improving partner acceptance, and expanding overall consumer confidence. Manufacturers are also testing ultra-thin variants and bio-based materials.

What are the key drivers in the female condoms market?

Growing Global Awareness of STIs & Dual-Protection Demand

Rising global incidence of sexually transmitted infections and public-health emphasis on HIV prevention are major drivers of female condom adoption. For public-health agencies, female condoms represent a unique woman-controlled barrier method, especially in contexts where male condom negotiation is difficult. As family-planning and prevention campaigns intensify across Africa and Asia, female condoms are gaining visibility as essential low-cost health tools. Dual protection contraception plus STI prevention amplifying demand across both institutional and retail channels.

Women’s Empowerment & Rising Control Over Sexual Health Choices

Growing advocacy for women’s reproductive rights and autonomy is directly influencing contraceptive behavior. Female condoms empower women with control over protection, reducing dependence on male cooperation. Changing social norms, urbanization, higher literacy, and rising workforce participation among womenespecially in APAC and Latin Americaare accelerating acceptance. Young urban women represent a rapidly growing consumer segment, actively purchasing through pharmacies and online platforms.

Distribution Expansion Through E-Commerce & Community Health Systems

Online retail has revolutionized accessibility by providing privacy, discretion, and instant doorstep deliverycritical in regions where buying condoms publicly is stigmatized. Simultaneously, community health workers, rural clinics, and NGO-supported outreach programs ensure last-mile penetration in underserved regions. This dual-channel expansion is broadening the user base across both developed and emerging markets.

What are the restraints for the global market?

High Unit Cost Compared to Male Condoms

Female condoms remain significantly more expensive to produce due to material requirements, specialized molding processes, and lower economies of scale. Higher retail prices limit uptake in cost-sensitive markets. Public-health programs face budget constraints, reducing large-volume procurement potential. This price disparity remains the most persistent barrier to widespread adoption.

Limited Awareness, Cultural Stigma & Partner Resistance

Many potential users lack basic knowledge of how to use female condoms correctly. Social stigma surrounding female-led contraception, cultural taboos around women purchasing condoms, and resistance among male partners hinder growth. In conservative societies, awareness campaigns remain insufficient to overcome entrenched attitudes, keeping usage levels relatively low.

What are the key opportunities in the female condoms industry?

Government-Backed STI/HIV Prevention Programs

Countries with high HIV prevalenceparticularly in Sub-Saharan Africa and parts of Southeast Asiaare rapidly expanding procurement of female condoms as essential public-health tools. Governments and NGOs are integrating female condoms into reproductive-health clinics, community outreach, and national HIV/AIDS strategies. This creates large-volume, long-term procurement contracts for manufacturers and strengthens global supply stability.

Social Attitude Transformation & Women-Centric Sexual Wellness

As societies increasingly normalize female sexuality and reproductive autonomy, demand for women-controlled contraceptives is rising. Brands promoting empowerment-driven marketing centered on consent, control, comfort, and gender equality are capturing younger demographics. The global sexual-wellness industry’s shift toward inclusivity and female-centered product development further elevates market visibility.

Technological Innovation in Materials & Scalable Manufacturing

Material innovations such as ultra-thin polyisoprene, nitrile advancements, softer rings, and ergonomic design evolution are improving acceptability. As manufacturing automation increases, per-unit costs are expected to decline. Companies investing in R&D can differentiate themselves in a market historically underserved by innovation. Lower pricing combined with better comfort performance will unlock penetration in retail markets and increase public-sector tender competitiveness.

Product Type Insights

Standard single-use female condoms dominate global demand, accounting for approximately 70–80% of the 2024 market value. Their leadership stems from broad public-health procurement, lower per-unit pricing relative to flavored or ultra-thin variants, and superior availability through clinics and NGOs. Enhanced comfort versions, including slimmer and scented condoms, are growing in urban retail channels but remain niche. Reusable variants are limited to specialized pilot programs in select low-income markets.

Application Insights

Dual-protection usagepreventing both pregnancy and STIsremains the primary application globally, representing roughly 60–70% of 2024 usage. Public-health institutions prioritize this positioning to maximize protective impact, particularly in high-HIV regions. STI-prevention-driven demand is growing fastest within clinics and outreach programs, while contraception-focused usage is expanding within e-commerce and pharmacy retail segments. Sexual-wellness–oriented use cases, emphasizing empowerment and comfort, are emerging among younger urban consumers in APAC, Europe, and North America.

Distribution Channel Insights

Institutional/public-health procurement accounts for 45–55% of global distribution in 2024, driven by large-scale government and NGO programs. E-commerce is the fastest-growing channel, benefiting from consumer privacy needs and rising digital literacy. Retail pharmacies remain essential for urban consumers, while clinics and sexual health centers dominate counseling-led distribution. Hybrid distributioncombining online presence with community-based outreach increasingly used by NGOs to expand reach.

End-User Insights

Public-health programs represent approximately 50–60% of total demand, owing to widespread use in HIV/STI prevention initiatives. Individual consumers are the fastest-growing end-user segment, especially in India, China, the U.S., and EU markets. Clinics and sexual health centers contribute a steady share, integrating female condoms into contraceptive counseling and post-test consultations. Export-driven demandparticularly from APAC manufacturing hubs to African public-health programs rising rapidly due to large-scale tenders and donor-supported procurement.

Age Group Insights

Women aged 25–40 represent the highest adoption segment due to higher sexual-health awareness and proactive contraception choices. Younger demographics (18–25) are increasingly purchasing through online channels, driven by privacy, empowerment, and digital marketing. Women aged 40+ remain active users in healthcare settings, particularly in STI-prevention-focused programs. Older consumers show increased interest in comfortable, well-lubricated variants to address menopausal sexual-health needs.

| By Material Type | By Product Type | By Distribution Channel | By End User | By Use Case |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

APAC holds the largest regional share (35–45% of 2024 revenue), driven by rising sexual health awareness, dense population, and expanding retail penetration. India and China lead consumption, with growing government-led awareness programs and improved online availability. Southeast Asia (Indonesia, Thailand, Vietnam) is experiencing strong adoption due to active public-health communications and youth-driven demand for discreet purchasing via e-commerce.

North America

North America contributes 15–20% of the global market value. The U.S. leads demand through pharmacies, sexual wellness brands, and digital retail platforms. High STI awareness, supportive health services, and growing female empowerment movements support steady adoption. Canada follows with strong clinic-led distribution.

Europe

Europe captures 10–15% of the market, with the U.K., Germany, and France being major contributors. High-quality sexual health education, widespread retail availability, and a preference for sustainable, women-centered contraceptives fuel growth. European consumers show a strong preference for premium materials and comfort-oriented designs.

Latin America

LATAM accounts for about 5–10% of global demand. Brazil and Mexico lead usage through clinic-based distribution and rising retail presence. Public-health programs in Argentina, Colombia, and Peru are expanding female condom integration into reproductive health initiatives, albeit at moderate penetration levels.

Middle East & Africa

especially Sub-Saharan Africa is the fastest-growing region, driven by high HIV prevalence and international donor-funded distribution programs. South Africa, Kenya, Tanzania, Nigeria, and Uganda are key demand centers. Affordability efforts, NGO-led education, and large-scale tenders are facilitating adoption despite social stigma and awareness gaps.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Female Condoms Market

- Veru Inc.

- Cupid Limited

- LifeStyles Healthcare

- Karex Berhad

- Okamoto Industries

- Mayer Laboratories

- Wink Inc.

- The Female Health Company

- Reckitt Benckiser Group

- Lelo

- RISCO

- HLL Lifecare (India)

- Thai Nippon Rubber

- INNOVATIVE Condoms (Asia)

- PATH (programmatic facilitator)

Recent Developments

- In March 2025, Cupid Limited announced capacity expansion for polyisoprene female condom production to meet rising procurement demand from African health agencies.

- In January 2025, Veru Inc. introduced a next-generation female condom with ultra-soft nitrile technology designed to enhance comfort and reduce noise.

- In October 2024, LifeStyles Healthcare launched a digital awareness campaign across India and the Philippines, promoting women-controlled contraception via e-commerce channels.