Fashion Influencer Marketing Market Size

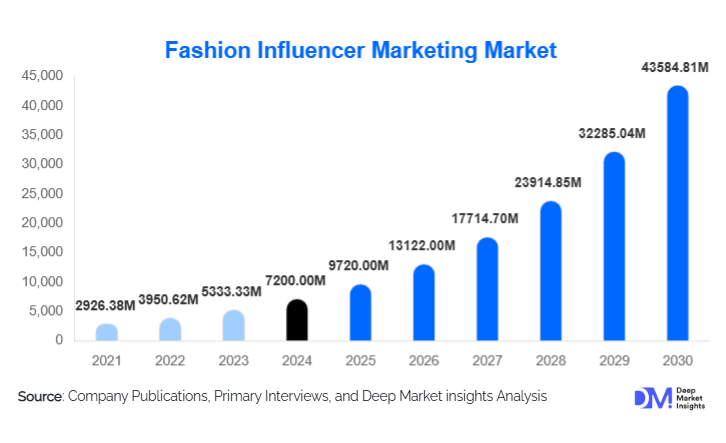

According to Deep Market Insights, the global fashion influencer marketing market size was valued at USD 7,200.00 million in 2024 and is projected to grow from USD 9,720.00 million in 2025 to reach USD 43,584.81 million by 2030, expanding at a CAGR of 35.0% during the forecast period (2025–2030). The market growth is primarily driven by the rapid shift of fashion brands toward digital-first advertising strategies, rising consumer trust in creator-led recommendations, and the integration of social commerce features across major social media platforms.

Key Market Insights

- Micro and nano influencers dominate campaign execution, delivering higher engagement and conversion efficiency compared to celebrity endorsements.

- Instagram remains the leading platform for fashion influencer campaigns, while TikTok is the fastest-growing due to short-form video virality.

- DTC fashion brands account for the largest share of spending, using influencers as core customer acquisition channels.

- Fast fashion and athleisure segments generate the highest demand, supported by rapid trend cycles and frequent product launches.

- Asia-Pacific is the fastest-growing regional market, driven by livestream commerce and mobile-first consumers.

- AI-powered influencer analytics and performance-based pricing models are reshaping campaign ROI measurement.

What are the latest trends in the fashion influencer marketing market?

Short-Form Video and Social Commerce Integration

Short-form video content on platforms such as TikTok and Instagram Reels has become the dominant campaign format in fashion influencer marketing. Brands increasingly combine influencer videos with embedded shopping links, live commerce features, and affiliate tracking, enabling real-time purchasing directly from content. This trend has significantly reduced the gap between product discovery and conversion, improving campaign attribution and ROI transparency.

Rise of Authentic and Niche Influencers

Brands are shifting away from mass-reach celebrity endorsements toward niche micro and nano influencers with highly engaged audiences. These creators are perceived as more authentic and relatable, particularly in sustainable fashion, streetwear, and local fashion segments. Long-term partnerships and brand ambassador programs are replacing one-off sponsored posts, strengthening brand credibility and consistency.

What are the key drivers in the fashion influencer marketing market?

Shift from Traditional Advertising to Creator Economies

Fashion brands are reallocating budgets from print, TV, and display advertising toward influencer-led digital storytelling. Influencers provide higher engagement rates, peer-driven trust, and targeted reach, making them more effective for brand awareness and sales conversion in fashion retail.

Growth of DTC and Digital-Native Fashion Brands

The rapid expansion of DTC fashion brands has accelerated influencer marketing adoption. These brands rely heavily on influencers to build visibility, reduce customer acquisition costs, and compete with established fashion houses. Influencer campaigns offer scalable and performance-driven growth models ideally suited for digital-native businesses.

Platform Innovation and Algorithm Support

Social media platforms are actively prioritizing creator content through algorithms, monetization tools, and shopping integrations. Features such as in-app checkout, livestream shopping, and creator marketplaces are structurally supporting long-term market growth.

What are the restraints for the global market?

Influencer Fraud and Engagement Inflation

The presence of fake followers, inflated engagement metrics, and undisclosed sponsorships poses challenges for brands seeking reliable ROI. While analytics tools are improving detection, fraud risks increase campaign vetting costs and reduce trust in influencer ecosystems.

Regulatory and Disclosure Compliance

Stricter advertising disclosure regulations across the U.S., Europe, and Asia require clear labeling of sponsored content. Compliance increases legal and administrative burdens, particularly for smaller brands and independent influencers, potentially slowing campaign execution.

What are the key opportunities in the fashion influencer marketing industry?

Live Commerce and Creator-Led Sales Channels

Livestream shopping and influencer-hosted sales events represent a major growth opportunity. Successful models in China and Southeast Asia are expanding globally, allowing influencers to function as direct revenue drivers rather than brand promoters alone.

Sustainable and Ethical Fashion Influencing

Growing consumer focus on sustainability is creating strong demand for influencers specializing ethically. Brands aligned with ESG goals can leverage trusted creators to communicate transparency, circular fashion practices, and responsible sourcing.

AI and Data-Driven Campaign Optimization

AI-powered influencer discovery, predictive performance modeling, and real-time attribution tools are enabling outcome-based pricing models. New entrants offering advanced analytics and fraud detection platforms can capture significant value.

Influencer Tier Insights

Micro influencers account for approximately 34% of the 2024 market, leading due to superior engagement rates and cost efficiency. Macro influencers follow with strong brand visibility advantages, while nano influencers are rapidly gaining traction for hyperlocal and community-based campaigns. Mega influencers remain relevant for luxury and global brand launches, but represent a smaller share due to high costs.

Platform Insights

Instagram dominates with nearly 38% market share in 2024, supported by mature shopping tools and visual content formats. TikTok is the fastest-growing platform, driven by algorithmic discovery and short-form video commerce. YouTube remains important for long-form fashion storytelling, while emerging platforms such as Xiaohongshu and Lemon8 are gaining relevance in Asia.

Fashion Category Insights

Fast fashion leads the market with around 29% share, fueled by rapid trend cycles and high influencer collaboration frequency. Luxury fashion emphasizes long-term ambassador partnerships, while athleisure and sustainable fashion are the fastest-growing categories due to lifestyle branding and wellness trends.

End-Use Insights

Apparel brands account for over 55% of total influencer marketing spend, followed by footwear and accessories. Athleisure and sustainable fashion brands are growing at over 15% annually, creating strong downstream demand. Influencer marketing is also expanding into fashion resale platforms and rental fashion services.

| By Influencer Tier | By Platform | By Fashion Category | By Campaign Type | By Brand Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America held approximately 32% of the global market in 2024, led by the U.S., which alone accounted for about 26%. The region benefits from high digital advertising expenditure, a strong direct-to-consumer brand base, and mature influencer marketing infrastructure. Well-established creator agencies, data-driven campaign measurement, and high brand spend per campaign continue to sustain market leadership.

Europe

Europe represented around 24% market share, with the U.K., France, Germany, and Italy leading demand. The market is shaped by sustainability-focused fashion narratives, strong luxury brand influence, and high regulatory awareness around advertising transparency. Established fashion capitals and cross-border brand collaborations further support consistent influencer-led campaigns.

Asia-Pacific

Asia-Pacific accounted for nearly 28% of the market and is the fastest-growing region, expanding at a CAGR above 16%. China, India, South Korea, and Japan drive growth through livestream shopping, short-video platforms, and mobile-first consumer engagement. High social commerce penetration and rapid creator monetization are accelerating regional adoption.

Latin America

Latin America held about 9% market share, led by Brazil and Mexico. Growth is supported by rising social media penetration, increasing influencer credibility among younger consumers, and expanding fashion e-commerce platforms. Local creators play a strong role in brand discovery and regional trend adoption.

Middle East & Africa

The Middle East & Africa accounted for roughly 7% of the market. The UAE and Saudi Arabia lead luxury-focused influencer campaigns, driven by high disposable incomes and premium brand investments. South Africa and Nigeria support regional growth through rapidly expanding digital creator communities and increasing mobile-led engagement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fashion Influencer Marketing Market

- Meta Platforms

- TikTok (ByteDance)

- Google (YouTube)

- LVMH

- Kering

- Inditex

- H&M Group

- Nike

- Adidas

- Shein

- Zalando

- ASOS

- Farfetch

- Boohoo Group

- L’Oréal

Recent Developments

- In March 2025, TikTok expanded its Creator Marketplace with enhanced campaign measurement and conversion tracking tools, allowing fashion brands to directly link influencer activity to sales performance.

- In February 2025, Meta rolled out new branded content controls on Instagram, strengthening disclosure requirements and brand safety features for fashion influencer partnerships.

- In January 2025, L’Oréal announced the expansion of its global influencer and creator program, integrating AI-driven creator selection across its fashion and beauty brand portfolio.