Facial Cleansing Tool Market Size

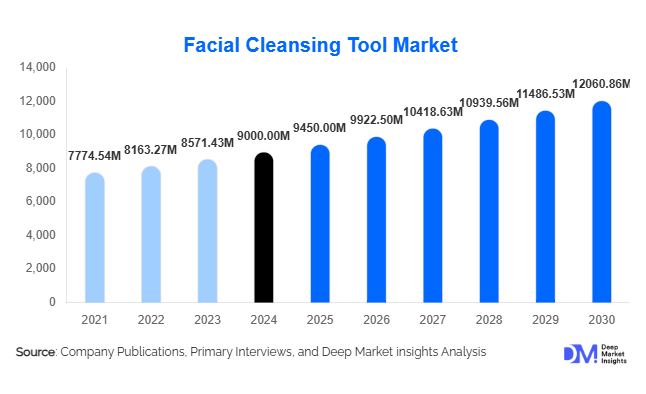

According to Deep Market Insights, the global facial cleansing tool market size was valued at USD 9,000 million in 2024 and is projected to grow from USD 9,450.0 million in 2025 to reach USD 12,060.86 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of skincare routines, rising adoption of advanced and smart skincare devices, and the growing popularity of personalized and eco-friendly cleansing solutions.

Key Market Insights

- Electric facial brushes dominate the market, accounting for 40% of the global market in 2024, due to their deep cleansing efficiency and technological innovations such as sonic vibrations and UV sterilization.

- Online retail channels are becoming the preferred distribution route, holding over 50% of market share in 2024, fueled by convenience, influencer marketing, and product reviews influencing purchase decisions.

- Silicone-based brushes are gaining traction due to their hypoallergenic properties, durability, and ease of cleaning, particularly appealing to consumers with sensitive skin.

- North America is the largest regional market, with approximately 35% share in 2024, driven by high disposable income and strong personal grooming habits.

- Asia-Pacific is the fastest-growing region, with countries such as China and India seeing rising demand from a growing middle class and increasing exposure to skincare trends via social media.

- Technological adoption, including AI-driven skin analysis, IoT-enabled smart brushes, and personalized skincare routines, is reshaping consumer engagement and product differentiation.

Latest Market Trends

Smart and Connected Facial Cleansing Devices

Manufacturers are increasingly integrating AI and IoT into facial cleansing tools. Devices now offer personalized skincare routines, real-time skin assessments, and app connectivity to monitor results. This trend is appealing to tech-savvy millennials and Gen Z consumers who seek efficient, data-driven skincare solutions. The combination of smart technology with traditional cleansing methods has enhanced the perceived value of these products, boosting adoption and fostering brand loyalty.

Sustainability and Eco-Friendly Innovation

Growing consumer awareness of environmental issues is leading to demand for eco-friendly facial cleansing tools. Biodegradable materials, recyclable packaging, and cruelty-free production practices are becoming key differentiators for brands. Companies focusing on sustainable solutions can tap into the environmentally conscious consumer base, driving long-term growth and creating opportunities for product innovation.

Facial Cleansing Tool Market Drivers

Technological Advancements

Innovation in facial cleansing tools, including sonic and pulsating technologies, UV sterilization, and customizable settings, is enhancing product efficiency and consumer appeal. These advancements are making tools more user-friendly, effective, and capable of delivering spa-like experiences at home.

Rising Consumer Awareness

Increased focus on skincare and grooming, especially among millennials and Gen Z, has led to growing adoption of facial cleansing devices. Consumers are seeking effective alternatives to traditional cleansing methods to improve skin health, prevent acne, and enhance product absorption.

Influence of Social Media and Beauty Influencers

Beauty influencers on platforms like Instagram, TikTok, and YouTube are driving product awareness and purchase intent. User-generated content, tutorials, and reviews are increasing visibility and trust, significantly impacting market growth and shaping consumer preferences.

Market Restraints

High Cost of Advanced Devices

Premium facial cleansing tools with smart features remain expensive, limiting penetration among price-sensitive consumers. The high upfront cost can slow adoption in emerging markets despite growing interest.

Lack of Consumer Education

Many consumers are unaware of the proper usage and benefits of facial cleansing tools. Insufficient education on techniques, device compatibility, and routine integration can reduce repeat purchases and limit market expansion.

Facial Cleansing Tool Market Opportunities

Integration of AI and IoT Technology

Smart devices that monitor skin health, suggest personalized routines, and sync with apps represent a major growth opportunity. These products appeal to consumers seeking advanced, data-driven solutions and foster brand differentiation.

Expansion in Emerging Markets

Rising disposable incomes and growing skincare awareness in Asia-Pacific and Latin America present untapped potential. Affordable devices and targeted marketing campaigns can capture new consumers and increase penetration in these regions.

Sustainable and Eco-Friendly Product Offerings

Consumers increasingly prioritize environmentally responsible products. Brands focusing on biodegradable materials, recyclable packaging, and cruelty-free processes can attract eco-conscious buyers and gain a competitive edge.

Product Type Insights

Electric facial brushes lead the market, preferred for their deep cleansing and exfoliation capabilities, holding 40% of market share in 2024. Silicone brushes are gaining preference due to hygiene, ease of cleaning, and suitability for sensitive skin. Manual brushes, though declining in share, remain popular in cost-sensitive segments and emerging markets.

Application Insights

Personal care households drive the largest demand, while commercial applications like beauty salons and spas are growing rapidly. Home-use devices are increasingly replacing professional treatments, reflecting rising self-care trends. Specialized facial cleansing tools targeting acne-prone or sensitive skin are emerging as niche applications.

Distribution Channel Insights

Online retail dominates, accounting for 50%+ of sales due to convenience, online reviews, and influencer-driven marketing. Offline channels, including specialty stores and supermarkets, remain relevant for premium and mid-range products. Subscription-based models and direct-to-consumer platforms are gaining traction for repeat users.

End-Use Insights

The personal care segment leads demand, while beauty salons and spas are rapidly adopting advanced devices. Emerging applications include dermatology clinics and wellness centers offering integrated skin treatments. Export-driven demand is rising from the U.S., Germany, and Japan, with Asia-Pacific acting as both a manufacturing and high-demand region.

| By Product Type / Technology | By Material / Brush Head Type | By Power Source | By End-User / Application | By Distribution Channel | By Skin Type / Consumer Segment |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America leads with a 35% market share in 2024. High disposable incomes, widespread awareness of skincare, and extensive online retail adoption support growth. The U.S. and Canada are major consumers of electric and smart facial cleansing tools.

Europe

Europe holds a significant share, driven by Germany, France, and the U.K., with increasing adoption of eco-friendly and smart devices. Consumers value sustainable and technologically advanced solutions, fueling demand for mid- to premium devices.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India, where rising middle-class incomes and exposure to global beauty trends drive demand. E-commerce penetration and social media influence are accelerating adoption.

Latin America

Brazil and Mexico are emerging markets with steady growth, focusing on affordable devices and mid-range options for urban consumers. Awareness campaigns and influencer marketing are supporting adoption.

Middle East & Africa

Luxury-conscious consumers in the UAE, Saudi Arabia, and South Africa are driving demand for premium devices. Increasing disposable income and grooming trends are promoting market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Facial Cleansing Tool Market

- Procter & Gamble

- Unilever

- Clarisonic

- Foreo

- Philips

- Panasonic

- Beurer

- PMD Beauty

- Vanity Planet

- Clinique

- L’Oréal

- Shiseido

- BaByliss

- Remington

- Kingdom Beauty

Recent Developments

- In March 2025, Foreo launched a new AI-powered facial cleansing device offering personalized skincare routines via mobile app integration.

- In February 2025, Procter & Gamble expanded its Clarisonic range with eco-friendly silicone brushes, responding to growing consumer demand for sustainable products.

- In January 2025, Philips introduced a smart facial cleansing tool featuring UV sterilization and app-based usage tracking, targeting tech-savvy consumers globally.