Face Cream Market Size

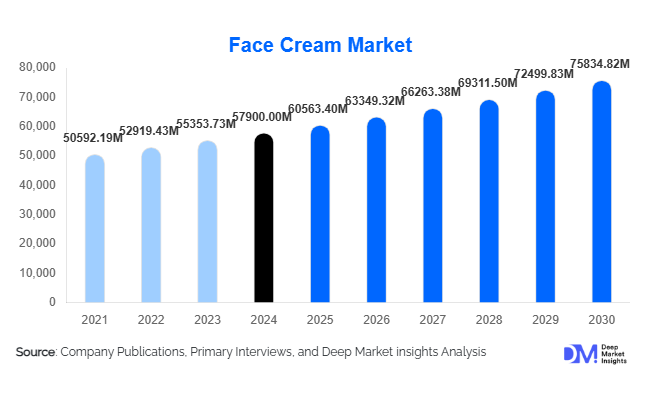

According to Deep Market Insights, the global face cream market size was valued at USD 57,900.00 million in 2024 and is projected to grow from USD 60,563.40 million in 2025 to reach USD 75,834.82 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). The face cream market growth is driven by rising skincare awareness, increasing demand for natural and clean beauty products, rapid expansion of e-commerce channels, and growing consumption of anti-aging, moisturizing, and dermatology-focused formulations across both developed and emerging markets.

Key Market Insights

- Moisturizing and daily-care face creams dominate global demand, accounting for consistent repeat purchases across all demographics.

- E-commerce and direct-to-consumer channels are rapidly transforming sales penetration, enabling personalized skincare and global brand reach.

- Asia-Pacific leads the market, driven by strong consumption in China, India, South Korea, and Southeast Asia.

- North America and Europe represent the most mature and premiumized markets, with strong adoption of anti-aging and dermatologist-backed products.

- Male grooming and sensitive-skin creams are among the fastest-growing segments, reflecting shifts in social norms and dermatological awareness.

- Clean beauty, organic ingredients, and eco-friendly packaging continue to shape brand differentiation and consumer preference.

What are the latest trends in the face cream market?

Natural, Clean, and Organic Face Creams Gaining Strong Traction

The rising global shift toward clean and natural skincare continues to reshape the face cream landscape. Consumers increasingly prefer botanical extracts, plant-based formulations, chemical-free blends, and sustainable packaging, driving brands to reformulate products around transparency and ingredient purity. Organic moisturizing creams, natural anti-aging serums, and dermatologist-approved sensitive-skin formulations are becoming mainstream. Brands are investing in traceable ingredient sourcing, cruelty-free certification, and eco-friendly packaging materials to attract conscious consumers. This trend is especially strong in North America, Europe, and premium segments of Asia-Pacific, where clean-beauty positioning commands considerable pricing power.

Technology-Enabled Personalization in Skincare

Technological advancements are driving a new era of personalized face creams, supported by AI-powered skin analysis, digital diagnostic tools, and personalized formulation engines. Online platforms and apps now allow users to scan their skin conditions and receive customized recommendations based on moisture levels, pigmentation, pores, and texture. Brands are also leveraging machine learning to analyze customer preferences, optimize ingredient selection, and tailor anti-aging or sensitive-skin creams. This digital transformation strengthens customer loyalty, supports premium pricing, and reinforces the shift toward data-backed skincare routines. E-commerce integration, virtual consultations, and automated subscription-based deliveries further elevate convenience for global consumers.

What are the key drivers in the face cream market?

Growing Global Skincare Awareness

Increasing awareness regarding skin health, pollution-related damage, and preventive skincare has significantly boosted demand for face creams across all demographics. Consumers now incorporate daily moisturizers, SPF-infused creams, and anti-aging formulations into their routines to maintain hydration, reduce fine lines, and protect against UV exposure. Younger consumers seek hydration and brightening creams, while aging populations in developed economies drive demand for firming, lifting, and wrinkle-reduction creams, fueling the industry's overall growth trajectory.

Shift Toward Sustainable, Natural & Clean Beauty Products

The clean beauty movement has become a central growth driver, with consumers seeking safe, eco-conscious, and non-toxic skincare solutions. Brands offering natural, organic, chemical-free, and cruelty-free face creams are gaining rapid market adoption. Clean formulations and sustainable packaging, including biodegradable jars, refill pods, and recycled plastics, improve consumer trust and appeal to a rapidly expanding segment that prioritizes ethical beauty consumption. This shift has reshaped R&D investments as companies develop eco-friendly ingredient alternatives.

Expansion of E-commerce & Direct-to-Consumer Channels

The rise of online beauty platforms and direct-to-consumer (DTC) channels has expanded the global reach of face cream brands. E-commerce simplifies price comparison, delivers personalized recommendations, and provides access to global brands across regions. Social media influence, beauty content creators, and online product reviews further enhance consumer awareness and drive digital-first purchase behavior. Subscription services, rapid fulfillment models, and AI-backed custom creams amplify demand, particularly among younger and tech-savvy consumers.

What are the restraints for the global market?

Regulatory Complexity and Ingredient Scrutiny

As consumer awareness grows, regulatory authorities are tightening safety standards for skincare ingredients, preservatives, and labeling. Compliance costs associated with ingredient certification, dermatological testing, and clean-beauty verification can be significant, especially for smaller brands. The lack of globally harmonized regulations for “organic” or “natural” claims creates ambiguity and may lead to consumer distrust when certification is unclear, posing challenges for international expansion.

Intense Competition and Market Saturation

The face cream market is highly fragmented, with global beauty conglomerates, regional manufacturers, niche organic brands, and private labels all vying for share. This saturation results in heavy promotional activity, rapid product launches, and pricing pressure that can reduce margins for mass-market players. In developed markets such as North America and Europe, consumer fatigue due to product overload and oversaturated shelves further restrains growth potential.

What are the key opportunities in the face cream industry?

Growth of Multi-Functional & Hybrid Creams

The demand for all-in-one skincare solutions such as moisturizer + SPF, anti-aging + antioxidant, or skin repair + brightening creams is rapidly rising. Consumers increasingly favor convenience without compromising efficacy, creating a strong opportunity for brands to innovate with multi-functional formulations. Hybrid creams drive higher price points and attract consumers seeking simplified routines, particularly busy professionals, students, and travelers.

Emerging Market Expansion & Regional Customization

Emerging economies such as India, China, Brazil, and Southeast Asia present significant opportunities with their large youth populations, growing disposable incomes, and rapidly modernizing beauty culture. Tailoring formulations for humid climates, pollution-heavy regions, and melanin-rich skin profiles can help brands differentiate. Local production hubs and export opportunities further support cost-efficient scaling across high-growth territories.

Product Type Insights

Moisturizing and daily-care creams dominate the market, accounting for the largest share due to their universal appeal and frequent purchase cycle. These products are used across all age groups and skin types, making them the backbone of the global face cream industry. Anti-aging creams represent the second-largest segment, driven by demand for lifting, firming, and wrinkle-reduction formulations. Specialty treatment creams for acne, pigmentation, and sensitive skin are rapidly growing as consumers increasingly seek targeted dermatological solutions. Hybrid products combining hydration, SPF, brightening, and skin-repair benefits are among the fastest-emerging categories.

Application Insights

Daily moisturizing applications lead global usage, supported by routine skincare habits and climate-related needs. Anti-aging applications demonstrate strong growth, particularly in regions with high aging populations such as Europe and North America. Brightening and pigmentation-care creams remain popular in Asia-Pacific, while acne-care and sensitive-skin creams address rising dermatological concerns among younger consumers. SPF-infused moisturizers and multipurpose daytime creams are achieving widespread adoption, driven by heightened awareness of UV protection and skin health.

Distribution Channel Insights

Offline retail channels dominate the market, including supermarkets, hypermarkets, pharmacies, and specialty beauty stores. These outlets benefit from high footfall, product accessibility, and consumer preference for physical testing. However, online channels are expanding rapidly due to convenience, extensive product assortment, personalized recommendations, and influencer-driven marketing. Direct-to-consumer websites and beauty-focused e-commerce platforms are gaining traction, especially for premium, organic, and customized face creams.

End-User Insights

Women account for the largest share of global face cream consumption, driven by broad product ranges and established skincare routines. Men represent a fast-growing demographic, with rising adoption of moisturizers, anti-pollution creams, and basic daily-care products. Youth segments (18–30 years) drive strong demand for hydrating, acne-control, and brightening creams, while consumers aged 40+ fuel growth in anti-aging and firming formulations. Baby and child-focused face creams form a smaller but steadily growing niche, especially in markets with strong hygiene-conscious parental segments.

Age Group Insights

Adults aged 26–40 years represent the largest consumption base due to active skincare routines, digital engagement, and high awareness of preventive skincare. The 41–55 demographic exhibits strong demand for anti-aging, firming, and high-performance creams. Teens and young adults drive growth in acne-treating and oil-control creams, influenced by social media and peer trends. Consumers aged 55+ represent a premium-driven segment seeking dermatological efficacy and sensitive-skin-safe formulations.

| By Product Type | By Skin Concern / Application | By Distribution Channel | By Age Group | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents a mature but high-value market characterized by strong demand for premium anti-aging, sensitive-skin, and clinical-grade face creams. U.S. consumers show high adoption of dermatologist-endorsed brands, while Canada demonstrates strong interest in natural and organic formulations. High disposable income and strong e-commerce penetration boost ongoing growth.

Europe

Europe remains a highly sophisticated skincare market with a strong emphasis on clean beauty, sustainability, and dermatological efficacy. Countries such as Germany, France, and the U.K. show strong demand for premium moisturizers, anti-aging formulations, and natural face creams. The region’s strict cosmetic regulations encourage quality-focused production and high compliance standards.

Asia-Pacific

Asia-Pacific leads global consumption, driven by large population bases, rising disposable incomes, and a thriving beauty culture in China, India, South Korea, and Japan. Whitening, brightening, and SPF-infused creams are particularly popular in the region. India and Southeast Asia represent the fastest-growing markets due to increasing beauty awareness and expanding retail networks.

Latin America

Latin America shows rising demand for moisturizing, brightening, and anti-pollution face creams, with strong growth in Brazil, Mexico, and Argentina. Consumers favor mid-range products, balancing affordability with efficacy. Economic fluctuations may influence premium segment expansion, but beauty culture remains strong across the region.

Middle East & Africa

MEA’s beauty market is expanding steadily, supported by increasing urbanization and a strong appetite for premium skincare in GCC countries. African markets such as South Africa, Kenya, and Nigeria show rising consumption of moisturizing and sun-protection creams tailored for warmer climates. Export-driven supply from global and regional manufacturers is expanding availability across the continent.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Face Cream Market

- L’Oréal S.A.

- The Estée Lauder Companies Inc.

- Unilever PLC

- Procter & Gamble Co.

- Johnson & Johnson

- Shiseido Company, Limited

- Beiersdorf AG

- Coty Inc.

- Amorepacific Corporation

- Clarins Group

- Chanel S.A.

- Avon Products Inc.

- Kao Corporation

- Oriflame Cosmetics AG

- The Body Shop International Ltd.

Recent Developments

- In January 2025, L’Oréal launched a new clean-beauty face cream line using biodegradable ingredients and recyclable packaging.

- In March 2025, Estée Lauder expanded its anti-aging portfolio with peptide-rich formulations targeting fine lines and skin repair.

- In April 2025, Unilever introduced a region-specific brightening and SPF face cream range tailored for Southeast Asian climates.