Extended Warranty Market Size

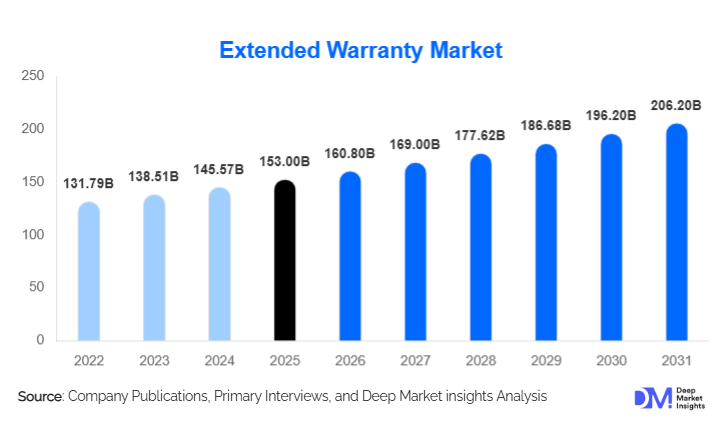

According to Deep Market Insights, the global extended warranty market size was valued at USD 153.00 billion in 2025 and is projected to grow from USD 160.80 billion in 2026 to reach USD 206.21 billion by 2031, expanding at a CAGR of 5.1% during the forecast period (2026–2031). Market growth is primarily driven by rising repair costs of high-value consumer products, increasing adoption of electric vehicles and smart appliances, and the strategic shift by OEMs toward service-led revenue models.

Key Market Insights

- Consumer electronics account for the largest share of extended warranty adoption, driven by smartphones, laptops, and connected home devices.

- OEM-backed warranty programs dominate globally, benefiting from higher consumer trust and point-of-sale bundling.

- North America leads the global market, supported by high warranty penetration rates and mature aftersales ecosystems.

- Asia-Pacific is the fastest-growing region, fueled by rapid growth in electronics and vehicle ownership in China and India.

- Subscription-based and digital warranty models are gaining traction, improving customer retention and recurring revenue.

- Electric vehicle warranties are emerging as a high-growth segment, particularly for battery and powertrain coverage.

What are the latest trends in the extended warranty market?

Digital and Subscription-Based Warranty Models

Extended warranty providers are increasingly shifting toward digital-first and subscription-based models. Monthly or annual protection plans are replacing traditional one-time payments, improving affordability and customer lifetime value. Digital platforms are integrating AI-driven diagnostics, automated claims processing, and predictive maintenance tools to reduce claim ratios and enhance profitability. This transition is particularly evident in consumer electronics and automotive segments, where connected devices enable real-time monitoring and proactive servicing.

EV-Specific and Technology-Centric Coverage

The rapid adoption of electric vehicles has led to the development of specialized extended warranty products covering batteries, charging systems, and software components. Given the high replacement cost of EV batteries, consumers increasingly view extended warranties as essential risk mitigation tools. Warranty providers are also incorporating software update protection and cybersecurity coverage, reflecting the growing software-defined nature of modern vehicles and appliances.

What are the key drivers in the extended warranty market?

Rising Cost of Repairs and Product Complexity

Modern consumer products and vehicles are significantly more complex and expensive to repair than earlier generations. Advanced electronics, embedded software, and specialized components have increased out-of-warranty repair costs, directly driving extended warranty adoption. Consumers increasingly prefer predictable ownership costs, making extended warranties a financially attractive option.

OEM Focus on Aftermarket Revenue

Manufacturers are prioritizing aftersales services to stabilize margins amid competitive pricing in core product markets. Extended warranties offer recurring revenue, higher customer retention, and valuable usage data. OEMs are embedding warranty offers directly into product ecosystems, reinforcing adoption at the point of sale.

What are the restraints for the global market?

Consumer Trust and Claim Transparency Issues

In certain markets, low claim approval rates, complex terms, and exclusions reduce consumer confidence. Lack of transparency in coverage details can limit repeat purchases and slow market penetration, particularly for third-party providers.

Regulatory Complexity Across Regions

Extended warranties are regulated differently across jurisdictions, sometimes classified as insurance products. Compliance with varying consumer protection laws increases operational costs and limits rapid global scaling for providers.

What are the key opportunities in the extended warranty industry?

Electric Vehicle and Advanced Mobility Coverage

EV adoption presents a major opportunity for extended warranty providers. Battery degradation protection, power electronics coverage, and software-related warranties represent high-value offerings with strong long-term demand. As EV penetration increases globally, this segment is expected to outpace traditional automotive warranties.

Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East offer significant untapped potential. Rising disposable incomes and growing ownership of high-value electronics and vehicles are driving demand for post-purchase protection. Localized pricing models and digital distribution can accelerate adoption in these regions.

Product Type Insights

Comprehensive coverage plans dominate the market, accounting for approximately 38% of global revenue in 2024. These plans bundle mechanical, electrical, and accidental damage protection into a single contract, reducing coverage gaps and simplifying claims management for consumers. Accidental damage protection is expanding at a faster pace, particularly for smartphones, tablets, and laptops, as device prices rise and usage intensity increases. Powertrain warranties continue to gain traction in the automotive and EV segments, supported by longer vehicle ownership cycles and higher replacement costs for core components.

Coverage Duration Insights

Extended warranties with coverage durations of 3–4 years lead the market with nearly 41% share. This duration aligns closely with typical product lifecycles and post-manufacturer warranty risk periods, offering consumers meaningful protection without steep upfront costs. Shorter-duration plans remain relevant for low-cost electronics, while longer 5-year and above contracts are increasingly adopted for vehicles, EV batteries, and premium appliances where long-term reliability is a key concern.

Sales Channel Insights

OEM-backed warranties account for approximately 44% of global market revenue, driven by strong brand trust, standardized coverage terms, and seamless bundling at the point of sale. These plans benefit from integrated service networks and simplified claims processes. Third-party providers are steadily gaining share through competitive pricing, broader coverage flexibility, and multi-brand compatibility. Digital direct-to-consumer channels are the fastest growing, supported by online retail growth, embedded warranty offerings, and subscription-based protection models.

End-Use Insights

Individual consumers represent nearly 63% of total demand, primarily driven by rising ownership of consumer electronics and personal vehicles. Automotive and EV end-use segments are growing at the fastest pace, supported by expanding vehicle parc, advanced electronics integration, and increasing repair and replacement costs. SME adoption is also rising, particularly for industrial equipment and commercial electronics warranties, as businesses seek predictable maintenance expenses and reduced operational downtime.

| By Product Type | By Coverage Duration | By Application | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of global market revenue in 2024, led by the United States. High extended warranty penetration, mature omnichannel retail ecosystems, and strong OEM participation at the point of sale support regional dominance. Widespread adoption across consumer electronics, appliances, and automotive segments, combined with higher average product prices, sustains consistent replacement and renewal demand.

Europe

Europe represents around 24% of the global market, with strong demand from Germany, the U.K., and France. High consumer protection awareness, established after-sales service infrastructure, and growing adoption of premium electronics and vehicles support steady growth. Regulatory emphasis on transparency and standardized coverage terms also reinforces consumer confidence in extended warranty offerings.

Asia-Pacific

Asia-Pacific holds nearly 28% of global share and is the fastest-growing region, expanding at a CAGR exceeding 6.5%. China and India are key growth markets, driven by rapid expansion of electronics ownership, rising vehicle penetration, and increasing participation of OEMs and third-party providers. Growth is further supported by expanding e-commerce platforms and improving access to digital warranty distribution.

Latin America

Latin America accounts for approximately 7% of global demand, supported by increasing smartphone penetration and rising automotive sales in Brazil and Mexico. Growing middle-class populations and gradual formalization of after-sales services are improving extended warranty adoption, particularly for mobile devices and consumer appliances.

Middle East & Africa

The Middle East & Africa region contributes around 5% of global revenue, with demand concentrated in the UAE, Saudi Arabia, and South Africa. High-value electronics consumption, premium vehicle ownership, and expanding organized retail channels drive adoption, while warranty penetration remains lower in price-sensitive and emerging markets across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The extended warranty market is moderately concentrated, with the top five players collectively accounting for approximately 40% of global revenue. Leading companies benefit from global distribution networks, OEM partnerships, and advanced underwriting capabilities.

Key Players in the Extended Warranty Market

- Assurant, Inc.

- American International Group, Inc. (AIG)

- Allianz Partners

- Zurich Insurance Group

- AXA Group

- Chubb Limited

- AmTrust Financial Services, Inc.

- Domestic & General Group

- The Warranty Group

- Sompo Holdings, Inc.

- MAPFRE S.A.

- CNA Financial Corporation

- Ping An Insurance (Group) Company of China, Ltd.

- Tokio Marine Holdings, Inc.

- Assicurazioni Generali S.p.A.