Extended Stay Hotel Market Size

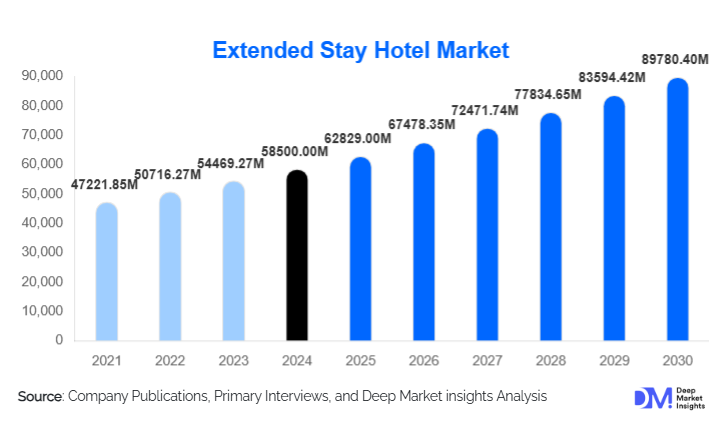

According to Deep Market Insights, the global extended stay hotel market size was valued at USD 58,500.00 million in 2024 and is projected to grow from USD 62,829.00 million in 2025 to reach USD 89,780.40 million by 2030, expanding at a CAGR of 7.4% during the forecast period (2025–2030). The market growth is primarily driven by rising corporate relocations, increasing demand for serviced apartments, the expansion of midscale and luxury extended stay offerings, and evolving traveler preferences toward long-term accommodations that combine the convenience of hotels with home-like amenities.

Key Market Insights

- Corporate extended stay hotels dominate globally, driven by long-term business assignments and project-based travel that require fully equipped accommodations.

- Midscale extended stay offerings are expanding rapidly, providing a balance of affordability and amenities for families, remote workers, and business travelers.

- North America remains the largest market, with the U.S. and Canada accounting for nearly 50% of the global market due to strong corporate mobility and domestic travel.

- Asia-Pacific is the fastest-growing region, led by increasing corporate projects, urbanization, and rising middle-class affluence in China and India.

- Technology adoption, including mobile check-ins, AI-driven services, and digital booking platforms, is enhancing guest experience and operational efficiency.

- Sustainability initiatives and eco-friendly properties are increasingly shaping consumer preference, particularly in Europe and North America.

What are the latest trends in the extended stay hotel market?

Rise of Serviced Apartments and Midscale Offerings

The trend toward serviced apartments and midscale extended stay hotels has accelerated as travelers seek a home-like environment with hotel-like services. Features such as kitchenettes, laundry facilities, living spaces, and communal lounges are becoming standard offerings. Midscale hotels provide a perfect balance for corporate travelers and families, delivering cost-effective long-term accommodations while maintaining comfort and convenience. This trend is particularly strong in urban centers and regions experiencing high workforce mobility.

Technology Integration and Smart Stays

Emerging technologies are being integrated to enhance guest experience and operational efficiency. Mobile check-ins, digital room controls, AI-powered concierge services, and predictive maintenance systems are now common in leading extended stay hotels. Online booking platforms allow for dynamic pricing, personalized offers, and real-time occupancy updates. These innovations appeal to younger, tech-savvy business travelers and remote workers seeking convenience, safety, and flexibility during long-term stays.

What are the key drivers in the extended stay hotel market?

Rising Corporate Relocations and Project-Based Work

Corporate travel and project-based assignments are the largest drivers of demand for extended stay hotels. Professionals working on medium- to long-term assignments prefer accommodations that offer comfort, kitchen facilities, and work-friendly environments. Partnerships between hotels and corporate clients ensure stable bookings, predictability in occupancy, and recurring revenue, particularly in North America and Europe.

Work-from-Anywhere and Remote Work Trends

The global shift toward remote and hybrid work models has fueled demand for long-term stays. Professionals now seek accommodations that provide office-friendly spaces, reliable internet connectivity, and home-like living arrangements. Extended stay hotels are increasingly targeting remote workers and “digital nomads” through specialized packages that combine workspaces, communal areas, and leisure amenities, driving occupancy outside traditional business travel periods.

Tourism Recovery and Family Travel

Leisure travel is rebounding post-pandemic, with families increasingly preferring long-term accommodations over traditional hotels. Extended stay hotels provide affordability, safety, and convenience for multi-day or week-long vacations. The trend toward domestic and regional tourism is further accelerating growth in APAC and LATAM markets.

What are the restraints for the global market?

High Operational Costs

Extended stay hotels require significant investments in room amenities, kitchens, laundry facilities, housekeeping, and technology systems. High operational and maintenance costs can deter new entrants and limit expansion in price-sensitive markets. These expenses are particularly impactful for midscale and upscale segments, where quality expectations remain high.

Regulatory and Zoning Challenges

Compliance with local regulations, including hospitality licensing, building codes, and safety standards, can slow market entry and expansion. Stringent regulations in Europe and North America increase operational complexity and compliance costs, posing challenges to scaling operations efficiently.

What are the key opportunities in the extended stay hotel industry?

Expansion in Emerging Markets

Emerging economies in Asia-Pacific and Latin America, particularly China, India, Brazil, and Mexico, present significant opportunities. Increasing corporate mobility, urbanization, and a growing middle class are driving demand for cost-effective midscale and premium extended stay accommodations. Operators investing in these regions can capitalize on lower construction costs, less competitive landscapes, and rising disposable incomes.

Technology and Smart Hotel Solutions

Hotels adopting smart technologies, such as AI-powered guest support, predictive maintenance, self-check-in kiosks, and mobile-based room controls, can enhance guest experience and optimize operational efficiency. These innovations attract tech-savvy travelers and enable operators to maintain competitive pricing while improving profitability.

Corporate & Relocation Partnerships

Strategic collaborations with corporates, government bodies, and relocation agencies present opportunities for stable, long-term bookings. Extended stay hotels providing fully furnished accommodations with business-oriented services are increasingly preferred over traditional hotels or rental apartments. Such partnerships can enhance occupancy rates, particularly during off-peak leisure periods.

Sustainability and Green Certifications

Hotels adopting energy-efficient operations, eco-friendly practices, and certifications such as LEED are gaining a competitive edge. Environmentally conscious travelers increasingly prefer properties that minimize ecological impact, making sustainability a differentiator in market positioning.

Product Type Insights

Corporate extended stay hotels dominate the market, accounting for approximately 45% of the global market in 2024 due to steady demand from project-based assignments and relocations. Midscale offerings represent 38% of the market, balancing affordability with essential amenities, while upscale and luxury segments cater to premium corporate and leisure travelers seeking personalized services. Economy/budget extended stay hotels are gaining traction in emerging markets due to cost-sensitive travelers and families. The trend toward serviced apartments and multi-room suites is shaping the overall market dynamics.

Application Insights

Corporate travel and project assignments remain the largest application, contributing 44% of the global market in 2024. Relocation/temporary housing demand is rising rapidly, particularly in APAC and LATAM, driven by multinational corporate expansions. Tourism and leisure applications are expanding steadily, especially among families seeking midscale and luxury extended stay accommodations. Government and institutional stays, including long-term deployments and temporary employee housing, also contribute to consistent demand.

Distribution Channel Insights

Online travel agencies (OTAs) and direct booking platforms dominate distribution, offering transparency, dynamic pricing, and convenience. Corporate agreements and bulk bookings continue to be critical for large hotel chains, ensuring steady occupancy. Digital marketing, loyalty programs, and subscription-based models are emerging as additional channels to attract repeat customers, particularly among business travelers and remote workers.

Traveler Type Insights

Business travelers are the largest customer segment, accounting for 42% of the global market in 2024, due to frequent project assignments and long-term relocations. Families are increasingly adopting extended stay hotels for vacations and temporary housing. Remote workers and digital nomads are emerging as a key growth segment, particularly in APAC. Relocation clients, government employees, and institutional travelers contribute to steady demand across regions.

Age Group Insights

Travelers aged 31–50 years form the largest market, balancing high disposable income with the need for long-term stays. The 18–30 age group is fueling growth in budget and midscale options, leveraging technology for bookings and extended stays. Older demographics, particularly 51–65 years, are significant contributors to premium and luxury extended stay segments, prioritizing comfort, amenities, and work-leisure integration.

| By Type | By Service Level | By Guest Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, holding 50% of the global share in 2024 (USD 18.75 billion). The U.S. leads due to corporate relocations, domestic tourism, and the presence of major branded extended stay chains. Canada follows, driven by project-based travel and business relocations. Midscale and corporate-focused offerings dominate, supported by strong demand for predictable quality and full-service amenities.

Europe

Europe holds 22% of the global market (USD 8.25 billion), with Germany, the U.K., and France as key markets. Germany benefits from industrial relocations, the U.K. from corporate assignments, and France from tourism and long-term business stays. Regulatory standards and high operational costs pose challenges, but quality and service excellence maintain steady demand.

Asia-Pacific

APAC accounts for 18% of the market (USD 6.75 billion) and is the fastest-growing region, with China and India driving demand due to corporate mobility, urbanization, and expanding middle-class travel. Japan and Australia represent mature markets with steady demand, while Southeast Asia is emerging as a hub for midscale and serviced apartment offerings.

Latin America

Brazil and Mexico are key markets, driven by corporate relocations and inbound tourism. Demand is gradually increasing, particularly for midscale and cost-effective extended stay hotels. Latin American travelers prioritize adventure, family-friendly stays, and flexible packages.

Middle East & Africa

UAE and Saudi Arabia lead in MEA due to corporate and tourism travel. Africa’s growing business travel, energy projects, and infrastructure development support regional demand. Extended stay hotels are increasingly popular among expatriates and long-term project workers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Extended Stay Hotel Industry

- Marriott International

- Hilton Worldwide

- IHG Hotels & Resorts

- Hyatt Hotels Corporation

- AccorHotels

- Extended Stay America

- Choice Hotels

- Ascott Limited

- Sonder

- Oakwood Worldwide

- Aimbridge Hospitality

- Red Lion Hotels

- Radisson Hotel Group

- Waterford Hotel Group

- Staybridge Suites

- Wyndham Hotels & Resorts