Exhibition Organizing Market Size

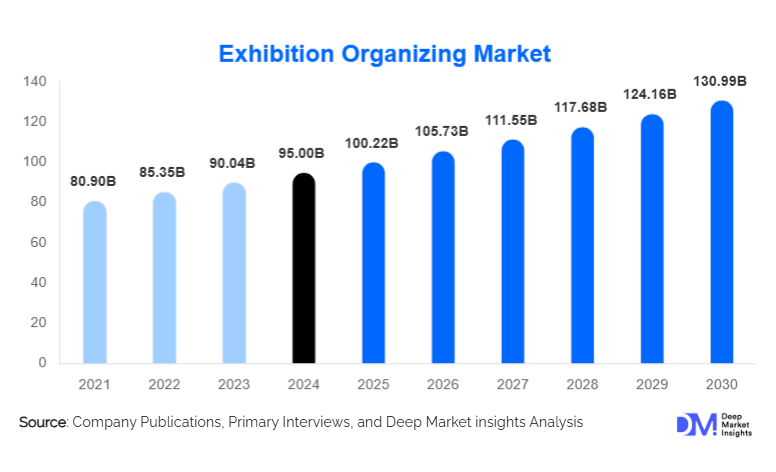

According to Deep Market Insights, the global exhibition organizing market was valued at USD 95.0 billion in 2024 and is projected to grow from USD 100.22 billion in 2025 to reach USD 130.99 billion by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Growth in this market is driven by robust post-pandemic recovery in physical events, accelerating industrial expansion in emerging markets, and rapid integration of hybrid and digital engagement technologies within major exhibitions worldwide. Corporate marketing budgets are rising steadily, while governments and industry associations are intensifying efforts to promote trade, investment, and global collaboration through large-scale exhibitions.

Key Market Insights

- B2B trade exhibitions dominate the global market, driven by industrial manufacturing, technology, and supply chain expansion in APAC and Europe.

- Hybrid and tech-integrated exhibitions are accelerating adoption, with AI matchmaking, virtual booths, and analytics platforms reshaping organizer revenue streams.

- Asia-Pacific leads the market with a 34% share in 2024, fueled by massive infrastructure investments in China, India, Japan, and Southeast Asia.

- North America and Europe remain strong, mature markets, supported by high exhibitor spending and recurring sector-specific events.

- Government trade-promotion initiatives such as “Make in India” and “Made in China 2025” are increasing demand for sector-focused trade fairs.

- Technology adoption, including RFID-based tracking, AI-driven visitor management, VR-enabled booths, and digital sponsorship systems, is transforming operational efficiency in exhibitions.

What are the latest trends in the exhibition organizing market?

Hybrid and Digitally Enhanced Exhibitions

The integration of digital technologies has revolutionized event planning, participation, and post-event analytics. Hybrid exhibitions, combining physical events with virtual components, enable exhibitors to reach global audiences without travel barriers. Organizers are adopting AI-powered business matchmaking, VR walk-throughs of booths, real-time lead retrieval systems, and post-event analytics dashboards. These enhancements are improving exhibitor ROI, enriching attendee engagement, and generating new recurring revenue streams from digital access tiers and subscription-based networking platforms. Organizers are also leveraging cloud-based systems for registration, ticketing, and crowd management, significantly streamlining event operations. As expectations for data-driven performance insights grow, technology integration is becoming essential rather than optional.

Rise of Large-Scale Sector-Focused Mega Exhibitions

Global demand for specialized exhibitions in sectors such as electronics, automotive, pharmaceuticals, food processing, defense, and renewable energy is rapidly expanding. These mega exhibitions attract international buyers, suppliers, investors, and government delegations, making them key trade platforms. Companies increasingly use such exhibitions for product debuts, technology demonstrations, and strategic partnerships. The growing complexity of supply chains further increases the importance of industry-specific fairs where stakeholders can meet in one place. Emerging markets, especially China, India, Vietnam, and the UAE, are investing heavily in large convention centers and trade promotion programs to host such events, reinforcing their role as global exhibition hubs.

What are the key drivers in the exhibition organizing market?

Global Recovery of Physical Events and Corporate Marketing Spend

The post-pandemic revival of business travel and in-person networking is fueling significant growth in exhibitions. Corporations allocate increasing budgets for trade fairs because they offer unparalleled opportunities for client acquisition, product demonstration, and brand visibility. High exhibitor retention rates and recurring annual shows in sectors like electronics, logistics, and healthcare further support this recovery. As industries resume physical outreach strategies, exhibition attendance continues to rise, accelerating market growth.

Industrialization and Supply Chain Expansion in APAC

The Asia-Pacific region is experiencing rapid industrial expansion across manufacturing, semiconductors, IT, automotive, and renewable energy. This surge in industrial activity generates strong demand for B2B exhibitions, where companies can engage with buyers, suppliers, and partners. China and India lead the region’s exhibition ecosystem, enabling organizers to scale events across multiple verticals. International firms increasingly view APAC exhibitions as essential gateways to regional markets, strengthening demand for large-scale trade fairs.

Digital Transformation in Event Management

Digital tools, AI-based visitor tracking, RFID movement monitoring, virtual event add-ons, and data analytics have become central to optimizing exhibition performance. Exhibitors now expect measurable ROI, digital lead capturing, and automated matchmaking services. These technologies enhance event efficiency, increase profitability, and reduce manual workload for organizers. As more organizations prioritize measurable marketing outcomes, digitally optimized exhibitions are gaining widespread preference.

What are the restraints for the global market?

High Infrastructure and Event Production Costs

Exhibition organizing requires substantial capital expenditure, including venue rentals, digital systems, security, logistics, and booth construction. Smaller organizers struggle to compete with global players who possess superior resources, technology, and long-term venue partnerships. Rising costs for digital integration, such as VR, analytics platforms, and cloud-based registration systems, further increase financial pressure on smaller firms.

Geopolitical and Economic Uncertainty

Exhibitions rely heavily on international mobility, trade flows, and cross-border collaboration. Global disruptions such as travel restrictions, political tensions, or economic slowdowns reduce exhibitor participation and visitor footfall. Currency fluctuations and rising travel costs also influence international attendance. These uncertainties can limit exhibition scale, reduce sponsorship spending, and impact long-term planning for organizers.

What are the key opportunities in the exhibition organizing industry?

Government-Led Trade Promotion and Industrial Strategy Programs

Many nations are leveraging exhibitions as strategic tools to promote exports, attract FDI, and showcase national manufacturing capabilities. Initiatives such as “Make in India,” “Saudi Vision 2030,” and “Invest in Indonesia” create opportunities for organizers to host sector-specific trade fairs supported by government funding, guaranteed participation, and long-term venue infrastructure. These partnerships reduce organizer risk, increase exhibitor confidence, and enable multi-year event scaling.

Technology-Driven Monetization Models

The adoption of digital tools presents new revenue streams for organizers. Offering virtual participation, subscription-based B2B matchmaking, data-driven performance analytics, and premium hybrid access packages allows organizers to monetize attendee and exhibitor engagement beyond the physical event days. AI-guided lead generation, immersive VR booths, and 3D venue mapping are becoming differentiators that attract high-value corporate clients and enhance overall event ROI.

Product Type Insights

B2B trade exhibitions dominate the global landscape, accounting for over half of total revenues due to strong demand in manufacturing, electronics, technology, and industrial supply chains. These exhibitions bring together global buyers and suppliers, creating high-value commercial opportunities. Consumer exhibitions maintain steady growth, driven by lifestyle, travel, and cultural events. Hybrid and virtual exhibitions are expanding rapidly as companies embrace digital engagement, enabling multi-format participation and broader international reach. Organizers offering integrated digital experiences, live-streamed sessions, virtual walk-throughs, and analytics dashboards are gaining a competitive advantage as exhibitors seek measurable outcomes.

Application Insights

Industrial and manufacturing exhibitions represent the largest application segment, driven by heavy demand from machinery, automation, and engineering sectors. Technology and ICT exhibitions are also accelerating due to ongoing digitalization, AI development, and semiconductor expansion worldwide. Healthcare, pharma, and biotech exhibitions continue to grow as medical device innovations and R&D collaborations increase globally. Consumer-centric expos, art, fashion, lifestyle, and entertainment attract wide audiences but represent a smaller share of overall revenue. Exhibitions focused on renewable energy, smart manufacturing, and logistics are emerging as high-growth applications aligned with global sustainability and digital transformation policies.

Distribution Channel Insights

Direct corporate sales and event partnerships continue to dominate exhibition bookings, particularly for large B2B trade fairs where booth customization and sponsorship tiers require tailored negotiations. Digital platforms and self-service registration portals are expanding rapidly, offering streamlined exhibitor onboarding and online booth selection. Industry associations remain influential channels for niche and sector-specific events, often serving as co-organizers. Online marketing, influencer partnerships, and targeted LinkedIn campaigns play a growing role in attendee acquisition, especially for hybrid events. Subscription-based exhibitor portals and digital networking platforms are emerging as new distribution channels that extend engagement beyond the event window.

Exhibitor Type Insights

Large corporations constitute the highest-value exhibitor segment, leveraging exhibitions for global product launches, partnership building, and brand positioning. SMEs form the largest volume of exhibitors, especially in manufacturing and tech supply chains, as exhibitions offer affordable entry into international markets. Government bodies, trade agencies, and NGOs participate actively in sector-focused exhibitions, promoting investment and policy initiatives. Startups increasingly use tech-focused exhibitions to secure funding, validate prototypes, and gain visibility. Exhibitor diversity continues to expand as hybrid events attract participants who might not attend purely physical events due to travel or budget limitations.

Age Group Insights

Attendees aged 30–50 account for the largest share, representing decision-makers and procurement specialists responsible for B2B investments. Younger audiences (18–30) are highly active in tech, gaming, and consumer expos, driving interest in digital interactivity and immersive experiences. Senior attendees (50–65) represent key buyers in industrial and manufacturing sectors, often participating in specialized trade fairs for high-ticket procurement. Older demographics also prefer structured, curated experiences with guided tours and VIP access packages. Across all groups, digital tools, mobile apps, QR-based badges, and AI-driven recommendations enhance engagement and influence participation patterns.

| By Exhibition Type | By Industry Vertical | By Service Offering | By Organizer Type | By Event Size |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 22% of the global market, with the U.S. dominating regional demand. Major exhibition hubs such as Las Vegas, Orlando, Chicago, and Houston host world-leading trade shows across technology, healthcare, manufacturing, and entertainment. High disposable corporate budgets and advanced event technology infrastructure support strong growth. Canada continues to expand sector-focused exhibitions, especially in renewable energy, agriculture, and industrial technology.

Europe

Europe holds approximately 28% market share, led by Germany, the U.K., France, and Italy. Germany remains a global exhibition powerhouse with events in industrial machinery, automotive, and logistics. The region benefits from mature event infrastructure, strong sectoral diversity, and high exhibitor loyalty. Eastern European countries are emerging as lower-cost destinations for industrial and consumer exhibitions.

Asia-Pacific

Asia-Pacific leads with 34% of the global market and is the fastest-growing region. China dominates exhibition scale and infrastructure investment, hosting major trade fairs in manufacturing, technology, and consumer goods. India shows the highest growth rate, fueled by government-backed industrialization and export-promotion initiatives. Japan, South Korea, and Southeast Asia contribute significantly through specialized exhibitions in electronics, robotics, healthcare, and logistics.

Latin America

Latin America holds around 8% market share, led by Brazil, Mexico, and Argentina. Growth is driven by expanding manufacturing capabilities, rising domestic demand, and increased foreign participation in trade fairs. Logistics, food processing, automotive, and mining sectors show strong exhibition activity.

Middle East & Africa

The region accounts for 8% of the market, led by the UAE, Saudi Arabia, and South Africa. Dubai’s world-class exhibition venues attract global events across technology, real estate, and consumer sectors. Saudi Arabia’s Vision 2030 is accelerating demand for industrial and tourism exhibitions. African markets show emerging growth potential, particularly in agriculture, mining, and infrastructure-related expos.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Exhibition Organizing Market

- Informa Markets

- RX Global (Reed Exhibitions)

- Messe Frankfurt

- GL Events

- Messe Düsseldorf

- Messe München

- Fiera Milano

- NürnbergMesse

- Koelnmesse

- Comexposium

- MCH Group

- Hong Kong Trade Development Council (HKTDC)

- Tokyo Big Sight – Exhibition Organization Division

- Shanghai New International Expo Center (SNIEC Organizing Arm)

- Qatar Tourism – DECC Organizing Division

Recent Developments

- In March 2025, Informa Markets expanded its hybrid exhibition platform, integrating AI-based attendee analytics and virtual sponsorship features across its global events.

- In January 2025, Messe Frankfurt announced new investments in sustainable exhibition infrastructure, including low-energy venue upgrades and eco-friendly booth design programs.

- In February 2025, GL Events entered a strategic partnership with the Government of Saudi Arabia to manage large-scale industrial and tourism exhibitions as part of Vision 2030 initiatives.