Essential Oils Market Size

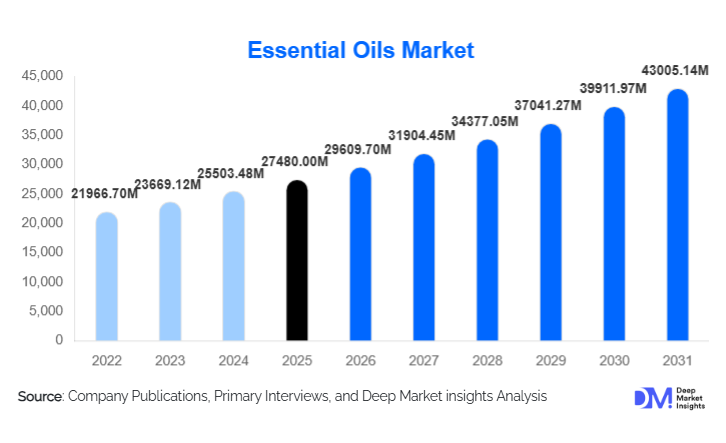

According to Deep Market Insights, the global essential oils market size was valued at USD 27,480.00 million in 2025 and is projected to grow from USD 29,609.7 million in 2026 to reach USD 43,005.14 million by 2031, expanding at a CAGR of 7.75% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer demand for natural and clean-label products, the expansion of wellness and aromatherapy applications, and the increasing adoption of essential oils in personal care, cosmetics, food & beverages, and therapeutic industries worldwide.

Key Market Insights

- Consumer preference is shifting toward natural, plant-based ingredients, fueling adoption across personal care, aromatherapy, and food & beverage applications.

- Aromatherapy and wellness applications dominate, with essential oils widely used in spas, wellness centers, and home-based therapy solutions.

- Europe holds the largest share of the essential oils market, driven by established wellness culture, stringent natural product regulations, and high per-capita usage in countries such as Germany, France, and the U.K.

- Asia-Pacific is the fastest-growing region, led by rising middle-class wealth, increasing health consciousness, and expanding adoption in China, India, and Southeast Asia.

- Technological innovations in extraction and product delivery, such as CO₂ extraction and smart aromatherapy devices, are reshaping product quality and consumer experience.

- Export-driven demand is strong, with major producing countries like India, Brazil, and Indonesia supplying high-quality oils to North America and Europe.

What are the latest trends in the essential oils market?

Rise of Clean-Label and Organic Essential Oils

Consumers increasingly demand organic, sustainably sourced essential oils with transparent supply chains. Certifications such as ISO, organic labeling, and ethical sourcing programs are driving trust and higher-value purchases. Premium blends targeting stress relief, sleep support, and immunity enhancement are gaining traction. Companies that emphasize transparency and high-purity formulations are capturing larger market shares and differentiating themselves from low-quality imports.

Integration of Essential Oils into Advanced Wellness Products

Essential oils are increasingly being incorporated into wearable aromatherapy devices, smart diffusers, and cosmetic delivery systems. AI-assisted formulation and bioactive blends allow personalization for wellness benefits such as relaxation, mood enhancement, and skin care. This trend appeals strongly to tech-savvy consumers seeking multifunctional and experience-driven products. Digital traceability, blockchain-based supply monitoring, and e-commerce platforms are facilitating direct-to-consumer engagement and premium product positioning.

What are the key drivers in the essential oils market?

Rising Demand for Natural & Plant-Based Products

Health-conscious consumers are shifting toward products free from synthetic additives, driving essential oils adoption in personal care, food, beverages, and home care applications. Oils such as citrus, lavender, and peppermint are highly versatile, enhancing both sensory experience and perceived functional benefits. Growth in clean-label, organic, and vegan products is further boosting adoption.

Expansion of the Wellness and Aromatherapy Sector

The global wellness trend, encompassing holistic health, mental well-being, and relaxation therapies, has propelled aromatherapy applications. Essential oils are widely used in spas, wellness retreats, and home diffusers, offering stress relief, sleep enhancement, and therapeutic benefits. Pandemic-driven home wellness adoption has further expanded this segment, making it a core growth driver for the market.

Increased Industrial Applications

Essential oils are being incorporated into functional foods, natural flavorings, household products, and eco-friendly cleaners. Their antimicrobial, antioxidant, and aromatic properties make them valuable for cosmetic formulations, personal care, and food & beverage sectors, expanding market penetration and revenue opportunities for producers.

What are the restraints for the global market?

Raw Material Supply Volatility

Essential oil production depends heavily on agricultural yields and climate conditions. Variability in crop production, disease outbreaks, and extreme weather events can disrupt supply and increase prices. This impacts manufacturers’ ability to scale operations and maintain profitability, particularly for niche botanical oils like lavender and sandalwood.

Regulatory & Quality Compliance Challenges

Fragmented global regulations and quality standards create compliance challenges for manufacturers seeking international distribution. Ensuring purity, consistency, and adherence to organic or ISO certifications can increase costs, particularly for smaller producers. Adulteration risks and inconsistent labeling may undermine consumer trust and hinder market growth.

What are the key opportunities in the essential oils market?

Emerging Wellness Governance & Standards

Adoption of stricter quality standards, certifications, and traceable supply chains is creating opportunities for premium brands to differentiate themselves. Harmonization of international regulations will ease market entry and improve export potential. Companies that emphasize sustainability and quality assurance can capture higher-value segments globally.

Expansion in High-Growth Regions

Asia-Pacific, Latin America, and emerging Middle Eastern markets are witnessing surging demand for wellness, personal care, and aromatherapy products. Rising disposable incomes, urbanization, and health awareness present significant growth opportunities. Localized product offerings and e-commerce strategies can help companies tap these expanding consumer bases.

Technology-Driven Product Innovation

Advancements in extraction methods, such as CO₂ and green solvents, enable higher purity and bioactive retention. Integration into smart devices, wearable diffusers, and personalized cosmetic formulations opens new usage occasions and revenue streams. AI-assisted formulation and digital supply chain traceability offer competitive advantages and enable premium pricing.

Product Type Insights

Citrus oils dominate the global essential oils market, accounting for approximately 28% of total sales in 2024. Their leadership is primarily driven by their wide functional versatility, cost-effectiveness, and large-scale availability. Citrus oils such as orange, lemon, and lime are extensively used across food & beverages as natural flavoring agents, in personal care products for fragrance and antimicrobial properties, and in aromatherapy for mood enhancement and stress relief. High production volumes in countries such as Brazil and the U.S. ensure stable supply chains and relatively lower price volatility compared to floral or exotic oils, reinforcing their global dominance.

Floral oils, including lavender, rose, jasmine, and chamomile, represent a high-value segment driven by strong demand in wellness, aromatherapy, and premium cosmetics. Lavender oil, in particular, benefits from its well-established therapeutic positioning for relaxation and sleep support. Although floral oils contribute a smaller volume share compared to citrus oils, they command higher per-unit prices due to labor-intensive cultivation and extraction processes. Specialty and exotic oils such as sandalwood, patchouli, vetiver, and frankincense cater to niche but premium segments. These oils are widely used in luxury fragrances, high-end skincare formulations, and therapeutic aromatherapy applications. Limited raw material availability, long cultivation cycles, and regulatory controls on harvesting contribute to their higher margins, making them strategically important for premium-focused manufacturers.

Application Insights

Aromatherapy & wellness is the leading application segment, accounting for approximately 30% of the global essential oils market in 2024. Growth in this segment is driven by the global rise in mental health awareness, stress management practices, and holistic wellness adoption. Essential oils are widely used in spa therapies, wellness retreats, home diffusers, and complementary medicine practices. Increased consumer spending on self-care products and the expansion of wellness tourism further strengthen this segment’s leadership.

Personal care and cosmetics represent the second-largest application, contributing around 25% of market share. Essential oils are increasingly incorporated into skincare, haircare, perfumes, and hygiene products for their natural fragrance, antimicrobial, anti-inflammatory, and antioxidant properties. The shift toward clean-label, sulfate-free, and naturally scented cosmetic products is a key driver supporting sustained demand from this segment. Food & beverages is a rapidly growing application area, where essential oils are used as natural flavoring agents and functional ingredients. Demand is particularly strong in organic foods, functional beverages, and clean-label formulations, where citrus, mint, and spice oils provide both flavor enhancement and preservative benefits.

Distribution Channel Insights

E-commerce and online platforms dominate distribution, accounting for approximately 35% of global essential oil sales in 2024. This leadership is driven by consumer preference for convenience, access to a wide variety of products, transparent pricing, and product reviews. Online channels enable direct-to-consumer engagement, allowing brands to educate consumers on usage, purity, and sourcing, which is particularly important in a quality-sensitive market.

Direct-to-consumer (DTC) models, including brand-owned websites and subscription services, are expanding rapidly. These models enhance customer loyalty, support recurring revenue, and allow companies to offer customized blends and wellness-focused product bundles. Specialty retail and institutional channels, such as pharmacies, wellness stores, spas, and B2B supply agreements with cosmetic and food manufacturers, continue to play a critical role, particularly for bulk and professional-grade essential oils.

End-User Insights

Personal care and cosmetics manufacturers remain the largest end-user segment, driven by sustained demand for natural fragrances and bioactive ingredients. Global beauty brands increasingly rely on essential oils to differentiate products and meet regulatory and consumer expectations around ingredient transparency.

Wellness centers and spas represent a high-growth end-user group, particularly in North America, Europe, and the Middle East. Essential oils are integral to massage therapies, aromatherapy treatments, and holistic wellness programs, supporting recurring and high-margin demand. Food & beverage producers and pharmaceutical companies also contribute significantly, using essential oils for flavoring, functional benefits, and therapeutic formulations. Export-driven demand from producing nations such as India, Brazil, and Indonesia further amplifies end-user consumption globally.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 25% of the global essential oils market in 2024, led by the United States and Canada. Regional growth is driven by high consumer awareness of wellness products, strong purchasing power, and widespread adoption of aromatherapy and natural personal care solutions. A mature e-commerce ecosystem supports direct-to-consumer sales, while regulatory clarity around natural ingredients encourages product innovation. Rising demand for organic cosmetics, home wellness products, and functional foods continues to support steady market expansion.

Europe

Europe represents the largest regional market, with nearly 45% share in 2024, driven by Germany, France, and the U.K. Key growth drivers include a deeply embedded wellness culture, strong demand for organic and sustainably sourced products, and stringent regulatory frameworks that favor high-quality essential oils over synthetic alternatives. Aromatherapy, natural cosmetics, and pharmaceutical applications are particularly strong, while environmental consciousness accelerates the adoption of eco-certified essential oils.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, supported by rising middle-class incomes, rapid urbanization, and increasing health and wellness awareness in China, India, Japan, and Southeast Asia. Traditional medicine systems such as Ayurveda and Traditional Chinese Medicine reinforce cultural acceptance of essential oils. Expanding personal care manufacturing, growing spa and wellness infrastructure, and strong export capabilities position the Asia-Pacific as a key growth engine for the global market.

Latin America

Latin America, led by Brazil and Argentina, benefits from its dual role as both a major production hub and an emerging consumption market. Growth is driven by increasing use of essential oils in cosmetics, fragrances, and food & beverages. Abundant availability of citrus and botanical raw materials supports exports to North America and Europe, while rising regional wellness awareness is strengthening domestic demand.

Middle East & Africa

The Middle East & Africa region shows early-stage but accelerating growth. In the GCC countries, demand is fueled by high disposable incomes, luxury wellness trends, and the expansion of premium spa and aromatherapy services. South Africa leads regional adoption in personal care and wellness applications. Increasing tourism, spa infrastructure development, and consumer exposure to holistic wellness concepts are expected to support long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Essential Oils Market

- Givaudan SA

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Firmenich SA

- Takasago International Corporation

- Synthite Industries Ltd.

- Flavex Naturextrakte

- Ultra International B.V.

- Young Living Essential Oils

- doTERRA

- Aromatech

- Plant Therapy

- Robertet SA

- Kancor Ingredients Ltd.

- Naturex (Groupe InVivo)